If you are running your own business, it is vital to have other ways of generating extra income. Entrepreneurs can invest to increase income in different ways. This way, all your eggs will not be in the same basket.

If your business is just starting or it is not doing too well, the income from the other investments can keep you going for a while. Having other investments can also provide you with more money to increase the capacity of your business.

- Ways An Entrepreneur Can Invest To Increase Income

- How Can I Invest Like an Entrepreneur?

- How Can we Increase Source of Income?

- How do You Invest in Ideas?

- How do I Invest in a Business Idea?

- How Can I Increase my Income Without Working More?

- What Are The Five Sources of Income?

- How do You Increase Passive Income?

- How Can I Make Extra Income From Home?

- What Can I Invest in to Make Money Now?

- How Can I Invest in Stock?

- How do Investors Invest in Startups?

- How do Entrepreneurs Come up With Ideas?

- How Can a Business be Profitable?

- What is a Business Investment?

- How Can I Invest And Make Money Daily?

Ways An Entrepreneur Can Invest To Increase Income

Create an investment plan

When you want to start investing, it is vital to have a plan. A plan will make it easy to identify the right opportunities and also to manage your money properly. There are various investment products on the market and it is essential to conduct some research before you make your choice.

Read Also: How To Make Money

You do not really need a large amount of money to take advantage of some of the financial opportunities that are available in the market.

Consider the stock market

A lot of people go into buying and selling of stocks without getting the right education. There are certain facts that you have to understand if you want to have a good return. By becoming familiar with the basics of the stock market, you can easily make good returns on your money. Becoming a good investor will not happen overnight but if you are ready to learn, you are already on the right path.

Buy stocks that you can afford

Buying and selling stocks is an investment that is ideal for entrepreneurs who do not have a lot of money. A lot of people have the erroneous thought that investing in the stock market requires a large amount of money but this is not so.

If you look at the list of companies on popular exchanges, you will find out that there are several companies with affordable stocks. You can start by buying a few shares and have a plan to increase the volume as time goes on.

Focus on startup companies

The shares of most startups are usually cheap. They provide a great opportunity for investors with small money. However, before you purchase the shares of any company, ensure that you have conducted a thorough research about the company’s financial condition. You should also be familiar with the trends in the particular sector that you are interested in. It is also vital to have a strategy for your stock investment.

Consider government bonds

Government bonds and securities can also be a good option for an entrepreneur who wants to increase his or her income. Various government bonds can be bought easily at low prices. These types of bonds also have the advantage of yielding interest over a period of time. Bonds provide a good means of diversifying your portfolio so you can have safer investments.

Other ideas that you may consider include investing in tangible items such as gold, coins and collectibles. These are investments that are also more secure and they can be converted to money whenever you need cash.

How Can I Invest Like an Entrepreneur?

1. Invest in Yourself

We all invest our time and money in people and things. The best investment for entrepreneurs is always going to be in themselves. This could mean your health, education, well-being or relationships—anything that can fine-tune and improve your life will bring the highest return on investment because the cost is often very small.

Invest in yourself in both small and big ways. For example, hire a housekeeper so that you can stay focused on higher-value tasks. Get a massage every week to relax. Spend time with your family without distractions. Often, prioritizing time to exercise your body and mind will produce great returns.

Giving yourself set times to think and focus is a valuable investment. Look at the schedule of the world’s wealthiest entrepreneurs and you’ll uncover that comprehensive wellness is a high priority.

2. Invest in Your Business

If you can’t create the highest return on investment in your present company—then maybe you should rethink continuing to operate your business. Entrepreneurs should flow to the area where they can generate the highest returns on time and money.

When you think about investing in your business, consider adding talent and equipment. Look toward creating new sales and marketing structures that perpetuate your sales cycle. Oftentimes, entrepreneurs focus almost exclusively on top-line revenue growth that will lead to bottom-line profit gain. However, it is still critically important to focus on risk factors in one’s business.

All companies are sold using a simple formula of earnings times a multiple. The multiple is driven by the risk factors inherent in the business. If we can reduce the risk factors, we can increase the multiple. Sometimes, decreasing the risks provides greater returns than one can achieve by focusing on increasing profits. This is especially true in the years leading up to a sale.

3. Invest in Tax Strategy

Successful entrepreneurs may not realize that their single biggest personal expense is their income taxes. By evaluating options to lower their taxes, entrepreneurs can often increase their net income anywhere from 10 percent to 50 percent with only small changes in the way that they operate their business and personal life.

This increased cash flow, if reinvested wisely, can dramatically impact your future. We believe that once an entrepreneur is making more money than they need to cover their living expenses, then they should be focusing on building their tax structures.

4. Invest in Real Estate

Real estate is another area where entrepreneurs should allocate capital. Real estate can often be used to house the business of the entrepreneur. I’ve seen many instances where the entrepreneurs’ net proceeds from the sale of their real estate are greater than that of the sale of their business.

Real estate has many qualities that enhance its attractiveness, including tax benefits, the ability to use as leverage, inflation protection and more.

5. Invest in Life Insurance

Entrepreneurs too often dismiss investing in life insurance structures. Most life insurance is sold, not bought. Unfortunately, that creates a conflict of interest for the person that educates the entrepreneur about the insurance. When an entrepreneur purchases life insurance, the advisor receives a big commission. That is definitely something to be aware of, but life insurance is an incredible tool that can be used to enhance an overall financial plan.

One thing most entrepreneurs don’t realize is that banks will pay the majority of insurance premiums on their behalf. This can create positive leverage that produces net returns that can rival real estate investments while also providing protection to the entrepreneur’s family if they die unexpectedly.

6. Invest in Private Debt

High-performing entrepreneurs have good cash flow and little need for ongoing significant liquidity, especially if they’ve been able to establish lines of credit. As a result, we find entrepreneurs often have more cash and liquid investments than they need to accomplish their goals.

By allocating their conservative investments to private debt instead of publicly traded bonds, the entrepreneur trades liquidity for a higher yield. Often this results in 3 percent to 6 percent per year of additional returns.

7. Invest in Other Companies

When entrepreneurs have succeeded in growing their own business, they may find value in investing in other people’s companies, either actively or passively. Private equity returns are some of the highest of any asset class, but they also come with significant risks and a greater standard deviation between return expectations.

In layman’s terms, that means a lot of people lose money investing in companies. The best private equity investors can make 30 percent or greater annual returns. It’s critical to develop your own opportunity filter so when you begin to seek investments, you know precisely what to look for.

8. Invest in Stocks

I would be remiss to not suggest that entrepreneurs also should build a diversified portfolio of publicly traded stocks. Over time, publicly traded companies produce average returns that exceed inflation by 4 percent to 8 percent. The primary advantage of stocks over the above items is the ability to sell them and generate cash within days.

Compounding your investments in public companies over a lifetime should result in significant wealth creation.

How Can we Increase Source of Income?

Deep down we all know money cannot buy happiness but at the end of the day, we all need money to survive and thrive in life. If you are looking for ways to create multiple streams of income, here are a few ideas that might help you.

Leverage your subject matter expertise

If you have years of experience in your field, you can start giving guest lectures at colleges or offer tuition services or courses to help students prepare for competitive exams related to your field. Again, you might take some time in cracking a deal with the colleges or looking for students, but once you have set your foothold, you will be richer than before!

Start a carpool

Starting a carpool is not only good for your pockets but also for the environment. If you drive a car to the office alone, you can always start a carpool service where you can pick up people who are traveling on the same route as yours. The best news: you don’t need to invest anything!

Start a side hussle

Are you passionate about writing? Why not start taking freelance projects and see how it goes. Are you a great painter or can make amazing candles, homemade jewelry, chocolates or anything on similar lines?

Spare some extra time from your schedule and try to sell them online. You just need to figure out what you are good at, identify how you can monetize it and start the project you are passionate about.

Real estate investment

Depending upon the situation of the market and your financial status, investing in real estate can give you pretty good returns. You can always rent your property, start your PG (Paying Guest) accommodation, or simply sell your property for a better price after some time.

Again, keep all the factors and risks in mind before investing in real estate, and also be prepared that you will not start earning revenue immediately.

Equity investment

Keeping your savings in your bank account won’t offer you much interest. Talk to a financial adviser or search online to find out the best places to invest your money. It could be mutual funds, shares, SIPs (Systematic Investment Plans) or any other schemes, calculate the risk factor and just make sure you don’t place all your eggs in the same basket.

Start a blog

Starting a blog does not require huge investments and can reap long-term profits. Look for an area that you are passionate about and start writing content or making interesting videos on the same. It might take some time but once you develop a good number of followers, there won’t be a dearth of good opportunities to earn income.

How do You Invest in Ideas?

Every business starts with an idea. Whether you have an idea for a great new product or a service that will revolutionize an industry, your inspiration is a great start. But how are you going to bring your idea to life? Building a successful business takes more than a great idea and a vision—it takes planning, discipline, research, and a whole lot of money.

Before you can get funding, there are several steps to making sure your idea is solid and marketable. While it’s true that not all startups will make it, you don’t want to set yourself up to fail! If you have a great idea but no funding yet, here are five steps you’ll need to take on the road to wooing investors.

Step 1: Find a mentor and ask for advice

When you ask for money, people will automatically be skeptical and want proof that your idea is viable. But is it, really? Have you gotten the objective opinion of someone who has been in your shoes?

Finding a mentor is an important step in the entrepreneur’s journey, and a good, experienced mentor will give you the honest truth about your concept. After all, you don’t want to waste your time on a bad idea—there’s always another opportunity around the corner.

Start attending networking events and leverage people in your network to connect with a mentor. Many cities have innovation labs or mentoring programs that can help you get your idea off the ground. You never know—you may just get a potential investor out of it like Michael Litt, co-founder of Vidyard.

Litt says he’s never made a formal pitch—he’s gotten all his funding out of asking for advice and building relationships. Many seasoned entrepreneurs are happy to share their knowledge and opinions—you just have to ask!

Step 2: Perform market research

Finding your target market might be the most challenging step of making an idea into a business, but it’s also one of the most important.

Your second step is doing market research, and this process should begin by asking yourself a couple of questions:

- Who are you targeting with your product or service? Age, gender, education level, and other traits should be included—be as specific as possible.

- Are people interested in your product? Many entrepreneurs waste a lot of time and resources on their idea, only to find no one wants to buy.

To conduct your research, you should use a variety of different sources to examine the opportunities and pitfalls of the market. You will also need to gather direct data from your target audience. This can easily be accomplished by surveying current and potential business customers, testing focus groups, conducting one-on-one interviews, utilizing social media polls, and observing data through platforms like Google Analytics.

Some great secondary data sources include:

- Industry associations

- Universities

- Government statistics

- D&B financial and business services

- Local chamber of commerce

- Business development agencies

- Online business databases

One of the best ways to conduct live market research these days is to try crowdfunding. Many startups have launched Kickstarters to do market research and prove there is interest in their product. Oculus VR was able to secure their initial funding from a crowdfunding campaign, and later sold to Facebook for over $2 billion!

Step 3: Determine your capital needs and write a business plan

Throughout the course of your research, you’ll get a more realistic idea of how much funding you’ll need. Even if you manage to get a crowdfunding campaign off the ground or find a way to fund your startup yourself, the costs of running every aspect of the business can go way beyond your initial capital needs for launch.

Before you look for investors, it’s important to have a solid idea of how much money you actually need to start and grow a business. There are many different factors to consider, including increased inventory buildup prior to the Christmas season, experiential marketing budget, and much more. Your mentor may be able to help you come up with a ballpark number you can use when seeking funding.

In addition to knowing how much money you’ll need to get your business off the ground, you’ll also need to show potential investors how you intend to use it. You can do that by creating a business plan. Writing a business plan may seem intimidating, but it doesn’t have to be.

As long as it contains the most important components, such as your target market, product information, financial plan, and the metrics you’ll use, the plan doesn’t have to be long—in fact, the more concise you can be, the better.

Step 4: Enter a contest

Major corporations know there are entrepreneurs out there with fantastic ideas who need funding. To find the best of the best, many of these are offering contests for entrepreneurs. The competition may be fierce, but hey, someone has to win!

Each contest has its own requirements, so read them thoroughly and follow all the steps carefully. You don’t want to waste your (or the judges’) time on entering a contest that doesn’t apply to your idea.

Step 5: Consider outside investments

Now that you’ve done your market research, created your business plan, and discussed your idea with an honest, objective mentor, you can start thinking about funding. After following the steps above, you might be ready to seek outside investors to generate more capital and grow your business.

There are a number of ways to generate funding, with some of the most popular including:

- Small business loans

- VC funding

- Crowdfunding

- Angel investment

Each of these options has its pros and cons. For example, loans allow you to retain the most control over your company, but the requirements and repayment terms can be difficult for some entrepreneurs to manage.

Venture capital firms have funded some of the most successful startups, but can be difficult to attract and may have terms you’re not comfortable with. Seeking angel investing may seem like an intimidating concept, but it’s actually very simple and approachable once you understand it.

An angel investor is someone who invests in startups because they believe in the entrepreneur and the project—though of course, they’re also interested in making money off their investments. The relationships are usually more personal and hands-on than a venture capital firm, and can even be friends or family members of the entrepreneur.

Generally, you will need to offer equity in your company to people who are interested in investing—which can mean you end up with less control over your company in the long run. This is one of the tradeoffs of getting outside funding. However, most entrepreneurs do eventually need investments from external sources, and can’t rely on bootstrapping forever.

So how do you attract investors? Start by talking about your business with everyone you know. Leverage your network, see who’s interested (or has connections to those who might be interested), and have a formal pitch prepared before you have any meetings with potential investors.

Investors want assurance that your company has a good chance of giving them a healthy return on investment, and won’t be interested in funding you unless you can prove you have the product and the plan to make your business a success.

How do I Invest in a Business Idea?

Contrary to popular belief, there are actually many ways to start a business that let you focus less on the logistics and upfront costs and more on getting started.

These low-investment business ideas make a great entry point for beginners, bootstrappers, or anyone with a busy schedule, letting you pick up a side business without having to drop everything else.

You still need to come up with a solid idea, build a brand, put effort into marketing, and provide excellent customer service. But you can bypass many traditional startup costs, such as initial inventory, warehousing, and retail space.

Here are some of the low-investment business ideas you can start today.

1. Partner with a dropshipper

Buy stock, store it, pick it, pack it, ship it. Managing inventory can be a big commitment when you’re running a business.

Dropshipping is a fulfillment model where a third party supplier stores and ships inventory to customers on your behalf. You just need to make the sales and pass orders on to your supplier; you don’t need to handle the products yourself.

You can curate products from one or more suppliers into your own online store under a theme that focuses on a specific niche, like gear for yoga enthusiasts or water bowls for dog owners. When a customer buys a product from you, the order is sent to your supplier who fulfills it on your behalf. However, you are still responsible for your own marketing and customer service.

There are both local and overseas suppliers you can work with, as long as you can establish a relationship with them built on trust—an unreliable supplier will reflect poorly on your brand.

Dropshipping is a low-investment way to test product-market fit and launch a business before you invest in your own original products. Just be sure to always order a sample for yourself to make sure that your supplier is reliable and that the quality of the products is fit for selling to your customers.

2. Design and sell print-on-demand t-shirts

Another dropshipping model, print-on-demand puts inventory, shipping, and fulfillment in the hands of a third-party supplier. But unlike the dropshipping idea above, the focus here is on customizing these products with your own designs to create something original.

T-shirts, hats, phone cases, hoodies, skirts, tote bags, and more become canvases for your creativity. You can think up witty slogans for developers or references that resonate with cat owners—if there’s passion and pride within a community, there’s a potential t-shirt business you can start.

Even if you’re not a designer, you can find a designer to work with using freelance sites like Fiverr, Upwork, Dribble, or 99Designs.

With many print-on-demand services, you’re paying per product, so the base price per unit will be more expensive than if you were to order in bulk. But the advantage is that if a certain t-shirt design doesn’t sell, you haven’t actually paid for the item yet (only the design if you outsourced it).

You can even use t-shirt mockup templates so you don’t actually need to spend money on a full photoshoot for every new design.

There are a variety of print-on-demand platforms you can work with, many of which can be integrated with your Shopify store for seamless order fulfillment. However, be sure to always order a sample of your product (often offered at a discount) to make sure your custom products look good.

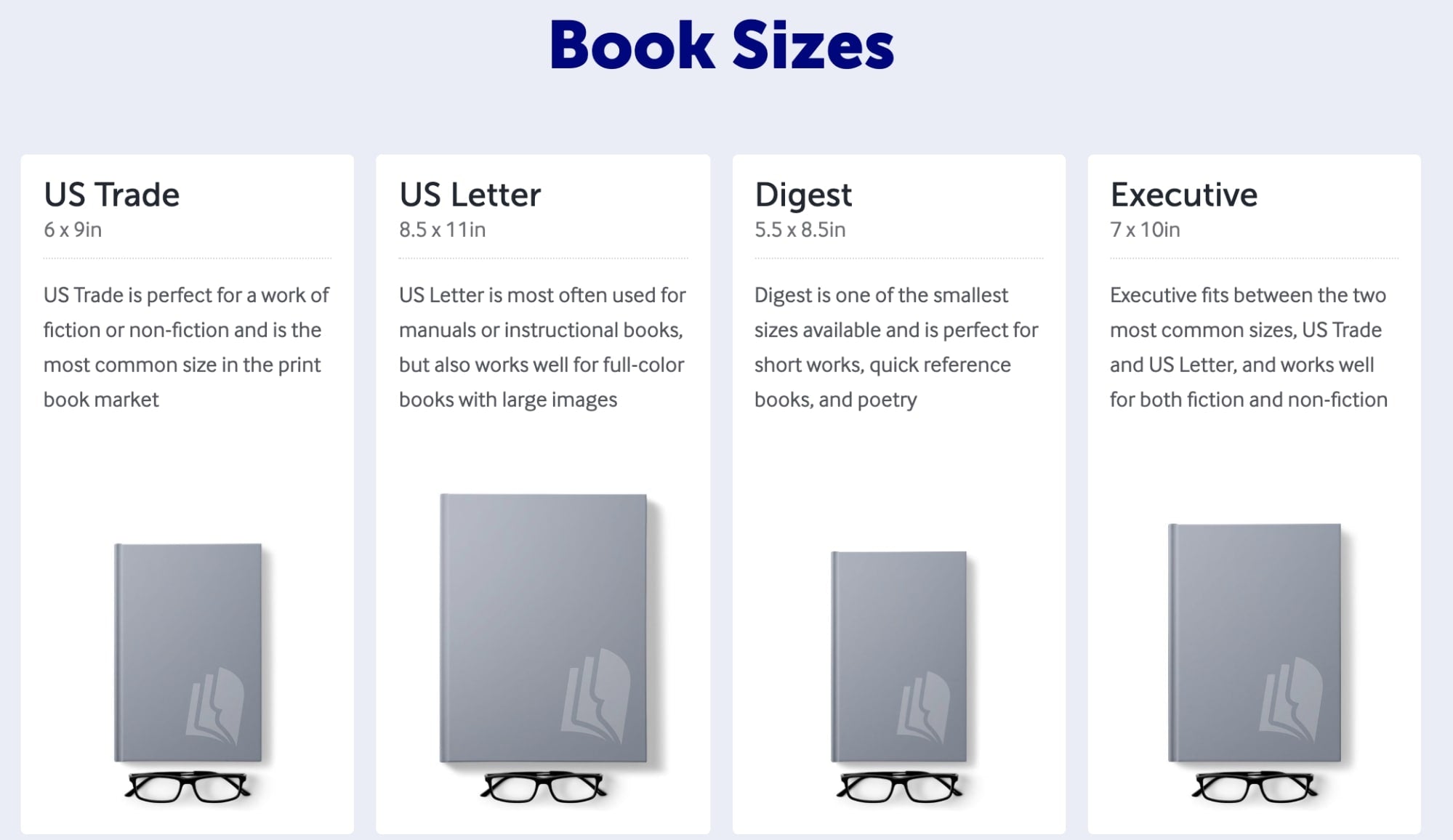

3. Launch your own book

A book is just another type of product when you think about it. And as such, you can create one to serve a particular demand in the market.

Cookbooks, picture books, comic books, poetry books, photo books, coffee table books, and novels—if you’ve got the knowledge or the creativity, there are a variety of original books you can bring to the market.

Print-on-demand publishing is a relatively safe way to test the waters and get started with self-publishing, while giving you control over the quality and look of your book.

Lulu Xpress and Blurb are popular platforms for this purpose, letting you create, order, and distribute your own books as digital and physical products.

While you can order one book at a time, costs naturally go down when you buy in bulk. You can consider pre-selling or crowdfunding your book idea to ensure that there’s demand and guarantee a certain number of customers for a bulk order.

Launching your own book can be a great way to monetize a blog if you have one or are looking to start one.

4. Create digital products or courses

Digital products like music, courses, and templates are unique on this list of ideas. Unlike the others, they’re not tangible products. There aren’t recurring manufacturing or shipping costs to worry about so your margins can remain high.

The trick is figuring out what makes for a good digital product. What is useful enough that people are willing to pay to download it?

The answers range from original instrumental beats to stock photos that can be licensed to other creators, to information products and templates that help people level up their skills in a particular field.

If you’ve got a talent that can be turned into a digital product, you can think about packaging it into a new stream of income.

Shopify offers a free digital downloads app that lets you offer digital products in your store as easily as physical products.

5. Sell print-on-demand posters, greeting cards, and prints

If you’re artistically inclined or know your way around a camera, you can dropship using a print-on-demand business model to let others physically own a piece of your work. Just be sure you have the rights to the content you want to print, unless you’re using public domain assets that you can freely monetize.

If you’ve already got an engaged online following, say you’re a cartoonist or an urban photographer, you’re in an especially good position to give this business idea a try.

Depending on the printer you work with, you can turn your work into products such as posters or framed wall art, even greeting cards. There are plenty of digital templates and mockup generators like Place.it that you can use to showcase your products without having to print out each item and conduct your own photoshoots.

6. Start a charitable business

Starting a non-profit organization isn’t the only path you can take to help fund a better world.

Having a mission to go along with a business, and setting aside some profit for a cause, gives social entrepreneurs a unique way to position their company in the market while addressing the issues they care about most.

In fact, 89% of consumers surveyed said they were likely to switch to a new brand with similar products and prices if it was associated with a good cause.

While many social enterprises offer their own original products, you can also take any of the business ideas above and partner with a non-profit, or execute that social good with your own hands, as long as you’re transparent about how it works.

As part of your marketing, you can share the impact that your customers are having by supporting your business, such as a blog post covering your work in the community or a real-time impact calculator on your website.

The Give & Grow Shopify app makes it easy to partner with charitable organizations and incorporate your mission into your business. You can set it up to donate a specific amount or a percentage of sales, or ask your customers to add a donation at checkout.

7. Sell a service

With services-based businesses, “time” is your inventory and your biggest investment. You’ve only got a limited supply of hours in your day. However, that makes it easier to get up and running if you’ve got skills that are in demand.

Writers, designers, developers, photographers, house cleaners, fitness trainers, and more can build a business around their skills.

They can also expand their business with any of the other ideas above to create additional revenue streams by “productizing” their services through physical or digital goods.

A photographer, for example, can service a local event while selling prints online through their Instagram account. A copywriter can sell a copywriting swipe file of high-converting sales copy. Coupling your service-based business with physical products can give you another source of income that isn’t directly tied to your time.

You can use the BookThatApp or Book an Appointment app for Shopify to let customers easily schedule a session, consultation, or buy tickets to a class with you through your store.

You can also offer your services through a freelance marketplace like Upwork to increase your chances of getting discovered by the people who need your skills.

8. Create an online fashion boutique

If you love fashion and sharing your sense of style online, you can consider creating your own online fashion boutique. You don’t need to become a fashion designer either—you can simply curate items from other vendors into your own online store (using the dropshipping model we discussed earlier).

From dresses, shoes, swimwear, accessories, and more, you can build your own fashion brand using one of the several product sourcing apps for Shopify, model them in your own product photos and social media posts, and build an online following as a trend-setter.

How Can I Increase my Income Without Working More?

These are some of the easiest ways to start increasing your monthly income without putting in additional work. This is truly passive income at its finest. Most of these income generating tools can raise your income instantly.

Here is our list of the best ways to increase your income without working more.

1. Selling Travel Photos Online

This is ideal for people who enjoy traveling and taking photos. Whenever you travel, the moments captured on camera would be worth even if you do not monetize them. However, finding sites online or selling your photos online would be a great way to increase income.

Some of the sites where you can sell the photographs include Shutterstock, Etsy, 500px and iStockphoto. There are many more sites where you could sell your photos online. However, you should be sure to read the terms and conditions for each site.

For example, some sites may have a minimum amount you should earn before you can withdraw your funds. To make sure the photos fetch the most money, you should invest in photography- by having a good camera.

Social media networks and getting active in photography forums online may also help in marketing your photography and making sure you earn the most from them.

This has been a great source of income for me since I love to travel through credit card churning and take my camera with me. If I travel for free with credit card churning and manufactured spending AND make money from travel photography, I usually end up making money from my travel experiences.

2. Renting Out Extra Space in Your House

Airbnb is the most commonplace that people use to rent out extra rooms in their houses. Renting out extra space is a good way to earn extra income without necessarily working more. However, there are few things that you should consider before doing this.

First, you should be aware that rental income is taxable. Check with your local government on this and make sure you are on the right side.

Secondly, if you plan to rent over a longer period of time (a number of months) you should make sure to collect an initial deposit from the tenant since there may be accidental damages. Short term stays for people who are traveling are, however, more likely to bring in more income. Another thing to consider before renting out extra space is the condition of the place.

The locks should be working and any utilities in the house should be in good condition. If not, you should spend time and money to make sure that everything is in working condition. A house in good condition is likely to attract higher bidders.

As stated, Airbnb provides a good opportunity to take advantage of these stays. You can list your extra room on their site and then wait for potential customers to call you.

3. Selling Items You Own But No Longer Use

If you have things that were once valuable but that you no longer use, selling them may be a good way to increase your income. For example, if you have had children who have grown up, you may sell their old stuff, such as beds, clothing and toys. Kidtokid.com is a great online resource that can help specifically with this.

Other things you may sell for extra income are used electronics when you need to upgrade.

Sites like Amazon and Ebay offer a great opportunity for this. To make sure that your things attract customers fast, you should include a good description of the item- measurements, duration of use, working conditions.

It is best to include a photo of the item for people to have a visual representation of the item they wish to purchase. Be sure to reply promptly to messages once you get an interested buyer to avoid losing out on good opportunities. This can boost money in your account right away.

If you can automate flipping items, that would be another way to increase your income without working more.

4. Sign Up for Uber or Lyft

Uber/Lyft is a good way to earn extra income from your car. You may find that you can only do this a few hours every week. Still, this may be enough to earn extra income.

In addition to the extra income, you also have an opportunity to meet new people while you work. It is also relatively easy to get started off with Uber as all you need is a car. With Uber / Lyft, you can raise your income just by running errands.

5. Open a Better Bank Account

With interest rates increasing, you can do a little research on banks and discover which bank account offers more interest on savings. Sometimes banks do not increase their savings rate retroactively with your account, so you could be missing out on an easy opportunity to earn additional income.

Ultimately, it will mean that you will get more money than you would from your current account. This is a great way to maximize your income. There are always more competitive rates out there, so you need to ensure that you are getting top dollar. This leads to increased income just for moving money from your savings accounts.

You’ll likely need to use your routing number to ACH money out of your account.

6. Peer to Peer Lending

LendingClub or USA Express Loans gives people an opportunity for people to lend others money and earn some interest on it. If you have some cash you may not be using for a long time, this may be a good idea to earn some interest on it.

On the site, potential borrowers are screened to ascertain their creditworthiness. The screening means that as a lender, you stand a high chance of gaining interest from your money. To further make sure that the risk you face as a lender is low, you should not invest any more than $5,000.

There is one main advantage of peer to peer lending. Usually, you earn more than the market rate since the loans are mainly microfinance loans.

What Are The Five Sources of Income?

At the most detailed level, the income sources are combined into five components: wages and salaries, self-employment income (farm and non-farm), government transfer payments, investment income and other income. The absolute values for these components are compared and the largest one is designated as the major source of income.

1. Earned Income

Otherwise known as your salary or typical monthly income from your primary job. Earned income could be based on an hourly rate alongside bonuses, commissions and more. This remains the same whether you are employed or self-employed. This earned income is typically subject to taxes, although likely at different thresholds depending on the amount.

2. Business Income

Alongside earned income, you may receive extra income from businesses you have set up. These are otherwise known as your side hustles, and may be made up from just one source or could be multiple.

It is typically found among your balance sheets, taking the difference between profit and loss. Once again, this is subject to taxes.

3. Interest Income

You’ll receive interest on your bank account savings, although since 2020 this interest rate has likely fallen significantly. Ideally, it would match the level of inflation but these days, interest rates are very low.

Find out your interest rate by checking your bank statements. If you have funded any loans, you are also likely to be eligible for interest as the principal amount is repaid.

Some banks with interest rates include CIT Bank, Aspiration, and Consumers Credit Union.

4. Dividend Income

The stocks and shares you invest in may yield dividends, or you be paid via dividend if it fits with your company structure. Dividends are more commonly known as a share of the profits.

For example, as the Director of an LLC, you are eligible to split your profits into twelve monthly dividend payments. Alternatively, some investments pay dividends quarterly or annually.

5. Rental Income

Once you own property, you can begin collecting rental income as an added monthly income stream. Depending on the structure of your property (whether you’ve got it under a separate company, for example), you may be subject to extra taxes, so the yield of your property income should account for this.

As a landlord, you’ll likely have a Mortgage to pay as you acquire new properties. This should also factor into your rental income pot.

How do You Increase Passive Income?

Passive income might sound complicated, but there are so many ways to make passive income in 2021 that you’re sure to find the perfect option to suit your skills, commitments, goals, and passions. To give you some inspiration for your mission towards financial independence, here are some of the best passive income ideas that almost anyone can take advantage of.

1. Invest in real estate

Real estate investing has been a well-established method for building wealth for almost as long as real estate has existed! Real estate investing was once a tricky venture to undertake – requiring a lot of time, effort, and expertise.

However, real estate investment apps have now removed many complications and made it easy and assessable to become a real estate mogul from the comfort of your couch.

If buying properties seems a bit out of budget, you could also purchase a real estate investment trust – also known as a REIT. These investments generally pay generous dividends and follow the performance of the stock market.

In this way, your investment value will go up/down just like physical property, but they are far easier to buy/sell, and you can diversify your portfolio by investing in different markets.

2. Get a high yield savings account.

Putting your money in a high-yield savings account might not be what you were dreaming about when we told you this list would be full of passive income ideas. Still, they are one of the safest and most reliable ways of getting your money to work for you, rather than the other way around.

Many high-yield accounts offer APYs of around 0.50% with no minimum balance to open, and some may even offer a cash bonus simply for opening the account.

You will need to place a relatively large amount of cash into the account to see any remarkable returns, but it’s still a worthwhile option.

3. Invest in dividend stocks

We mentioned earlier that we don’t consider investing for appreciation to be a passive income source. However, if you invest in stocks that offer high dividends to shareholders, you could potentially earn some impressive cash from your investments. Hopefully, the value of your shares will also increase while you own them, so you’ll be able to enjoy passive income from the dividends plus capital gains when you sell.

If you’re not an expert in the stock market, you may want to consider a broker or even try Robo-advisors for a genuinely passive investing system.

Remember, investments are high-risk, and you could lose more than you invest. Always get advice before starting an investment portfolio.

4. Buy or start a blog

A great way to earn money with minimum effort is with a blog. Of course, this will take time and effort to build, as you will need to write the blog regularly and build an audience. Still, you can earn an impressive amount of income with a blog via affiliate marketing or even selling ad space on your website.

If you’re unsure how to start a blog, you could also make money by buying an existing blog. This is a great “cheat,” as you can benefit from the traffic and cash flow already established.

5. Get involved in affiliate marketing.

Affiliate marketing involves partnering with a company to showcase and promote its products or services. Whenever someone follows one of your affiliate links to your partner’s site, you earn a commission.

There are a few ways to utilize your affiliate marketing partnerships to earn passive income. You could mention sponsors on your YouTube channel or podcast, write buying guides with links to the company’s products, compile product reviews, video unboxings, and much more.

To find the right company to become an affiliate for, you need to do some research and find a brand that matches your core values and your audience’s needs. There’s no point in becoming an affiliate for a butcher if your blog’s primary audience is vegans, for example.

6. Become a silent business partner

If you would love to own a business but don’t have the time or expertise, you might want to consider becoming a silent business partner. In other words, you contribute financially to the company but leave the day-to-day operations to your partner.

After your investment, you’ll be paid a percentage of the profits regularly, and your money will be backed by a percentage ownership of the company.

Don’t trust your dodgy mate’s business idea enough to invest? There are many websites for entrepreneurs looking for a silent business partner to invest in their business.

7. Write an eBook

While writing a blog and monetizing it is a good passive income idea, writing a book or eBook is an even better example of passive income, as you only need to write it once!

Instead of writing a blog, spend a while sharing your creativity or specialist knowledge by writing a book or eBook and sell it. Every time someone buys a copy, you’ll receive royalties, which can quickly add up if you hit the right mark.

Royalties for a printed book tend to be between 5-20% of the book’s price. eBooks are even more profitable, paying around 25%. Audiobooks usually pay royalties between 10-25%.

Obviously, you need to write a great book to earn a living income from your writing. However, just a few sales could help you earn that extra money you need for an upcoming holiday or to put you closer to your early retirement goals.

8. Create an online course

Like writing a book, creating an online course that people can buy repeatedly is an excellent way to earn passive income. Sure, it’ll take time, effort, and expertise to get the course built, but once it’s ready, you can stick it online and enjoy the revenue created every time someone purchases.

These days, there are virtually no limits to the topic you could cover with your online course. Personal trainers could create a series of fitness videos, chefs could start an online cookery course, accountants could help others learn bookkeeping. Basically, if you have a skill or specialist knowledge, you could build an online course and earn money from it.

That said, you may need to show relevant qualifications and/or experience to build an online course that will actually sell. However, you might be able to earn income via a YouTube channel even if you’re not formally qualified… Everyone loves a life hack!

9. License your music

If you’re a musician, you could write and license your music to receive money anytime someone wants to use your track in their project. There are a few ways licensing your music could make you money, and it’s a great way to supplement your income if live gigging isn’t paying out (or you don’t want to perform live).

10. Sell stock photos

If you always have your camera on you and are renowned for taking excellent photographs, you could monetize your passion by selling your images to stock photography companies. With these, any time someone purchases your image via a third-party site, you’ll receive a share in the profits.

The best companies to sell your photos to are the most well-known (as these have the most customers who might see, love, and buy your images). Try Adobe Stock, Shutterstock, Alamy, etc.

Even if you only have a smartphone, several stock image businesses will buy good-quality pictures snapped on a phone, so fancy equipment isn’t necessarily vital for this passive income idea.

How Can I Make Extra Income From Home?

Thanks to the internet and technology, we can now earn extra income from the comfort of our homes without having to juggle between two jobs.

We have put together a list of jobs that you can do to earn that extra income for yourself or your family.

1. Freelancing

Becoming a freelancer is one of the most popular ways of making money from your home. A freelancer is a self-employed person who offers his/her services to clients for a short period and gets paid for them.

If you are good at writing articles, designing websites, digital marketing, or graphic designing, you can find a lot of paid work online. As a freelancer, you will have the added advantage of choice. You can pick and choose your own projects and clients. You can work at your own pace.

To become a freelancer, you should have a primary skill and build a strong profile around that skill. It might take a while before you can find clients, but patience and willingness to improve yourself will take you a long way. A freelancer is usually paid per task, so, your income is directly proportional to your hard work.

2. Blogging

If you are particularly passionate about writing and creating content, you can consider starting your blog. It is one of the best ways to earn extra income from home in India. Blogging is not one of those who make quick money methods. It takes time, effort, and patience to set up your blog and build an audience. However, once you manage to find your audience, you will be able to make enough money to support your family and even more.

From fashion and lifestyle to travel and business, you can blog about anything under the sky. As a blogger, you can work for yourself and be your boss. One common way through which bloggers earn is money is by placing ads on their websites.

You could also include affiliate links on your website or earn money by selling your products. On average, a successful blogger makes around Rs.70,000 – Rs.1,00,000 a month.

3. Start a YouTube Channel

YouTube is one of the most popular streaming platforms in the world. If you are passionate about entertaining or educating others, you could consider starting a YouTube channel. Just like blogging, your YouTube channel could also be about anything under the sky. You have to know how to present your topic properly in the form of a video. Once you start a channel and build an audience for yourself, you can monetize it.

YouTubers usually earn through ads that run on their videos. Apart from this, you can also make through brand integrations in your videos. You can also create your merchandise and sell it to your audience. Apart from money, YouTube also gives you a public identity and an opportunity to interact with thousands of people across the globe.

4. Airbnb Hosting

Airbnb is an online platform where you can host travelers in your house for small durations of time and get paid for it. If you have a spare room at home, you could put it to great to use by hosting travelers from all over the world.

If you do not have spare space at home, you still can make money by hosting an experience for travelers. You could take people on a walking tour of your city, give them a taste of your local food and culture, teach them how to cook some of your local dishes, take them on a hike or give them the experience of your city’s nightlife.

Travelers these days are willing to spend any amount of money for a memorable experience. Airbnb experiences are a creative way of earning money and do not require a lot of experience to get started with.

5. Tutoring

Are you passionate about teaching others? Do you have expertise in a particular subject? If yes, you could earn substantial income by tutoring students. Share your subject expertise online or with students in your locality.

There are several websites online where you can find online tutoring jobs. Promote yourself enthusiastically and follow the best teaching practices to get better visibility and eventually higher-paying jobs.

6. Become an Online Consultant

A consultant is someone who has expertise in a particular field and can provide advice to individuals or even businesses. If you have expertise in the field of business, marketing, finance, engineering or even health care, you can earn an ample amount of money by sharing this expertise with those in need of it.

The advantage of doing this online is that you can build your schedule and offer your services whenever you have some time to spare.

7. Start Selling on E-commerce Websites

Thanks to technology, now we have several businesses that you can start and run from your home. E-commerce websites like eBay and Amazon are the most viable platforms to start selling your products and kickstart your business.

Selling on e-commerce websites is slightly competitive, but good marketing can help you stand out.

8. Earn from Social Media

We all spend hours scrolling through social media, then why not earn from it. Social media is not just for consuming content but also for creating content. If you are interested in doing this, then all you have to do is pick a niche that excites, research on it, create a suitable page on social media and start posting your content. It might take some time and a lot of effort to build a follower base.

But, once you have a sizable audience, you can start earning money through sponsored posts and affiliate links on your page. You can also use social media to support your blog or YouTube channel.

9. Rent Out Some of Your Household Items

Most of us have a ton of items in our houses that we rarely use. You could make a decent side income by renting out some of these items. Some items you could rent out are furniture, vehicles, books, DSLR cameras, and musical instruments.

If you have any of these items sitting at a corner in your house, go ahead and put them to good use. You can list these items for rent at many websites like Olx and Quickr.

10. Babysit/Petsit

If you love babies or animals, you can earn a stable income just by taking care of them at your home. Start off by asking your neighbors or friends to drop off their babies or pets at your place while they are busy.

Just make sure that you are prepared and have some experience looking after babies/pets. Let the local pet shop owners, pediatricians and veterinarians know that you are in business. You might get your first few clients from there.

What Can I Invest in to Make Money Now?

The term “investing” may conjure images of the frenetic New York Stock Exchange, or perhaps you think it’s something only meant for those wealthier, older or further along in their careers than you. But this couldn’t be further from the truth.

When done responsibly, investing is the best way to grow your money, and most types of investments are accessible to virtually anyone regardless of age, income or career. Such factors will, however, influence which investments are best for you at this particular moment.

Here are some best investments for consideration, generally ordered by risk from lowest to highest. Keep in mind that lower risk typically also means lower returns.

1. High-yield savings accounts

Online savings accounts and cash management accounts provide higher rates of return than you’ll get in a traditional bank savings or checking account. Cash management accounts are like a savings account-checking account hybrid: They may pay interest rates similar to savings accounts, but are typically offered by brokerage firms and may come with debit cards or checks.

2. Certificates of deposit

A CD is a federally insured savings account that offers a fixed interest rate for a defined period of time.

A CD is for the money you know you’ll need at a fixed date in the future (e.g., a home down payment or a wedding). Common term lengths are one, three and five years, so if you’re trying to safely grow your money for a specific purpose within a predetermined time frame, CDs could be a good option.

It’s important to note, though, that to get your money out of a CD early, you’ll likely have to pay a fee. As with other types of investments, don’t buy a CD with money you might need soon.

3. Money market funds

Money market mutual funds are an investment product, not to be confused with money market accounts, which are bank deposit accounts similar to savings accounts. When you invest in a money market fund, your money buys a collection of high-quality, short-term government, bank or corporate debt.

Money you may need soon that you’re willing to expose to a little more market risk. Investors also use money market funds to hold a portion of their portfolio in a safer investment than stocks, or as a holding pen for money earmarked for future investment.

While money market funds are technically an investment, don’t expect the higher returns (and higher risk) of other investments on this page. Money market fund growth is more akin to high-yield savings account yields.

4. Government bonds

A government bond is a loan from you to a government entity (like the federal or municipal government) that pays investors interest on the loan over a set period of time, typically one to 30 years.

Because of that steady stream of payments, bonds are known as a fixed-income security. Government bonds are virtually a risk-free investment, as they’re backed by the full faith and credit of the U.S. government.

The drawbacks? In exchange for that safety, you won’t see as high of a return with government bonds as other types of investments. If you were to have a portfolio of 100% bonds (as opposed to a mix of stocks and bonds), it would be substantially harder to hit your retirement or long-term goals.

5. Corporate bonds

Corporate bonds operate in the same way as government bonds, only you’re making a loan to a company, not a government. As such, these loans are not backed by the government, making them a riskier option. And if it’s a high-yield bond (sometimes known as a junk bond), these can actually be substantially riskier, taking on a risk/return profile that more resembles stocks than bonds.

Best for Investors looking for a fixed-income security with potentially higher yields than government bonds, and willing to take on a bit more risk in return. In corporate bonds, the higher the likelihood the company will go out of business, the higher the yield. Conversely, bonds issued by large, stable companies will typically have a lower yield. It’s up to the investor to find the risk/return balance that works for them.

How Can I Invest in Stock?

To buy stocks, you’ll first need a brokerage account, which you can set up in about 15 minutes. Then, once you’ve added money to the account, you can follow the steps below to find, select and invest in individual companies.

It may seem confusing at first, but buying stocks is really pretty straightforward. Here are five steps to help you buy your first stock:

1. Select an online stockbroker

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker’s website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically.

2. Research the stocks you want to buy

Once you’ve set up and funded your brokerage account, it’s time to dive into the business of picking stocks. A good place to start is by researching companies you already know from your experiences as a consumer.

Don’t let the deluge of data and real-time market gyrations overwhelm you as you conduct your research. Keep the objective simple: You’re looking for companies of which you want to become a part owner.

Warren Buffett famously said, “Buy into a company because you want to own it, not because you want the stock to go up.” He’s done pretty well for himself by following that rule.

Once you’ve identified these companies, it’s time to do a little research. Start with the company’s annual report — specifically management’s annual letter to shareholders. The letter will give you a general narrative of what’s happening with the business and provide context for the numbers in the report.

After that, most of the information and analytical tools that you need to evaluate the business will be available on your broker’s website, such as SEC filings, conference call transcripts, quarterly earnings updates and recent news. Most online brokers also provide tutorials on how to use their tools and even basic seminars on how to pick stocks.

3. Decide how many shares to buy

You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at once. Consider starting small — really small — by purchasing just a single share to get a feel for what it’s like to own individual stocks and whether you have the fortitude to ride through the rough patches with minimal sleep loss. You can add to your position over time as you master the shareholder swagger.

New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows you to buy a portion of a stock rather than the full share.

What that means is you can get into pricey stocks — companies like Google and Amazon that are known for their four-figure share prices — with a much smaller investment. SoFi Active Investing, Robinhood and Charles Schwab are among the brokers that offer fractional shares. (SoFi Active Investing and Robinhood are NerdWallet advertising partners.)

Many brokerages offer a tool that converts dollar amounts to shares, too. This can be helpful if you have a set amount you’d like to invest — say, $500 — and want to know how many shares that amount could buy.

4. Choose your stock order type

Don’t be put off by all those numbers and nonsensical word combinations on your broker’s online order page. Refer to this cheat sheet of basic stock-trading terms:

| Term | Definition |

|---|---|

| Ask | For buyers: The price that sellers are willing to accept for the stock. |

| Bid | For sellers: The price that buyers are willing to pay for the stock. |

| Spread | The difference between the highest bid price and the lowest ask price. |

| Market order | A request to buy or sell a stock ASAP at the best available price. |

| Limit order | A request to buy or sell a stock only at a specific price or better. |

| Stop (or stop-loss) order | Once a stock reaches a certain price, the “stop price” or “stop level,” a market order is executed and the entire order is filled at the prevailing price. |

| Stop-limit order | When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met. |

There are a lot more fancy trading moves and complex order types. Don’t bother right now — or maybe ever. Investors have built successful careers buying stocks solely with two order types: market orders and limit orders.

Market orders

With a market order, you’re indicating that you’ll buy or sell the stock at the best available current market price. Because a market order puts no price parameters on the trade, your order will be executed immediately and fully filled, unless you’re trying to buy a million shares and attempt a takeover coup.

Don’t be surprised if the price you pay — or receive, if you’re selling — is not the exact price you were quoted just seconds before. Bid and ask prices fluctuate constantly throughout the day. That’s why a market order is best used when buying stocks that don’t experience wide price swings — large, steady blue-chip stocks as opposed to smaller, more volatile companies.

Good to know:

- A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed.

- If you place a market order trade “after hours,” when the markets have closed for the day, your order will be placed at the prevailing price when the exchanges next open for trading.

- Check your broker’s trade execution disclaimer. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week.

Limit orders

A limit order gives you more control over the price at which your trade is executed. If XYZ stock is trading at $100 a share and you think a $95 per-share price is more in line with how you value the company, your limit order tells your broker to hold tight and execute your order only when the ask price drops to that level. On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set.

Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. They’re also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment.

There are additional conditions you can place on a limit order to control how long the order will remain open. An “all or none” (AON) order will be executed only when all the shares you wish to trade are available at your price limit.

A “good for day” (GFD) order will expire at the end of the trading day, even if the order has not been fully filled. A “good till canceled” (GTC) order remains in play until the customer pulls the plug or the order expires; that’s anywhere from 60 to 120 days or more.

Good to know:

- While a limit order guarantees the price you’ll get if the order is executed, there’s no guarantee that the order will be filled fully, partially or even at all. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to execute the trade.

- Limit orders can cost investors more in commissions than market orders. A limit order that can’t be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed.

5. Optimize your stock portfolio

We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. But if things turn difficult, remember that every investor — even Warren Buffett — goes through rough patches. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Market gyrations aren’t among them. But there are a few things in your control.

Once you’re familiar with the stock purchasing process, take the time to dig into other areas of the investment world. How will mutual funds play a part in your investment story? In addition to a brokerage account, have you set up a retirement account, such as an IRA? Opening a brokerage account and buying stocks is a great first step, but it’s really just the beginning of your investment journey.

How do Investors Invest in Startups?

Ordinary people can invest in startups via crowdfunding sites. Startup investing platforms offer a curated selection of companies and require varying minimum buy-ins. Major players in the crowdfunding startup space include:

- Wefunder

- SeedInvest

- StartEngine

- Republic

“Thousands of companies apply to raise on our platform each year, and we approve only about 3% of them,” says Kendrick Nguyen, CEO of crowdfunding platform Republic.

Most of the sites listed above let you get started investing in startups with as little as $100, while SeedInvest requires at least $500.

AngelList is another leading startup investing platform, but it only admits accredited investors with incomes of at least $200,000 ($300,000 if married) or net worth of at least $1 million, excluding their primary residence. Minimum buy-ins on AngelList are at least $1,000.

Non-accredited investors should be aware there may be a maximum amount you can invest in crowdfunding ventures during any 12-month period, according to SEC guidelines:

- If your annual income or your net worth is less than $107,000, you can invest up to the greater of $2,200 or 5% of the lesser of your annual income or net worth.

- If your annual income and your net worth are equal to or more than $107,000, you can invest up to 10% of annual income or net worth, whichever is less. This amount, however, cannot exceed $107,000.

Just because you can invest a certain amount in startups doesn’t mean you should go all-in. “The right amount to allocate should be no more than the investor can comfortably lose if the startup goes bankrupt or takes an especially long time to pan out,” says Randy Bruns, a certified financial planner (CFP) in Naperville, Ill.

Experts generally also recommend making several small investments in a few different startups versus one big investment in one startup. In fact, AngelList even writes in its investing guidelines that you should “only invest if you have enough capital to make 15-20 startup investments.”

This provides diversification: If you invest in five startups, and four of them fail, you still have one winner, which may help protect some of your money. That said, “you should expect your total losses to exceed your gains,” notes AngelList.

How do Entrepreneurs Come up With Ideas?

The popular perception is that most entrepreneurs search for them, looking at newspapers, magazines, the Internet, and so on for information about market trends and business opportunities unfolding in the marketplace.

Moreover, 70.9 percent of the founders of new businesses surveyed in the PSED indicated that the identification of their business opportunities wasn’t a “one-time thing”, but instead unfolded over time.

If entrepreneurs don’t search for business ideas, how do they tend to find them? Most entrepreneurs get their ideas from their experience working in industry. The PSED found that 55.9 percent of new firm founders in the United States attribute the identification of their new business idea to their experience in a particular industry or market.

Particularly important are the interactions that entrepreneurs had with customers in their prior jobs. A study by the National Federation of Independent Businesses found that the founder’s prior job was the source of the idea for a new business 43 percent of the time, that 61 percent of new businesses serve the same or similar customers as their founder’s previous employer, and that 66 percent of the new businesses were in the same or similar product line.

In short, most entrepreneurs come up with new business ideas by noticing gaps and problems in how customers are being served, while working for someone else.

How Can a Business be Profitable?

Small businesses can struggle with profitability for a number of different reasons. They keep prices too low. They focus more on big picture ideas than real consumers. They have way, way too many expenses. The list goes on and on.

But even if your business doesn’t make a lot of money early on, the goal should eventually be to sustain operations and earn a profit.

Calculate the Exact Costs for Your Business

Before you focus on increasing profits, you have to know where you’re starting from. That means you need to know all of your costs. And don’t just calculate general expenses either. You also need to know how much your regular activities are worth to your business.

Pillar explained in an email interview with Small Business Trends, “Profitability isn’t rocket science — it’s about the relationship between revenue and expense. Getting a very accurate view of what’s referred to as “unit economics” — what the entire revenue and cost chain looks like at a micro level (e.g.: how much a minute of drive time costs, the revenue yield on a specific piece of machinery, etc.) — is essential to supporting the business.

Getting clear, accurate and real-time visibility to your unit economics is key. When owners can find the bandwidth to focus and spend their time on the things that matter, they tend to be able to make good decisions.”

Automate Where Possible

Since some of the low value or mundane activities you want to cut out are essential functions, you need to find ways to accomplish them without spending tons of time on them. That’s where automation software and online solutions come into play.

Pillar says, “Automating those out frees up much-needed time to work on the business, instead of in the business. A key development over the past number of years for small businesses has been the emergence of mobile solutions to these essential, but low value activities, enabling businesses to manage their team, their clients and their billings from nearly anywhere, and often in a single platform solution.”

Track Your Time

You also need to know exactly how you spend your time if you want to eliminate other types of waste in your business. Use a time tracking software or keep track manually so you can get a good picture of what’s happening.

Analyze Your Finances Regularly

Once you have systems in place for tracking things like time, expenses and earnings, you need to keep an eye on those things regularly. Analyzing any changes can help you determine what’s working for your business and what isn’t.

Make Buying as Easy as Possible

Another potential roadblock is a difficult buying process. If customers have to jump through 10 different hoops in order to complete a purchase, they’re more likely to go with a competitor instead.

Prevent Theft and Waste

You might not be able to prevent all waste and theft in your business, but that doesn’t mean you shouldn’t try. Put systems in place to detect and alert you of any issues or abnormalities so you can address them as quickly as possible.

Look for Ways to Increase Minimum Order Prices

Instead of providing basic discounts, you can try to increase sales by offering bulk discounts, bundling or similar offers aimed at increasing the size of orders so the company makes more money overall.

What is a Business Investment?

A business investment (BI) is defined as the money spent on creating, developing, running or expanding a business with the expectations of future returns. A prerequisite for something to be considered a business investment is that you have some ownership of the business and, hence, stand to make a profit.

Ways to expand your business include adding new products or services, or purchasing an existing business. If you manufacture a product, you might purchase an additional product that fits into your line. You can continue to have the new product made where it’s currently being produced if you don’t want to interfere with your current operations.

If you have the production capacity and expertise to manufacture it for less cost, you might make the product yourself. You might purchase another company and merge it into yours to expand your locations, customers and distribution. In some cases, it makes financial sense to purchase another business and shut it down to remove a competitor that’s causing you to lower your prices, or to add its unique technology to your product.

How Can I Invest And Make Money Daily?

There are multiple ways to make money daily by investing your time and your money to make more money.

1. Dividend Investing

Dividend reinvesting is a way to invest and make money on those investments through your earnings. Through this investment strategy, investors purchase dividend paying stocks. Dividend stocks can pay cash directly to the investor. However, through a dividend reinvestment plan the investor uses the dividends to buy stocks and increase the size of their investment portfolio.

This is the epitome of using your money to invest and make money over and over again!

An easy way to get started is to choose a dividend ETF like Vanguard Dividend Appreciation ETF (VIG) or a pre-made investment portfolio (pie) made up of globally diversified dividend paying companies. MI Finance premade portfolios offers 6 income earners portfolios including a global dividend portfolio

2, Real Estate Investment Trust

Real Estate Investment Trusts (REITs) are a great way to start investing. REITs come in many varieties and are companies that own or provide financing to various types of income-producing real estate, according to the REIT website, Nareit. The beauty of REITs are that they are required to pay out roughly 90% of their income in cash dividends, creating an income stream or way to invest and make money daily.

Many investors want to get involved in real estate investing because the payout can be great. Many people claim real estate investment was their ticket to financial freedom! However, the risk and initial outlay is high when purchasing properties yourself.

Rather than sinking your emergency fund into a fixer-upper, real estate investment platforms like Fundrise, DiversyFund, or Groundfloor give investors an opportunity to make small and often short-term loans to buyers.

3. Trade Commodities

Trading physical commodities is also an option for investors. Prices for commodities are impacted by supply and demand, so a good understanding of the current economy (and a solid prediction of future needs!) is important here.

Active trading or buying and selling commodities like wheat, metals, energy and agriculture can be accomplished with futures contracts, stock trading, or funds. This way to make money daily online requires education and practice. The best way to get started is with a paper account, where you can learn to trade, without risking real money.

If you want to learn how to invest and make money daily, you might be surprised to see how effective even a small investment can be.

Shares in some big name companies, like Apple or Amazon, are really expensive. When you purchase a fractional share in a company you’re still getting the benefit of that investment, but paying a lot less. Some fractionally shares can even be purchased for pennies!

For small investors, many companies allow you to buy fractional shares of stock with small amounts of money, like Sofi active investing and stock slices from Schwab.

Through this method you can invest money online and earn daily through compounding returns, just like the regular stock market.

5. Spare Change Apps

Acorns is only one spare change app designed to make investing more accessible and affordable to the everyday person.

This small-scale robo-advisor invests the leftover change from your everyday purchases into fractional shares. You’d be surprised how quickly your account can grow!

6. Bonds

When you purchase a bond, you are lending money to an entity. The bond is that entity’s promise to repay your investment, with interest, over a certain number of years. Bonds are a fairly low-stakes investment option, which makes them a good addition to any portfolio. However, bonds tend not to earn as much as investments in other riskier ventures (think index funds).

Read Also: Making Money The Easy Way

The best way for small investors to buy bonds is via exchange traded bond funds. Although you might not invest and make money daily, as the funds typically pay interest monthly, you will likely grow your original investment.

7. Day Trading

While there are many robo-advisors on the market that can help both beginning and seasoned investors create strong stock investment portfolios, some investors might choose a much riskier option: day trading.

Traditional stock market investments are best over time. Investors purchase a stock and hold on to it for a while — sometimes for years! — and ride out any ebbs and flows until eventually selling for a profit. Day trades, on the other hand, are just what they sound like: you purchase a stock early in the day with the intent to sell it later on after it has rapidly increased in value.

There is a great deal of risk involved for a day trader because no one can consistently, accurately predict the market. Those who do well tend to be in-tune with events that might cause slight price changes within the market. They also risk major losses if a purchase goes awry.