If you happen to come across this post, perhaps you have some questions on how to invest in Bitcoins and cryptocurrencies. In fact, it is not surprising that more and more people are exploring further on how these virtual currencies work.

As they are popular investment products in recent years, these cryptographic tokens have fascinating features of being exchangeable, non-manipulatable, and valuable currencies that the future holds. This is why advocates of cryptocurrencies view Bitcoins as the next generation of currency to replace the existing ones we have today.

- What Are Some Things to Remember Before Investing in Bitcoins

- Protecting Your Bitcoins

- What to do Before Investing in Bitcoins?

- How Much Would I Have if I Invested $1000 in Bitcoin When it Started?

- Can I Invest $100 in Bitcoin?

- Is Now a Good Time to Invest in Bitcoin?

- Is Bitcoin a Bad Investment?

- How Far Will Bitcoin go up?

- What Will Bitcoin be Worth in 2030?

- What Was The Cheapest Bitcoin Ever?

- Can 1 Bitcoin Make You a Millionaire?

- Can You Lose All Your Money on Bitcoin?

- Is it Wise to Invest in Bitcoin?

- What Are The Advantages And Disadvantages of Bitcoin?

- Can You Get Scammed on Bitcoin?

- Will Bitcoin Ever Crash Again?

- Will Bitcoin be Around in 5 Years?

- Who Own The Most Bitcoin?

- Are There Bitcoin Billionaires?

- How Much Bitcoin Should You Own?

What Are Some Things to Remember Before Investing in Bitcoins

Here, we will shed some light on the following topics you may have about investing in Bitcoins and other cryptocurrencies:

Read Also: Top 10 Best Cryptocurrency to Invest in 2022

Whether you are just curious about Bitcoins, or you want to take action and start investing in the near future, you can gain valuable pieces of information from the texts you are about to read. So let’s start the ball rolling.

Bitcoin Investment Facts: Reasons to Invest in Bitcoins

The internet is becoming an indispensable tool for a multitude of things – communication, shopping, business, and even investing. With the people’s high reliance on the world wide web, it is expected that digital currencies will soon become more popular. Bitcoin, for instance, can be used for purchasing items online and may even be an alternative to physical currencies in the future.

But did you know that the number of Bitcoin is limited, with just 21 million of this cryptocurrency available? With its scarcity, the more valuable it becomes to people much like how precious metals that are tedious and expensive to mine are worth a fortune. This is why according to Hard Stacks, these assets may serve as a buffer when financial turbulence hits the economy.

At the same time, the significance of Bitcoin increases due to the global chaos that is tormenting economies of various nations. Currencies will soon devalue, and precious metals – along with an apolitical digital currency such as Bitcoin – will increase in value over time.

This is why if you are looking to create a balanced investment portfolio, it is practical to limit your selection on the top valuable currencies with a high level of security. You may also consider reading further about these coins in question, so you can be more informed when you select the best assets that will give you higher returns.

Some coins are known for their privacy including Zcash, Monero, and Dash. On the other hand, Bitshares, Nem, or Ripple are just some coins that are decentralized and less open, making it harder to get a hold of these.

But then again, it is important to note that it can be easy to both win and lose money due to the vagueness of the cryptocurrency world. There are new coins introduced each day and some coins simply lose value. It is a matter of weeding out the bad coins from the good ones.

So how can you tell the difference?

Good altcoins are those with an active and progressive development team, enthusiastic advocates, and an open technical vision. On the other hand, the bad coins are those that come with hazy directions on how you can get them, coupled with a community that is centered towards becoming rich fast.

OneCoin, as an example, is targeted merely towards the MLM system. Its false promises and claims to become the future Bitcoin only means that you should avoid them like the plague.

Beginner’s Guide to Buying Bitcoins

Several years back, buying cryptocurrencies was much like entering a black hole, with avid investors unsure of how to to penetrate this novel investing product. But now, there are clearer and simpler ways to get started.

For instance, you can make use of investment vehicles such as Bitcoin ETI, Bitcoin Investment Trust on the Second Markets, and also the XBT Tracker as some options. You may bet on the price of the Bitcoin using these tools, but with the exception of buying it.

We recommend this mode for first-timers who just want to get their feet wet before they take a plunge in the actual buying of Bitcoins. This way, no serious risk is involved, and you will eventually learn the ropes on how to invest like a pro.

But if you feel ready enough to take on the real thing – that is, to own actual Bitcoins and invest in them – then this is the time you purchase them on exchanges. The popular ones include Coinbase, BitStamp, Bitcoin.de, Gemini, Kraken, BitFlyer, and OKCoin.

Depends on where you are buying the Bitcoin, you can use the designated exchanges for your location. The best way to go is to opt for an exchange situated near where you are. This way, you can get your money back without any problem in case things go wrong.

Small exchanges are good for those who want to take their time in buying Bitcoin and only a small number of it. But for larger purchases, a major exchange can promise you with ample liquidity as the need arises. The main benefit of small exchanges, though, is that you can expect better prices the moment you have your orders filled.

Protecting Your Bitcoins

Valuable items need maximum security, as there will always be scammers, hackers, and thieves that will make a ploy in stealing your precious bitcoins. This is why securing your possessions is highly important to ward off anyone who is after your investment. Bitcoin wallets can provide you with peace of mind and assurance that your coins are safe and secure no matter what.

Trezor and Ledger Nano S are the two big security companies catering to Bitcoin protection. But wherever you decide to place your bitcoins, make it a point to secure it in a wallet that only you can control.

Also, the fact that Bitcoin is purely internet-based, once it is stolen retrieving it can be a tough ordeal. Thus, selecting the best wallet for storing these precious coins must be a priority.

What to do Before Investing in Bitcoins?

When it comes to cryptocurrencies, one of the biggest challenges for investors is not getting caught up in the hype. Digital currencies have quickly risen to a place of prominence in the portfolios of many retail and institutional investors. At the same time, analysts have continued to caution investors about their volatile nature and unpredictability.

If you’ve decided to invest in the cryptocurrency market, as with any other investment, it’s important to do your research before you hand over any money. Below, we’ll explore the things you should know before you invest.

Consider Why You Are Investing in Cryptocurrency

Perhaps the most fundamental question you should ask yourself before making a cryptocurrency investment is why you’re doing it. There are myriad investment vehicles available at this point (many of which offer more stability and less risk than digital currencies).

Are you interested simply because of the trendiness of the cryptocurrency craze? Or is there a more compelling reason for an investment in one or more specific digital tokens? Of course, different investors have various personal investment goals, and exploring the cryptocurrency space may make more sense for some individuals than for others.

Get a Feel for the Industry

Particularly for those investors who are new to digital currencies, it’s essential that they develop a sense of how the digital currency world works before investing. Take time to learn about the different currencies on offer. With hundreds of different coins and tokens available, it’s crucial to look beyond the biggest names, like Bitcoin, Ether, and Ripple.

In addition, it’s important to explore blockchain technology to get a sense of how this aspect of the cryptocurrency world works.

If you don’t have a computer science or coding background, it’s likely that some aspects of blockchain technology will be a challenge for you to parse out. There are many primers on blockchain technology that are intended for a layperson to understand.

Once you’ve identified the cryptocurrency (or several cryptocurrencies) for investment, look into how those tokens make use of blockchain technology and if there are any innovations that they provide that make them distinct from the rest of the field.

By better understanding cryptocurrencies and blockchain technology, you’ll be more fully equipped to determine whether a potential investment opportunity is worthwhile.

Join an Online Community of Cryptocurrency Enthusiasts

Because the digital currency space is such a trendy area, things tend to develop very quickly. Part of the reason for this is that there is a robust and very active community of digital currency investors and enthusiasts in communication with one another around the clock.

Get plugged into this community to learn about the buzz going on in the cryptocurrency world. Reddit has become a central hub for digital currency enthusiasts, but there are also many other communities online with active discussions going at all times.

Read Cryptocurrency White Papers

More important than word of mouth, though, is the specifics of a digital currency itself. When you’re considering an investment, take the time to find the project’s white paper. Every cryptocurrency project should have one, and it should be easily accessible (if it’s not, consider that a red flag).

Read the white paper carefully; it should tell you everything about what the developers of the project intend in their work, including a timeframe, a general overview of the project, and specifics. If the white paper does not contain data and specific details about the project, that is generally seen as a negative.

The white paper is a development team’s chance to lay out the who, what, when, and why of their project. If something in the white paper feels incomplete or misleading, that might speak to fundamental issues with the project itself.

Timing Is Key

After diligent research, you’ve likely developed a feel for the cryptocurrency industry and you may have determined one or more projects in which to invest. The next step is to time your investment. The digital currency world moves quickly and is known for being highly volatile.

On one hand, buying into a hot new currency before it explodes in popularity and value may prompt investors to move equally quickly. In actuality, though, you’re more likely to see success if you monitor the industry before making a move.

Cryptocurrencies tend to follow particular price patterns. Bitcoin often leads the way among digital currencies, which tend to follow its general trajectory.1 News of an exchange hack, fraud, or price manipulation can of course send shockwaves through the cryptocurrency sphere, so it’s important to watch out for what’s going on in the space more broadly.

Finally, remember that digital currencies are a highly speculative area. For every overnight bitcoin millionaire, there are many other investors who have poured money into the virtual token realm only to see that money disappear. Investing in this space means taking a risk. By doing your homework before making an investment, you help to give yourself the best chances of success.

How Much Would I Have if I Invested $1000 in Bitcoin When it Started?

Bitcoin surged in popularity in 2017 when it rallied from $900 to almost $20,000 in less than a year. But it has become known as much for its plunges as for its rallies and has seen its value plummet on several occasions. It is volatile for the same reason that it is valuable — there is no central authority that can intervene in the market.

But unlike other cryptocurrencies, such as dogecoin, which have also seen similar rallies and plunges, bitcoin is more technologically developed and has scarcity built into its creation process.

Bitcoin currently has a market cap of around $736 billion. That’s far greater than Ethereum’s $277 billion market cap, which is the second-largest cryptocurrency by market cap.

If you invested in bitcoin last July, it would have grown 252% over the past 12 months. A $1,000 bitcoin purchase on July 26, 2020 — at a price of $10,990.87 per coin — would be worth $3,525.65 at Monday morning’s price of $38,750, according to CNBC calculations.

If you zoom out further, the growth curve is even steeper. On July 26, 2016, $1,000 would have bought you 1.52 bitcoin at a price of $656.17 per coin. Today, that investment would be worth $58,900, representing growth of 5,805%.

Going back 10 years, bitcoin’s percent growth is six figures. In July 2011, two years after it was created, one coin cost $13.91. Back then, $1,000 would have bought you 71.89 bitcoin, which would be worth $2,785,737.50 today. That figure represents growth of 278,476.56%.

Can I Invest $100 in Bitcoin?

You can invest as little as $100 in bitcoin.

In fact, you can buy bitcoin fractions up to $100, which means you don’t have to buy a whole coin, which is currently retailing at $32,979 (1 July 2021). Bitcoin units referred to as Satoshi is divisible to eight decimal places, and a single bitcoin is equal to 100,000,000 satoshis.

You can also buy or sell one-thousandth of a bitcoin.

The price of this crypto has been on an upward trend in 2021, so if you were to invest $100 in bitcoin today, you are likely to reap enormous gains in the future.

As it is, bitcoin’s value has increased dramatically, having quadrupled in 2020 to heights above $28,000. And this value is going to soar even higher, which translates to higher returns for investors, considering the high-profile support from multinationals like Tesla and Mastercard.

But that’s not all. The Bank of New York plans to offer custody services for digital assets like bitcoin owing to increasing client demand. According to the CEO of Galaxy Digital, a renowned cryptocurrency bull, bitcoin might rise to $55,000 or $60,000 by Dec 2021.

Is Now a Good Time to Invest in Bitcoin?

If you’re interested in investing, you might be considering cryptocurrencies, stocks, and forex. With so many opportunities to invest, some would-be investors are trying to figure out where they should put their money in order to start building wealth through investing.

One of the hottest investment trends right now is Bitcoin and other cryptocurrencies. With a high price tag, bitcoin has captured the imagination of many investors. However, just because something has a high price and has seen a huge increase in a short period of time doesn’t mean it’s the right investment for you.

So, is Bitcoin a good investment?

Deciding whether to trade forex vs. crypto vs. stocks depends on your individual investment style and goals. Different strategies can be used for stocks vs. crypto vs. forex that can allow you to build wealth in both the short-term and the long-term.

Some of the things to consider as you decide which market is right for you include:

Experience with investing

In general, you’re likely to have more success as a beginning investor if you start with stocks. You can get a general feel for how markets work and learn the basics. Those with intermediate to advanced experience might be interested in branching out to cryptocurrencies and forex.

Beginners can also be successful with crypto trading, especially if they start with basics and use an exchange like Coinbase to learn the ropes. Later, it might make sense to get your own digital wallet and use other exchanges.

Forex trading, especially if you want to use trades with multiple legs and be involved in more complex transactions, is usually more suited for those with more experience.

Funds

If you’re more interested in a “set it and forget it” approach with instant diversity, access to funds is important. While there are currency and crypto funds, stocks are often better suited to fund investing.

Risk Tolerance

Crypto and forex trading are considered riskier than stocks. If you have a low-risk tolerance, stock trading is probably a better choice. On the other hand, if you can stomach the ups and downs, as well as handle the potential for larger losses, forex and crypto might work well for you.

Time Horizon

If you’re trying to make more money in a short amount of time, crypto and forex can help. For those with a longer time horizon, stocks might be a good choice, since you can find value investments that grow at a slower rate but come with a lower risk of loss.

Is Bitcoin a Bad Investment?

It’s possible to get filthy rich by investing in cryptocurrency. But you could also lose all of your money. How can both be true? Investing in crypto assets is risky but also potentially extremely profitable.

Cryptocurrency is a good investment if you want to gain direct exposure to the demand for digital currency, while a safer but potentially less lucrative alternative is to buy the stocks of companies with exposure to cryptocurrency.

Several factors make cryptocurrency not entirely safe, at least currently, while other signs are emerging that cryptocurrency is here to stay.

Cryptocurrency risks

Cryptocurrency exchanges, more so than stock exchanges, are vulnerable to being hacked and becoming targets of other criminal activity. These security breaches have led to sizable losses for investors who have had their digital currencies stolen.

Safely storing cryptocurrencies is also more difficult than owning stocks or bonds. Cryptocurrency exchanges such as Coinbase (NASDAQ:COIN) make it fairly easy to buy and sell crypto assets such as Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH), but many people don’t like to keep their digital assets on exchanges due to the aforementioned risk of cyberattacks and theft.

Some cryptocurrency owners prefer offline “cold storage” options such as hardware or paper wallets, but cold storage comes with its own set of challenges. The biggest is the risk of losing your private key, without which it is impossible to access your cryptocurrency.

There’s also no guarantee that a crypto project you invest in will succeed. Competition is fierce among thousands of blockchain projects, and projects that are no more than scams are also prevalent in the crypto industry. Only a small number of cryptocurrency projects will ultimately flourish.

Regulators may also crack down on the entire crypto industry, especially if governments begin to strongly view cryptocurrencies as a threat rather than just innovative technology.

And, with cryptocurrencies being based on cutting-edge technology, that also increases the risks for investors. Much of the tech is still being developed and is not yet extensively proven in real-world scenarios.

Bitcoin as a long-term investment

Bitcoin, as the most widely known cryptocurrency, benefits from the network effect — more people want to own Bitcoin because Bitcoin is owned by most people. Bitcoin is currently viewed by many investors as “digital gold,” but it could also be used as a digital form of cash.

Investors in Bitcoin believe the cryptocurrency will gain value over the long term because the supply is fixed, unlike the supplies of fiat currencies such as the U.S. dollar or the Japanese yen.

The supply of Bitcoin is capped at just under 21 million coins, while central-bank-controlled currencies can be printed at the will of politicians. Many investors expect Bitcoin to gain value as fiat currencies depreciate.

Those who are bullish about Bitcoin being extensively used as digital cash believe that, over the long term, Bitcoin has the potential to become the first truly global currency.

How Far Will Bitcoin go up?

Because Bitcoin is so powerful and has so much potential, Bitcoin’s projected value and estimated growth could be astronomical. Speculation from crypto analysts and industry experts suggests that Bitcoin’s long term value could reach over $100,000 to as much as one million dollars per BTC in the future.

Several experts have weighed in on their short and long-term price expectations for Bitcoin price. Here are some of the most popular Bitcoin price forecasts from top crypto industry experts.

Max Keiser, investor, and host of the Keiser Report calls for $100,000 Bitcoin in the short term, but $400,000 in the long-term.

Max Keiser, Financial Analyst and Host of The Keiser Report

Keiser is one of Bitcoin’s most outspoken bull, calling for $100,000 since the asset was trading at just $1. His new $100,000 target though is for the end of 2020, meanwhile, $400,000 is a long-term goal due to the coronavirus and comparison to gold.

“I am officially raising my target for Bitcoin — and I first made this prediction when it was $1, I said this could go to $100,000 — I’m raising my official target for the first time in eight years, I’m raising it to $400,000,” Keiser said.

Robert Kiyosaki, Entrepreneur, Investors, and Best-Selling Author

Robert Kiyosaki, New York Times bestselling author of the book Rich Dad, Poor Dad has been recommending his followers buy gold and Bitcoin. He calls for gold to reach $3,000 an ounce, and Bitcoin to reach $75,000.

Plan B’s Stock-to-Flow Model Based on Scarcity

The popular Stock-to-Flow model created by Bitcoin expert Plan B which uses the asset’s digital scarcity to estimate price valuations in the future. The model shows Bitcoin reaching as high as $288,000 in the next cycle peak, which should take place over the next couple of years.

Adam Back, Bitcoin Developer and CEO at Blockstream

Bitcoin developer and early electronic cash pioneer Adam Back says that Bitcoin should reach as high as $300,000 over the next several years.

“[Bitcoin] might not require additional institutional adoption [to reach $300,000] because the current environment is causing more individuals to think about hedging [and] retaining value when there’s a lot of money printing in the world,” Back told Bloomberg.

What Will Bitcoin be Worth in 2030?

While Bitcoin will sooner or later come out of the current price correction phase, the majority in a survey of 42 crypto experts globally recently said hyperbitcoinisation – the moment when Bitcoin overtakes global finance – will happen by 2050.

The study noted that 29 percent said hyberbitcoinisation will happen as soon as 2035 while an additional 20 percent believed it to happen by 2040. However, 44 percent of panelists didn’t expect it to ever occur.

Bitcoin has managed to gain increased backing or attracted the interest of companies and financial entities across the globe such as JPMorgan, Goldman Sachs, PayPal, Visa, Tesla, Apple, MicroStrategy, and more.

Recently, the Central American nation El Salvador became the first country globally to adopt Bitcoin as a legal tender. Others such as Bulgaria and Ukraine also owned Bitcoins, according to BitcoinTreasuries.org.

Even as there could be a medium-term price depreciation, the price of Bitcoin is predicted to increase up to $318,417 by December 2025, according to the panel. “Halving events and inflation along the way to 2025 and 2030 will likely trigger the larger upside moves,” said Justin Chuh, Senior Trader, Wave Financial in the report. “Prices are likely to be continuously driven by supply and demand, less availability for a wider group of users.”

However, panelists expected that by December 2030, the price will go up to $4,287,591 but “the average is skewed by outliers – when we look at the median price prediction, the 2030 price forecast comes down to $470,000.” This is still over 14X from the current price of near $32,000.

Nonetheless, 2021 is expected to end at $66,284, according to 61 per cent of panelists. This would be just $2,000 more than the all-time high of $64,234 as of April 14, 2021, as per data from CoinMarketCap.com.

What Was The Cheapest Bitcoin Ever?

For the most part, Bitcoin investors have had a bumpy ride in the past roughly 13 years. Apart from daily volatility, in which double-digit inclines and declines of its price are not uncommon, they have had to contend with numerous problems plaguing its ecosystem, from multiple scams and fraudsters to an absence of regulation that further feeds into its volatility.

In spite of all this, there are periods when the cryptocurrency’s price changes have outpaced even their usually volatile swings, resulting in massive price bubbles.

The first such instance occurred in 2011. Bitcoin’s price jumped from $1 in April of that year to a peak of $32 in June, a gain of 3,200% within three short months. That steep ascent was followed by a sharp recession in crypto markets, and Bitcoin’s price bottomed out at $2 in November 2011. There was a marginal improvement the following year, and the price had risen from $4.80 in May to $13.20 by Aug. 15.

2013 proved to be a decisive year for Bitcoin’s price. The digital currency began the year trading at $13.40 and underwent two price bubbles in the same year. The first of these occurred when the price shot up to $220 by the beginning of April 2013. That swift increase was followed by an equally rapid deceleration in its price, and the cryptocurrency was changing hands at $70 in mid-April.

But that was not the end of it. Another rally (and associated crash) occurred toward the end of that year. In early October, the cryptocurrency was trading at $123.20. By December, it had spiked to $1,156.10. But it fell to around $760 three days later. Those rapid changes signaled the start of a multiyear slump in Bitcoin’s price, and it touched a low of $315 at the beginning of 2015.

By March of 2021, bitcoin prices reached new all-time highs of over $60,000. Continued institutional interest in the cryptocurrency further propelled its price upward, and Bitcoin’s price reached just under $24,000 in December 2020, for an increase of 224% from the start of that year. It took less than a month for Bitcoin to smash its previous price record and surpass $40,000 in January 2021.

Bitcoin eventually reached a peak of more than $64,000 on April 14, 2021. The summer, however, saw prices fall by 50%, hitting $32,000. The Autumn of 2021 saw another bull run, with prices scraping $50,000, but accompanies by large drawdowns to around $42,500.

Can 1 Bitcoin Make You a Millionaire?

Let’s start with the obvious: You’re never going to make any money off of Bitcoin if you don’t own any tokens. If you’re just interested in purchasing a small amount of Bitcoin, that’s not too difficult to do.

Most cryptocurrency exchanges enable you to purchase partial coins, so you don’t need thousands of dollars to get started. And you can still make a handsome little profit, even if you don’t own a whole coin.

Let’s say you invest $5,000 in Bitcoin right now. At the time of writing, that would buy you about 0.13 of a Bitcoin. If Bitcoin makes it back to $60,000 a coin and you sell it, you’d pocket about $2,800 in profits. That’s not bad, but it’s not going to make you a millionaire.

A single Bitcoin is trading for just under $39,000. Even if you had a whole coin, you’d only make about $61,000 should Bitcoin make it to $100,000 a coin. You’d need to buy over 16 Bitcoins in order to make a $1 million profit if Bitcoin hits $100,000, and that means coughing up over $620,000 right now. That’s not an easy feat for a lot of people.

You may be able to make a million-dollar profit with less Bitcoin if it ends up worth more than $100,000 a coin

Can You Lose All Your Money on Bitcoin?

Yes, you can lose more than what you invested. Even in some instances, you could lose all the money you invested in bitcoin. Situations when companies fold up or when the company you invested in or the crypto platform you use is been controlled by charlatans who are out to take as much as they can without the intentions of giving out anything.

Most people are flooding there self into the cryptocurrency world without knowing how it works, the pros and the cons all tend to focus their minds on is that people are making money from cryptocurrencies.

Cryptocurrency is a virtual time of currency compared to fiat currencies that are our local currencies and all crypto transactions are carried out on the blockchain network initially these transactions were almost impossible to trace but as we all know the father of creativity is necessity. We have tech firms that specialize in tracing cryptocurrencies lost to scammers

Assuming that you’re not using any leverage – no, you will never lose more money than you invest in Bitcoin. The worst case scenario is that BTC goes down to $0, which means that if you bought $10,000 worth of BTC, your $10,000 would be worth $0.

Technically in this scenario, you most likely spend a small percentage of that trade-in fees – so in total you may have lost $10,020 or something like that in this investment. Outside of this and assuming you are not using any leverage, you will never lose more money in BTC than the amount you initially invested.

On top of that, you only lose money if you sell when BTC is down. As such, if you never sell, you’ll never lose any money (unless it goes to $0). While BTC is extremely volatile and you can see swings of 10%+ per day, historically (outside of purchasing BTC in Feb 2021), if you just hold your BTC, you’ll be in the green in the long term.

Is it Wise to Invest in Bitcoin?

Similar to any speculative investment, buying Bitcoin carries risk. Since its inception, Bitcoin was the 1st digital asset to beget the current ecosystem of cryptos.

For quite a while, it grew an underground following of investors who saw its future as a possible replacement to the physical monetary system. Now Bitcoin has become a household name as institutions and governments develop ways to serve their customer’s growing demand for exposure.

Similar to how the internet was once a speculative investment, Bitcoin has received similar criticism. In reality, Bitcoin’s current adoption rate outpaces that of the internet’s, with a 2021 user base roughly the size of the internet’s in 1997.

In 2021, El Salvador became the 1st country in the world to make Bitcoin a legal tender; Paraguay and other countries look to follow suit. El Salvador is also the first and only country to have Bitcoin in its treasury. As of September, El Salvador has 700 coins. President Nayib Bukele has not been shy about announcing his purchases on Twitter.

As the traditional finance world realizes Bitcoin’s potential for disruption, they must choose either to adopt cryptocurrencies or face irrelevance. The personal decision to invest in bitcoin comes down to your appetite for risk and your perspective on the future of humanity.

With institutions adding Bitcoin to their balance sheets and El Salvador officially making Bitcoin legal tender, it’s looking like Bitcoin will be the future of currency, or at least an accepted store of value. However, with so much volatility in the market, risk-averse investors are still hesitant to buy Bitcoin, much less any other cryptocurrency.

Since Bitcoin isn’t controlled by a central entity, its monetary policy is much more sound than any government. Ark Invest CEO Cathie Wood describes Bitcoin as a “rules-based monetary system”, as Bitcoin’s monetary policy is set by the parameters of the code.

With governments printing out more money than ever before in light of the pandemic, investors are looking for alternative investments to hedge against inflation. Many are turning to Bitcoin to do so, facilitating adoption of a cryptocurrency over the long-term.

What Are The Advantages And Disadvantages of Bitcoin?

Advantages

The overwhelming performance of bitcoin — as a currency and investment — has attracted traditional and institutional investors alike. Bitcoin as an investment tool provides you with the following advantages over traditional investments.

- Liquidity. Bitcoin is arguably 1 of the most liquid investment assets due to the worldwide establishment of trading platforms, exchanges and online brokerages. You can easily trade bitcoin for cash or assets like gold instantly with incredibly low fees. The high liquidity associated with bitcoin makes it a great investment vessel if you’re looking for short-term profit. Digital currencies may also be a long-term investment due to their high market demand.

- Lower inflation risk. Unlike world currencies — which are regulated by their governments — bitcoin is immune to inflation. The blockchain system is infinite and there’s no need to worry about your cryptos losing their value.

- New opportunities. Bitcoin and cryptocurrency trading is relatively young — new coins are becoming mainstream on a daily basis. This newness brings unpredictable swings in price and volatility, which may create opportunities for massive gains.

- Minimalistic trading. Stock trading requires you to hold a certificate or license. You must also go through a broker to trade a company’s shares. But bitcoin trading is minimalistic: simply buy or sell bitcoin from exchanges and place them in your wallet. Bitcoin transactions are also instant — unlike the settlement of stock trading orders, which could take days or weeks.

Disadvantages

Bitcoin may be the future of monetary exchange, but it is equally important that you are aware of the concerns surrounding cryptocurrency investing. Here are some serious risks associated with bitcoin investments.

- Volatility. The price of bitcoin is always rippling back and forth. If you happened to buy bitcoin on December 17, 2017, the price was $20,000. Weeks later, you couldn’t sell your investment for more than $7,051. While you’d be doing great now in 2021, holding for years at a time is not a viable option for all investors.

- Threat of online hacking. While using a trusted exchange like Coinbase or Gemini will do wonders to lower your risk of being hacked, the only way you can be totally secure is by taking custody of your own private key. This can be done with a crypto wallet like the Ledger Nano X or Coinbase Wallet.

Can You Get Scammed on Bitcoin?

Thanks to the anonymity of the internet, scammers blend into the crypto scene with claims that can seem plausible. Cryptocurrencies are still unknown territory for many, making it harder to tell what’s real and what’s a scam. Let’s take a look at the top five crypto investment scams highlighted by the Commission:

1. Pyramid schemes:

Online, people may appear friendly and willing to share their “tips,” which is often part of the ruse to get people to invest in their scheme. Some of these schemes are based on referral chains (a type of pyramid scheme) and work by bringing in people who then recruit new “investors,” read the FTC report.

Scammers tell people to pay in crypto for the right to recruit others into a program in turn for rewards paid in cryptocurrency. The more you pay, the more money they promise you’ll make, they say.

2. Bogus websites:

Crypto amateurs are lured to “bogus” websites that advertise opportunities for investing in or mining for cryptocurrencies — and many of these websites make it appear as though your investment is growing. However, people report that when they try to withdraw their apparent profits, they are told to send even more crypto, but they get nothing back in the end.

3. Giveaway scams:

So-called “giveaway scams” — promoted on Twitter, Facebook, and other social media sites — that appear to be sponsored by celebrities or thought leaders in the cryptosphere promise to immediately multiply the cryptocurrency people send. In most cases, duped investors are just sending coins directly to a scammer’s wallet. In fact, impersonators of crypto enthusiast and self-described “Doge Father” Elon Musk have received over $2 million in 2021 alone.

4. Online dating:

Other tactics include using online dating to draw people in. The FTC received reports of investors who are lured into believing they are in long-distance relationships. When a trust has been established, these “lovers” promise huge returns on exciting, new cryptocurrency investment schemes — then ghost them, leaving with the money (oh, come on, folks!).

5. Impersonating a government authority or business:

Scammers are increasingly impersonating a government authority or business. Some people reported to the FTC that they deposited cash into Bitcoin ATMs to pay imposters claiming to be from the Social Security Administration. Others reported losing money to scammers posing as Coinbase, the largest U.S.-based cryptocurrency exchange and wallet provider.

It’s worth pointing out, though, that only 14 percent of reported losses to imposters on the internet involved cryptocurrency. A much larger proportion, 86 percent, involved fiat currency. But this ratio is likely to change: The crypto industry is growing exponentially. If trends continue, the percentage of losses involving digital currency looks to increase in the coming years.

And it’s not just individuals that are targeted by scams and hacks. Perpetrators of the July 2020 data breach (and subsequent data leak) of the France-based crypto wallet provider Ledger are still capitalizing on victims of the attack.

After the Ledger database was compromised, names, email addresses, home addresses, and telephone numbers of 272,000 customers were released. Now, cybercriminals are demanding payment in cryptocurrency from victims in an extortion campaign that “threatens users’ financial and emotional well-being.”

Large crypto companies, perhaps even more so than individual consumers, are hot targets. Despite being considered one of the leaders in cryptocurrency storage, even companies like Ledger are susceptible to malicious actors. Don’t just be careful who you send cryptocurrency to, also be careful who you store your cryptocurrency with.

Will Bitcoin Ever Crash Again?

Any investment is done primarily for returns. The higher the returns, the higher would be the investment. Backing exactly this sentiment, Saylor and his ilk preferred Bitcoins over gold. In 2020, Bitcoin outdid every other asset to give 318 percent returns.

Over the last year or so, there has been a steady influx of positive stories on the Bitcoin front:

- In September 2020, MicroStrategy acquired a total of 38,250 bitcoins valued at $425 million and subsequently announced its intentions to raise another $537.2 million to buy even more bitcoin

- In October 2020, PayPal allowed their customers to buy, sell, and hold bitcoin using their online wallets.

- In February this year, electric car manufacturer Tesla announced that they had bought $1.5 billion in Bitcoins. The company added that they are also likely to accept the cryptocurrency as payments.

- Recently, El Salvador has adopted Bitcoin as legal tender and the Argentinian President also said that he is open to the idea of treating cryptos as legal currency.

These stories have boosted the sentiment around Bitcoins.

However, going back to what we mentioned at the start of the story. Bitcoin and other cryptocurrencies are highly volatile. Their prices will touch highs and lows all the time, so it’s tough to predict a rise or crash. Nobody can say that with any guarantee or certainty. But what you can do as an investor is be prudent when it comes to investing in Bitcoins.

One approach that you can follow is rupee-cost averaging. Instead of buying Bitcoins for a lump sum amount in one go, what you can do is spread your investment over a period of time. This will shield you from Bitcoin’s volatility upto a certain extent and also give you better returns.

The best time to buy Bitcoin was 2009 and the next best time is today. Helping you invest in Bitcoins in a safe, secure and simple manner is ZebPay. With ZebPay, you can begin your cryptocurrency journey for as little as Rs 100. Start now and get ready to ride the crypto wave!

Bitcoin’s recent report card

- December 16, 2020: Bitcoin touches $20,000/coin for the first time ever

- April 13, 2021: Bitcoin touches a record high of $63,375

- June 22, 2021: Bitcoin slips under $30,000 for the first time in five months

- August 2, 2021: Bitcoin rally takes it to the highest level since May at $40,000

- August 23, 2021: Bitcoin returns to above the $50,000 mark

Will Bitcoin be Around in 5 Years?

The next decade could prove its importance in Bitcoin’s evolution. Revolutions within the financial ecosystem apart, there are a couple of areas in Bitcoin’s ecosystem that investors should pay close attention to.

Currently, cryptocurrency is poised between being a store of value and a medium for daily transactions. Institutional investors are eager to get in on the action and profit from the volatility in its prices even as governments around the world, such as Japan, have declared it a valid form of payment for goods.

But problems with scaling and security have prevented both occurrences from happening. “Arguably the biggest failings for Bitcoin and other cryptocurrencies over the previous years lie with security,” said Chakib Bouda, CTO at Rambus—a payment firm.

Bouda is referring to the billions of dollars worth of Bitcoin and other cryptocurrencies that have been stolen from exchanges by hackers. According to him, a secure Bitcoin ecosystem will lead to widespread adoption. “We expect in 10 years’ time, Bitcoin will become mainstream and have a remarkably different reputation,” he said.

The mainstreaming of Bitcoin (or, for that matter, increase in its attractiveness as an asset class) as a payment mechanism will not occur without technological improvements in its ecosystem. To be considered a viable investment asset or form of payment, Bitcoin’s blockchain should be able to handle millions of transactions in a short span of time.

Several technologies, such as Lightning Network, promise scale in its operations. New cryptocurrencies which have formed as a result of hard forks of the bitcoin blockchain, including Bitcoin Cash and Bitcoin Gold, aim to adjust the parameters of the ecosystem in order to handle more transactions at a faster pace.

Along with improvements in Bitcoin’s blockchain, Ripple’s CTO David Schwartz compared Bitcoin to Ford’s Model T in 2018. The automobile’s manufacturer heralded a revolution in transportation and an entire ecosystem, from highways to gas stations, evolved to serve the automobile. Thanks to extensive media coverage, the beginnings of an ecosystem have already taken root in the last couple of years.

As regulation evolves to keep pace, it is likely that the ecosystem will expand. Schwartz predicts that the next decade will “bring an explosion of low-cost, high-speed payments that will transform value exchange the way the Internet transformed information exchange.”

So far in 2021, the price of Bitcoin has topped $60,000 before falling to around $40,000. Large banks are continuing to take notice of the cryptocurrency, with Goldman Sachs reopening its crypto trading desk and BNY Mellon opening custody services for digital currencies.

Citi said Bitcoin could be the currency of choice for international trade. This comes as both PayPal (PYPL) and Tesla (TSLA) made investments in cryptocurrency in early 2021. Tesla bought $1.5 billion in Bitcoin, while PayPal made a bid to buy crypto custodian Curv.

Citi noted that Bitcoin’s future is still very uncertain, but that it’s on the cusp of mainstream acceptance. The institutional investor interest is driving broad interest in the cryptocurrency, but issues over custody, security, and capital efficiency are still headwinds for the digital asset, noted Citi.

Who Own The Most Bitcoin?

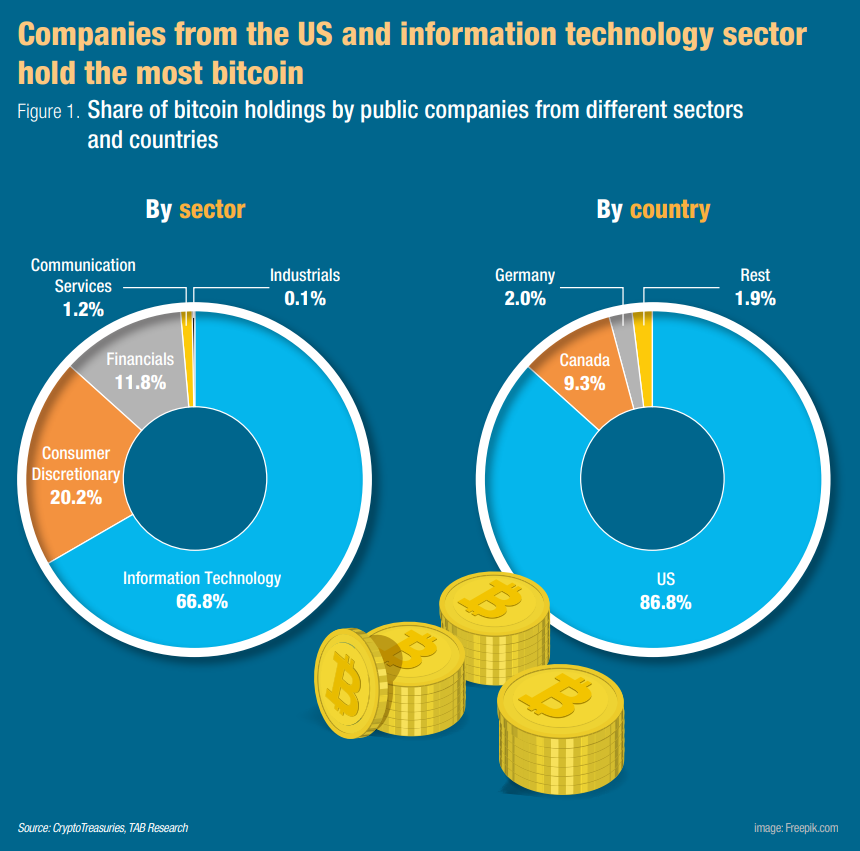

Twelve companies from the US together hold over 185,000 bitcoins on their balance sheet, accounting for 87% of the aggregate number of bitcoins held by all 34 public companies, while the share of 13 Canadian companies is much smaller at 9.3%.

The top 10 public companies that hold the most bitcoin comprise seven from the US, two from Canada and one from Germany. In addition, those from the information technology sector hold the most bitcoin on their balance sheet, with a share of 66.8%, followed by companies from the consumer discretionary sector (20.2%) and financial sector (11.8%).

The number of bitcoins owned by the top 10 public companies with the largest bitcoin holdings totalled over 204,000. MicroStrategy is the public company that holds the most bitcoin on the balance sheets, followed by Tesla, Galaxy Digital Holdings, Voyager Digital, Square and Marathon Digital Holdings.

MicroStrategy holds approximately 105,085 bitcoins, worth $3.6 billion based on price on 28 June 2021. Galaxy Digital Holdings offers trading, asset management and investment banking services for institutional investors, while also making a sizeable investment in cryptocurrency with its own money. Currently, the company holds around 16,400 bitcoins.

Payments firm Square purchased approximately 4,709 bitcoins for an aggregate price of $50 million in October 2020 and acquired an additional 3,318 bitcoins for $170 million in February 2021. The average price of all its bitcoin purchases is $27,407 per token.

The company announced that it has no plan to purchase more bitcoin in May 2021, while it is looking into creating a hardware bitcoin wallet for users to store their cryptos without Square’s custody.

Marathon Digital Holdings, a US bitcoin mining company, increased its bitcoin holdings to around 5,518 bitcoins as of May 2021. The company purchased approximately 4,813 bitcoins at an average price of $36,857 in January 2021.

From January to May 2021, it has produced 580.5 newly minted bitcoins. Hut 8 Mining, another bitcoin mining company based in Canada, holds more self-mined bitcoin than any other bitcoin miner or public company.

MicroStrategy to acquire more bitcoin

MicroStrategy has allocated a large proportion of its corporate treasuries to bitcoin. Its CEO Michael Saylor has been a leading advocate of bitcoin. The company made its first investment in August 2020 and adopted bitcoin as its primary treasury reserve asset. Acquiring and holding bitcoin has become part of the company’s corporate strategy since February 2021.

MicroStrategy bought 21,454 bitcoins in August 2020, 16,796 bitcoins in September 2020, 32,220 bitcoins in December 2020, 314 bitcoins in January 2021, 19,747 bitcoins in February 2021, 795 bitcoins in March 2021, 253 bitcoins in April 2021, 500 bitcoins in May 2021 and 13,005 bitcoins in June 2021. The company disclosed that these bitcoins were bought for a total of $2.741 billion and at an average purchase price of approximately $26,080 per token.

The company invested more in bitcoin following cryptocurrency price plunge. On 8 June 2021, it announced to sell $500 million of seven-year senior secured notes with an annual interest rate of 6.125% to fund the purchase of more bitcoin.

The company increased the size of the offering from $400 million to $500 million as it received around $1.6 billion in orders. Previously, the company had issued $550 million worth of convertible senior notes in December 2020 and another $1.05 billion in February 2021 to add more bitcoin to its balance sheet.

With the proceeds from the sale of the $500 million high yield bonds, MicroStrategy bought an additional 13,005 bitcoins for $489 million in cash on 21 June. It also unveiled a plan to sell as much as $1 billion in common shares for general purposes, which includes additional investment in Bitcoin.

Tesla to resume bitcoin transactions

Tesla bought $1.5 billion worth of bitcoins in January 2021. Elon Musk, Tesla’s CEO, said that the company sold around 10% of its bitcoin holdings in the first quarter of 2021 to demonstrate the liquidity of Bitcoin. The sale generated proceeds of $272 million and the company made $101 million in profits from the sale.

Musk’s comments on social media have exerted great influence on the price of cryptocurrencies. In March 2021, Tesla started accepting bitcoin as a payment option for its electric vehicles. However, on 12 May, Tesla announced to suspend accepting bitcoin as a form of payment, citing concerns over energy consumption. On 17 May, Musk clarified that Tesla has not sold any bitcoin.

On 13 June, Musk said that Tesla will accept bitcoin payments again once miners of the bitcoin can show they are using roughly 50% clean energy. The bitcoin mining council was formally launched on 10 June amid worries over bitcoin’s energy consumption and is open for membership applications. Both Michael Saylor and Musk are facilitators, but its website claims that Musk has no role in the council and Saylor is a key member of the council.

Companies have become more cautious about purchasing cryptocurrencies for their corporate treasuries, mainly due to the fluctuations in the price of the cryptocurrencies. The accounting for cryptocurrencies also remains an issue.

US public companies holding bitcoin in their treasuries will need to write down the value of their holdings as an impairment charge if the value of bitcoin falls, except for investment firms or broker-dealers. However, the interest in cryptocurrencies remains strong, which can be shown from the massive excess in demand for MicroStrategy’s high yield bonds.

Are There Bitcoin Billionaires?

Since Bitcoin kickstarted the cryptocurrency revolution in 2009, the crypto space has grown dramatically. In the recent bull run, which saw Bitcoin’s price reach a high of nearly $42,000, Bitcoin alone has reached a market capitalization of over $692 billion (peaking at over $758 billion). More than thirty other digital assets have achieved a market cap of more than $1 billion.

As a result of this staggering growth, a number of early adopters, pioneers and builders have become billionaires, joining the ranks of the world’s wealthiest individuals. However, due to the volatility of Bitcoin and other cryptocurrencies, any wealth held in crypto assets can fluctuate wildly—making it difficult to pin down exactly who is a billionaire at any one time.

Read Also: Investing in Cryptocurrency: Is it Worth the Risk?

There are also likely a handful of anonymous Bitcoin billionaires out there; as of January 2021, there are 25 individual Bitcoin addresses holding more than a billion dollars, according to BitInfoCharts. Of those, five belong to crypto exchanges: CoinCheck, Bittrex, Binance, Bitfinex and Huobi.

Of course, it’s likely that savvy Bitcoin billionaires have split their holdings up among multiple addresses, as the Winklevoss twins are known to have done.

With recent reports that Bitcoin improves a portfolio’s performance it’s likely that there are other billionaires who own Bitcoin beyond the ones who got rich off it—but we’re focusing on those who’ve made their fortunes from the cryptocurrency.

How Much Bitcoin Should You Own?

You should invest in Bitcoin somewhere around 5% to 30% of your investment capital. I consider 5% to be very safe and 30% to be pretty risky.

Ultimately, the decision is yours. And although it depends on market factors, it also depends on personal factors such as your risk tolerance and the amount of money you can afford to lose.

If you’re still afraid of investing in your first pieces of Bitcoin, follow these advice that will help you get started smoothly:

- Invest even $10 on any recommended cryptocurrency exchange or broker. This way you’ll get started and you’ll have a much better understanding of what it is to be a cryptocurrency investor.

- Divide the budget you had in mind and invest it over some time -. 1 month, 3 months, 12 months – it’s your call. But doing so will prevent you from making costly mistakes and save you money.

- Remember that you can still reevaluate your decision in the future.

- Choose the best platforms to buy Bitcoin.

Wrap Up

Overall, buying Bitcoin is advisable once you have packed yourself with sufficient information about this up-and-coming investment opportunity. Most importantly, you should take a plunge only when the price is within a low level and stabilized, so you won’t suffer many losses.

Buying just because of a dip is not a smart move, either, since there may or may not be another crash. Do your homework and get informed.

0 Comment

Earn on binary options

http://bin-partner.blogspot.com – indicators forex

Comments are closed.