There’s a lot of buzz these days about Social Security. Given the uncertainties surrounding the program’s future, the amount has been increased even further. However, the discussions would be more fruitful if they focused on a larger issue: many pre-retirees will rely on a system they know very little about for a living.

As you prepare for your future retirement, include Social Security benefits in your planning and budgeting. No matter how distant retirement feels, Social Security will still be around when you stop working, although it may look different than it does now. Understanding how the program works will help in your retirement decision-making.

Look out for the following points:

- Understanding Social Security Basics

- Social Security Trust Funds and Their Role

- Eligibility and Filing Options for Social Security Benefits

- Different Types of Benefits

- Calculating Your Social Security Benefits

- How to Maximize Your Social Security Benefits

- Taxation of Social Security Benefits

- Social Security Special Considerations and Benefits

- Social Security and Retirement Planning

- Appeals and Corrections in Your Social Security Records

- Future of Social Security

Here are some key things to know about Social Security as you plan for retirement.

1. You’ll have Social Security when you retire

There are three main funding sources for Social Security. Income taxes are the biggest one, which makes up 89% of the program’s total funding. This means that as long as people are working and paying their taxes, Social Security will have a reliable influx of money to keep the program running – and you should include it in your estimated retirement income.

2. Benefits are based on a 35-year span

Social Security benefits are based on your lifetime earnings and are adjusted to account for changes in average wages. To estimate what you may receive, the program bases your benefits on your 35 highest-earning working years. Even though retirement may feel far off, you can review your status and make sure your earnings are correct at the Social Security Administration’s website.

3. Your payout may be reduced

Social Security is not going away. For decades the program usually took in more money than it paid out, and as of 2019, had a reserve of $2.9 trillion. With more people (including the baby boomer generation) retiring, those reserves are now being tapped. The number of retired workers receiving Social Security benefits increased from 33.5 million in 2009 to 45.1 million in 2019 – with growth holding steady year over year.

At the current pace, reserves may be used up by 2035, but Social Security won’t end. The program will still pay out benefits from the money it receives from annual tax revenue. Those payments would be about 80% of what beneficiaries would normally collect if the reserves hadn’t been used. A financial planner can help you explore ways to supplement retire income from Social Security.

4. You’ll have to wait a bit longer for full payout

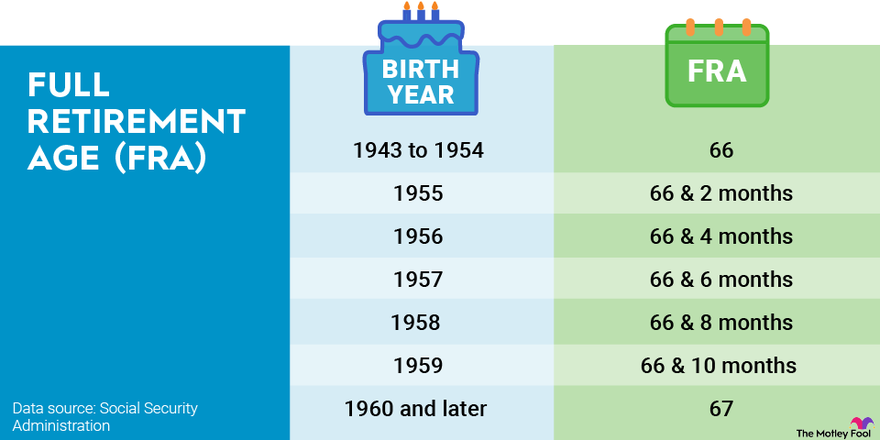

Since people are living longer and are generally healthier in older age, the Social Security Administration raised the full retirement age to 67 for people born in 1960 or later, up from 65. You can apply for benefits as early at 62, although your benefit would be reduced by 30%. On the other hand, if you can wait until age 70, you will get 124% of the monthly benefit because you delayed getting benefits for 36 months. Consider how each scenario might impact your retirement planning. Preparing for different outcomes now is the best way to help protect your savings – and peace of mind – down the line.

5. Account for taxes

Depending on your income in retirement, your Social Security benefits may be taxable. If Social Security is your only source of income, you may not have to pay taxes. However, if you receive income in addition to your benefits, such as receiving income from a traditional individual retirement account, capital gains or job earnings, your benefits may be taxed.

If you file a federal tax return as an individual and your combined income is more than $34,000, up to 85% of your benefits may be taxable. One of the few income sources not considered taxable for Social Security purposes are qualified distributions from a Roth IRA.

Understanding Social Security Basics

The phrase “Social Security” refers to the United States’ Old-Age, Survivors, and Disability Insurance (OASDI) programme. The Social Security Administration (SSA), a federal agency, manages it. It is most recognized for its retirement benefits, but it also offers survivor benefits and income for injured workers.

In 2023, over 67 million Americans will receive benefits. Let’s take a look at how Social Security works and how much money you may expect from it.

Social Security is an insurance program. Workers pay into the program, typically through payroll withholding where they work. Self-employed workers pay Social Security taxes when they file their federal tax returns.

Read Also: What will your Social Security Cost of Living Adjustment (COLA)

Workers can earn up to four credits each year. For every $1,510 earned in 2022, one credit was granted up to $6,040, or four credits had been achieved.7 It’s $1,640 up to $6,560 in 2023.8

That money goes into two Social Security trust funds: the Old-Age and Survivors Insurance Trust Fund (OASI) for retirees and the Disability Insurance Trust Fund (DI) for disability beneficiaries. These two funds are used to pay benefits to people who are currently eligible for them. The money that is not spent remains in the trust funds.

A board of trustees oversees the financial operation of the two Social Security trust funds. Four of the six members are the secretaries of the Departments of Treasury, Labor, and Health and Human Services, and the Commissioner of Social Security. The remaining two members are public representatives appointed by the president and confirmed by the Senate.

Medicare is the federal health insurance program for Americans who are age 65 and older and some people who are receiving Medicare benefits due to a disability.

U.S. Centers for Medicare and Medicaid Services. “What’s Medicare?” It is also supported through payroll withholding. That money goes into a third trust fund, which is managed by the Centers for Medicare & Medicaid Services (CMS). Social Security provides benefits to retirees, their survivors, and workers who become disabled.

Below are some key terms that you should be familiar with when it comes to social security.

FICA: FICA stands for “Federal Insurance Contributions Act.” It’s the tax withheld from your wages that funds the Social Security and Medicare programs.

PIA: The monthly amount payable if you are a retired worker who begins receiving benefits at full retirement age or if you’re disabled and have never received a retirement benefit reduced for age.

COLA: Social Security benefits and Supplemental Security Income (SSI) payments may be increased in the year following an increase in the cost of living (inflation).

Social Security Trust Funds and Their Role

The Social Security trust funds are financial accounts in the U.S. Treasury. There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits.

Social Security taxes and other income are deposited in these accounts, and Social Security benefits are paid from them. The only purposes for which these trust funds can be used are to pay benefits and program administrative costs.

The Social Security trust funds hold money not needed in the current year to pay benefits and administrative costs and, by law, invest it in special Treasury bonds that are guaranteed by the U.S. Government. A market rate of interest is paid to the trust funds on the bonds they hold, and when those bonds reach maturity or are needed to pay benefits, the Treasury redeems them.

Eligibility and Filing Options for Social Security Benefits

Workers who have paid into the Social Security system for at least 10 years become eligible for early retirement benefits at age 62. Waiting until your full retirement age (FRA), between ages 66 and 67 (depending on when you were born), results in higher monthly benefits. You’ll receive even more if you delay collecting retirement benefits to age 70, but benefits don’t continue to increase if you wait longer than that.

Spouses can also claim benefits based on either their own earnings records or their spouses’ records. A divorced spouse who is not currently married can receive benefits based on an ex-spouse’s earnings record if the marriage lasted at least 10 years. Children of retirees can also receive benefits until they turn 18, or longer if the child is disabled or a student. The cutoff is age 16 if you’re caring for a child who is not your own.

Different Types of Benefits

There are four basic types of benefits based on the person receiving them. The types are retirement, disability, survivors and supplemental benefits.

- Retirement Benefits

Retirement benefits are what typically come to mind when most people think of Social Security. Such benefits are available for people 62 or older who have worked at least 10 years. Your benefit amount will vary based on your pre-retirement salary as well as the age at which you begin collecting benefits. While it is not meant to be your only source of income, it can help you avoid debt during your retirement years. Additionally, your spouse or divorced spouse may be eligible for Social Security retirement benefits even if he or she has not paid into the program.

- Disability Benefits

Disability benefits support people who cannot work because of disabilities. As with retirement benefits, you need to have worked a certain number of years to be eligible for Social Security Disability Insurance (SSDI) benefits. The amount of work you need depends on your age, and your monthly benefit amount depends on your pre-disability salary. SSDI benefits may also be available for your spouse or divorced spouse.

- Survivors Benefits

Survivors benefits can help bridge financial gaps for survivors of workers and retirees. Eligible recipients typically include help for widows and widowers, divorced spouses and children. The 2015 U.S. Supreme Court decision (Obergefell v. Hodges) gave same-sex couples access to Social Security benefits.

The level of benefits depends on a number of factors, including the worker’s age at death, the worker’s salary, the survivors’ ages and the survivors’ relation to the deceased.

There also is a “death benefit” for survivors that is a one-time payment of $255 that goes to the spouse or children of a deceased worker.

- Supplemental Security Income Benefits

Supplemental Security Income (SSI) helps people who are unable to earn sufficient wages on their own. It is available to adults with disabilities, children with disabilities and people 65 or older. Individuals with enough work history may be eligible to receive SSI in addition to disability or retirement benefits. The amount individuals receive varies based on their other sources of income and where they live.

When and How to File For Social Security

There are two schools of thought about whether to start collecting Social Security at 62 or wait.

The first is that everyone should start getting their money out of the system as soon as possible.

This theory is based on two things:

- You have no assurances that you will live to full retirement age.

- You must live deep into retirement to make up the difference in the two potential payouts, the one you can collect at 62 and the one you can collect if you wait until full retirement age.

In other words, getting some benefits now is better than the promise of more benefits later.

The second theory states that you should wait until full retirement age in order to collect larger monthly sums. If you live long enough, this option will be more profitable.

Let’s take a closer look at your total payout potential based on the age at which you begin collecting benefits. Assume your full benefit amount would be $1,000 per month, or $12,000 each year, and your full retirement age is 67. Here’s the total amount you could receive from the Social Security program.

Starting benefits at age 62 would mean more money overall if you don’t live past age 79. However, if you live to 79 or older, you’d receive more money during your lifetime if you began earning benefits at age 67.

Ultimately, the choice is up to you, and there’s no way to predict which option is better. However, financial advisers say that if you need the monthly income at 62, start taking it. If you can afford to wait – and if you are healthy and believe you will live many more years – elect to wait and enjoy the extra money when you do start collecting.

You can apply:

- Online; or

- By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Call ahead to make an appointment.

- If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

You can help by being ready to provide the information and documents listed below.

Information About You

- Your date and place of birth and Social Security number;

- The name, Social Security number and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death (if appropriate);

- The names of any unmarried children under age 18, age 18-19 and in elementary or secondary school, or disabled before age 22;

- Your bank or other financial institution’s Routing Transit Number and the account number.

- Your citizenship status;

- Whether you or anyone else has ever filed for Social Security benefits, Medicare or Supplemental Security Income on your behalf (if so, we will also ask for information on whose Social Security record you applied);

- Whether you have used any other Social Security number;

- If you are applying for retirement benefits, the month you want your benefits to begin; and

- If you are within 3 months of age 65, whether you want to enroll in Medical Insurance (Part B of Medicare).

Information About Your Work

- The name and address of your employer(s) for this year and last year;

- The amount of money earned last year and this year. If you are filing for benefits in the months of September through December, you will also need to estimate next year’s earnings;

- A copy of your Social Security Statement or a record of your earnings. If you do not have a Statement, you can view your Social Security Statement online by creating an account and signing in with us. Even if you do not have a record of your earnings or you are not sure if they are correct, please fill out the application. We will help you review your earnings when you apply;

- The beginning and ending dates of any active U.S. military service you had before 1968;

- Whether you became unable to work because of illnesses, injuries or conditions at any time within the past 14 months. If “Yes,” we will also ask the date you became unable to work;

- Whether you or your spouse have ever worked for the railroad industry;

- Whether you have earned Social Security credits under another country’s social security system; and

- Whether you qualified for or expect to receive a pension or annuity based on your own employment with the Federal government of the United States or one of its States or local subdivisions.

Note

If you are outside the U.S., we may need to know if you worked or will be working over 45 hours a month outside the United States.

Documents You May Need To Provide

We may need to see certain documents in order to pay benefits. If you apply online, a list of documents we need to see will appear at the end of the application, along with instructions on where to submit them. The documents we may ask for are:

- your original birth certificate or other proof of birth (You may also submit a copy of your birth certificate certified by the issuing agency);

- proof of U.S. citizenship or lawful alien status if you were not born in the United States;

- a copy of your U.S. military service paper(s) (e.g., DD-214 – Certificate of Release or Discharge from Active Duty) if you had military service before 1968; and

- a copy of your W-2 form(s) and/or self-employment tax return for last year.

Calculating Your Social Security Benefits

The Social Security benefits formula is what the government uses to determine your primary insurance amount (PIA). That’s the benefit you’re entitled to if you sign up at your full retirement age (FRA). This is 67 for anyone born in 1960 or later.

Before the government can use the benefits formula, it must calculate your average indexed monthly earnings (AIME). This is your average monthly earnings over your 35 highest-earning years, adjusted for inflation. We’ll talk more about calculating that below.

Once the government knows your AIME, it gets plugged into the Social Security benefits formula in effect during the year you turn 62. The result is your PIA. But that’s not always the same as your monthly benefit.

Some people choose to apply for Social Security before or after their FRA. If you claim early, you can start receiving benefits as soon as you turn 62. You’ll get more checks this way, but each one will be smaller. You can also delay benefits and your checks will grow a little each month until you reach your maximum benefit at age 70.

In both of these cases, the government runs an additional calculation to determine how to adjust your PIA to determine your final monthly benefit.

The Social Security formula for the year 2023 — which applies to anyone born in 1961 — is as follows:

- Multiply the first $1,115 of your AIME by 90%.

- Multiply any amount between $1,115 and $6,721 by 32%.

- Multiply any amount over $6,721 by 15%.

- Add the results from the three steps above and round to the next lowest $0.10.

So for example, if your AIME was $3,000, you would do the following:

- Multiply the first $1,115 by 90%, giving you $1.003.50.

- Multiply the remaining $1,885 by 32%, giving you $602.20.

- Multiply any amount over $6,172 (in this case $0) by 15%, giving you $0.00.

- Add the results from the three steps above, which gives you $1,605.70.

In the formula above, $1,115 and $6,721 are known as the bend points. These are the only parts of the Social Security benefits formula that change from one year to the next. You can find the bend points for any previous year on the Social Security Administration website.

How to calculate your Social Security benefits

If you simply want to know how large your Social Security checks will be if you sign up at a certain age, you can figure this out by creating a my Social Security account. But if you want to understand how the government arrived at this number, you can duplicate its work by taking the following steps:

- 1. Determine your wages for each year you’ve worked

The federal government keeps track of how much money you’ve paid Social Security taxes on each year in your earnings record. You can view this in your my Social Security account.

For most people, their actual income and the income they’ve paid Social Security taxes on are the same. But this isn’t always the case with high earners. In 2022, for example, you only pay Social Security taxes on the first $147,000 you earn. In 2023, this amount increases to $160,200. So if your earnings record shows $147,000 for 2022, that’s not a mistake, even if your actual income for the year was much higher.

- 2. Adjust your wages for each year for inflation

The government uses the Average Wage Index (AWI) to adjust your wages for inflation so it can accurately pick out the years you’ve earned the most. You can view the AWI for all previous years going back to 1951 on the Social Security Administration’s website.

The AWI you use to adjust your wages is the one that was in effect in the year you turned 60. You divide this AWI by the AWI for the year you’re adjusting wages for. The result is your index factor. Multiply this by your income as reported in your earnings record for that year to get your index-adjusted wages.

For example, if you turned 60 in 2021, you’d use the 2021 AWI of $60,575.07 as your benchmark. If you earned $50,000 in 2015 and you want to calculate your index-adjusted income for that year, you’d do the following:

- Divide the 2021 AWI of $60,575.07 by the 2015 AWI of $48,098.63, giving you an index factor of about 1.259.

- Then you’d multiply your $50,000 in income from 2015 by 1.259 to give you an index-adjusted income of $62,950 for that year.

If that’s a little too much math for you, you can skip the first step and go straight to the indexing factors. The Social Security Administration keeps lists of all the indexing factors for all years. You just have to enter the year you turn 60 and it will give you the index factors to use. Then all you have to do is multiply those indexing factors by your income for the appropriate year.

- 3. Calculate your AIME

After you’ve adjusted your income for inflation, total up the income from your 35 highest-earning years. If you didn’t earn income in at least 35 years, then total your income for all the years you’ve worked.

Next, divide this total by 420 — the number of months in 35 years — which will give you your AIME. It may not be as high as you expect if you worked fewer than 35 years because you’ll have some zero-income years factored into your calculation.

- 4. Apply the Social Security benefits formula

Once you know your AIME, you can plug it into the Social Security retirement benefits formula as outlined above. But remember to choose the correct formula for your age. You should use the one that was in effect in the year you turned 62 regardless of whether you signed up for benefits at that age.

The results you get from this step will give you your PIA. If you choose to sign up at your FRA, that’s also how much you’ll get for a benefit. But if you sign up before or after your FRA, there are a few extra steps to calculating your monthly benefit.

- 5. Adjust your PIA up or down as necessary

To do this step, you need to know what your FRA is. Here’s a table to help you figure that out:

If you claim Social Security early, the government reduces your checks by:

- 5/9 of 1% per month up to 36 months

- 5/12 of 1% for each additional month if you claim more than 36 months early

For example, if your FRA is 66 and you claimed at 62, you’d lose 5/9 of 1% from your checks for each of the first 36 months you claimed early. So you’d multiply (((5/9) x 0.01) x 36) x 100 and you’d get a 20% reduction. But that’s not all.

Then, you have to add a further 5/12 of 1% monthly deduction for claiming checks between 62 and 63. So you’d take (((5/12) x 0.01) x 12) x 100 and you’d get an additional 5% decrease. Added together, the two steps above result in 25% smaller checks for claiming at 62 as opposed to waiting until 66.

For those who choose to delay benefits past their FRA, the process is pretty similar. You add 2/3 of 1% per month for every month you delay past your FRA. However, this only continues until you turn 70. After that, your benefit won’t grow anymore.

- 6. Subtract your Medicare Part B premiums if necessary

The five steps above will tell you the kind of benefit you’re entitled to based on your work history and claiming age, but that’s not always the same as your take-home benefit. Seniors on Medicare have their Part B premiums automatically deducted from their Social Security checks.

In 2022, that’s $170.10 per month, but it’s dropping to $164.90 in 2023. If you’re not on Medicare yet, you won’t have to worry about this until you sign up for it.

- 7. Round your benefit amount down to the nearest dollar

The final step in calculating your take-home Social Security benefit is to round your answer from Step 6 down to the nearest dollar. Even if your result from the previous step was $1,680.99, you’d still round down to $1,680 rather than rounding up to $1,681.

Once you understand how the government calculates your Social Security benefit, you can use this information to boost your own benefit. For example, if you didn’t know that the government based your benefit on your 35 highest-earning years, you might have retired before you worked that long. That would have resulted in zero-income years being included in your benefit calculation.

Understanding how your FRA plays into your benefit calculation can also help you choose the best time to sign up. This depends on your life expectancy and financial circumstances.

You can use the steps above to calculate your benefit at various claiming ages. Then multiply each of these monthly benefits by 12 to get your estimated annual benefit. You then multiply this figure by the number of years you expect to claim to get your estimated lifetime benefit. For example, if you expect a $2,000 monthly check at your FRA of 67 and believe you’ll live to 87, you’d have an estimated lifetime benefit of $240,000.

How to Maximize Your Social Security Benefits

Workers contribute to the Social Security system through payroll taxes over the course of their careers, so you might as well maximize your benefits.

There are things you may do that can help you maximize your Social Security retirement benefits significantly. You can combine some of the tactics listed below, some of which have eligibility requirements:

Please keep in mind that the Social Security Administration changes Social Security benefits on a regular basis to account for rising costs (or inflation). Social Security and Supplemental Security Income (SSI) recipients will receive an 8.7% COLA in 2023. In 2023, the average monthly payout for retired workers is expected to increase to $1,827.

Below are the nine ways to help boost Social Security benefits.

1. Work for 35 Years

You can be eligible for Social Security benefits after working for as little as 10 years, and you can begin receiving benefits as early as age 62 or as late as age 70. Your benefit amount is based on the average of your 35 highest-earning years. If you work for fewer years, those zeros are averaged in.

As your benefit is based on your highest-earning years, the more you earn, the higher your benefit. There are limits, though. The maximum benefits for 2023 are $2,572 for those retiring at age 62, $3,506 for those retiring at the full retirement age of 66, and $4,555 for those retiring at age 70.

2. Wait Until at Least Full Retirement Age

As you can see from the maximum levels above, you can retire as young as 62 and collect Social Security, but your benefits will be reduced by 25% to 30%. For everyone born after 1942, the full retirement age is 66, with two months added for each year after 1954. For those born in 1960 and after, it is age 67.

It’s wise to wait until the full retirement age to start collecting to get the highest amount you’re eligible to receive. If it makes sense for your life situation, you can wait even longer and become eligible for delayed retirement credits that increase your monthly payment.

3. Sign Up for Spousal Benefits

If you are married and have little earned income, you may be entitled to spousal benefits of up to 50% of your partner’s eligible amount. If you’re at least 62 years old and have a child in your care, you may be eligible to receive benefits through your spouse. The spousal benefit can be as much as 50% of the partner’s benefit, depending on when the partner retires.

Even divorcees are eligible. In fact, both parties in a divorce can claim spousal benefits based on the other spouse’s Social Security earnings. However, if you have remarried, you cannot collect your ex-spouse’s benefits.

4. Receive a Dependent Benefit

If you are retired but still have dependents under age 19, they are entitled to up to 50% of your benefit. This dependent benefit doesn’t decrease the amount of Social Security benefits that a parent can receive. They are added to what the family receives.

5. Monitor Your Earnings

If you continue to work after your Social Security payments begin, keep track of your earnings to ensure they don’t exceed the allowed limit. For 2022, the limit on earned income is $19,560 for recipients below full retirement age (FRA) and $51,960 in the year when you reach full retirement age. For 2023, those numbers rise to $21,240 for those below FRA and $56,520 for the year they reach it.

Your benefit payment is reduced for the year if you exceed these limits. After you have achieved FRA, however, there is no penalty for earned income at any level.

6. Watch for a Tax-Bracket Bump

If you’re still working while receiving benefits, you also have to watch out for tax-bracket creep. Your earnings plus Social Security could put you up a notch in the tax table. If you earn enough more income, of course, the bracket bump-up may not matter compared to the additional cash.

7. Apply for Survivor Benefits

If your deceased spouse (or ex-spouse) was eligible for a higher Social Security payment than you are, you might be eligible for that higher survivor benefit. You might qualify for the higher benefit even if your spouse died before applying for benefits.

8. Check for Mistakes

You get a Social Security statement every year. Do not assume it is accurate. Check the numbers and report any errors to the Social Security Administration. Remember, your benefits are based on the average of your 35 highest-earning years. A miscalculation for even one or two of those years could impact your benefit for the rest of your life.

9. Change Your Mind

You may have the right to suspend your benefit, pay back the money you’ve already received, and start collecting benefits again later. You can do this as long as you’ve been receiving benefits for less than a full year.

This could happen if you get a job after you retire or inherit money and decide you can afford to delay filing to get a higher benefit check. You do this by filing Social Security Administration Form 521, Request for Withdrawal of Application. When you file again later, your benefit should be substantially higher.

Married? Divorced? You have options

Social Security offers a lot of benefits to people in a lot of different scenarios, and some of the most complex choices occur if you’re married or divorced. Spouses and ex-spouses should then carefully consider their options and what works best for them, especially in the area of survivor’s benefits when one spouse predeceases the other.

“If married, you have to consider your spouse,” says Eric Bond, a wealth advisor with Bond Wealth Management in the Los Angeles area. “How much the surviving spouse will receive at the passing of the first spouse will depend on when that [deceased] spouse started their Social Security.”

“The largest benefit stays in the household when a spouse dies,” says Beau Henderson, lead retirement planning specialist with RichLife Advisors in Gainesville, Georgia. “This is why we need to think about the impact of our claiming decision on both lives. There are a lot of scenarios and they need to be modeled to give you the best result.”

And just because you’re divorced doesn’t mean you can’t claim Social Security benefits on your ex-spouse’s earnings. But there are specific requirements that you need to meet.

The existence of a spouse or ex-spouse complicates the planning process and means that you need to model more scenarios to see what maximizes your benefits.

Taxation of Social Security Benefits

Is Social Security income taxed? It is for the vast majority of Americans. That is, the vast majority of those who receive Social Security benefits pay income tax on up to 50% or even 85% of their payments because their combined income from Social Security and other sources exceeds the extremely low tax limits.

To reduce the amount of tax you pay on Social Security benefits, you can adopt one of three strategies: deposit some retirement income in Roth IRAs, remove taxable income before retiring, or purchase an annuity.

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

However, regardless of income, no taxpayer has all their Social Security benefits taxed. The top level is 85% of the total benefit.

Here’s how the Internal Revenue Service (IRS) calculates how much is taxable:

- The calculation begins with your adjusted gross income (AGI) from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions (RMDs) from qualified retirement accounts, and other taxable income.

- Tax-exempt interest is then added. (It isn’t taxed, but it goes into the calculation.)

- If that total exceeds the minimum taxable levels, then at least half of your Social Security benefits will be considered taxable income. You must then take the standard or itemize deductions to arrive at your net income. The amount you owe depends on precisely where that number lands in the federal income tax tables.

Individual Tax Rates

Benefits will be subject to tax if you file a federal tax return as an individual and your combined gross income from all sources is as follows:

- From $25,000 to $34,000: You may have to pay income tax on up to 50% of your benefits.

- More than $34,000:Up to 85% of your benefits may be taxable.

The IRS has a worksheet that can be used to calculate your total income taxes due if you receive Social Security benefits. When you complete this exercise in arithmetic, you will find that your taxable income has increased by up to 50% of the amount you received from Social Security if your gross income exceeds $25,000 for an individual or $32,000 for a couple. The taxed percentage rises to 85% of your Social Security payment if your combined income exceeds $34,000 for an individual or $44,000 for a couple.

For example, say you were an individual taxpayer who received the average amount of Social Security: about $18,000. You also had $20,000 in “other” income. Add the two together, and you have a gross income of about $38,000. However, your combined income is computed as only $29,000 (other income plus half of your Social Security benefits). That’s within the $25,000–$34,000 range for a tax of 50% of your benefits So, half of the difference between that income and the $25k threshold is your taxable amount: ($29,000 – 25,000 = $4,000; $4,000/2 = $2,000). The calculation can become more complicated for taxpayers with different forms of income.

Married Tax Rates

For couples who file a joint return, your benefits will be taxable if you and your spouse have a combined income as follows:

- From $32,000 to $44,000:You may have to pay income tax on up to 50% of your benefits.

- More than $44,000: Up to 85% of your benefits may be taxable.

For example, say you are a semi-retired couple filing jointly and have a combined Social Security benefit of $26,000. You also had $30,000 in combined “other” income. Add the two together, and you have a gross income of $56,000. Your combined income for Social Security is $43,000 (other income plus half of your Social Security benefits). This combined income falls in the $32,000–$44,000 range, meaning that half the difference between the income and the threshold is computed at 50% to get your amount taxable: ($43,000 – 32,000 = $11,000; $11,000/2 = $5,500).

Are Spousal, Survivor, Disability, and SSI Benefits Taxable?

These programs follow the same general rules as the Social Security program for retirees, except for Supplemental Security Income (SSI).

Spousal Benefits

If you don’t have Social Security benefits but collect spousal Social Security benefits based on your marital partner’s benefits, the rules are the same as for all other Social Security recipients. If your income is above $25,000, then you will owe taxes on up to 50% of the benefit amount. The percentage rises to 85% if your income is above $34,000.

Survivor Benefits

Survivor benefits paid to children are rarely taxed because few children have other income that reaches the taxable ranges. The parents or guardians who receive the benefits on behalf of the children do not have to report them as part of their income.

Disability Benefits

Social Security disability benefits follow the same rules on taxation as the Social Security retiree program. Benefits are taxable if the recipient’s gross income is above a certain level. The current threshold is $25,000 for an individual and $32,000 for a couple filing jointly.

SSI Benefits

SSI is not Social Security; it’s a needs-based program for people who are blind, disabled, or age 65 and older. SSI benefits are not taxable.

Social Security Special Considerations and Benefits

If an individual taxpayer’s income exceeds $25,000, or a married couple filing jointly has income that’s more than $32,000, they will be required to pay taxes on their Social Security benefits.

The portion of benefits that is subject to taxation depends upon income level, but no one pays taxes on more than 85% of their Social Security benefits, regardless of income. Benefits received due to disability are, in most cases, tax-free. If your child receives dependent or survivor benefits, this money does not count toward your taxable income.

In 2022, the maximum monthly Social Security payment for retired workers is $3,345, rising to $3,627 in 2023. The SSA’s retirement calculators can help you determine your full retirement age, the SSA’s estimate of your life expectancy for benefit calculations, rough estimates of your retirement benefits, actual projections of your retirement benefits based on your work record, and more. Retired adults with non-FICA or SECA-taxed wages will require additional help because rules for those individuals are more complex.

Social Security and Retirement Planning

Planning today can make a big difference in your retirement lifestyle tomorrow. Once you leave the workforce, the years that follow can be all that you want them to be—if you pave the way with a comprehensive financial plan that includes your Social Security income.

Your plan should be based on what you know today and flexible enough to adapt to any changes—like unforeseen personal circumstances or developments that come out of Washington.

Social Security can be a valuable tool to help bridge any gap you may have between your expected sources of income and your expenses. If you already have a retirement plan that takes your Social Security benefits into account, that’s great! You’re one step closer to ensuring your assets last throughout your lifetime.

Regardless of where you are in life, there are several key steps that apply to almost everyone during their retirement planning. The following are some of the most common:

- Come up with a plan. This includes deciding when you want to start saving when you want to retire, and how much you’d like to save for your ultimate goal.

- Decide how much you’ll set aside each month. Using automatic deductions takes away the guesswork, keeps you on track, and takes away the temptation to stop or forget depositing money on your own.

- Choose the right accounts for you. Take the chance to invest in a 401(k) or similar account if your employer offers that option. Remember, if the company offers an employer match and you don’t sign up, you’re just giving away free money. And don’t forget to have an emergency fund, which can be easily liquidated if you need cash in a pinch.

- Check on your investments from time to time and make periodic adjustments. It’s always a good idea to make any changes whenever there’s a change in your lifestyle and when you enter a different stage in your life.

Frequently Asked Questions about Social Security Benefits

If you are nearing retirement age and wish to begin receiving benefits, or if you are caring for someone who is, you may have questions regarding Social Security benefits. Here are the answers to some frequently asked questions.

1. When can I start receiving Social Security benefits?

You can start receiving Social Security benefits as early as 62 years of age, but that’s not your full retirement age (FRA). Your FRA is 67 if you were born after 1960. And you can max out your Social Security benefits if you wait until you turn 70.

If you choose to start receiving benefits as soon as possible, or when you reach 62 years of age, your benefits will be reduced to a portion of what you’d receive if you were at full retirement age. Delaying Social Security until after you hit full retirement age can qualify you for delayed retirement credits, which can increase your monthly Social Security benefit.

2. How are my Social Security benefits calculated?

Your Social Security benefits are calculated by your lifetime earnings. Your average indexed monthly earnings (AIME) is what you earned, on average, for up to 35 years worth of work. Your monthly benefit amount might be more or less than that average, based on what you earned and the national average wage index.

If you’re planning to retire after the normal retirement age, you can expect higher benefits than if you were to retire at 62 years of age.

3. What happens to my Social Security benefits if I continue to work after I start receiving them?

You can get Social Security benefits even if you continue to work. You’ll also continue to pay into Social Security when you get paid. But how much you earn in Social Security benefits depends on how much you’re earning in your job.

If you’re planning to start collecting Social Security before your full retirement age and make more than the yearly earnings limit, your benefits will be reduced. If you’re under full retirement age for the full year, Social Security cuts $1 from your benefits for every $2 you earn above the annual limit. For 2023, that’s $21,240.

4. Can I receive Social Security benefits if I’m still working?

You can receive Social Security benefits if you’re still working or even if you plan to return to work after you start collecting them. But the amount you receive in benefits will be reduced based on your earned income.

5. What is the maximum Social Security benefit I can receive?

The most you can earn in Social Security depends on when you retire. If you retire in 2023, these are the maximum benefits you can expect to receive:

| Age in 2023 | Maximum amount received |

|---|---|

| 62 | $2,572 |

| Full retirement age | $3,627 |

| 70 | $4,555 |

6. How do I apply for Social Security benefits?

You can apply for Social Security benefits through the Social Security Administration website. You can apply for yourself or on behalf of someone else. Before you apply, you can also check your eligibility for Social Security benefits. Social Security benefits aren’t just for retirement. You can apply for benefits when you can’t work because of a disability, you lose a spouse, or you’re having trouble paying for essentials. Checking your eligibility can help you figure out which benefits you qualify for.

Appeals and Corrections in Your Social Security Records

If you believe the Social Security Administration miscalculated your benefit, you have the right to appeal the decision. You must submit the appeal request within 60 days of receiving the initial letter from Social Security stating your benefit amount.

You can file an appeal online or in writing. In the latter case, you’ll need to fill out an SSA-561 “Request for Reconsideration” form, which you can download from the Social Security website, and send it to your local Social Security office.

There are four levels of appeal. If you disagree with the decision at one level, you can seek redress at the next.

- Reconsideration, in which a Social Security official not involved in the original decision reviews the case, including any new evidence

- A hearing before an administrative law judge

- A review through Social Security’s Appeals Council

- A lawsuit in federal court

Future of Social Security

The future of Social Security remains uncertain, forcing people to ask questions like, “Will Social Security run out?” According to the 2022 annual report from the Social Security board of trustees, Social Security’s cash reserves will be fully depleted by 2034 — one year earlier than their 2020 report indicated. Annual taxes are expected to cover only about 78% of the benefits each year after that.

An increase in the payroll tax rate could take different forms. Currently, the total payroll tax is allocated equally between the employee and the employer. The tax increase could be allocated equally among employers and employees or allocated more to the employer to hide the tax hike from taxpayers.

A legislative proposal called the Social Security 2100 Act from Rep. John Larson (D-Conn.) favors the latter option. It would raise the federal payroll tax rate by 6.2% for employers, and would only raise taxes on employees making more than $400,000. The bill has gained some support but so far has stalled in Congress, Politico reported.

Raising the taxable wage limit would only affect people whose wages exceed the current contribution and benefit base. For example, if you make $80,000 per year, you pay Social Security taxes on all of your income, so whether the limit is $130,000, $300,000 or removed entirely, it doesn’t affect your payroll taxes.

However, if you make $250,000 as a W-2 employee, you only pay Social Security taxes on the first $137,700, for a total of $8,537.40. If the limit went up to $300,000, you would pay Social Security taxes on all of your $250,000 income, for a total of $15,500.

Conclusion

While Social Security could play a more limited role in your retirement income in the future, it does represent a foundation upon which you can build your monthly income. Don’t leave any of it on the table, if you can help it. The key to maximizing what you get from the program is timing when you begin to claim your benefits, says Dziuba. About half of people ages 25 to 54 would like to retire before their 65th birthday, according to the Civic Science poll. But claiming before full retirement age reduces your benefits — for life. For every year you wait to claim, up to age 70, your monthly benefits increase by about 8%.

No matter what happens to Social Security, “maximizing the income you get from all your sources will go a long way toward helping you live the life you want in retirement,” says Kaneer. And regularly reviewing your strategies with your advisor as your expenses and financial priorities change can help you keep that retirement goal on track.