Everyone knows that GCash is a great app for sending or receiving money, paying your bills, shopping online, buying prepaid load and many more. But do you know that you can earn money in GCash, too?

GCash can be an excellent moneymaking app for students, unemployed and even those with full-time jobs who are looking to make some extra cash on the side.

GCash offers us a variety of ways to earn–from prepaid loading, investing, playing games, and watching ads to reading news, answering surveys, and so on.

Read on to find out how you can transform your GCash virtual wallet into a money-making digital platform.

- What is GCash?

- What Can I do With GCash?

- How Can You Maximize GCash?

- How Does GCash Bridge The Gap In Financial Institutions?

- How to Earn Money in GCash

- Does GCash Need Bank Account?

- How do I Put Money on my GCash?

- Is GCash Safe?

- Can Basic GCash Receive Money?

- How to Verify Your GCash Account

- Important GCash Tips and Reminders

- How Can I Withdraw Money From GCash?

- How Much is The Maximum Cash in in GCash?

- How Can I Open GCash Account?

- Is it Safe to Connect Bank Account to GCash?

- How Much Can I Withdraw From GCash?

What is GCash?

A more recent and notable digital development in this space is the e-wallet, of which the Philippines is no stranger to, thanks to GCash. Arguably a household name for convenient electronic transactions, GCash is an app that you can install on any of your devices—be it a smartphone or a tablet. It allows you to pay your bills, purchase goods and services, and even send or receive money wherever you are.

Read Also: Earn Money On the web With Video Editing

To date, GCash has made financial transactions easier for its 33 million registered users. And with over 73,000 partner merchants in the country, it truly has helped revolutionize the way Filipinos transact.

What Can I do With GCash?

GCash takes convenience to an entirely different level. You can do so much on the app that it has effectively taken away the struggles of braving heat—or rain—in Manila traffic, as well as long lines and wasted time. With the hours you save, you can invest more in the things that infinitely matter more: family, friends, passions and health.

Pay bills. GCash takes the dread out of waiting in long lines at payment centers. With a simple tap on your screen, you’re finished paying off your financial obligations. The app allows you to pay utilities, credit card bills, government bills, loans and even tuition fees without breaking a sweat.

To make things even easier, GCash allows you to save your preferred billers and billing details on the app and can set a monthly reminder so you never oversee another due date! Also: the occasional rebate.

Save Money. Enjoy greater security and financial freedom in life by building up your savings with GCash’s GSave.

GSave makes saving money more accessible and easy for both banked and unbanked individuals. You don’t need to worry about maintaining balance because GSave doesn’t require it. Moreover, users get to enjoy a 3.1% interest rate with any amount deposited. See your savings grow quickly within the app. You can also schedule auto-deposit within the GSave feature, so you don’t forget to save regularly.

Plant a Tree. Enjoy planting virtual trees like Avocado, Guyabano, Yakal, and Narra—that have real-life equivalents—on GForest. Every time you use GCash for transactions, whether to buy load, send money, or pay bills, you are rewarded with “green energy points” you can collect and use later to “plant” a tree, as spearheaded by Globe.

With GForest, you get to make every day Earth Day by harvesting energy points to plant more trees and contribute to enriching the country’s natural resources.

Book movies. Take more control of your leisure time and book your seat at movies as early or as late as you want at any our partner cinemas. Skip the queue and straight to the theaters of your favorite Ayala Malls, SM Supermalls and Uptown Bonifacio.

Transfer money. Stressed about the fees that your bank charges whenever you transfer or send money to another account? Install the GCash app! You can send money to anyone or any of our partner banks in real-time.

The Send Money To Bank Account feature lets you transfer money from your digital wallet to any partner bank—eliminating the need for multiple banking apps! Take note that starting November 2020, sending money via bank transfer costs Php15. Meanwhile, GCash also allows you to transfer money to another GCash wallet with no additional charges, no matter what network you’re using.

Cash Out/Withdraw Cash. If you’ve accumulated a significant amount of GCash, you can cash out the money through partner outlets, transfer directly to your bank account or withdraw from any Bancnet ATM with your GCash card.

Use GCredit. Think of GCredit as your personal credit line with the app. You can use it to shop now and pay later at partner merchants or to pay your bills. This feature is only available for fully verified users who have raised their GScore to acertain level, however—so use the app often! The more transactions you make, the bigger your limit will be.

Buy load. Running low on load? You can top it up through the GCash app! Buy load for any network and possibly earn a 5 percent cashback! Aside from prepaid load, you can also purchase load combos, gaming pins and even broadband packages.

Borrow load. If you’re low on digital cash but need the load urgently, you can take advantage of the Borrow Load feature of the app. You’ll have two days to pay back the amount without having to pay interest or service fee.

Order food and shop online with GLife. GLife aims to level up and simplify your shopping experience. It’s a new permanent feature that integrates “mini-apps” from various merchants or brands within the GCash dashboard. Now, you can shop and use the services of local and international online stores within this app thanks to this new shopping feature.

Within the GCash app, you can conveniently order food online or shop without the need to download your merchant’s online shopping app. For instance, if you need to buy something from Lazada, you don’t need to access or download the app and just shop within the GCash Lazada mini-app.

Currently, there are over 30 lifestyle brands on GLife, including online shops, food delivery services, airline companies, gadget stores, grocery stores, and more.

You can also order food and shop online with GLife and pay with cash. Simply choose GCash as your payment option and confirm your transaction. Since you’re already shopping within the app, it’s easier for you and the merchant to process the payment.

You can also shop online and transact through other payment methods in the GCash ecosystem. You can apply for American Express Virtual Pay through the GCash app with your email or get a GCash Mastercard for only Php150.

Grow money with GInvest. For those who are new to investing and planning to make their first investment but unsure where to start, the GInvest feature is a good investment for beginners. GInvest allows you to invest in different investment funds from GCash’s reliable partner product providers.

GInvest has a swift account verification process and is more inclusive than banks. With GInvest, you only need to get your account verified and put in a minimum investment of Php50. There are no commission and sales fees, and you can sell and buy through your GCash wallet.

Wondering how to invest money in GCash? Read on—it’s easy, hassle-free, and affordable!

Go to GInvest and start with the registration process. Answer the questions on the screen honestly to see the type of investor you are. Once you complete the process and read the GInvest User Agreement or Terms and Conditions, you’ll see your risk profile assessment result.

After this, you can start viewing the investment products on GInvest and start your GCash investment. You can also schedule your preferred time to remind you to grow your funds so that you can invest money regularly.

Have peace of mind with GInsure. Be financially secure and ready for anything with GInsure. This feature on the GCash app offers users access to various insurance products that provide cash assistance and medical coverage. With GCash Insurance, you can access different protection products powered by Singlife, such as:

- Cash for Dengue Costs

- Cash for Income Loss (Accidents)

- Cash for Income Loss (Any Cause)

Getting started with GInsure is simple. Just open the GCash App and head to GInsure. Choose the insurance product you want and select the coverage plan you prefer. Review your GCash profile and confirm your details, then confirm the payment. A congratulatory page will show after successfully paying for your insurance coverage.

You can buy any of the protection products as long as you are:

- 18 to 54 years old (18 to 64 years old for Cash for Income Loss due to accidents)

- A fully verified GCash user

- A Filipino citizen or a foreigner who is a legal resident of the Philippines

- In good health and able to work and do not have any pre-existing conditions (for Cash for Income Loss due to any cause)

- In good health and has never been a “confirmed COVID-19 case” (for Cash for Dengue Costs)

You can get covered and buy and manage retail insurance packages for as low as Php300 per year on GInsure. With that amount, you can stay prepared for emergencies and live worry-free without breaking the bank. You don’t have to go through long forms and processes.

As long as you have a verified GCash account, you can apply and choose among the types of insurance you need in minutes.

Buy in-store. Besides the online shopping, you can make the most out of your account by using it to pay for in-store purchases with over 73,000 GCash merchants. Enjoy the experience of going cashless when you shop; just scan the store QR code to pay with GCash when you buy food, groceries, clothes and more.

How Can You Maximize GCash?

Everyone can use GCash, whether or not they’re Globe users or have the usual bank requirements. When you’ve embraced the mobile payment service and are ready to take your experience further, then you can make the switch from a Globe prepaid sim to a postpaid line.

By subscribing to Globe Postpaid, you’ll be able to earn mobile promos, bill rebates, and points, which you can use as cash at a variety of partner stores. You can also check out GPlan with GCash, a new flexible offering that allows customers to use GCash credits for mobile and life essentials, such as data allocations, content subscriptions, GInsure coverage, and shopping vouchers

Live with the convenience of paying your bills through GCash, too. Not only will you boost your GScore, but you’ll also get more GCredit perks in no time!

How Does GCash Bridge The Gap In Financial Institutions?

GCash was awarded the Best Mobile Payment Service in the 2018 Telecom Asia Awards—and with this achievement comes a deeper significance to the country. Additionally, data from App Annie, the industry standard for mobile data and analytics, ranks GCash as the top finance app (10 million downloads within nine months) with the most number of active users among Filipinos.

In 2019, over 51 million Filipinos were found to have no bank accounts due to lack of enough money, lack of documents, and refusal to open a bank account. Nine out of 10 locals were also found to have no access to credit cards, credit lines, or credit scores.

However, the silver lining in this situation is that in a country of 107 million people, 73 million are mobile users, of which 67 million are online at any time of the day.

GCash bridges the gap between the banked and unbanked sectors by allowing anyone to pay for anything from bills to online and offline shopping, load for prepaid cards and sending or receiving money to and from loved ones no matter where they are in the world. Credit lines have also become available with GCash, allowing all users to make urgent transactions.

How to Earn Money in GCash

GCash is undeniably one of the easiest and most convenient applications for fund management, financial services, business, lifestyle and shopping, and bills payment. But it’s actually possible as well to earn real money using the GCash app or mobile apps which pay via GCash. That raised the question, how? If you really want to know then you must continue reading.

1. Refer the GCash app to your friends

You’ll receive P50 within 5 working days when your friends use your referral code and get verified in GCash. You can actually earn as much as P1,250 just by inviting your friends to use GCash.

Steps in inviting your friend to use Gash.

Step 1: Go to your GCash app and sign in with your 4-digit MPIN.

Step 2: Press the Profile button on the right corner below.

Step 3: Click Refer Friend.

Step 4: Choose among the available method to refer such as Facebook Messenger, SMS, QR Code and more.

2. Establish a load business

The Buy Load feature of GCash can actually be your chance to create a load business by selling prepaid load. Simply add P2 to P3 pesos for every load transaction to earn profit.

Steps in selling load using GCash.

Step 1: Go to your GCash app and sign in with your 4-digit MPIN.

Step 2: Press the Buy Load button on your home screen.

Step 3: Put the digit of your recipient.

Step 4: Choose the amount of load or promo followed by tapping the Next button.

Step 5: Continue with your payment. On your screen, a notification will appear. A confirmation will also be received via SMS.

3. Play Goama Games

Playing while earning seems a good deal. GCash via GOAMA, helps you earn real money by playing mobile games tournament. Sadly, you must pay for the entry fee to join. Plus, paid tournament can only be played within a week.

To earn here, you must score big time to level up on the ranking. For instance, is the game “Run Ninja Run”. By paying an entry fee of P10, you have the chance to win P500 for first place, P200 for second place to fifth, P120 for sixth place and more.

Steps in playing GOAMA game.

Step 1: Go to your GCash app and sign in with your 4-digit MPIN.

Step 2: Press the GLite on your home screen.

Step 3: Choose GOAMA Games.

Step 4: Decide your preferred tournament. Then, pay for your entry fee.

4. Make an investment in GCash

GInvest allows verified users to invest in a variety of investment funds for as little as P50. You can buy asset funds managed by ATRAM, a major independent asset manager in the Philippines, by investing in GInvest. ATRAM will then lend your money to the government or firms, or buy equity from other companies, based on your investment.

GInvest also offers two investment funds managed by BPI Investment Management Inc. (BIMI), one of the country’s largest financial institutions.

Also, GInvest does not require you to open a bank account to begin investing, and there are no commissions or sales costs. Additionally, the GCash app allows you to effortlessly track the performance of your weekly funds.

Steps in investing in GInvest.

Step 1: Go to your GCash app and sign in with your 4-digit MPIN.

Step 2: Click GInvest. Press View all GCash Services if GInvest is not on your screen.

Step 3: Fill out the Risk Profile Questionnaire.

Your risk appetite will be displayed once you have completed your Risk Profile Questionnaire. You can choose the fund that best meets your risk appetite.

Step 4: Click View Details to see a list of investment funds. You may use your risk appetite to help you decide which investment to make. You may, however, purchase investment funds that exceed your risk appetite.

GInvest has seven investment funds available. ATRAM manages five of these funds, while BPI manages the other two.

Investment Funds from ATRAM.

The Peso Money Market Fund is a local fixed-income fund with a greater rate of return than traditional bank accounts. In comparison to other ATRAM local funds, this one has a lower risk but higher return. The initial investment is P50.

The Total Return Peso Bond Fund invests in both government and business bonds in the Philippines. It’s best for people who aren’t afraid of taking risks. The minimum amount to invest is P50.

SM Investment Corp, BDO, and Ayala Land are among the firms that make up the Philippine Equity Smart Index Fund, which invests in their equities. Despite the fact that it has a higher risk rating than the two prior local funds, it is riskier because it has a higher risk rating. The initial investment is P50.

Investment Funds of BPI.

For those with a 5-year investing horizon, both of the funds listed below are high-risk investments.

The Philippine Stock Index Fund is a local fund that tracks the performance of the Philippines’ top 30 publicly traded firms. The first payment is P50.

The ALFM Global Multi-Asset Income Fund is a dividend-paying fund based in the United States. This fund will pay you a monthly dividend that will be paid to your GCash account. The minimum investment is P1000.

Step 5: Purchase shares in the investment fund you’ve chosen.

You can invest a minimum of P50 in local funds. On the other hand, you can invest a minimum of P1,000 in worldwide funds. Each time you buy units of your chosen fund, you will receive an SMS notification.

Your orders will be processed in three business days.

5. Use mobile apps which pay via GCash

1. Buzzbreak

Earning while reading and watching? Maybe, Buzzbreak is the one for you. Just download the Buzzbreak app from the Google Playstore and earn points by inviting friends, watching videos and ads, reading news, answering surveys, and playing games. You can cash out your earnings via GCash account if you have gained enough points to redeem which is 20,000 points for P1.

2. Milieu Survey

Milieu Survey is a paying survey app. You can download its app via Google Playstore and cash-out money using your GCash account.

Every survey you complete with Milieu Survey earns you points. There are usually 2-3 surveys per week. When you’ve earned 11,500 points, you’ll be able to redeem them for GCash e-gifts worth P 200.

Does GCash Need Bank Account?

A new feature called GCash Padala enables you to send money to a receiver who doesn’t have a bank account or a GCash account. All you need is the recipient’s name and contact number. The recipient can easily claim the money at one of over 17,000 GCash-partner outlets nationwide.

Meanwhile, if the receiver doesn’t have a GCash account yet, you can also send money to any of the GCash partner banks.

Simply tap the Bank Transfer option, choose the name of the bank, and enter the desired amount along with the receiver’s account name and number.

Tap Send Money to complete the transaction.

How do I Put Money on my GCash?

You’ll never run out of places to go to cash in to your GCash account with their numerous partner outlets. You can even cash in from where you’re standing by doing it through your GCash app via Online Banking!

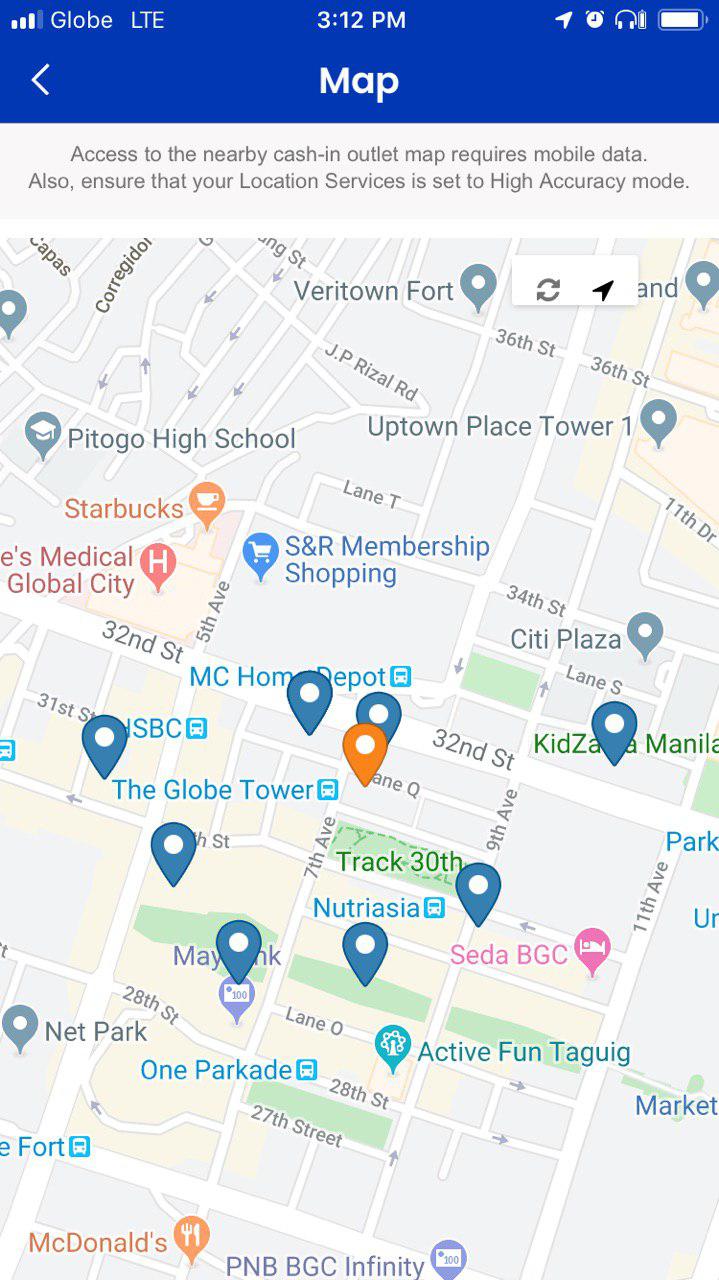

When selecting Cash In on the App, you can see the list of Over-the-Counter outlets like Cebuana Lhuiller, Tambunting, or Puregold. There will also be an option to find the nearest Cash In outlet near you when you select ‘View nearby Cash-In Locations.’ Just make sure the Location Services settings of your phone is on.

For more info regarding Wallet & Transaction check out the articles in the Wallet & Transaction Limits section.

Is GCash Safe?

As a customer, you are also responsible for the safety of your account and money. Here are some tips to make sure that your account information doesn’t fall on the wrong hands:

- Keep it to yourself!

Never share your MPIN and OTP (One-Time-Password) to anyone! Do not trust anyone who asks for your login information such as MPINs and authentication codes. Legitimate financial institutions or representatives will never ask for these details.

- Two is better than one!

Your account is protected by Two-Factor Authentication which serves as an added security layer to access your account. It is there to make sure that you’re the only person who can access your account. It works by sending a unique code to your GCash-registered mobile number.

- Think before you click!

Be careful when clicking a link that prompts you to enter your login details, especially if the website looks sketchy. Fraudsters use a common method called Phishing — this is where they use a fake website in order to get user’s account information to create fraudulent transactions.

Wait, there’s more! We also get questions like “How do I secure my GCash card?”, “Is there a way to keep my card safe?”, and many more. Find out how below!

- Be clingy!

Always glue yourself to your debit card! Whether you are swiping it in a restaurant, paying for gas at the local station or anything that requires it to be away from you. One of the best conveniences of having a debit card is being able to pay using your card instead of cash. Being present when swiping your card prevents fraudsters from taking note of your card information.

- Online shopping? No worries!

Online shopping is fun, most especially when it’s sale! To avoid your card information from being compromised, make sure that the online shop that you are buying from is legitimate by conducting a few searches and checking for reviews before buying from the store.

- Memorizing a 3-digit code? Easy as pie!

Memorize your CVV code, which is the 3-digit number at the back of your card. Your CVV (Card Verification Value) is a very important part of your card information. A good way to protect this from wandering eyes is to memorize and cover it with a “void sticker” to prevent others from having a full peep at your card information whenever you use your card!

Can Basic GCash Receive Money?

Basic (unverified) accounts are also limited to a wallet size of ₱50,000 compared to ₱100,000 for semi-verified and fully verified accounts. Unverified accounts have a monthly incoming limit of ₱50,000 and a daily outgoing limit of ₱40,000, while fully verified users can enjoy monthly incoming and daily outgoing limits of ₱100,000.

GCash has three verification levels:

- Basic Level. This is an unverified account with lower wallet size and spending limits. Features are limited and basic level users cannot send money or perform cash-outs.

- Semi-Verified. You can opt for this level if you don’t want to submit a copy of your valid ID. Only a selfie is required. Your status will be valid for only one year.

- Fully Verified. This level gives you full access to all the features of the GCash app, as well as the maximum wallet size and transaction limits.

Check out the table below for a full feature comparison between the three verification levels:

| Features | Basic Level | Semi Verified | Fully Verified |

|---|---|---|---|

| Offline Cash-in | Yes | Yes | Yes |

| Pay Bills | Yes | Yes | Yes |

| Buy Load | Yes | Yes | Yes |

| AMEX Virtual Pay | Yes | Yes | Yes |

| Pay QR | Yes | Yes | Yes |

| GCash Mastercard | No | Yes | Yes |

| Send Money | No | Yes | Yes |

| Cash Out | No | Yes | Yes |

| Request Money | No | Yes | Yes |

| Card Transactions | No | No | Yes |

| Invest Money | No | No | Yes |

| GCredit | No | No | Yes |

| Online Cash-in | No | No | Yes |

| International Remittance | No | No | Yes |

Take note that all users can request money, but only semi-verified and verified users can pay a money request. All users regardless of verification level can also buy the GCash Mastercard but only semi-verified and verified users can use it. ATM and over-the-counter withdrawals are limited to ₱20,000 per transaction.

How to Verify Your GCash Account

Account verification is a one-time process and only takes a few minutes. First, tap the hamburger icon on the top left of the screen and a slideout menu will appear. Tap “Verify now” to start the account verification process.

Prepare a valid ID. Here is a list of valid IDs:

- Universal multi-purpose ID (UMID)

- Social Security System (SSS) ID

- Government Service Insurance System (GSIS) eCard

- Passport

- Driver’s license

- National Bureau of Investigation (NBI) clearance

- Police clearance

- PhilHealth card

- Tax identification number (TIN) ID

- Voter’s ID

- School ID with photo

- Home Development Mutual Fund (HDMF) or Pag-IBIG ID

- Postal ID

- Senior citizen’s ID

- Barangay clearance

- Professional Regulation Commission (PRC) ID

- Integrated Bar of the Philippines (IBP) ID

- Government office or government-owned and controlled corporation (GOCC) ID

- Department of Social Welfare and Development (DSWD) certification

- Maritime Industry Authority (MARINA) ID

- Alien Certificate of Registration

- Overseas Filipino Worker (OFW) ID

- Overseas Workers Welfare Administration (OWWA) ID

- Seaman’s Book (SIRB)

- Company IDs issued by private institutions registered with, regulated, or supervised either by Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission (SEC), or the Insurance Commission

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

With your ID ready, tap “Get Fully Verified.”

Choose your ID from the list.

Take a photo of your ID, placing it inside the rectangular frame with blue borders. Tap “SUBMIT” when done.

Next, pose for a selfie. Position your face within the frame and tap “Next.”

Complete the application form. When you’re done, tap “Next.” Check the box signifying your acceptance of the terms and conditions, and then tap “Confirm.”

Wait for the text message informing you that your GCash account has been fully verified. This will take more or less 30 minutes.

You can also have your GCash account verified at any Globe store or GCash partner outlet such as Bayad Center and Cebuana Lhuillier.

To have your account verified at a GCash partner store, you have to fill up a GCash service form and have your photo taken. You will also receive a text message informing you that your account has been verified.

Important GCash Tips and Reminders

- You can help save the environment by activating GCash Forest. For every transaction or activity, you’ll earn “green points” that will be used to plant trees in the Ipo Watershed Forest Reserve in Norzagaray, Bulacan. The more you use GCash, the more you help in saving Mother Nature!

- On the GCash app, you can swipe from the right to launch the QR code reader. Scan the store’s QR code and enter the amount to be paid.

- Your GCash wallet size is the total amount of transactions in a month, including cash-ins, withdrawals, bill payments, and bank transfers. So if you’ve already exceeded ₱100,000 in total transactions (the maximum wallet size for verified users) for the month, you can no longer use GCash and you’ll have to wait for the next month.

- You can set up security questions to make your GCash account more secure. Just go to “Settings” and tap “Account Authentication” to get started.

- You can use the same GCash account on multiple devices. However, you can’t use it at the same time on two or more devices.

- Take care of your MPIN as it’s the password to your Gcash account. Never share it with anyone. For added protection, set up security questions in the settings.

- GCash works on Globe and TM numbers with no data charges, so you don’t need to subscribe to an Internet data promo.

How Can I Withdraw Money From GCash?

Need to withdraw your GCash balance? There are two convenient ways you can use to cash-out from your GCash account:

1. via GCash MasterCard

Just go to any BancNet or GCash MasterCard affiliated ATM and withdraw using your card. Use your GCash MPIN as your ATM PIN.

2. via GCash Partner Outlets (GPO)

To cash-out via GCash Partner Outlets, present one valid ID (e.g. driver’s license, TIN ID, etc.). Each Partner Outlet has its own cash out steps. You can view these via the GCash App.

Step 1. Log in to the GCash app and tap ‘Show More.’

Step 2. Tap “Cash Out” to proceed.

Step 3. Select your preferred GCash Partner Outlet for more instructions on how to Cash Out. Tap on View all to see the entire list of cash out partners.

Step 4. You can also find your nearest partner outlet by tapping on View nearby partners.

How Much is The Maximum Cash in in GCash?

Have you been transacting with GCash more lately, but keep on going over the P100,000 monthly wallet limit? Well, gone are the days when you would have to calculate your monthly GCash transactions down to the last centavo to fit the limit.

After receiving waves of requests and suggestions to increase GCash’s monthly wallet limit, we are happy to announce that you can now increase it to hold up to P500,000 at any time!

At this point, you must already be thinking, “When and how can I get my wallet limit increased? I need it!” You can actually do it right here and right now. It’s super easy—just visit go.gcash.com/increasedlimits, or follow these simple steps:

- Make sure your GCash account is fully verified.

- Link your bank account or Mastercard card to GCash.

- You will receive an SMS confirmation of your wallet limit increase a day after successfully linking your bank account to GCash.

- Enjoy your higher wallet limit!

Now that you’ve got your account properly set up, it’s important to know what exactly comes with the increased wallet limit, so here’s what’s in store for you:

Bigger wallet size

As mentioned before, your wallet will be able to hold up to P500,000 at any time on a monthly basis.

Higher incoming limit

With that, you will be able to put in or receive P500,000 in your wallet per month.

No monthly outgoing limit

You will be able to send money and transact way over the previous monthly limit of P100,000 now! How great is that?

More cashless transactions

A bigger wallet size enables you to fully shift to digital means of transacting everyday. Not only that, it’s also a better and wiser choice to go cashless and pay the contactless way to ensure your safety in times like this!

Read Also: How To Earn Income With Micro Job Websites

Given all that, if you still haven’t increased your GCash wallet limit to P500,000, just scroll back up a bit and follow the simple steps to enjoy the big benefits!

How Can I Open GCash Account?

There are 3 easy ways to start your GCash

1. Via the GCash App

Download the app.

Enter your mobile number and click Register in the prompt.

Provide the necessary information as prompted. Nominate a 4-digit MPIN.

2. Via *143#

On your phone, dial *143# then select ‘GCash’.

Select ‘GCash’, then ‘Register’.

Nominate a 4-digit MPIN.

Provide the necessary information as prompted.

3. Via Facebook Messenger

Download the latest Facebook Messenger app.

Search for @gcashofficial.

Click the ‘Get Started’ button.

Click on the ‘Menu’ button found at the lower left corner.

Click on ‘Account’ and select ‘Create an Account’.

Type in your Globe/TM mobile number.

Type in your Facebook password and wait for a verification message.

Wait for the verification code to confirm linking.

Is it Safe to Connect Bank Account to GCash?

So, is GCash safe to use? Is it safe to make transactions, transfer money, pay bills, even make investments? Yes, GCash is safe.

It’s natural to have concerns, especially those who are new with any technology. However, like any other method where you place your money like ATM, passbook, even in a ‘piggy bank or alkansya’, you need to follow safety reminders to minimize any risk of loss.

The best way to keep your GCash safe is to make sure you keep MPIN secure and never disclose it to anyone. You should be the only one who knows your PIN. MPIN is also the same PIN that you will use if you will withdraw using the GCash MasterCard.

How Much Can I Withdraw From GCash?

The maximum amount that you can transfer is ₱50,000 per transaction. A convenience fee of ₱15 pesos will be deducted in your GCash account per transaction. So, make sure you have extra funds to do this transaction.