As a small business, you need a lot of software to help with different tasks in your business, and that is where account receivable software comes in. Accounts receivable software is typically used to perform accounting and financial functions. The solutions range from simple single-entry apps for check writing and bookkeeping to advanced double-entry systems that include a general ledger.

Sophisticated platforms offer extra features such as inventory, fixed assets, invoicing, and more. Accounts receivable software provides plenty of benefits as you can use it to automate your routine tasks, eliminate manual errors, keep your books accurate, get timely notifications to avoid penalties, and more. Growing companies especially need good quality accounts receivable software.

This article will focus on what an account receivable software is, its functions and features, and how it will benefit your business. Let’s get into it.

- What is Accounts Receivable Software?

- What is the Meaning of Account Receivable?

- What is AP Software?

- What is Accounts Receivable in SAP?

- How do I Record my AR?

- What is an Example of Accounts Receivable?

- What Are The Top Features of Accounts Receivable Software

- How Does my Business Benefit From Accounts Receivable Software?

- What is AP Automation Software?

- How Does SAP Process Accounts Receivable?

- Why do we Use Accounts Receivable?

- How do You Prepare Accounts Receivable?

- What Are The Best Accounts Receivable Software?

- How Does Invoice Automation Work?

- What is a Workflow Accounts Payable?

- What is Called SAP?

What is Accounts Receivable Software?

Companies use accounts receivable software to perform accounting and financial reporting. The solutions may include invoice processing, general ledger, payment processing, and more. Accounts receivable software provides businesses with many benefits, including automating routine accounting tasks, eliminating manual errors, keeping your books accurate, and more.

Read Also: The Use Of Electronic Document Management Software To Achieve Profitability

Growing businesses need a quality accounts receivable program to ensure their accounting and financial records are accurate and in order. Without it, your company may suffer because of inaccuracies and difficulty collecting receivables on time or at all. If this happens, you may not have enough cash to cover day-to-day operations and operating expenses.

Accounts receivable software automates a business’s invoicing and collections processes. As a result, businesses can better manage their cash flow cycle, increase accuracy and improve customer relations.

What is the Meaning of Account Receivable?

Accounts Receivable (AR) is the proceeds or payments which the company will receive from its customers who have purchased its goods & services on credit. Usually, the credit period is short ranging from a few days to months or in some cases maybe a year.

The word receivable refers to the payment not being realized. This means that the company must have extended a credit line to its customers. Usually, the company sells its goods and services both in cash as well as on credit.

When a company extends credit to the customer, the sale is realized when the invoice is generated, but the company extends a time period to the customers to pay the amount after some time. The time period could vary from 30-days to a few months.

Account Receivables (AR) are treated as current assets on the balance sheet. Let’s understand AR with the help of an example. Suppose you are a manufacturer M/S XYZ Pvt Ltd and you manufacture tyres.

A customer gives you an order of Rs 1,00,000 for 100 tyres. Now, when the invoice is generated for that amount, the sale is recorded, but to make the payment the company extends the credit period of 30-days to the customer.

Till that time the amount of Rs 1,00,000 becomes your account receivable because the customer will pay that amount before the period expires. If not, the company can charge a late fee or hand over the account to a collections department.

Once the payment is made, the cash segment in the balance sheet will increase by Rs 1,00,000, and the account receivable will be decreased by the same amount because the customer has made the payment.

The amount of account receivable depends on the line of credit that the customer enjoys from the company. Usually, this is offered to customers who are frequent buyers.

What is AP Software?

The AP automation software technology can help your business cut costs, be more productive and liberate your employees to be engaged with more strategic projects. AP software consists of a set of instructions customized for automated start-to-finish business payment processes. The software classifies, matches, verifies information, and then forwards it to your accounting system to be posted.

AP software automates the AP process from receiving the invoice all the way to paying suppliers while maintaining existing banking relationships and workflows.

By automating this invoice and payment process, customers have 24/7 visibility into payment and approvals while a dedicated service team with the software provider manages the suppliers and executes payments on their behalf.

Sequentially, some of the key features of this software from the user’s perspective include:

- logging in to see all pending approvals sitting in their queues

- accessing the invoices from any device connected to the Internet

- seeing exact amounts of invoices, how long they’ve been in the queue and who should approve them next

- once approved, specifying which invoices customers want to pay or payments they want to send and

- sending payments in the exact way recipients want to receive them such as by electronic payments or checks.

Unlike manual AP in which people are heavily involved throughout the process, AP automation reduces the need for people to get involved.

One of the more valuable capabilities of this software is that it relies on various conditions to execute tasks. For example, if your company’s policy has a condition that the CFO must approve any invoice above $1,000, the software can identify that condition and make sure to automatically forward that invoice to the CFO for approval.

Similarly, if your company has a condition that any invoice below $100 does not have to be approved by anyone other than an AP manager, the software identifies invoices below $100 and routes the invoice for approval only to the AP manager, and no one higher up in the company.

What is Accounts Receivable in SAP?

SAP FI Accounts Receivable component records and manages accounting data of all customers. It is also an integral part of sales management.

All postings in Accounts Receivable are also recorded directly in General Ledger. Different G/L accounts are updated depending on the transaction involved (for example, receivables, down payments, and bills of exchange). The system contains a range of tools that you can use to monitor open items such as account analyses, alarm reports, due date lists, and a flexible dunning program.

The correspondence linked to these tools can be individually formulated to suit your requirements. This is also the case for payment notices, balance confirmations, account statements, and interest calculations. Incoming payments can be assigned to due receivables using user-friendly screen functions or by electronic means such as EDI.

The payment program can automatically carry out direct debiting and down payments.

We have a range of tools available for documenting the transactions that occur in Accounts Receivable, including balance lists, journals, balance audit trails, and other standard reports. When drawing up financial statements, the items in foreign currency are revalued, customers who are also vendors are listed, and the balances on the accounts are sorted by their remaining life.

Accounts Receivable is not merely one of the branches of accounting that forms the basis of adequate and orderly accounting. It also provides the data required for effective credit management (as a result of its close integration with the Sales and Distribution component) as well as important information for the optimization of liquidity planning.

How do I Record my AR?

Accounts receivable (AR) is money that your customers owe you for buying goods and services on credit. Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Your customers should pay this amount before the invoice due date. AR are recorded as an asset on your company’s balance sheet.

Here we have explained accounts receivable with an example.

ABC company sold goods worth $50,000 on credit to CDE company. Here is the accounts receivable journal entry in ABC company books:

| Account Name | Debit | Credit |

|---|---|---|

| Accounts Receivable | $50,000 | |

| Sales | $50,000 | |

The cost of these items for ABC company was $10,000. Once the inventory items are delivered to CDE company, here is the journal entry to update the cost of goods sold in ABC company books:

| Account Name | Debit | Credit |

|---|---|---|

| Cost of Goods Sold | $10,000 | |

| Inventory | $10,000 | |

CDE company paid the full amount of $50,000 in cash to ABC company. Here is the payment journal entry in ABC company books:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $50,000 | |

| Accounts Receivable | $50,000 | |

Here we have explained the steps of the accounts receivable process:

Step 1 Selling Goods and Services on Credit

The accounts receivable process starts with selling goods or services to customers on credit.

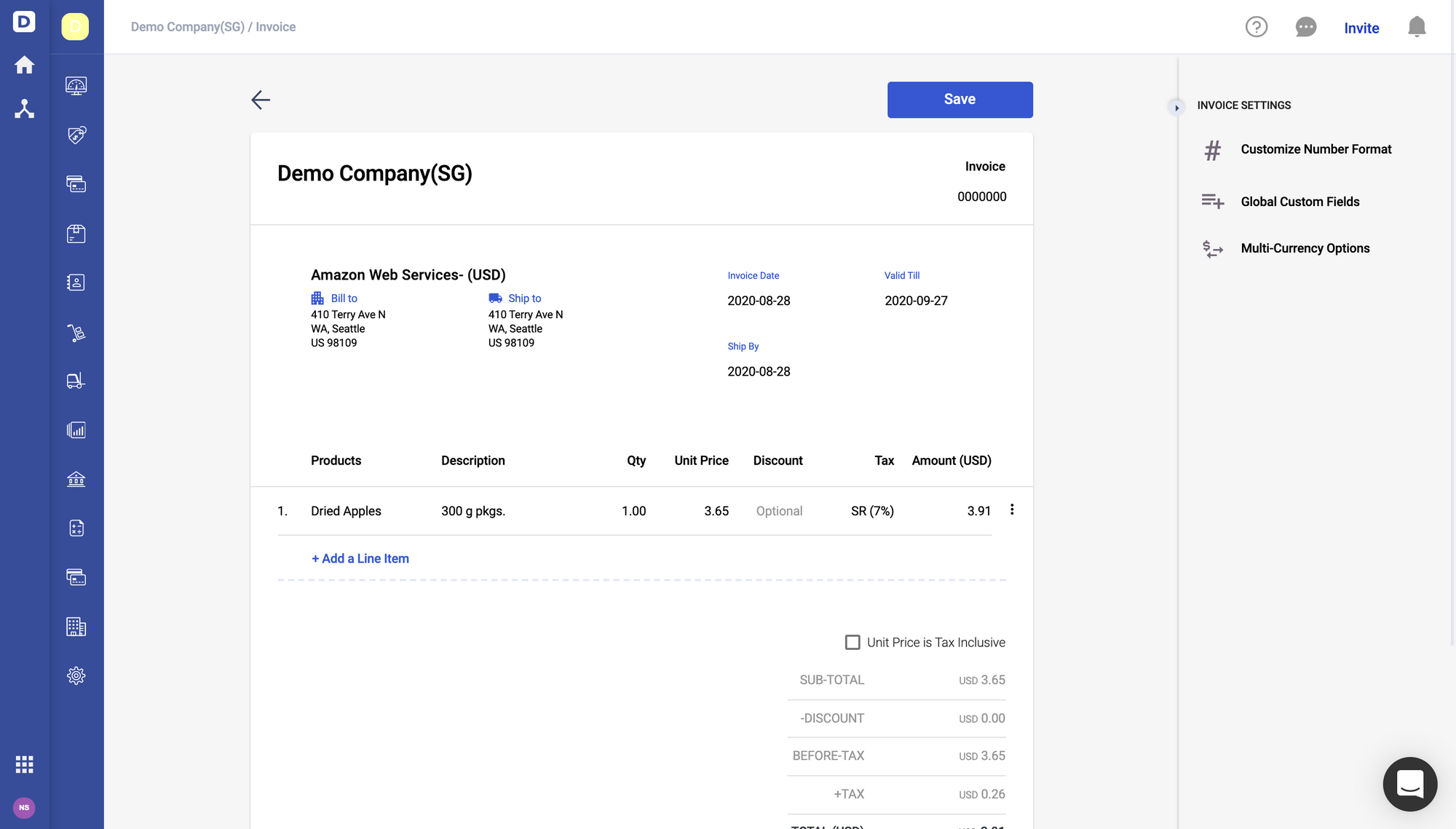

Step 2 Sending an Invoice

Once the sale is confirmed, you need to send an invoice to your customer. An invoice is a sales document that has a list of products and services provided with their quantity and prices. Sending an invoice to your customer is telling them about the money owed for the goods and services provided by your business.

The invoice can be sent to customers before or after the goods or services delivery, depending upon the sales contract. While creating an invoice, ensure that invoice has all the important information such as:

- Invoice date

- Customer information such as name, billing, and shipping addresses, etc.

- Services and goods name, quantity with the price.

- Amount due

- Invoice Due date

- Relevant purchase order number and information if your customer shared it with you.

- Your contact information

- Payment terms

- Tax and discount details

Once an invoice is sent to your customers, you also need to record the invoice journal entry. While recording the invoice journal entry, you need to debit the accounts receivable account for the amount due from your customer and credit the sales account for the same amount.

You also need to post the cost of goods sold in a journal entry to update your inventory. If you are using an accounting system such as Deskera Books, these journal entries will be automatically created upon the generation of sales invoices and fulfillment.

Step 3 Payment Collection

Once your customer has received the invoice, they need to make payment. All customers need to make payment before the invoice due date. Once you have received the payment, you need to give them a payment receipt and also record the payment entry in the system. While recording the payment journal entry, you need to debit the cash to show an increase due to the payment and credit accounts receivable to reduce the amount owed by your customer.

What is an Example of Accounts Receivable?

Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company. The phrase refers to accounts a business has the right to receive because it has delivered a product or service. Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period. It typically ranges from a few days to a fiscal or calendar year.

Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less.

If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser. Essentially, the company has accepted a short-term IOU from its client.

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service.

A receivable is created any time money is owed to a firm for services rendered or products provided that have not yet been paid. This can be from a sale to a customer on store credit, or a subscription or installment payment that is due after goods or services have been received.

What Are The Top Features of Accounts Receivable Software

Accounts receivable software automates a company’s credit management, cash application, invoicing, payments, collections and other processes. It provides leadership with a better way to manage the cash flow cycle and customer relations and provides greater accuracy.

The optimal accounting software may vary depending on the company size and goals regarding accounts receivable management. Below are the features to look for in AR software.

Cash flow management

By consolidating your sales, invoicing and payment processes with a single vendor, you can reduce the friction between making sales and posting payments while increasing your cash flow.

Digital B2B Payments

It should be easy and economical to accept and reconcile payments through all the major channels: ACH payments, credit cards, emails, wire transfers and EFTs.

Automated credit application

Automated credit applications move your customers more quickly through the application process, gathering third-party data and helping you make faster decisions.

Invoice generation and distribution

APIs integrate with leading AP portals to deliver invoices quickly so that you may avoid the labor and expense associated with manually keying invoice data. Self-service Billing and payment portals allow your customers to view and pay invoices 24/7.

Automated cash application

Intelligent cash applications software can deliver market-leading match rates even with missing or decoupled remittance by automating the process of remittance capture.

Automated collections emails

How realistic is it that collectors have time to email every customer to remind them to pay their invoice? It’s not. With automated email, you have the opportunity to create the email template, set up who should receive an email and allow the accounts receivable software to do the rest. You can rest easy knowing that your account portfolio is being nurtured.

How Does my Business Benefit From Accounts Receivable Software?

You may be wondering about the benefits companies have received from utilizing accounts receivable software.

Improve the payments acceptance process

Automating your payment process allows you to accept your customers’ preferred form of payment more efficiently. You’ll make your cash application easier and may also save on the costs associated with accepting credit card payments.

Increase adoption of electronic invoicing

How many of your customers already accept electronic invoices? Suppose you’d like to increase your company’s adoption rate. Billtrust can analyze your current customer base and see which of your customers are accepting electronic invoices from other suppliers. We can encourage them to receive electronic invoices from your company as well.

Expedite credit approvals and management

Using a manual process to manage your credit approvals and management slows down the process. Plus, you may not receive an accurate picture of your credit risk. Onboarding your customers with credit application forms gives you better visibility from start to finish.

You can also automatically obtain current bureau data and access information about customers you may have in common with your peers. Also, AI-assisted data analytics can help you with scoring so that you make better credit decisions.

Enhance cash flow

If you don’t get paid on time, you may not have enough cash to pay your operating expenses. Using accounts receivable automation software allows you to manage your receivables better and gives you a clearer picture of your cash flow position. If you make it easier for your customers to pay, you may improve your cash quicker than you thought possible.

Enable a remote workforce

More companies have embraced a remote workforce for many reasons, from having access to the best talent to reducing offices’ overhead. As long as your employees have access to a reliable internet connection, you can have employees anywhere in the world. You have the opportunity to connect with other time zones and countries.

For example, you may have collection employees on the West Coast of the United States who work after your East Coast headquarters close for the business day. Your team’s processing may continue for more hours daily.

Decrease paper usage

Paper invoices, envelopes and checks are standard in accounting departments; processing paper may result in multiple errors that you can’t keep track of during the month. Small business owners who use cloud-based AR systems may discover that their accounts receivable process improves because less paper means more speed, flexibility and data from implementing SaaS processes.

With receivable automation, managing your accounts receivables can remove the guesswork from determining how much time you must spend on figuring out which customers to call, when and why. Furthermore, it may speed up the collection of past due invoices, which may improve the position of your balance sheet and other financial statements.

Accounts receivable and payment management software helps your business in many ways. In fact, Paystream Advisors found that companies using accounts receivable management software can automate manual tasks and get organized faster, which may:

- Increase the time spent on contacting customers for payment to 62% from 20%.

- Reduce the time spent on managing disputes to 13% from 40%.

- Reduce the time spent prioritizing and preparing for calls to 6% from 15%.

Implementing an automated receivable solution may be a step in the right direction if you want to improve your business’s cash flow.

What is AP Automation Software?

AP automation is the use of software to digitize the vendor invoicing process and create faster leaner, more cost-effective AP workflows. No more paper receipts. No forwarding invoices in email. No cutting paper checks. Automation lets you eliminate manual AP tasks, increase visibility into spend, and control costs like never before.

It would be difficult to overstate how significantly AP automation contributes to an organization’s overall success. To give you an idea, here are a handful of ways that automation can help:

- Control costs and reduce unnecessary spend (like invoice processing costs and check fees).

- Boost employee morale and give staff more time or strategic tasks.

- Attract and retain top AP talent (if you offer automation rather than manual processes, it’s far more likely that staff will love their jobs and stick around).

- Reduce errors and duplications that come from manual data entry.

- Uncover data that will help you make informed decisions.

- Increase policy compliance and strengthen vendor relationships.

True, upgrading to an automated system requires an investment like any new tool. That said, in today’s fast-paced, always-shifting business environment, organizations that don’t automate will struggle to compete and miss opportunities for growth. This means that you easily could argue that companies can’t afford NOT to invest in automation.

Plus, if you compare the cost of automating to the time and expense of continuing to do AP manually, the return on your investment is easy to see.

Consider this: The Institute of Finance Management (IOFM) puts the cost of manually processing a single vendor invoice at $10 to $23 per invoice; automating vendor invoice management can reduce the cost of processing one invoice by up to 80%.

Think about how many invoices you process in a single week alone. Or an entire year. You’ve just learned that there’s a way to save 80% on each one.

How Does SAP Process Accounts Receivable?

To post a manual incoming payment using Transaction F-28, follow the application menu path, Accounting > Financial Accounting > Accounts Receivable > Document Entry > F-28 – Incoming Payments, as shown below.

Double-click F-28 – Incoming Payments from the menu path, or enter “F-28” in the Command field (see below) and press (Enter).

The Post Incoming Payments: Header Data screen opens, as shown in the figure below. In the top portion of the screen, most field values should contain default values, depending on your configuration and editing options.

Make sure to input all required fields that don’t prepopulate values. In this example, default values populated into the Posting Date, Type (i.e., document type), Period, Company Code, and Currency/Rate fields. We manually input a value into the Document Date field.

In the Bank data area, enter values for Account, Amount, and any other fields that are required. In this example, we also entered a value in the Profit Center field. In the Open item selection area, enter the customer number in Account.

Finally, in the Additional selections area, choose a button that indicates how the program should search for and select open invoices. For this example, select the Amount button.

With all relevant fields entered, click the Process open items button in the top-left portion of the screen shown in the first figure below. The Post Incoming Payments Enter selection criteria screen opens (see second figure). In this example, we entered the amount of our invoice to be paid ($2000) in the From and To fields.

After your selection criteria are entered, click the Process open items button in the top-center portion of the screen (next figure). The Post Incoming Payments Process open items screen opens (second figure below).

If the correct open items have been selected, click the Save icon, or press Ctrl+S. The program posts the payment document and issues a “document posted” message.

Performing accounting tasks in SAP can be easy when you know what you’re doing. When it comes to performing accounts receivable in SAP ERP FI, creating an incoming payment is part of the bread and butter skills you should have.

Why do we Use Accounts Receivable?

Accounts receivable is the lifeblood of a business’s cash flow. It helps with cash flow management by telling you which clients owe you money and how much. This lets you discern whether your cash account accurately reflects your current financial standing. In other words, accounts receivable make the difference between worrying that you don’t have enough money and staying calm in the knowledge that money will come soon.

If you don’t keep track of accounts receivable, you may forget to bill certain customers, or you may not know if you’ve been paid. You could end up providing your product for free, negatively impacting your profitability. The longer you take to send an invoice, the less likely you’ll receive payment promptly. Keeping track of accounts receivable is also a great way to document proof of income at tax time.

How do You Prepare Accounts Receivable?

Some of the most basic and essential steps for a typical AR process are:

1. Develop a collection plan

Create invoices to bill to clients at the right time. Ask your clients what day is the most convenient for them in terms of cash flow. Some customers might get billed bimonthly, some weekly. It will depend on your business agreement.

Consider these factors when creating a new business agreement:

- What is this customer’s payment history? If they’ve always been on time, then you can be lenient when they need an extension. If they’re routinely late, then you may need to build a more detailed payment plan.

- How does your business stand? If you need to get money back faster, then you’ll have to make your payment terms shorter.

- What are the industry standards? Take a look at the billing practices in your field. Depending on what you’re able to afford, decide whether you’ll match payment terms or outdo your competitors by giving your customers an advantage (e.g., more time).

Agree on a date and send all invoices electronically to keep better documentation. This strategy will streamline your accounts receivable process flow.

2. Document your collection process

So now you’ve got a plan, but how can you make sure that everyone follows it? Or that it’s working the way it should? You need to document your AR collections process. Visualizing your process with Lucidchart can help you:

- Reduce errors in billing.

- See which processes could be automated or done electronically to reduce input errors.

- Audit and optimize your process.

- Onboard new employees more quickly.

3. Log all charges and expenses concurrently

Another best practice is to scan all receipts, orders, and requests as they arrive so that they’ll always be in the system for the next invoice. If you delegate invoicing responsibilities to specific staff, they’ll anticipate the tasks needed for completion.

4. Incentivize early payments by offering discounts

One of the most trying aspects of AR collections is securing timely, consistent payments. However, every business loves a good deal. Not every company will have a strong enough cash flow to take the offer, but you can incentivize the companies that do to make payments earlier by offering them some kind of discount.

5. Build and maintain relationships with clients

The best-kept secret for successful accounts receivable collection? Make your clients feel like gold. If you’ve ever had an overdue medical bill or credit card debt, chances are you’ve received a host of annoying calls. No one enjoys those—you don’t know who the voice on the other end is and you’re not exactly ecstatic to pay.

However, to ante-up the accounts receivable process, you need to make sure your AR staff have phenomenal relationships with clients and maintain consistent contact with them. Always respect the client and make sure your business focuses on the clients and how they will feel at each stage of the process.

6. Have a plan in place to always get your payments

In spite of how great your client relationships are, unforeseen circumstances sometimes prevent payment—not meeting revenue, interrupted cash flow, and even bankruptcy.

Regardless of the cause, don’t let it affect your accounts receivable process. If you happen to stumble upon a worst-case scenario non-payment issue, here are six steps to follow:

- Make a friendly phone call asking if they need more time.

- Wait no more than five business days before calling again.

- Visit them in person, and then send a follow-up email explaining your concerns.

- Send a letter of demand.

- Send a final letter of demand, if needed.

- Hand the case over to a debt collection agency.

Sometimes even the best clients have cash flow problems. However, setting up all payment expectations at the beginning of the relationship will better every outcome.

These basic tips should help you streamline your accounts receivable process. Planning ahead and sticking to your plan by documenting your process allows your employees to be more efficient and consistent when handling collections. Overall, this will make it possible for the rest of your business to operate smoothly and invest in growth.

What Are The Best Accounts Receivable Software?

1. FreshBooks

A winner of our 2020 Best Accounting Software Award, this robust cloud accounting app for small businesses makes billing easy and efficient. FreshBooks allows users to manage key processes easily from turning receipts into expense files to tracking billable hours. Special modules to manage projects and tax are also available.

2. NetSuite ERP

A scalable cloud ERP solution for growing medium-sized businesses and large enterprises. It offers complete control and automation options in managing financials, billing, orders, inventory, fixed assets, and revenue. It also has different modules to help you bring together all your key business processes.

3. QuickBooks Online

QuickBooks Online is Intuit’s comprehensive yet easy-to-use software solution that simplifies accounting tasks for freelancers and small businesses. It offers tools to track expenses, calculate taxes, manage invoices, monitor sales, and more.

4. Sage Business Cloud Accounting

A comprehensive accounting software for freelancers and small businesses, this is one of the most easy-to-use web-based platforms available on the market. Users can manage key accounting processes like managing items, supplies, and customer accounts in one centralized hub.

5. Gaviti

Gaviti is an AR collection platform that optimizes processes by automating workflows to accelerate cash flow. It initiates automatic workflows and improves visibility and control by employing key metrics.

6. Zoho Books

Zoho Books is the winner of our 2017 Great User Experience Award. It is smart accounting software designed for small businesses to better manage their finances and more efficiently control their cash flow. It is also user-friendly, with a clean design yet robust set of features that helps users generate actionable, data-based insights.

7. Xero

A popular online accounting app designed to meet the needs of small and medium businesses in any industry. One of the most user-friendly accounting solutions available today, Xero features real-time tracking of accounts receivable, expenses, billing, and invoicing.

8. Sage 50cloud

Sage50 Accounting is a comprehensive cloud-based accounting software that helps businesses of all kinds and sizes manage key processes from billing to tax management. It has modules to help manage orders, contacts, inventory, and suppliers. It also includes advanced report generation for forecasting and different types of financial analyses.

9. FreeAgent

A financial management and accounting tool for freelancers and small businesses packed with comprehensive features including customizable invoices, automated bank feeds, and sales tax reports among others. It helps users be on top of their finances. The platform is also very easy to use, thanks to its sleek design.

10. Bill.com

An intelligent business payment platform, Bill.com streamlines accounts payable and accounts receivable processes. With this, users can capture invoices, approve payments, and keep tabs on all company transactions.

How Does Invoice Automation Work?

Invoice processing automation is software used by businesses to ultimately help streamline accounts payable processes by automatically paying supplier invoices. Invoice processing automation involves extracting invoice data entering a system and seamlessly inputting that data into your ERP or accounts payable system, allowing payments to be made in minutes.

The traditional method of invoice document management starts when the accounting department receives a supplier’s invoice. At this point, it is matched and approved. Typically, if the amount of the invoice is a large payout, further approval is needed.

From there, it must then be entered into the system where it is “posted” for payment. Then payment is issued. Depending on the company, sometimes the manual invoicing process can take up to 15 separate steps. This is a large amount of time; especially when processing multiple invoices.

Automated invoicing cuts to the chase. When the invoice arrives, it is scanned and fed into the digital accounting system. This form of data capture (otherwise known as invoice capture) cuts out hours of manual data entry. The invoice automation software will then convert the data into a text-searchable document.

The invoice data can be extracted and mapped in the automated management system so it remembers which fields to capture and register into the ERP system. This includes data like supplier name, the purchase amount, quantity, and so forth. Invoices are then routed to the appropriate parties for review and approval.

Automated invoicing has a multitude of advantages. This includes up to 80% reduction in a company’s procure-to-pay cycle. Additional benefits include:

- Cuts down on error rates. Less manual entry means less room for mistakes.

- Speeds up the approval process and reduces processing times.

- Saves on labor costs. Staff can work on more business-critical tasks.

- Reduces duplicate invoices and payments.

- Improves relationships. Employees are liberated from tedious tasks and vendors have a more transparent process.

- Slashes the costs of manually processing invoices (postage, paper, etc).

- Better to secure early-payment discounts and avoid making late payments.

The ability to assign a GL code without direct access to a company’s accounting platform is another benefit named by reviewers online.

What is a Workflow Accounts Payable?

The accounts payable workflow describes a company’s complete end-to-end process in the procurement and payment of transactions. In essence, a workflow maps the steps from the point at which goods are received to the point at which invoices are paid.

A streamlined AP workflow is essential for managing the consistency, accuracy, and efficiency of each step in the process from start to finish.

The manual flow of documents in an organization is prone to errors. For example, invoices can be “lost” in someone’s inbox resulting in late fees and ruined business credit scores.

An effective workflow can be designed to identify and prevent any potential errors. While Accounts Payable processes may vary in complexity, the AP workflow should be explicitly designed with “rules” that clarify the logic used to confirm, verify, approve, record, and reconcile transactions.

These “rules” help standardize each step in the workflow so that successful results are achieved consistently.

An Accounts Payable department’s workflow can be defined and managed manually or through automation using software, and at times by delegating any of the processes to a third-party company specializing in managing business processes.

Often when people refer to “Accounts Payable workflow” they are referring to AP workflow automation. Well-implemented software workflows increase efficiency by ensuring the enforcement of processing rules and provide visibility to the status of Accounts Payable.

What is Called SAP?

SAP, or Systems Applications and Products, is a widely-used enterprise resource planning (ERP) software SAP creates a centralized system for businesses that enables every department to access and share common data to create a better work environment for every employee in the company. SAP is the most-used ERP software on the market and contains hundreds of fully integrated modules that cover nearly every aspect of business management.

Read Also: How To Convert Youtube Videos Into Mp3 Files?

SAP collects and processes data from all functions in a business on one platform. SAP is essential for many businesses because it allows every department to communicate with each other easily. The success of any organization relies on effective communication and data exchange between its functions, and SAP is an effective way to support those efforts.

Developing SAP skills can make you a competitive candidate if you’re applying at companies that use enterprise resource planning software. Experience and proficiency with SAP may even be a requirement for some roles. Here are several common SAP skills:

- Utilizing transactions Being able to use transactions and input data into the SAP software can give you an advantage when applying for a job that requires you to be able to manage sales.

- Reporting Understanding how to execute reports can provide data that you, your manager or another department might need.

- Accounting Knowing how to use the accounting modules within the SAP software can give you an advantage in a finance or accounting job but can also be beneficial to any employee working in the accounting department of a company.

- Recruiting Understanding the recruiting modules of SAP software can help human resource professionals better manage applicants and potential employees.

- Management There are a variety of management modules within SAP, including customer management, project management, warehouse management, transportation management and inventory management. Gaining skills in management systems can give you an advantage when applying for a management position.

- Communication One of the most important aspects of SAP software is the ability to communicate with other departments to keep a company running smoothly. Being able to show a recruiter or interviewer your understanding of communication among departments using SAP software can give you an advantage over other applicants at any job.

Many companies around the world use SAP, so understanding how to use SAP software can give you an advantage when applying for jobs or seeking a promotion within the company you work for. Here are a few popular industries and positions where you would use SAP software and the modules and capabilities of each:

- Human resources management

- Project management

- Warehouse management

- Customer relationship management

- Finance management and accounting

SAP provides a comprehensive suite of financial management and accounting systems that give companies the tools they need to keep track of their finances. Here are a few of the finance management systems:

- Financial planning and analysis: This system helps finance professionals with strategic planning, forecasting, budgeting, performance management, analytics and reporting.

- Accounting and tax management: This system assists professionals with financial accounting and reconciliation, reporting, disclosure, regulation compliance and closing process accounting.

Treasury and cash management: This system includes features like corporate treasury management, cash management, cash flow forecasting, debt management, risk management and investment management.

Accounts payable and receivable: This system provides modules that assist with credit evaluation, risk management, collections, dispute management, billing and invoice management.