Money market accounts are interest-bearing accounts that can be opened at banks and credit unions. They are a sort of deposit account for savers, similar to a savings account. However, one significant difference between the two is that a money market account typically includes some checking account features. (While a savings account may allow you to write checks, money market accounts are more likely to do so.)

It’s also worth noting that money market accounts differ from money market mutual funds, which are securities rather than bank accounts.

Money market accounts often provide reasonable interest rates and are a secure location to store your savings. If you want a consistent yield in a federally guaranteed account, consider creating a money market account.

Money market accounts offer additional withdrawal options than traditional or online savings accounts. However, money market accounts are normally limited to six withdrawals per month and are not intended to be used as a substitute for a checking account. They may need higher minimum deposits and balances than savings accounts.

Money market accounts combine some features of savings and checking accounts. They may come with check-writing privileges or a debit card, like a checking account. But typically the number of withdrawals permitted each statement period is limited to six, as with a savings account.

Unlike checking accounts, money market accounts accrue interest at competitive rates, which are frequently tiered based on the account’s balance. The rate on a money market account is variable, and there may be a minimum balance requirement to earn the rate.

Because they offer limited access to funds in the account, money market accounts might be a good fit for shorter-term savings goals, such as building an emergency fund. Then you’re able to access the money when necessary, unlike with a CD, which typically doesn’t permit withdrawals until the end of a set term length without imposing a penalty.

Difference Between a Money Market Account vs. Other Accounts

- Money market account vs. checking account

While money market accounts may offer check-writing privileges, these accounts aren’t designed to be used like checking accounts. A former federal mandate, Regulation D, limited withdrawals from savings and money market accounts to no more than six per month, which many financial institutions still impose. The best money market account rates are much higher than checking account rates, however.

- Money market account vs. savings account

Savings accounts and money market accounts have more in common than not: They pay interest, and they are designed to keep you saving. But there are a few key differences. Money market accounts may have higher minimum balance requirements. With a money market account, you can also get checks and/or a debit card. It’s less common for a savings account to come with this level of liquidity.

- Money market account vs. CD

A certificate of deposit could pay you a more competitive rate than a money market account, but your money is more liquid in a money market account than in a CD. If you are deciding between a money market account and a CD, evaluate what savings goals you have and how much access you’ll need to the funds. The liquidity of a money market account might make it a good option for shorter-term goals.

What is The Minimum Deposit For a Money Market Account?

A money market account is a sort of savings account that may allow you to write a few checks or use your debit card every month.

Some high-yield savings accounts outperform money market rates and have cheaper fees, so you’ll come out ahead with them. The best savings accounts offer low or no minimum deposits. However, because conventional savings accounts do not accept debit cards or cheques, they may be more difficult to access than MMAs.

The average money market rate is less than 1 percent. But let’s say you put $10,000 in an account that earns a full 1% APY. After a year, your balance would earn 100 bucks. Put that same amount in a money market account with a 4% APY, and it would gain just over $400. You earn extra money with no extra effort.

Discover® Money Market Account

- Money market rate: The Discover® money market account has a 4.00% APY on balances below $100,000. If you have more to deposit, the rate is 4.05% APY.

- Minimum balance and fee: The minimum opening deposit for a money market account is $2,500, but beyond the initial deposit, there is no requirement to maintain a minimum balance. There is also no monthly fee.

- What you should know: This money market account has check-writing and debit card privileges. Discover® Bank offers customer support 24 hours a day, seven days a week. Discover also has a cash back rewards checking account with no monthly fee.

Quontic Money Market Account

- Money market rate: 5.00% APY on all balances.

- Minimum balance and fee: There is a $100 minimum to open an account, but no monthly fee.

- What you should know: This money market account comes with a debit card. Customer service is available by phone or chat on weekdays from 9 a.m. to 6 p.m. ET.

Vio Bank Cornerstone Money Market Account

- Money market rate: The Vio Bank Cornerstone Money Market Savings Account earns 5.30% APY on all balances.

- Minimum balance and fee: There is a $100 minimum to open and no monthly fee.

- What you should know: Vio Bank is a division of Oklahoma City-based MidFirst Bank. Customer service is available by phone 7 a.m. to 9 p.m. CT on weekdays, 8 a.m. to 6 p.m. CT on Saturdays and 12 p.m. to 4 p.m. CT on Sundays.

Sallie Mae Money Market Account

- Money market rate: Earn 4.65% APY on any balance.

- Minimum balance and fee: There is no minimum balance requirement and no monthly fee.

- What you should know: This account comes with check-writing privileges. Customer service is available weekdays from 9 a.m. to 6 p.m. ET.

Ally Bank Money Market Account

- Money market rate: The Ally Money Market Account earns 4.25% across all balance tiers.

- Minimum balance and fee: There is no monthly fee or minimum amount required to open an account.

- What you should know: This account offers a debit card and the ability to write checks. Customer service is available 24 hours a day, seven days a week.

Zynlo Money Market Account

- Money market rate: Zynlo’s money market account earns 5.00% APY on balances up to $250,000, and 0.10% APY on amounts above that level.

- Minimum balance and fee: There is a $10 minimum deposit to open an account and no monthly fees.

- What you should know: While Zynlo Bank doesn’t have any branches, it does have customer service representatives available by phone 24 hours a day, seven days a week. Services are backed by PeoplesBank, which is based in Massachusetts.

EverBank Yield Pledge® Money Market

- Money market rate: The Yield Pledge Money Market from EverBank (formerly TIAA Bank) lets account holders earn a 4.30% APY on balances up to $250,000. This is a one-year introductory rate. For balances above that amount, and for accounts that have been opened for longer than one year, the APY is lower.

- Minimum balance and fee: There is no minimum amount to open an account, and there is also no monthly fee.

- What you should know: EverBank (formerly TIAA Bank) does not charge ATM fees. In addition, if you use domestic ATMs that are not in the bank’s network, EverBank will reimburse any ATM fees charged by the machine owner, up to $15 each month. If your average daily bank balance is at least $5,000, the ATM fee reimbursement is uncapped. Customer service is available by phone weekdays from 8 a.m. to 8 p.m. ET and Saturdays from 9 a.m. to 7 p.m. ET.

First Foundation Bank Online Money Market

- Money market rate: First Foundation Bank’s Online Money Market account earns a 4.90% APY.

- Minimum balance and fee: You’ll need $1,000 to open an account. After that, there is no monthly fee, even if the balance dips below $1,000.

- What you should know: A debit card is available upon request. This account also has check-writing privileges. Customer service is available by phone Monday through Thursday 5 a.m. to 8 p.m. PT, Fridays from 5 a.m. to 6 p.m. PT and Saturdays from 6 a.m. to 2:30 p.m. PT.

The finest money market accounts have higher-than-average annual percentage yields, and many include checking account features that make it easier to access your assets. This makes them excellent savings vehicles for producing a return while also allowing you to access your funds directly without having to move them from your savings to your checking account.

What is The Downside of Money Market Account?

Savings accounts are intended to hold your financial reserves, whilst checking accounts are built for daily transactions and bill payments. A money market account combines the benefits of both and can help you earn income on savings that you do not need right away. That is undoubtedly a wonderful thing, but there are some downsides to consider.

Returns May Be Lower Than Other Investments

Investing is all about netting potential returns. While a money market account is considered a safe investment, returns tend to lag behind higher-risk assets. Over the past century, the average annual stock market return has been almost 10%. That’s not to say it’s all smooth sailing or that stock returns are guaranteed. When it comes to stock investing, market volatility comes with the territory.

Read Also: What is The Tax Planning Strategy?

This is precisely why maintaining a diversified portfolio is so important. The idea is to include a variety of high- and low-risk investments across different asset classes. That can help mitigate risk while still exposing you to some high-return investments.

Your Financial Institution May Limit Convenient Withdrawals

One of the biggest disadvantages of a money market account is that some financial institutions may put a cap on how many convenient withdrawals you can make each month. The Federal Reserve once limited consumers to six per month, though this rule was phased out in 2020. That excluded ATM withdrawals but did include electronic transfers, as well as debit and check transactions. Some financial institutions have continued to uphold these rules, so be sure you understand any limitations before opening a money market account.

There May Be Minimum Balance Requirements

Some high-yield money market accounts require minimum opening deposits and have minimum balance requirements. Failing to maintain that minimum balance could result in fees for the account holder. If you’re just beginning to build your savings, you might want to research money market accounts that don’t have these mandates. You can always switch to a higher-yield money market account once your balance is large enough to qualify.

Money market accounts are important for keeping our money safe and liquid. But they are frequently misinterpreted and abused. But, what are they? How do you avoid some of the common blunders individuals make while investing in these low-interest vehicles?

Continue reading to learn about the five most common mistakes that investors make with money market accounts.

Misconception #1: They Are Money Market Funds

Mistaking a money market account for a money market fund is common, but there are critical distinctions between the two financial instruments.

A money market fund is a mutual fund characterized by low-risk, low-return investments. These funds invest in very liquid assets such as cash and cash equivalent securities. They generally also invest in high credit rating debt-based securities that mature in the short term. Getting in and out of an MM fund is relatively easy, as there are no loads associated with the positions.

Often, though, investors will hear “money market” and assume their money is perfectly secure. But this does not hold true with money market funds. These types of accounts are still an investment product, and as such have no FDIC guarantee.

Money market fund returns depend on market interest rates. They may be classified into different types such as prime money funds which invest in floating-rate debt and commercial paper of non-Treasury assets, or Treasury funds which invest in standard U.S. Treasury-issued debt like bills, bonds, and notes.

Misconception #2: They Are a Safeguard Against Inflation

A common misconception is believing that placing money in a money market account safeguards you against inflation. But that’s not necessarily true.

Many argue it is better to earn small interest in a bank rather than earn no interest at all, but outpacing inflation in the long term is not really the point of a money market account, rather, it is simply to grow savings at a faster rate than traditional checking or savings accounts.

Let’s assume, for example, that inflation is lower than the 20-year historical average. Even in this situation, the interest rates banks pay on these accounts decrease as well, affecting the original intent of the account. So while money market accounts are safe investments, they really don’t safeguard you from inflation.

Misconception #3: A Large Allocation Is Efficient

The changing rates of inflation can influence the efficacy of money market accounts. In short, having a high percentage of your capital in these accounts is inefficient.

Six to 12 months of living expenses are typically recommended for the amount of money that should be kept in cash in these types of accounts for unforeseen emergencies and life events. Beyond that, the money is essentially sitting and losing its value.

Misconception #4: They Are the Most Beneficial Option

In many instances, we are programmed to believe that hoarding money is the most fruitful approach. But that’s not necessarily true, especially when it comes to saving money in money market or standard savings accounts.

It is difficult to have money that you have worked hard for, thrust into the open market, exposed to all the uncertainty that comes with it. Unfortunately, people often stay put in their cash positions for too long instead of investing them, and that’s all because of fear.

The Great Recession only led already wary investors further into the cash-hoarding rabbit hole. But high-yield returns on your money can only come from diverse investments. Fifty years ago, you could stow money away little by little each day and be confident you would be okay, but modern times dictate a far different future for our financial stability. Today, the challenge is to outsmart our natural reflex to hold all of it.

Misconception #5: One Account Is Enough

The diversification of assets is one of the fundamental laws of investing. Cash is no different. If you insist on holding all your money in money market accounts, no one account should hold more than the FDIC-insured amount of $250,000. It is not uncommon to see families or estates with multiple bank accounts insuring their money as much as possible.

Using this strategy, dividing the money up into three “buckets” can prove useful. Having money set aside for the short-term (one to three years), the mid-term (four to 10 years, and the long-term (10 years plus) can lead investors down a more logical approach to how long—and how much—money has to be saved. To take a more tactical approach, we can apply the same buckets and assess your tolerance for risk in a realistic way.

Consider putting long-term money into other low-risk investment vehicles like an annuity, life insurance policy, bonds, or Treasury bonds. There are countless options to divide your net worth to hedge the risk of losing the value of your money kept in cash.

Several investment vehicles aside from money market accounts offer higher interest. For more tolerant investors or those who want to keep some money moving for the short and medium terms, there are funds and investment strategies that can provide the returns which you seek—given time and your stomach for volatility.

These approaches, along with keeping money constantly moving for each period of your life, can help to outpace current and future inflation while protecting money from losing its value. Either way, being keen on the full understanding of these products is what will allow you to make the right decision for yourself.

The one possible downside of a money market account is that the institution may limit how many withdrawals you can make at a time, usually within a month or year, thus limiting access to your funds.

Money market accounts serve a singular purpose: To keep your money parked. Money, though, does nothing unless it is moved, and will ultimately require the investor to research their options and invest more diversely.

Is a Money Market Account a Good Place to Put Money?

If you’re looking for ways to keep your money safe from market volatility while also making it easy to pay payments and cover emergencies, a money market account is worth considering. These risk-free deposit accounts combine the earnings potential of a savings account with the convenience of a checking account.

A money market account “may be a good solution for those who want the higher interest rate of a savings account but want the flexibility to write checks,” says Michelle Riiska, a financial planning services consultant at Fidelity’s wealth management platform, eMoney Advisor. Some banks need minimum balances to obtain higher interest rates, but many do not, particularly those that operate entirely online.

It’s important to review the pros and cons of money market accounts before deciding whether or not to open one. Because you earn higher interest rates than with a traditional savings account, a money market account can be a great choice to set aside some emergency cash or start building your savings. And unlike a traditional savings account, you have more options for withdrawing your money when you want it. Finally, while MMAs can be used as investment products, they are also insured by the FDICup to $250,000 or NCUA.

However, because some financial institutions limit withdrawals on money market accounts, you could incur fees if you exceed those limits. Likewise, many money market accounts have minimum balance requirements. If the balance drops below that amount, you could incur fees. If you plan to use your money market account as an investment tool, it likely will have lower returns compared to other investments such as buying stocks or investing in real estate.

MMA vs. other interest earning vehicles

Money market accounts typically earn higher interest rates than traditional savings accounts. When compared to other interest-earning accounts and investments, however, they often earn lower rates.

- MMA vs. HYSA

Like money market accounts, a high-yield savings account (HYSA) earns a higher interest rate than regular savings accounts. Also, withdrawals from HYSAs usually are limited, similar to a MMA. However, a high-interest savings account may earn a higher rate than a MMA, but without any minimum balance or deposit requirements. HYSAs also may have fewer fees than a MMA, but it’s important to research these details before choosing one.

- MMA vs. CD

A certificate of deposit (CD) is another type of savings account. When it comes to accessing your money, a CD has more limitations than a regular savings account or a money market account. With a CD, you agree to deposit your money and leave it untouched for a specific term which can range from months to years. If you make withdrawals before the maturity date, you will incur a penalty fee.

On the plus side, CD rates often are higher than money market account rates, so if you don’t plan to use the money for a while, you could earn more with a CD. What’s more, the rate is fixed for the term of the CD. MMA rates can fluctuate.

- MMA vs. regular savings

Money market accounts often earn higher interest rates than a regular savings account. In addition, your money may be more easily accessed from a MMA. Account holders usually cannot access a regular savings account by check or debit card as you can with a MMA. However, some regular savings accounts may not have minimum balance requirements that could incur fees. It’s important to compare all the features of each account type—and the offerings of each specific account—in order to determine which is the best choice for you.

- MMA vs. mutual funds

While a money market account is an interest-bearing account for cash, mutual funds are investments that use the funds from investors to purchase stocks, bonds, and other securities. The return on mutual funds can be higher than a MMA, but there’s also a risk of losing your investment if the performance of the fund takes a nosedive. Accessing money from a mutual fund also takes longer than a MMA because you have to sell your shares to receive money. In addition, while MMAs are insured by the FDIC or NCUA, mutual funds are not.

- MMA vs. high-interest checking

A high-interest checking account earns a higher rate than a regular checking account. However, to receive that rate, account holders often have to meet certain requirements each month. These can include maintaining a minimum balance and having a minimum number of direct deposits or automated clearing house (ACH) payments, plus a minimum number of debit card transactions.

Other requirements could include signing up for paperless statements and online banking. While a MMA usually has limits on withdrawals and could have minimum balance requirements, they may be less than those associated with a high-interest checking account.

- MMA vs. money market fund

Despite sounding similar, money market accounts and money market funds are not the same. Whereas a MMA is a bank account earning a higher rate of interest compared to a regular savings account, a money market fund is a type of mutual fund. While a money market fund is a lower-risk mutual fund, it still functions the same and does not receive protection from the FDIC or NCUA.

If you want to maximize how much interest you earn on your savings, a money market account can be a good option compared to other savings accounts because it usually earns a higher rate of interest. Plus, if you need quick access to your money, you can do so in a variety of ways. And, compared to some savings accounts and tools, a money market account can incur less risk while building on your savings.

Money market accounts can be an ideal way to save money for specific goals such as paying college tuition, saving for a new car, or funding home improvements. The bonus is the interest you will earn as you save toward your goal. Then, when you’re ready, you can take out the money you need without incurring fees provided you make withdrawals in accordance with the account’s requirements.

How Does a Money Market Account Work?

Money market accounts allow clients to accelerate their interest earnings by offering potentially higher yields. The FDIC reports that the national average interest rate for savings accounts under $100,000 is currently 0.46%, while money market accounts are at 0.63%. That may not sound like much, but keep in mind that the best money market accounts pay up to 5.00% APY or higher.

Here’s a closer look at money market accounts, how they differ from other bank accounts, and why they could be the best banking choice for you.

A money market account is a type of account that tends to offer a higher interest rate than traditional savings accounts. Typically, money market accounts also have higher minimum balance requirements.

Think of a money market account as a hybrid account, often mixing the best features from both savings and checking accounts. You have the interest-earning power of a high-yield savings account, plus many money market accounts come with a debit card and check-writing privileges.

Money market accounts let you grow your money more quickly, but without the uncertainty tied to investment accounts. Eligible money market accounts are FDIC-insured up to $250,000 per depositor, for each account ownership category, so your funds are protected in the event of a bank failure.

Not meant for use as an everyday spending account, money market accounts offer some flexibility so you can access funds when you need them, but they also are subject to federal transaction limits.

Money market accounts work like other deposit accounts, such as savings accounts. As customers deposit funds in a money market account, they earn interest on those funds. Typically, interest on money market accounts is compounded daily and paid monthly. Money kept in money market accounts is accessible when you need it, without incurring a withdrawal penalty, as you might with a certificate of deposit.

Money market accounts are available from brick-and-mortar banks and credit unions, as well as many online banks. Online banks may offer higher rates because they have less overhead than traditional banks.

Transaction Limits for Money Market Accounts

Traditionally, money market accounts are limited to just six transfers or withdrawals per month (or statement cycle) thanks to Regulation D. Limited transaction may include:

- Check-writing

- Debit card purchases

- Transfers from one account to another

However, in response to the COVID-19 crisis, and to make it easier for consumers to tap their savings, in April 2020 the Federal Reserve announced an interim final rule to suspend the Regulation D limit on monthly money market account withdrawals. However, banks and credit unions may still impose a fee if the usual monthly limit is exceeded.

Money market accounts were created by the Garn-St. Germain Act of 1982. This law aimed to address increasing inflation and encourage Americans to save by allowing financial institutions to offer better interest rates on consumer deposits. Following the Depository Institutions Deregulation Act of 1980, it continued to phase out deposit interest ceilings and allowed new account types to be created—including money market deposit accounts (MMDAs).

MMDAs were designed to compete with money market mutual funds, a type of investment account that threatened banks’ profits and deposits because consumers chose them for their higher rates. MMDAs were authorized to have no caps on rates, no maturity terms, deposit minimums of at least $2,500 and up to six monthly transfers. By 1986, the required minimum deposit on MMDAs fell to zero, though many accounts still impose their own minimums today.

Modern money market accounts, which often drop the term “deposit” from their name, are still used for saving and tend to offer interest rates that are close to top CDs and high-yield savings accounts.

Here are the steps you’ll need to take to open a money market account:

- Compare rates. Before choosing a money market account, you’ll first want to compare rates at multiple banks to find the best money market account for your needs and goals.

- Apply. Submit an application by providing personal information and identifying documents, including your name, address, occupation and Social Security number.

- Deposit funds. You can often fund a money market account with an internal or external electronic transfer, direct deposit transfer or check. Some accounts also accept cash deposits.

Once your money market account is approved, you can register for online and mobile banking if you haven’t already. Checks or debit cards you request often arrive within a couple of weeks.

Money market accounts are a great vehicle to use for pursuing both short-term and long-term savings goals. They allow you to separate specific money from your everyday bank account to save for the future. Money market accounts are an excellent bank account to use for:

- Emergency funds

- Wedding expenses

- Vacation funds

- Tax payments

- Home renovation projects

- Saving for a new car

- Retirement savings

- Other short-term savings goals

There’s no shortage of uses for a money market account. Plus, your money is readily accessible if you find you need it.

Benefits of a Money Market Account

Money market securities typically come with maturities under 12 months. The short-term nature of the securities is a way of reducing risk and uncertainty. The selection of money market investments is performed by a fund manager as it should relate to the type of money market fund. Money market funds are not insured by the federal government (FDIC), unlike money market accounts, which are insured.

Money market mutual fund income is usually in the form of a dividend; it can be taxed or tax-exempt depending on the nature of securities invested in the fund. The funds can be used as a cash management tool in business because of their liquidity and flexibility, hence their popularity.

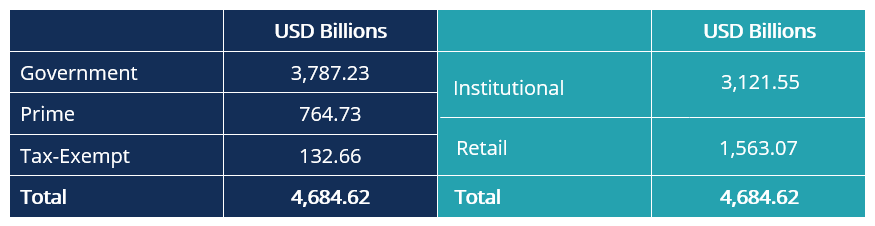

Money market funds were developed and came into use in the 1970s. They are regulated through the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940 in the United States and Regulation 2017/1131 in Europe. According to the Investment Company Institute, money market funds total $4.68 trillion, as of June 17, 2020, and are distributed as follows:

The Securities and Exchange Commission (SEC) regulations comprise three categories of money market funds based on the securities in the fund:

- 1. Government

The funds invest in about 99.5% in government-backed securities such as U.S. Treasury bills, collateralized U.S. Treasury securities, repurchase agreements, and Federal Home Loan securities. They also invest in government-sponsored enterprises (GSE) securities, such as Freddie Mac and Fannie Mae. Since government-backed paper is “risk-free,” the funds are considered very safe.

- 2. Prime

They are funds invested in short-term corporate debt instruments, such as commercial paper, corporate notes, and short-term bank securities (banker’s acceptances and certificates of deposits). They also include repurchase and reverse repurchase agreements.

- 3. Municipal tax-free

The money market funds are predominantly invested in securities issued by municipalities, which are federal and often state income tax-exempt securities. Other entities also issue securities with tax protection, which the money funds also participate in, such as state municipal.

Perks of money market accounts often include competitive annual percentage yields (APYs) and easy access to your cash, and your funds are protected when the account is with a federally-insured bank or credit union.

MMAs earn interest

When you make a deposit in a money market account, it does more than just sit there. It grows. The average money market account rate is currently 0.48 percent, according to Bankrate data. Make sure to shop around, though. The best money market rates are significantly higher than the average, with many over 4 percent and up to 5.25 percent.

You have easy access to cash

You don’t have to jump through hoops to withdraw the money from a money market account when you need it. You don’t have to completely redo your banking portfolio, either. Instead, you can link your checking account at your existing financial institution to a money market account at a new bank for online transfers.

Additionally, many money market accounts come with debit cards for ATM access and check-writing privileges. There is typically a limit of six withdrawals per statement period, though.

Money is protected by federal insurance

At federally insured institutions, you don’t have to worry about the safety of the funds in a money market account. Provided the bank or credit union has insurance from the Federal Deposit Insurance Corp. (FDIC) or National Credit Union Administration (NCUA), respectively, up to $250,000 is protected even if the institution fails and shuts its doors.

Benefits of Using Money Market Funds

- 1. Liquidity

The redemption of a money market fund usually takes less than two business days, and it is fairly easy to settle brokerage account investment trades.

- 2. Risk management

Money market funds act as a risk management tool, as funds are invested in cash equivalent securities with low risk and high liquidity.

- 3. Short-term

The short-term nature of money market funds ensures a low interest rate, credit, and liquidity risk.

- 4. Security

Money market funds invest in low-risk and high-credit quality securities, ensuring high security.

- 5. Stability

Money market funds are low volatility investments.

- 6. Convenience

Easy access to funds through a checking account linked to an income-yielding money market investment fund.

- 7. Diversification

Money market funds usually hold a diversified portfolio of government, corporate, and tax-free debt securities.

- 8. Tax exemption

Municipal issues in which money market funds invest in are federal and often state income tax-exempt; hence they provide tax-efficient income.

Money Market Account vs Savings Account

Money market accounts and savings accounts are both financial instruments that allow you to save and withdraw funds. These bank accounts allow convenient access to your savings and may offer competitive returns, both of which can be significant during economic downturns and inflation.

While savings and money market accounts have certain similarities, there are significant distinctions in how you can use them. Understanding the rules of each might help you determine which is ideal for you.

What is a savings account?

A savings account is a financial product at a bank or other financial institution that allows you to deposit money, and it typically earns a modest amount of interest. The national average savings account interest rate is just 0.58 percent, according to Bankrate data as of Mar. 31, 2024, but the best savings accounts pay around 4 percent or higher.

A savings account usually doesn’t require a lot of money to open. It’s a good place for an emergency fund, since you can access the money easily at any time to handle unplanned expenses such a car repair, a medical bill or a sudden loss in income.

As an interest-earning deposit account, a savings account is similar to a money market account in that unlimited deposits are allowed but withdrawals may be limited — up to six per month.

Savings accounts are usually a safe place to keep your savings. Like a money market account, they are often insured through the Federal Deposit Insurance Corp. (FDIC) or National Credit Union Association (NCUA) up to $250,000 per account holder.

Pros and cons of savings accounts

| Pros | Cons |

|---|---|

| Interest-bearing | Nominal interest earned |

| ATM withdrawals allowed | May be limited to six withdrawals or transfers per month |

| FDIC/NCUA-insured | Bill payments and check-writing not allowed |

The majority of households (98 percent) have a transactional account such as a savings account. Other transactional accounts are money market accounts, checking accounts and certificates of deposit (CDs).

Thanks to its liquidity, a savings account is a practical place for money set aside for emergencies. However, only 4 in 10 U.S. households said they were able to cover an unexpected $1,000 expense in a recent Bankrate survey. Furthermore, more than three-quarters of adults have not seen an increase in their emergency fund balance in the past year.

In addition to using savings accounts to set aside money for emergencies or other expenses, Americans commonly save for retirement in 401(k) accounts and Individual Retirement Accounts (IRAs). Like with emergency funds, many people report not having enough saved for retirement. In fact, a full 52 percent of American workers feel they’re behind on retirement savings, a Bankrate survey found.

What is a money market account?

A money market account is an interest-bearing account that’s similar to a savings account, but money market accounts commonly allow you to pay bills, use a debit card and write checks. Like savings accounts, money market accounts feature variable interest rates. Unlike most savings accounts, however, the rates tied to money market accounts are commonly tiered, meaning larger balances earn higher rates.

The national average money market account interest rate is 0.47 percent, according to Bankrate data for Mar. 31, 2024. However, like savings accounts, the best money market accounts currently pay around 4 percent. You may find that money market accounts require a bigger deposit amount in order to open the account or earn the top APY. If you have a smaller amount to deposit, a savings account may be the better option.

While it resembles a checking account, a money market can’t fully replace one. Some banks limit the number of withdrawals or transfers you can make each month — often allowing up to six. Ultimately, if you’d like an interest-earning account that allows you to occasionally pay a bill or two, a money market account is a good option.

While withdrawing and spending the funds is often easier with a money market than a savings account, savers who want to make it more difficult to spend their money may be better off with a savings account.

Also note that money market accounts and money market funds are not the same thing.

Pros and cons of money market accounts

| Pros | Cons |

|---|---|

| Interest-bearing | Nominal interest earned |

| Bill payments and check-writing allowed | May be limited to six withdrawals or transfers per month |

| ATM withdrawals allowed | May require a sizable minimum deposit |

| FDIC/NCUA-insured |

Reasons people commonly choose to open money a market account include:

- Competitive APYs: Money market accounts may earn competitive APYs, and big savers may appreciate the ability to earn better rates for higher balance tiers.

- Check-writing privileges: It’s common to find money market accounts that allow you to write checks. (Some only permit up to six withdrawals or transfers per statement cycle, which includes checks written.)

- Debit and ATM cards: Money market accounts often allow you to withdraw money from an ATM as well as make debit purchases. (ATM withdrawals don’t count toward withdrawal or transfer limits.)

- Safety: Money market accounts are insured up to $250,000 per depositor, per insured bank and per ownership category when they’re offered by Federal Deposit Insurance Corp. (FDIC) banks and National Credit Union Administration (NCUA) credit unions.

Both savings accounts and money market accounts allow you to deposit money and earn interest. Unlike savings accounts, however, money market accounts often come with transactional features — such as the ability to write a limited number of checks and make bill payments each month. Some money market accounts also come with a debit card.

The following chart breaks down which features may be provided with savings accounts and money market accounts:

| Savings account | Money market account | |

|---|---|---|

| Earns interest | Yes | Yes |

| ATM withdrawals | Yes | Yes |

| Unlimited withdrawals* | No | No |

| Check-writing | No | Yes |

| Automated deposits possible | Yes | Yes |

| FDIC/NCUA-insured | Yes | Yes |

*The Federal Reserve removed Regulation D withdrawal limitations in 2020 that banks had been required to impose on savings accounts. This allowed banks to let customers make more than the standard six maximum withdrawals and transfers each month. Check with your bank to clarify its withdrawal limit rules; many banks didn’t ease their policies despite the Fed ruling.

You do not have to pick between a money market account and a savings account; many institutions provide both alternatives. For example, you could have a savings account to save money for a future trip or a down payment on a house, as well as a money market account to keep some money so you can pay bills, use a debit card, or make checks.

However, if you are deciding between a money market account and a savings account, here are some things to consider.

Determine what the money is for

Start by determining the use of the funds. You may be interested in growing an emergency fund, saving for a down payment on a house or paying for a vacation. Once you know your purpose for the money, review the pros and cons of each product to determine which one is best for you. A savings account may be all you need if you’re simply saving money for later use.

Money market accounts are also good options for saving money for specific goals. However, because they often allow for check-writing and bill payments, you may view this account as more of a transactional account. This can come in handy for paying an occasional bill or two, but if you’d rather not be tempted to make unnecessary purchases using checks or a debit card, it might be best to stick with a savings account.

Compare fees and rates

Take a look at a bank or credit union’s schedule of fees and rate disclosures to learn more about an account. You can find competitive interest rates on both savings accounts and money market accounts, so be sure to shop around.

Money market accounts may have higher minimum deposit and balance requirements, so consider whether you’ll be able to deposit enough money to open the account and maintain enough money to keep the account open. Money market accounts may also feature tiered rates based on the balance amount, paying higher yields for higher balance thresholds.

Open the account

Whether you’re opening a savings account or money market account, you’ll need some basic information. For your application, you’ll need a government-issued ID, Social Security number, birth date, address and contact information.

You may need to make a minimum deposit to open a savings account or money market account. You will need the routing number and bank account number for the account you will be sending funds from.

Watch for fees

Some savings and money market accounts may charge you a monthly maintenance fee if you don’t meet certain conditions such as having a minimum balance or receiving at least one deposit per month. Make sure you follow an account’s requirements to avoid monthly fees that can cut into growing your savings. Or even better, find a bank that doesn’t charge monthly fees.

Most savings and money market accounts are limited to six transfers or withdrawals per month, though your bank may have lifted this restriction after the Federal Reserve ruling. Remember to check with your bank to confirm an account’s withdrawal limits so you don’t exceed them, or you may be charged excess withdrawal fees.

Money Market Account Typical Interest Rate

Money market accounts provide a unique approach to save and spend money. They function as a hybrid of a savings and checking account. This means you can earn interest on your money market account balance and simply access it using a debit card and/or cheques. Of course, just like with your savings accounts, you’ll want to maximize your funds by using the highest money market rates.

Money market accounts typically earn at higher rates than basic savings accounts, instead climbing closer to CD rates. That’s not always the case, though, as you can see with Regions Bank. You will often find money market accounts that earn according to a balance tier. This simply means that your exact interest rate depends on your account balance, with higher balances usually earning at a higher rate.

Average money market rates fall between 0.01% APY and 3.45% APY, again depending on your balance. Below, we’ve listed a number of popular banks and given a range of their basic money market account rates. Again, your rate will depend on your account balance. It’s also important to note that a few big names in the financial industry do not offer money market accounts.

Money Market Rates

| Bank | Account Balance | Rates |

| Bank of the West | $0 – $9,999 $10,000 – $24,999 $25,000 – $49,999 $50,000 – $249,999 $250,000 – $999,999 $1,000,000+ | 0.02% 1.17% 1.17% 1.17% 1.23% 1.23% |

| Capital One 360 | $0 – $9,999 $10,000+ | 0.80% 0.80% |

| Citizens Bank | All balances | 0.01% |

| Comerica Bank | All balances | 0.02% |

| Dime Direct | $0 – $50,000 $50,000+ | 1.35% 0.20% |

| EverBank | $0 – $9,999 $10,000 – $24,999 $25,000 – $49,999 $50,000 – $99,999 $100,000+ | 3.75% 3.75% 3.75% 4.05% 4.30% |

| FifthThird Bank | All balances | 0.01% |

| Navy Federal Credit Union | $2,500 – $9,999 $10,000 – $24,999 $25,000 – $49,999 $50,000+ | 0.95% 1.06% 1.10% 1.50% |

| PNC Bank | All balances | 0.02% |

| Regions Bank | All balances | 0.01% |

| Santander | $0 – $9,999 $10,000+ | 0.03% 0.05% |

| SunCoast Credit Union | $0 – $999 $1,000 – $24,999 $25,000 – $49,999 $50,000 – $99,999 $100,000 – $249,999 $250,000 – $499,999 $500,000+ | 1.15% 1.30% 1.40% 1.50% 2.00% 2.50% 3.00% |

| TD Bank | $0 – $9,999 $10,000 – $24,999 $25,000 – $49,999 $50,000 – $99,999 $100,000 – $249,999 $250,000 – $499,999 $500,000 – $999,999 $1,000,000+ | 0.01% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% |

| U.S. Bank | $0 – $24,999 $25,000+ | 0.01% 0.25% Bonus 4.50% |

While money market accounts typically have higher rates than a basic savings account, not all financial institutions can offer the highest rates. Online banks tend to offer much higher rates on their savings vehicles than a bank with multiple physical branches. This is due to the costs of physical branch upkeep that online banks don’t have to meet.

Below are the online banks that offer money market accounts. Northpointe and Synchrony each have one location, but operate entirely online otherwise.

Online Money Market Rates

| Bank | Account Balance | Rates |

| Ally Bank | All balances | 4.40% |

| Discover | $0 – $99,999 $100,000+ | 4.20% 4.25% |

| Northpointe | $2,500 – $4,999 $5,000 – $24,999 $25,000 – $3,00,000 $3,000,000+ | 0.25% 0.35% 3.25% 0.35% |

| Sallie Mae | All balances | 4.75% |

| Synchrony | All balances | 2.25% |

Money Market Account vs CD

When it comes to saving money, you have several account alternatives. You can first consider a simple savings account that permits your money to grow at a fixed interest rate. You can also choose between a money market account and a certificate of deposit. A money market account is a hybrid of a savings and checking account. A CD, on the other hand, provides little flexibility in terms of accessing your money due to its fixed period and withdrawal limits.

Here are some key differences between CDs and money market accounts:

- CDs generally offer higher interest rates compared with money market accounts.

- Money market accounts provide access to funds and offer interest rates similar to regular savings accounts.

- CDs earn more interest over time but have restricted access to funds until maturity.

- Money market accounts are a better option when you need to withdraw cash.

Both CDs and money market accounts are insured at banks that are insured by the Federal Deposit Insurance Corp. (FDIC) or the National Credit Union Administration (NCUA) for up to $250,000 per institution and account type, so your principal and earned interest are protected in case your bank fails.

What Is a Money Market Account?

Money market accounts (MMAs) are useful money management tools. They are best described as a hybrid of a savings account and a checking account. Money market accounts earn interest much like savings accounts do, i.e. according to the interest rate that applies at a given time. Plus, MMAs typically have more favorable rates than a typical savings account.

Like a checking account, money market accounts often include ATM cards and check-writing abilities. You will want to double check with your bank, though, since not all money market accounts offer these perks.

However, MMAs don’t have the complete flexibility of checking accounts. MMAs do limit you to six outgoing transactions, like withdrawals and transfers, per statement cycle just like with a savings account.

You may also want to be wary of MMA minimums. Higher minimum deposits and balances can come as a cost of better interest rates. This usually means minimum deposits of $2,500 or higher, with some even reaching five figures.

What Is a CD?

Certificates of deposit, or CDs for short, are term-based deposit accounts. When you open a CD, you choose your term length from the options your bank or credit union give you. These terms usually range from three months to five years.

To calculate how much interest you could earn with a CD, try using SmartAsset’s CD calculator.

Once you open an account, you have to make a deposit. That deposit stays for the entire term length, during which you cannot make any withdrawals or additional deposits. This definitely limits how easily and how often you can access that money.

The whole set up of CDs is to lock away your money for a set amount of time while it earns interest. This allows the issuing bank to use your money during that time for other purposes. Then when your CD reaches maturity, you’ll receive your initial deposit back, plus all the interest it earned over the term.

If you were to try to make a withdrawal during your term, which isn’t how CDs are designed, you’ll face a pretty hefty penalty. This usually deducts days or months of interest earned from your withdrawal depending on your CD term length.

CDs can also require high minimum deposits, whether $500 or $10,000. This limits potential customers from opening a CD if they can’t safely set that amount of money aside.

When money market accounts are a better fit

A money market account is a good way to grow your savings, but it’s not the best fit for everyone. Here are two situations when a money market account makes sense:

- You want easy access to your funds

A money market account allows you to spend or transfer funds a few times each month or statement period. Though monthly transaction limits typically apply, most consumers will find it’s possible to work within those guidelines to cover any emergency expenses.

A money market account is a better choice than a CD if you’re looking for someplace to stash an emergency fund and may need immediate access to it. CDs are subject to an early withdrawal penalty, should you decide to take funds out of a CD before its term ends.

- You’re looking for a short-term boost to savings

Money market accounts often offer competitive interest rates and provide a better return than a traditional savings account, for example. A higher APY can go a long way toward helping you achieve a short-term savings goal, such as a vacation, wedding or new computer. With a money market account, you’re able to grow your savings more quickly without risking any principal while still maintaining easy access to your funds.

When CDs are a better fit

CDs are a good choice for those looking to grow their savings over a longer term without needing access to the funds that are stashed away. Here are some situations when a CD might be a good option for you.

- You want to lock in a high APY

If you’re looking to earn more interest, a CD usually offers higher rates than a money market account.

While rates on both CDs and money market accounts are variable, CDs usually have fixed rates. That means you can lock in a higher interest rate on money that you won’t need to access soon.

- You have a long-term plan for these funds

CDs, with their set terms, are an easy way to impose some financial discipline, since withdrawing money before the end of a term comes with a penalty.

When you open a CD, you are choosing to lock your funds away for a specified period. Depending on the term, it might range from a few months to several years. If you have a specific plan for these funds — and won’t need to tap them in an emergency — then a CD might be a good fit.

Read Also: Which Bank Has The Best Bill Pay System?

If you plan to buy a house in five years, for example, then a CD could be the right place to stash a down payment, allowing you to take advantage of the most competitive interest rates while still providing access to the funds when you are ready to purchase your home. Plus, there’s no worry about losing money, unlike investing in stocks or other types of nonguaranteed investments.

- You want these savings locked away

Saving money can be difficult. If you struggle to keep from spending your savings account, then a CD could be a good choice. The funds will be off limits for the entire term, unless you’re willing to pay an early withdrawal penalty — incentive to keep from dipping into your savings to explore a last-minute sale at your favorite store. Plus, your savings will be growing through the term.

Comparing money market accounts and CDs overall isn’t entirely fair since they are structured so differently, so let’s break it down.

Money market accounts are better than CDs if you’re looking for a more accessible account. You can easily deposit and withdraw funds to and from a money market account with an ATM card, personal checks, online or on mobile. Again, also double check whether a bank issues ATM cards or personal checks with their money market accounts. Your main limitation will be the only six outgoing transactions you’re allowed per statement cycle.

CDs, on the other hand, are all about limiting access to your money. Once you open an account and make your initial deposit, you cannot move money in or out of the account without facing a heavy penalty. This may help you though, if you’re prone to spending and not saving. If that’s the case, a money market account may give you too much freedom.

When it comes to interest rates, money market accounts may be the way to go. MMA rates are typically higher than basic savings accounts and short-term CD rates. CDs can have higher rates than a money market account, but those are often the long-term accounts from two years and upward. That means to snag a CD rate that’s higher than a money market account rate, you’ll most likely have to wait a couple years to have access to that money.

Money Market Account vs High Yield Savings Account

Money market accounts and high-yield savings accounts are broadly comparable. Each is a depository account that earns more interest than a typical savings account but has some limitations on how you can utilize your funds. A money market account provides easier access to your cash but has higher fees and balance limits. High-yield savings accounts may be more difficult to access, but they are typically less expensive.

Here’s a comparison between the two.

Money Market Account

A money market account is a hybrid bank account. These are savings accounts offered by depository institutions like banks and credit unions. That means that they store money, pay interest and are insured by the FDIC. However, they also share some characteristics of a checking account. Specifically, a standard money market account will come with a checkbook and an ATM card. This lets you spend money directly from your money market account, a feature that savings accounts don’t have.

A money market account pays around the same rate of interest as a standard savings account, although most give a slightly better return. Money market accounts can pay the same rate of interest as a high-yield savings account. And while not impossible, it is rare, if ever, that a standard money market account will pay that kind of return.

The upside to a money market account is savings account interest with direct access to your money. The downside is twofold. First, money market accounts have to obey the same transaction limit regulations as savings accounts. This means that you can only transfer money and/or write checks up to six times per month from this account. This makes them ill-suited, if not impossible, for functions like ordinary bill paying.

The exception to this is ATM withdrawals, which are unlimited for most money market accounts.

Second, these accounts can have relatively high fees and minimum limits. You should expect account minimums of around $5,000 to $10,000, and some accounts will charge you a monthly maintenance fee as well. As a result, you end up needing to keep much more cash locked up in this account than with either an ordinary checking or savings product.

High-Yield Savings Account

A high-yield savings account is a savings account that generates much more interest than a standard savings account. This means that these savings accounts earn higher interest rates than ordinary savings accounts. When comparing competitive rates, high-yield savings accounts can commonly collect between 0.5% and 3%.

So, as an example, if you put $10,000 into a traditional savings account that pays 0.01% in interest, then that compounded monthly interest would pay $1 annually. Comparatively, with all other factors remaining constant, a high-yield savings account paying 1% in interest would earn $100.46 in the same time period.

The downside to a high-yield account, however, is regulation and cost. Like a money market account, this is a savings product. Government regulation limits you to six transactions per month out of any kind of savings account. At the same time, very few banks give you direct access to funds in a savings account. You need to transfer money into a checking account, and then spend that money from checking.

Most high-yield accounts require you to keep a minimum balance, but this requirement has declined in recent years. Today you can easily find high-yield accounts that require you to keep as little as $1,000 on deposit, if anything. The same goes for monthly maintenance fees. While some high-yield accounts have fees of around $15 – $25 per month, banks are increasingly waiving this requirement altogether.

While any financial product can be complicated, the core difference between a money market account and high-yield savings is flexibility vs. return. A money market account gives you more access to your money in the form of direct checking and ATM withdrawals, but it will generally provide a lower interest rate. A high-yield savings account pays a much higher interest rate, but you have transfer limits and few, if any, accounts let you directly spend money.

Money market accounts also tend to tie up more of your money, requiring higher minimum account balances than a high-yield savings account. While both accounts can come with monthly maintenance fees, it’s increasingly easy for consumers to find no-fee accounts.

Ultimately, the right product is a highly individual decision based on personal financial factors. That said, with the current banking environment, high-yield savings accounts will probably be the right answer for most consumers. These accounts can offer significantly more interest with a significantly lower minimum balance requirement.

While a high-yield savings account doesn’t have the flexibility of a money market account, the withdrawal limits mean that you will almost certainly need a companion checking account either way. So most consumers will probably be better off taking the higher interest rate of a high-yield savings account and just spending their money from checking as needed.

Bottom Line

Money market accounts are financial products that are offered to customers at traditional and online banks and at credit unions. They give account holders some of the key benefits of a savings account while providing them with the features of a checking account, including:

- Interest: Like savings accounts, MMAs allow account owners to earn interest on their balances. The interest rate offered is normally higher than a traditional savings account. The interest rate, though, tends to be variable, which means it fluctuates as market conditions rise and fall.

- Debit Cards: Some banks include a debit card with the account, which allows owners to use automated teller machines (ATMs) to make deposits, withdrawals, and transfers.

- Check-Writing: Along with debit cards, clients may also be able to write checks against their account balances.

Banks often require a minimum initial deposit in order to open an MMA and balances must be maintained over a certain threshold while they are active. Banks may impose a service charge if the balance falls below that minimum amount.

Money market accounts are suited for individuals who want to earn more interest than they would with a savings account with short-term goals in mind. As such, an MMA may be a good idea if you’re saving up for a specific purchase, such as a vacation, the down payment for a car, or for a rainy day or emergency fund. They are not intended for long-term purposes like retirement.

Some of the benefits of MMAs include higher interest rates, insurance protection, check-writing, and debit card privileges. The lure of higher interest rates than savings accounts is one of the main attractions of MMAs. They are able to offer higher interest rates because they’re permitted to invest in certificates of deposit, government securities, and commercial paper, which savings accounts cannot do.

These accounts also offer easy access to funds as well as the flexibility to transfer funds between multiple accounts at the same institution. And unlike savings accounts, many MMAs offer some check-writing privileges and also provide a debit card with the account, much like a regular checking account.