Investing in mutual funds via SIPs is a popular option for millennials, and SIP calculators estimate the returns made on mutual funds by using a simulation. SIP calculators provide investors with a sense of how their mutual fund investments will perform, but it’s important to note that the return on investments differs based on several factors. A SIP calculator does not take into account exit loads or expense ratios; it uses an expected annual return as the basis for the calculation of the SIP amount.

This calculator uses the compound interest formula to calculate the return on investment based on the investment amount, frequency, length, and expected returns. Mutual fund returns are based on compounded interest. The SIP Calculator compares the mutual fund returns with fixed deposit returns. You can use the SIP return calculator to figure out how much you have accumulated at the end of your SIP tenure.

Investors can invest in Mutual fund companies using SIPs (Systematic Investment Plan) on a weekly, monthly, and quarterly basis. SIPs also provide disciplined investment management for retail investors. SIP calculators can be a great tool to use if you want to calculate your SIP. This is because it encourages a positive attitude toward investing for long-term wealth creation. SIP calculators allow you to learn more about assets and make the right investment decisions.

Benefits of SIP calculators:Easy to use: An SIP calculator allows investors to quickly create investment plans rather than having to calculate the formula by hand, which can result in error-prone calculations. However, with the use of a SIP calculator, investors can get accurate results which can be used to make investment decisions. The sip calculator can calculate your return in a matter of seconds once

- you enter all the details. With a simple dashboard on hand, you do not have to take time out of your workday to check your investments. Monitoring investments becomes straightforward.

- Effortless results: In the SIP calculator, both those who have a good understanding of finances and those who don’t have one are greatly benefited as it simplifies the process for both groups. It makes much sense to use free online resources instead of developing your SIP calculator in Excel, especially since most people can do so in Excel.

- Mostly accurate estimated returns: With the SIP investment calculator, the playing field is perfectly leveled for both new investors and experienced investors, so the results produced by the calculator are almost exact. As a result, the investor may be better able to estimate their future returns on mutual fund investments, which, in turn, can help them to benefit from such investments.

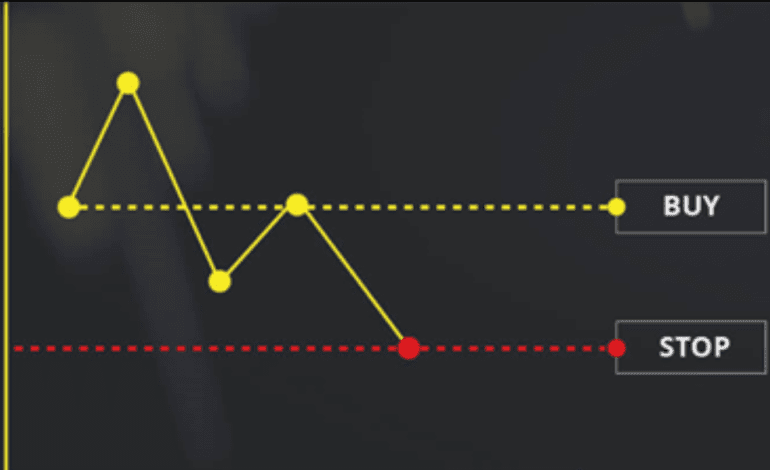

- Help with averaging rupee cost: You can take advantage of rupee cost averaging with a SIP. When the amount is invested every month, you can buy more securities at low prices, and fewer securities at high prices. Overall, your cost is lower than if you invested a lump sum.

The simplest SIP calculator has an easy-to-use interface and requires only a few details to generate results, the perfect example of which is the 5paisa SIP calculator. Countless fund houses and brokers rely on it for the promotion of mutual funds.