Finance models are a way to understand and project future financial performance. Companies use financial models to estimate future profits, understand how many workers to hire, and much more.

For many small business owners, financial modeling might sound like something best left to accountants and analysts at Fortune 500 companies. But it’s much more accessible these days. In fact, every small business owner can leverage financial modeling to make better decisions for their company.

Let’s now talk about what every small business owner needs to know about finance models and how they can get started.

- What are Financial Models in Business?

- What are 6 Types of Financial Models?

- What are the Most Common Types of Financial Models?

- What are the Major Components of Financial Modeling?

- What are the Basic Financial Models?

- How do you Create a Financial Model for a Small Business?

- Financial Modeling Examples

- What are Financial Modelling Tools?

- How do you Build Financial Models?

- How does an LBO Model Work?

- Why is Financial Modelling Important?

- What Financial Models do Investment Bankers Use?

What are Financial Models in Business?

Financial modeling is the process of creating a summary of a company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision.

Read Also: How can Small Companies Contribute to Global Change?

A financial model has many uses for company executives. Financial analysts most often use it to analyze and anticipate how a company’s stock performance might be affected by future events or executive decisions.

Financial modeling is a representation in numbers of a company’s operations in the past, present, and the forecasted future. Such models are intended to be used as decision-making tools. Company executives might use them to estimate the costs and project the profits of a proposed new project.

Financial analysts use them to explain or anticipate the impact of events on a company’s stock, from internal factors such as a change of strategy or business model to external factors such as a change in economic policy or regulation.

Financial models are used to estimate the valuation of a business or to compare businesses to their peers in the industry. They also are used in strategic planning to test various scenarios, calculate the cost of new projects, decide on budgets, and allocate corporate resources.1

Examples of financial models may include discounted cash flow analysis, sensitivity analysis, or in-depth appraisal.

The best financial models provide users with a set of basic assumptions. For example, one commonly forecasted line item is sales growth. Sales growth is recorded as the increase (or decrease) in gross sales in the most recent quarter compared to the previous quarter. These are the only two inputs a financial model needs to calculate sales growth.

The financial modeler creates one cell for the prior year’s sales, cell A, and one cell for the current year’s sales, cell B. The third cell, cell C, is used for a formula that divides the difference between cells A and B by cell A. This is the growth formula. Cell C, the formula, is hard-coded into the model. Cells A and B are input cells that can be changed by the user.

In this case, the purpose of the model is to estimate sales growth if a certain action is taken or a possible event occurs.

Of course, this is just one real-world example of financial modeling. Ultimately, a stock analyst is interested in potential growth. Any factor that affects or might affect that growth can be modeled.

Also, comparisons among companies are important in concluding a stock purchase. Multiple models help an investor decide among various competitors in an industry.

What are 6 Types of Financial Models?

There are many different types of financial models. Below, we will outline the top six most common models used in corporate finance by financial modeling professionals.

1. Three-Statement Model

The three-statement model is the most basic setup for financial modeling. As the name implies, the three statements (income statement, balance sheet, and cash flow) are all dynamically linked with formulas in Excel. The objective is to set it up so all the accounts are connected and a set of assumptions can drive changes in the entire model. It’s important to know how to link the three financial statements, which requires a solid foundation of accounting, finance and Excel skills.

Here is a screenshot of the balance sheet section of a three-statement single worksheet model. Each of the other sections can easily be expanded or contracted to view sections of the model independently.

2. Discounted Cash Flow (DCF) Model

The DCF model builds on the three-statement model to value a company based on the Net Present Value (NPV) of the business’s future cash flow. The DCF model takes the cash flows from the three-statement model, makes some adjustments where necessary, and then uses the XNPV function in Excel to discount the cash flows back to today at the company’s Weighted Average Cost of Capital (WACC).

These types of financial models are used in equity research and other areas of the capital markets.

Here is a screenshot of the discounting cash flows section in a DCF model. In this section, the cash flows that were calculated above are being discounted by the calculated WACC.

3. Merger Model (M&A)

The M&A model is a more advanced model used to evaluate the pro forma accretion/dilution of a merger or acquisition. It’s common to use a single tab model for each company, where the consolidation of Company A + Company B = Merged Co. The level of complexity can vary widely. This model is most commonly used in investment banking and/or corporate development.

Here is an example of an M&A model used to evaluate the impact of an acquisition. The M&A model is a more advanced type of financial model, as it requires making adjustments to create a Pro Forma closing balance sheet, incorporate synergies and terms of the deal, and modeling accretion/dilution, as well as performing sensitivity analysis, and determining the expected impact on valuation.

4. Initial Public Offering (IPO) Model

Investment bankers and corporate development professionals also build IPO models in Excel to value their business in advance of going public. These models involve looking at comparable company analysis in conjunction with an assumption about how much investors would be willing to pay for the company in question. The valuation in an IPO model includes “an IPO discount” to ensure the stock trades well in the secondary market.

5. Leveraged Buyout (LBO) Model

A leveraged buyout transaction typically requires modeling complicated debt schedules and is an advanced form of financial modeling. An LBO is often one of the most detailed and challenging of all types of financial models, as the many layers of financing create circular references and require cash flow waterfalls. These types of models are not very common outside of private equity or investment banking.

Here is an example of an LBO model. As you see below, the LBO transactions require a specific type of financial model that focuses heavily on the company’s capital structure and leverage to enhance equity returns.

6. Sum of the Parts Model

This type of model is built by taking several DCF models and adding them together. Next, any additional components of the business that might not be suitable for a DCF analysis (e.g., marketable securities, which would be valued based on the market) are added to that value of the business. So, for example, you would sum up (hence “sum of the parts”) the value of business unit A, business unit B, and investments C, minus liabilities D to arrive at the Net Asset Value for the company.

What are the Most Common Types of Financial Models?

Business owners can leverage a variety of financial models to answer specific questions about their finances, performance, and prospects. Below we’ve outlined the essential models business owners may eventually need to use.

Three-statement model

The model that links the three basic financial statements (balance sheet, cash flow statement, and income statement) to offer a complete picture of your business’s financial health. The advantage of this model lies in the modified income statement. By experimenting with different scenarios, your income statement will reflect these changes.

Sensitivity model

Sensitivity models are used to test out different scenarios to understand how they’ll impact revenue and other top-line financials. For example, how would revenue look if sales increased by 5 percent over last year? What about 10 percent? Understanding revenue across different outcomes allows you to better prepare for what’s to come and inform your business decisions.

Scenario model

While sensitivity looks at how one variable impacts your business, scenario financial models take into account several variables based on a hypothetical event. For example, what happens if a business has to adjust their hours of operation due to new restrictions? Sales, overhead, and more would be affected. Scenario models will take all of these factors

Forecasting model

Forecasting models use past performance data and industry benchmarks to forecast future business performance. Though often used for budgeting, forecasting is also used for projecting sales, revenue, and more. Keep in mind—it’s important to never treat forecasts as absolute truths. Instead, they’re useful for getting a general idea of where performance may be headed.

Budgeting model

Every small business needs to plan out their spending. Budgeting models break down your spending into great detail, so you know exactly where your expenses are coming from. With this information, you’re better able to set appropriate limits on supplies and other costs. Budget models can also be used in tandem with cash flow forecasts to understand cash-on-hand when various expenses are due.

Discounted cash flow model

This model focuses on the cash flow statement and is typically used to understand cash flows after large-scale capital projects. The result is an understanding of your capital costs and the present value of your business.

Financial models can also be used to project the impacts of important decisions as your business grows. Merger & acquisition (M&A) models, for example, are used to show stakeholders the growth in value of your business following the acquisition of another business.

If you decide to move into another line of business, Consolidation models can show the top-line financial projections that include all your business units.

What are the Major Components of Financial Modeling?

A financial model is simply a spreadsheet which is usually built in Microsoft Excel, that forecasts a business’s financial performance into the future. The forecast is typically based on the company’s historical performance and assumptions about the future and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (known as a 3-statement model). From there, more advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged buyout (LBO), mergers and acquisitions (M&A), and sensitivity analysis.

There are many types of financial models with a wide range of uses. The output of a financial model is used for decision-making and performing financial analysis, whether inside or outside of the company. Financial models are used to make decisions about:

- Raising capital (debt and/or equity)

- Making acquisitions (businesses and/or assets)

- Growing the business organically (e.g., opening new stores, entering new markets, etc.)

- Selling or divesting assets and business units

- Budgeting and forecasting (planning for the years ahead)

- Capital allocation (priority of which projects to invest in)

- Valuing a business

- Financial statement analysis/ratio analysis

- Management accounting

Forecasting a company’s operations into the future can be very complex. Each business is unique and requires a very specific set of assumptions and calculations. Excel is used because it is the most flexible and customizable spreadsheet tool available. Other software programs may be too rigid and specialized, whereas Excel knowledge is generally more universal.

What are the Basic Financial Models?

Financial Modeling is either building a model from scratch or maintaining the existing Model by implementing newly available data to it. As you can notice, all the above financial situations are of a complex and volatile nature. It helps the user to gain an in-depth understanding of all the components of the complex scenario.

In Investment Banking, it is used to forecast the potential future financial performance of a company by making relevant assumptions of how the firm or a specific project is expected to perform in the forthcoming years, for instance, how much cash flow a project is likely to produce within five years from its initiation.

It is easily possible to work on different individual parts of the Model without affecting the whole structure and avoiding huge blunders. It is useful when the inputs are volatile and are subject to change with newly available data. So there is a certain flexibility one can have with the structure when working on Financial Modeling as long as they are accurate, of course!

Majorly modeling is used for determining reasonable forecasts, prices for markets/products, asset or enterprise valuation (Discounted Cash Flow Analysis, Relative Valuation), the share price of companies, synergies, effects of merger/acquisition on the companies, LBO, corporate finance models, option pricing, etc.

How do you Create a Financial Model for a Small Business?

You want your model to easily change assumptions for each year, and you want to include a waterfall throughout the entire sales funnel, that’s going to include conversion rates and unit economics.

This is a best practice that the best CEOs do because it provides an understanding of the resources and effort required to close a sale. You also want to remember to include delays due to sales cycle and customer collections. This is going to affect your cash flows.

Next, you want to stress test your model, conversion rates, and growth rates and see what the impacts are. When these start to go sideways, you’re going to be prepared. If not, it can kill your cash. Next, your model should include a balance sheet, income statement, and cash flows. Finally, be honest with yourself in building your model.

Below are the steps to creating a finance model for your startup.

Step 1. Determine the goal of the model. This is so you can decide how complicated to make the project. In general, if you are market sizing or doing back-of-the-envelope estimates, less complicated is better. The next level of complication is if you are raising capital – too detailed, and your conversations with investors will get bogged down in minutiae. But have enough detail to show that you understand the market. Finally, for a detailed cash flow model for an operating business, it is typical to have very detailed analysis.

Step 2. Determine your KPIs. Ideally, these are numerical factors and assumptions that you will be able to track – KPIs in a model a useless if you can’t track how you perform against them! Use industry standard KPIs as a starting point.

Step 3. Get a financial model template. Don’t start from nothing; building a working piece of Excel is time consuming and a waste of time. Use one of the many free templates – like the ones on this page.

Step 4. If you have an operating business, merge your actual results into your projections. It’s best to start with reality, so you can level set. Strange ‘kinks’ in the model where actual results meet projections is a sign that there is something off with your projections.

Step 5. Work your way down the income statement, starting with revenue. When you think about how much revenue you’ll have, make sure you understand what’s driving that revenue. Is there a particular number of customers or salespeople or marketing spend/activities that will cause that revenue growth? You’ll also want to think about your cost of goods sold as you project your revenue. Note that this does NOT make sense if you are projecting a hardware or biotech company with a long time to revenue. Instead, for those, map out the effort you’ll need to reach critical product development milestones.

Step 6. For most startups, headcount is the biggest expense (at least until marketing kicks in!) How many people will you need to achieve your goals, and how much will each cost? Don’t forget recruiting costs; even if you have a deep network, you will likely need to hire in the out years.

Step 7. Estimate other expenses. You can use examples from other successful companies to see how they’ve scaled their expenses. Remember to add in additional expenses as the company grows – this should also apply to your headcount expenses. Very few companies have over a 50% pre-tax profit margin, so make sure you are adding in expenses!

Step 8. Working capital matters. Read our section below. Basically, understand when your clients will pay you, and when you’ll need to pay big vendors.

Step 9. Review your startup financial projections. Take a look at the summary. Does it make sense? Is the model telling the story that you envisioned? A sanity check is always a good idea.

Financial Modeling Examples

Various financial modeling examples are different in type and complexity as the situation demands. They are widely used for valuation, sensitivity analysis, and comparative analysis. There are other uses, like risk prediction, pricing strategy, effects of synergies, etc. Different examples cater to their own set of specialties, requirements, and users.

Following are some of the examples that are widely used in the Finance Industry:

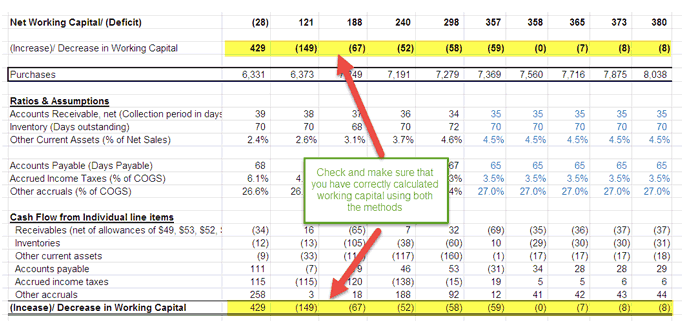

Example #1 – Full-Blown Three Statement Financial Modeling:

- This type of financial Model represents the complete economic scenario of a company and projections. This is the most standard and in-depth form.

- As the name suggests, the Model is a structure of all the three financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) of a company interlinked together.

- There are also schedules supporting the data. (Depreciation schedule, debt schedule, working capital calculation schedule, etc.).

- The interconnectivity of this Model sets it apart, which allows the user to tweak the inputs wherever and whenever required, which then immediately reflects the changes in the entire Model.

- This feature helps us to get a thorough understanding of all the components in a model and its effects thereof.

- The actual uses of this Model are forecasting and understanding trends with the given set of inputs.

- Historically the Model can stretch back as long as the conception of the company and forecasts can try up to 2-3 years depending requirement.

Example #2 Discounted Cash Flow (DCF) Model:

Through this financial Model, you will learn Alibaba’s 3 statement forecasts, interlinkages, DCF Model – FCFF Formula, and Relative Valuation.

- The most widely used method of valuation in the finance industry is the Discounted Cash Flow analysis method, which uses the concept of Time Value of Money.

- The concept working behind this method says that the value of the company is the net present value (NPV) of the sum of the future cash flows generated by the company discounted back today.

- The discounting factor does the discounting of the projected future cash flows. One rather important mechanic in this method is deriving the ‘discounting factor.’ Even the slightest error in calculating the discounting factor can lead to enormous amounts of change in the results obtained.

- Usually, the + [Cost of Debt * % of Debt * (1-Tax Rate)]” url=”https://www.wallstreetmojo.com/weighted-average-cost-capital-wacc/”]Weighted Average Cost of Capital (WACC) of a company is used as the discounting factor to discount the future cash flows.

- DCF helps to identify whether a company’s stock is overvalued or undervalued. This proves to be a rather important decision making factor in case of investment scenarios.

- In simplicity, it helps to determine the attractiveness of an investment opportunity. If the NPV of the sum of future cash flows is more significant than its current value, then the option is profitable, or else it is an unprofitable deal.

- The reliability of a DCF model is vital as it is calculated on the base of Free Cash Flow, thus eliminating all the factors of expenses and only focusing on the freely available cash to the company.

- As DCF involves the projection of future cash flows, it is usually suited for working on financials of big organizations, where the growth rates and financials have a steady trend.

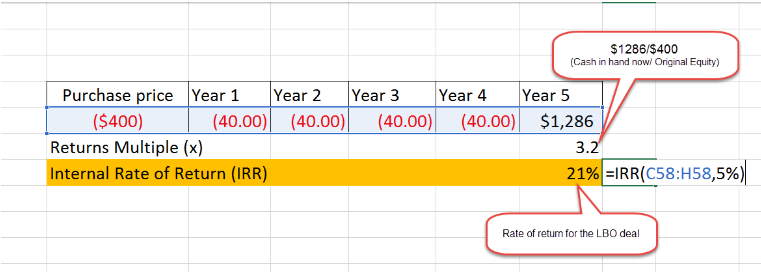

Example #3 Leveraged Buyout (LBO) Model:

- In a leveraged buyout deal, a company acquires other companies by using borrowed money (debt) to meet the acquisition costs. The cash flows from the assets and operations of the acquired company are used to pay off the debt and its charges.

- Hence, LBO is termed as a very hostile/aggressive way of acquisition as the target company is not taken under the sanctioning process of the deal.

- Usually, cash-rich Private Equity firms are seen to be engaged in LBOs. They acquire the company with a combination of Debt & Equity (where a majority is of debt, almost above 75%) and sell off after gaining substantial profit after a few years (3-5 years).

- So the purpose of an LBO model is to determine the amount of profit that can be generated from such a deal.

- As there are multiple ways debt can be raised, each having specific interest payments, these models have higher levels of complexity.

- The following are steps that go into making an LBO model;

- Calculation of purchase price based on forward trading multiple on EBITDA

- Weightage of debt and equity funding for the acquisition

- Building a projected income statement and calculate EBITDA

- Calculation of cumulative FCF during the total tenure of LBO

- Calculating Ending exit values and Returns through IRR.

Example #4 Merger & Acquisition (M&A) model:

- The M&A model helps to figure out the effect of merger or acquisition on the earnings per share of the newly formed company after the completion of the restructuring and how it compares with the current EPS.

- If the EPS increases altogether, then the transaction is said to be “accretive,” and if the EPS decreases than the current EPS, the transaction is said to be “dilutive.”

- The complexity of the model varies with the type and size of operations of the companies in question.

- Investment Banking and corporate financing companies generally use these models.

- The following are the steps that go into making an M&A model;

- Valuing Target & Acquirer as standalone firms

- Valuing Target & Acquirer with synergies

- Working out an Initial offer for the target firm

- Determining combined firms ability to finance transaction

- Adjust cash/debt according to the ability to finance the transaction

- Calculating EPS by combining Net income and figuring out an accretive/dilutive situation.

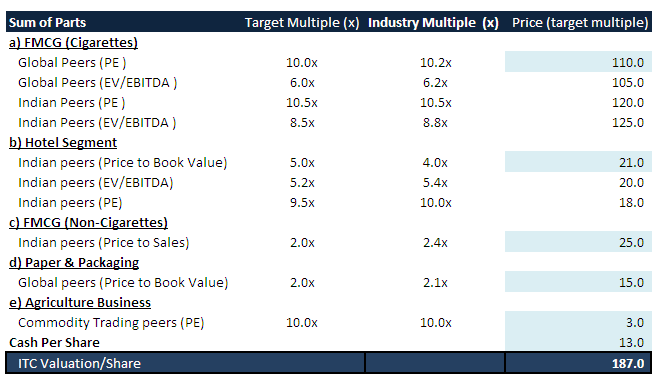

Example #5 Sum-of-the-parts (SOTP)

- Valuing of huge conglomerates becomes challenging to value the company as a whole with one single valuation method.

- So, valuation for the different segments is carried out separately by suitable valuation methods for each element.

- Once all the segments are valued separately, the sum of valuations is added together to get the valuation of the conglomerate as a whole.

- Hence, it is called the “Sum-of-the-parts” valuation method.

- Usually, SOTP is suitable in the case of a spin-off, mergers, Equity carve-outs, etc.

Example #6 Comparative Company Analysis model:

- Analysts, while working on a comparative valuation analysis of a company looking for other similar companies that are equal in terms of size, operations, and peer group companies.

- By looking at the numbers of its peers, we get a ballpark figure for the valuation of the company.

- It works on the assumption that similar companies will have comparable EV/EBITDA and other valuation multiples.

- It is the most basic form of valuation done by analysts in their firms.

Example #7 – Comparable Transaction Analysis Model

The transaction multiples Model is a method where we look at the past Merger & Acquisition (M&A) transactions and value a comparable company using precedents. The steps involved are as follows –

- Step 1 – Identify the Transaction

- Step 2 – Identify the right transaction multiples

- Step 3 – Calculate the Transaction Multiple Valuation

What are Financial Modelling Tools?

Financial modeling tools are the set of information or skills or any other factor element which helps an analyst evaluate the value of a company or a business segment or the viability of the project.

Let’s now talk about the top ten finance modeling tools.

1. Microsoft Excel

The first and foremost tool an analyst needs is Microsoft excel. Now why excel only and not any other software? Well, Microsoft Excel has many functions that ease the job of any scale around the globe.

2. Excel Knowledge

Just owning Microsoft Excel Software does not make you a pro. You need to know the inbuilt capacities of Microsoft excel. Unless you don’t know what Excel can do, you will never try those things.

3. Knowledge of Finance

The first step in financial modeling is to gain an intermediate knowledge of finance. Finance is the crux of financial modeling. There are three levels for any knowledge: basic, intermediate, and expert. Expert knowledge is required for suggesting or decision-making based on the information available. Intermediate knowledge lets you work on the ground. Basic knowledge is what traditional financial bankers do when you keep a time deposit with them.

To start with financial modeling, you at least need an intermediate level of financial knowledge.

4. Knowledge of Accounting

You don’t need to possess expert knowledge of accounting. Basic accounting knowledge or accounting norms are required for financial modeling.

5. Knowledge about the Economy

It would help if you had your opinion about the current scenario of the economy. Your opinion defines the level of your knowledge of the economy. Again at least basic knowledge about the economy is expected. If you can’t decide the direction of price levels by observing the demand and supply, then you need to develop a perspective.

6. Mindset

Problem-solving mindset is necessary for financial modeling. You have to start from a scattered type of information & reach a goal. So, the approach and the right mindset are essential.

7. Presentation Skills

Your presentation skills define you. Here, we are talking about the Powerpoint PPT. It does not mean using too many colors or making a fancy type of PPT. You are a professional & hence high quality is expected in the presentation.

8. Colour Formatting Knowledge

Essential parameters of color formatting in excel are consistency, efficiency & clarity. The lack of any of these generally does not serve the purpose of the financial model. To incorporate these things into a model, you need to develop these things within your habits.

9. Decision Making Skill Set

Decision-making is the result of a financial model. Every work prepared for financial modeling should be relevant for decision-making. If something is not necessary for decision-making, such information is ideally hidden.

10. Critical Thinking Skill

Critical thinking means the approach of thought-process should be towards achieving the end purpose. An open mind of critical & rational thinking is required to decide on various parameters in the financial model. This tool is necessary to be developed if one does not possess it.

How do you Build Financial Models?

When you build a financial model, you’re representing a real-life situation with numbers so that decision-makers can make improved financial decisions. If a financial problem in the real world needs to be solved, analyzed, or translated into an easy-to-digest numerical representation, a financial model is a big help.

Sometimes it’s just a concept or idea that needs translating into an easy-to-understand proposal or use case. For instance, how can you convey the depreciation on a piece of equipment? Or explain a free cash flow sensitivity analysis?

These models help you build working business plans that help with budgeting, financial planning, and more.

Once you become adept at financial modeling, you can help others understand the grandest of concepts, from the cost of goods sold (COGS) and corporate finance to investment banking and private equity.

You’ll help put actual meaning into business ideas as you supplement details that officers can use to make decisions, garner investors, or hire staff.

As an example, financial models help investors choose which projects are worth their time and money. Models help executives discern the most plausible marketing campaigns having the highest ROI. They also help production managers choose when and if purchasing new equipment is right for the company.

Knowing how to build a financial model is a must for financial officers, investors, and others involved in the financial operations of a business or organization.

Here are the six basic steps for building a financial model:

1. Gather historical data. You’ll need at least the last three years of financial data for the company.

2. Calculate ratios and metrics. Using the historical data from the first step, you’ll calculate historical ratios and metrics, like growth margins and rates, asset turnover ratios, and inventory changes.

3. Make informed assumptions. Armed with your historical data, ratios, and metrics, continue using this information to build future ratio and metric projections. Use assumptions to calculate future growth margins and rates, assets that may turnover, and projected changes in inventory.

4. Create a forecast. Use all the above data and reports to forecast the usual accounting documents, such as future income, balance sheets, and cash flow statements. Do this by reversing your original calculations for historic ratios and metrics. Specifically, use your previous assumptions to build out the forecasted statements.

5. Value the company. After you’ve forecasted, you can now value the company using the DCF, or Discounted Cash Flow, method.

6. Review. Once you have this information before you, use your drafted statements to decide how different scenarios may play out.

How does an LBO Model Work?

An LBO model is a financial tool typically built in Excel to evaluate a leveraged buyout (LBO) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Both the assets of a company being acquired and those of the acquiring company are used as collateral for the financing.

The buyer typically wishes to invest the smallest possible amount of equity and fund the balance of the purchase price with debt or other non-equity sources. The aim of the LBO model is to enable investors to properly assess the transaction and earn the highest possible risk-adjusted internal rate of return (IRR).

In an LBO, the goal of the investing company or buyer is to make high returns on their equity investment, using debt to increase the potential returns. The acquiring firm determines if an investment is worth pursuing by calculating the expected internal rate of return (IRR), where the minimum is typically considered 30% and above.

The IRR rate may sometimes be as low as 20% for larger deals or when the economy is unfavorable. After the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90% of the purchase price. The company’s cash flow is used to pay the outstanding debt.

Why is Financial Modelling Important?

Several organizations depend on financial models for effective decision making. The use of financial modeling tools and techniques is increasing, considering its overall benefits.

1. Improved and in-Depth Understanding of a Business

A financial model is developed after having a deep insight into the business. The analysts understand how a business operates and what are the different factors that could impact such a business. The businesses are also required to understand what changes are expected to take place in a scenario when there are changes in the internal as well as external environment of the business.

Thus, companies that develop financial models can understand their business as well as the factors affecting them better than their competitors and are therefore better prepared for any uncertain situation.

2. Periodic Review of Performance

To understand how a business is performing, it is important to do the variance analysis. Financial models help in carrying out the variance analysis by comparing the actual results of the business against the budgets. The performance review can be done periodically to get feedback on the business operations. Some advanced financial models help businesses to carry out adjustments in their operations based on the variance analysis so that overall profits can be improved.

3. Decide the Fund Requirement & Strategy

Financial models provide clarity on the expected cash inflows and outflows. A business can get to know the net cash flows that it would be required to arrange to run its affairs. The next step is to decide the source of funding, i.e. debt vs equity.

For this, the financial models help in understanding what would be the cash flow position after meeting the interest expense and repayment of loans. This helps to decide whether and to what extent the business can take debt and what shall be the level of equity financing.

4. Business Valuation

Companies that wish to know their worth can use financial models. A financial model helps in determining free cash flows that are expected to accrue to a business at different points of time which further helps in reaching the fair value of a business. This becomes useful for businesses when making any restructuring, such as when selling the stake to outsider parties and investors.

5. Risk Minimization

Since a financial model helps in carrying out due diligence by suggesting the financial impact of a particular activity, thus, it helps the businesses in minimizing the overall risk in a business. For example, suppose a business wants to enter the new market; a financial model would guide the business regarding the cost of such entrance, the effect of marketing, price changes, and so on.

6. Financial Models Generate Quick Outputs

Businesses may take months to get answers to certain financial questions and to determine the impact of a certain decision. However, financial models are quick in giving results which helps in quick decision-making. In such a way, financial models become very useful for businesses.

7. Much Accurate Financial Budgets and Forecasts

Financial models build financial budgets and forecasts based on business data and thus, tend to be accurate. Businesses can use these budgets and forecasts for their business activities so that their activities remain structured and within the defined structure. Not following any budget or business strategy can be harmful to the businesses.

8. Helps in Business Growth

How the financial models help a business to grow is by suggesting the areas that are capable of generating higher profits. The models also help in carrying out a cost-benefit analysis of new projects. Businesses can use financial models to understand as investment shall be made in which areas and projects for better profitability and growth.

What Financial Models do Investment Bankers Use?

Investment banking is part of the overall financial industry that focuses on evaluating the worth of companies. Its primary purpose is to create capital for corporations, governments, and other institutional organizations. They also help manage and facilitate mergers and acquisitions (M&A) such as leveraged buyouts (LBOs), help with corporate restructuring and reorganizations, and in the overall investment of capital by commercial enterprises. That’s why financial modeling is an important skill that many investment banking professionals should possess.

There are 4 main categories of financial models used at normal companies, investment banks that advise companies on transactions, and investment firms:

- Category #1: 3-Statement Models (Income Statement, Balance Sheet, and Cash Flow Statement) or “Budgets” at normal companies

- Category #2: Valuations and DCF Models (Discounted Cash Flow Models)

- Category #3: Merger Models (also known as M&A Models or Accretion/Dilution Models)

- Category #4: Leveraged Buyout Models (slight variations include the Growth Equity Models and “Investment Models”)

In these financial models, you project a company’s revenue, expenses, and cash flow-related line items, such as the Change in Working Capital and Capital Expenditures.

You then use these numbers to forecast the company’s financial statements, i.e., its Income Statement, Balance Sheet, and Cash Flow Statement, over several years.

Read Also: The Impact of Online Marketing Strategy on Conversion and Revenue Growth

The Income Statement shows a company’s revenue, expenses, and taxes over a period of time and ends with its Net Income (i.e., its after-tax profits).

The Balance Sheet shows a company’s Assets, or its resources that will deliver future benefits, and its Liabilities & Equity, or its funding sources that have direct or indirect “costs.”

The Cash Flow Statement provides a reconciliation between a company’s Net Income and the cash it generates, which is often quite different.

For example, accounting rules state that cash outflows for spending on long-term items such as factories and properties should not appear directly on the Income Statement because these items could be useful for many years.

So, companies record the cash outflows for this spending as “Capital Expenditures” on the Cash Flow Statement.

If a company buys a new factory for $100 million, its cash flow is reduced by $100 million – but you wouldn’t know it by looking at the Income Statement.

The company’s Income Statement only shows the “Depreciation” representing the allocation of this $100 million over many years.

For example, if the factory is expected to be useful for 20 years, the company might record $100 million / 20 = $5 million of Depreciation per year on its Income Statement.

The Cash Flow Statement records all the cash inflows and outflows, which gives you a full picture of the company’s business health.

It prevents companies from hiding behind non-cash revenue and expenses that might distort their Income Statement.

These 3-statement models are widely used at normal companies for budgeting purposes and at banks and investment firms to assess companies’ financing requirements.

For example, a 3-statement model might tell you that a company will need additional capital in 3-4 years to continue its aggressive expansion strategy:

If a company has already borrowed money, a 3-statement model might tell you how well it can repay that Debt over the next 5 years.