The predicted financial returns or monetary disbursements from investments or annuities are referred to as payouts. A payout can be defined as a percentage of the investment’s cost or as an actual dollar amount and can be expressed on an annual or recurring basis.

A payout can also refer to the time it takes for an investment or project to recover its initial capital expenditure and become marginally profitable. It is an acronym that stands for “time to payout,” “term to payout,” or “payout period.”

Payouts in financial products such as annuities and dividends relate to the amounts received at specific times in time. In the case of an annuity, for example, payments are provided to the annuitant at regular intervals, such as monthly or quarterly.

There are two main ways that companies can distribute earnings to investors: dividends and share buybacks. With dividends, payouts are made by corporations to their investors and can be in the form of cash dividends or stock dividends. The payout ratio is the percentage rate of income the company pays out to investors in the form of distributions. Some payout ratios include both dividends and share buybacks, while others only include dividends.

For example, a payout ratio of 20% means the company pays out 20% of company distributions. If company A has $10 million in net income, it pays out $2 million to shareholders. Growth companies and newly formed companies tend to have low payout ratios. Investors in these companies rely more on share price appreciation for returns than dividends and share buybacks.

The payout ratio is calculated with the following formula:

- Payout ratio = total dividends / net income

The payout ratio can also include share repurchases, in which case the formula is as follows:

- Payout ratio = (total dividends + share buybacks) / net income

The cash amount paid out to dividends can be found on the cash flow statement in the section titled cash flows from financing. Dividends and stock repurchases both represent an outflow of cash and are classified as outflows on the cash flow statement.

What Are The Main Determinants of Dividend Payout?

Dividend declaration requires both legal and financial issues. From a legal standpoint, the basic rule is that dividends can only be paid out on gains that do not damage capital in any way. However, the different financial variables make it difficult for management to make a judgement on dividend distribution.

These considerations are discussed below:

Type of Industry:

Industries that are characterised by stability of earnings may formulate a more consistent policy as to dividends than those having an uneven flow of income. For example, public utilities concerns are in a much better position to adopt a relatively fixed dividend rate than the industrial concerns.

Age of Corporation:

Newly established enterprises require most of their earning for plant improvement and expansion, while old companies which have attained a longer earning experience, can formulate clear cut dividend policies and may even be liberal in the distribution of dividends.

Extent of share distribution:

A closely held company is likely to get consent of the shareholders for the suspension of dividends or for following a conservative dividend policy. But a company with a large number of shareholders widely scattered would face a great difficulty in securing such assent. Reduction in dividends can be affected but not without the co-operation of shareholders.

Need for additional Capital:

The extent to which the profits are ploughed back into the business has got a considerable influence on the dividend policy. The income may be conserved for meeting the increased requirements of working capital or future expansion.

Business Cycles:

During the boom, prudent corporate management creates good reserves for facing the crisis which follows the inflationary period. Higher rates of dividend are used as a tool for marketing the securities in an otherwise depressed market.

Changes in Government Policies:

Sometimes government limits the rate of dividend declared by companies in a particular industry or in all spheres of business activity. The Government put temporary restrictions on payment of dividends by companies in July 1974 by making amendment in the Indian Companies Act, 1956. The restrictions were removed in 1975.

Trends of profits:

A closely held company is likely to get consent of the shareholders for the suspension of dividends or for following a conservative dividend policy. But a company with a large number of shareholders widely scattered would face a great difficulty in securing such assent. Reduction in dividends can be affected but not without the co-operation of shareholders.

Need for additional Capital:

The extent to which the profits are ploughed back into the business has got a considerable influence on the dividend policy. The income may be conserved for meeting the increased requirements of working capital or future expansion.

Business Cycles:

During the boom, prudent corporate management creates good reserves for facing the crisis which follows the inflationary period. Higher rates of dividend are used as a tool for marketing the securities in an otherwise depressed market.

Changes in Government Policies:

Sometimes government limits the rate of dividend declared by companies in a particular industry or in all spheres of business activity. The Government put temporary restrictions on payment of dividends by companies in July 1974 by making amendment in the Indian Companies Act, 1956. The restrictions were removed in 1975.

Trends of profits:

The regularity of dividend payment and the stability of its rate are the two main objectives aimed at by the corporate management. They are accepted as desirable for the corporation’s credit standing and for the welfare of shareholders.

Read Also: Online Payment: The Risks And Growth of Financial Technology

High earnings may be used to pay extra dividends but such dividend distributions should be designed as “Extra” and care should be taken to avoid the impression that the regular dividend is being increased.

A stable dividend policy should not be taken to mean an inflexible or rigid policy. On the other hand, it entails the payment of a fair rate of return, taking into account the normal growth of business and the gradual impact of external events.

A stable dividend record makes future financing easier. It not only enhances the credit- standing of the company but also stabilises market values of the securities outstanding. The confidence of shareholders in the corporate management is also strengthened.

How do Companies Decide on Payouts?

A dividend payment is the distribution of a company’s profits to its shareholders. Dividends are usually paid in cash but sometimes in company stock, and companies often use them to return excess profits to investors.

Beyond that basic definition, there are a number of important things about dividend payments that investors should know:

- How do companies decide on dividend payments?

- How do stocks pay dividends?

- When do stocks pay dividends?

- How do you get dividend payments?

- What is the average dividend payment?

How do companies decide on dividend payments?

A company’s board of directors is responsible for its dividend policy and determining the size of a dividend payment. Depending on a company’s growth goals, earnings and cash flows, its industry, and other factors, the board will determine an appropriate (if any) dividend payment.

This can vary from one industry to the next and among companies in different growth phases. Industries that are lower growth but generate stable earnings and cash flows, such as utility companies, often prioritize higher dividend payments to attract investors. Companies in sectors that are more cyclical, such as consumer discretionary goods, may pay a lower portion of their earnings — the payout ratio — as dividends, prioritizing their ability to maintain the dividend payment when business is weaker.

How do stocks pay dividends?

Whether you want dividend stocks as a source of income or for more cash to reinvest in your stock portfolio, it’s important to know how a company pays a dividend. The short answer is that a company pays a dividend from its earnings. When a company earns a profit, it essentially has three things it can do:

- Invest it back into the business (build a factory, expand into a new market, make an acquisition, pay off debt, etc.).

- Retain it for a future need.

- Return it to shareholders by repurchasing stock or paying a dividend.

In a broad sense, if a company doesn’t have a clear internal use for excess profits, returning them to investors by paying a dividend is ideal.

A company that doesn’t generate regular or consistent earnings, or is not yet profitable — like many start-ups or high-growth companies that are aggressively spending to expand their operations — may not be able to pay a dividend. These companies have better use for their earnings, or they simply don’t generate enough earnings to afford a dividend.

In a few instances, a company may pay dividends in stock, not cash. While it’s rare, it’s important to make sure you know whether this is the case, especially if you’re counting on those dividend payments for income today.

You may also earn something called substitute payments in lieu of dividends. This happens when you own a dividend stock but allow your broker to lend it out to a short-seller. In this case, the dividend doesn’t technically come to you, so the short-seller reimburses the dividend to you. The upside is you earn extra money by lending your shares and continue to earn the dividend equivalent. The downside is additional tax complications, depending on what kind of brokerage account you’re using.

When do stocks make dividend payments?

The vast majority of dividend stocks pay dividends quarterly, although there are some companies that make dividend payments monthly and a very small number that make annual and semiannual dividend payments. This recurring, expected dividend is generally called a regular dividend.

Some companies may occasionally pay a special dividend. This is a nonrecurring, one-time payout, and it is usually the result of an extraordinary circumstance or event that generates excess earnings or cash for a company. This can include an asset sale, divestiture of a subsidiary or part of the company, or a particularly profitable quarter or year.

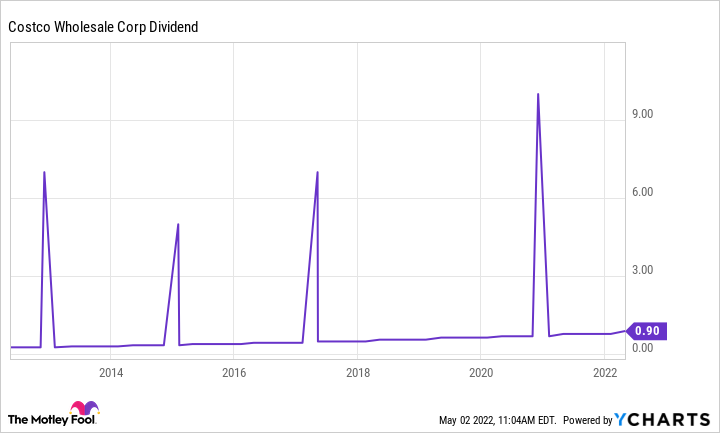

Special dividends are generally rare, but there are a few companies with a track record of paying special dividends every few years, with the most notable being Costco (COST 1.91%). As you can see in the chart below (the four big spikes in the dividend) it is not out of the ordinary for Costco to issue a large special dividend every few years.

But those special dividends are less secure than the regular dividend, even from companies with a history of paying them. Investors looking for dependable income should exclude them from dividends per share when calculating the dividend yield.

Determining when each stock you own will pay dividends is relatively easy. When a company’s board of directors determines the next dividend, it will declare the dividend, typically in a press release or in a filing with the Securities and Exchange Commission (SEC). This release will disclose the amount of the dividend, the dividend payment date, and the date you must own shares to receive the dividend payment.

How do you get dividend payments?

Although some investors own stocks in company-sponsored direct stock purchase plans and receive the dividend directly from the company, the vast majority own stocks through a broker. In this case, the dividend payments come to your brokerage and are deposited in your brokerage account.

For this reason, your dividend payment may not appear in your account on the payment date in the company’s release declaring it. It could be a day or two before the money shows up. This is particularly important if you are counting on those dividend payments for income since you may need to allow for a few more days to transfer the cash from your brokerage account into your checking or savings account.

In those rare instances when a company makes a dividend payment in company stock, it will take even longer to get cash if you own the dividend as a source of income today. You’ll need to sell the shares and then wait a couple of business days for the trade to settle before you can initiate the cash transfer. Make sure to plan accordingly.