A key idea in finance is compound interest, which is the interest on a principal amount plus additional interest that has accumulated over time. Given that it enables an initial investment to grow at an exponential rate over time, it is regarded as a potent tool for saves and investments.

The famous statement “Compound interest is the eighth wonder of the world” was made by Albert Einstein once. Whoever comprehends it, deserves it. Whoever doesn’t pays for it. This quotation demonstrates the value of compounding and provides a fitting synopsis of all the information in this piece. Here, we’ll go over the basics of compound interest and how it relates to your income streams, market timing and chasing risks, and the value of adhering to a long-term investing strategy.

What is Compound Interest?

In simple words, compound interest is the interest generated on the principle amount plus all previously collected interest. Compound interest is the interest earned on an initial investment, as well as on any compounded interest. It’s an important financial idea that has the potential to grow significantly over time.

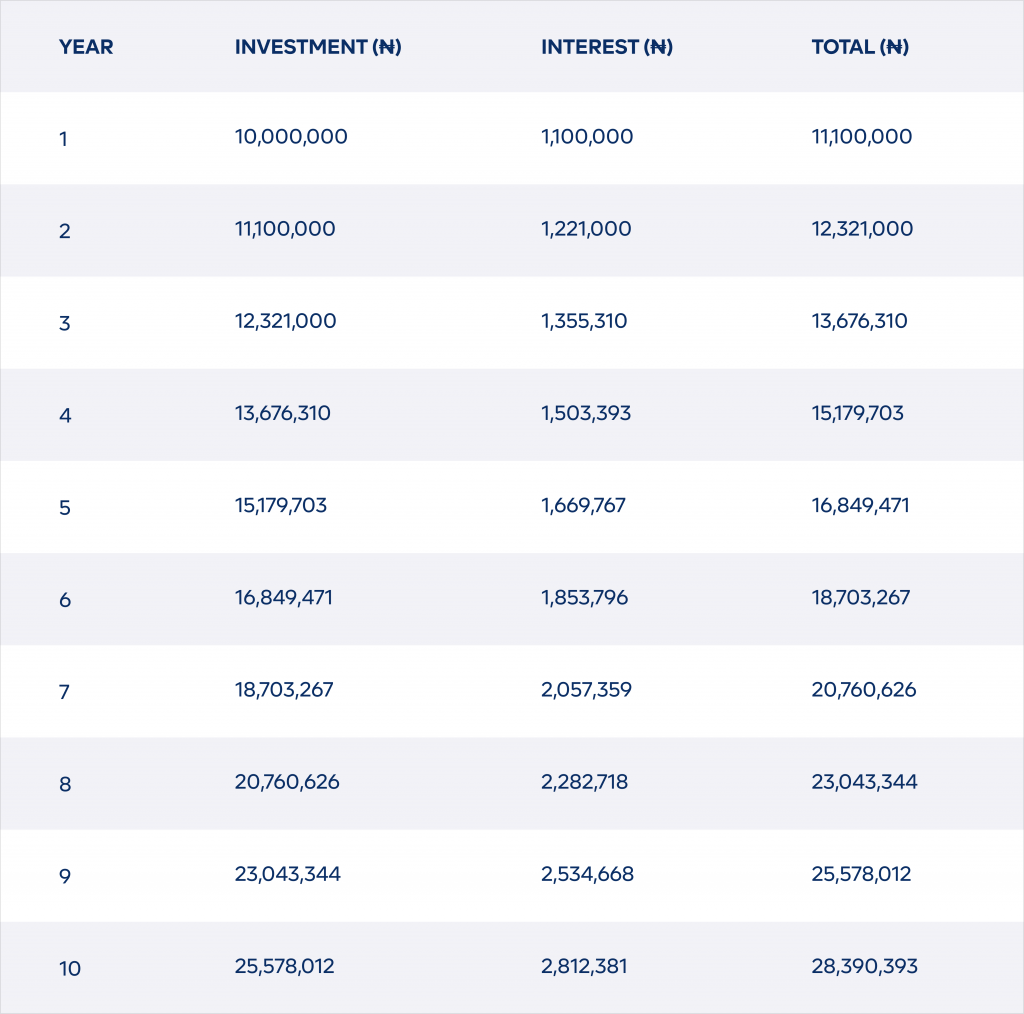

In order to comprehend compound interest, let’s look at a straightforward example. A year later, you would have earned ₦1,100,000 in interest if you invested 10 million naira at an interest rate of 11% annually. This would have increased your total balance to ₦11,100,000. You would receive interest on both your original investment and the interest from the first year in the second year.

This means that, in the following year, the interest would be calculated on the new balance of ₦11,100,000, rather than the original 10 million naira. Thus, the interest earned in the second year would be ₦12,321,000.

As seen from the table, the investment grows to over 28 million naira after 10 years, due to compound interest. This shows the power of compounding in long-term investment growth, as the investment earns interest on the accumulated interest, leading to exponential growth over time.

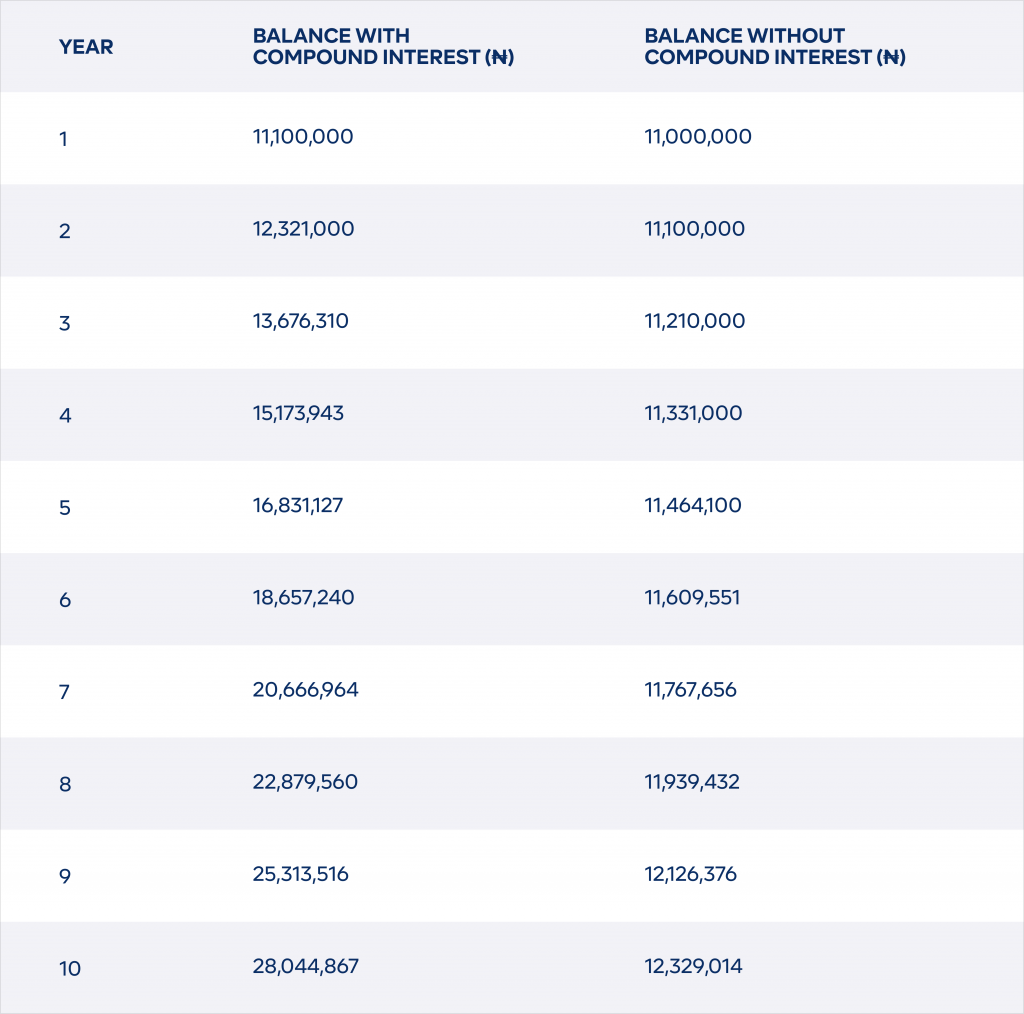

As the table shows, over the course of 10 years, the investment balance with compounding grows much faster than the investment balance without compounding, due to the interest earned each year being reinvested in the following years. This illustrates the powerful effect that compounding can have on long-term investment growth.

The operation of compound interest in a savings account is another straightforward illustration. Interest is paid on the balance of a savings account; when a person tops out their account, the interest for that month is computed based on the larger amount. As a result, the savings might increase exponentially over time.

Relevant Compound Interest Concepts

One of the most effective strategies for increasing investment returns over time is compounding. It’s critical to comprehend the pertinent ideas and their workings in order to completely appreciate and benefit from compounding. The significance of time, the time worth of money, the influence of regular contributions, dollar-cost averaging, and the dangers of market timing are some of these ideas.

A effective investing plan can be developed by people who have a solid understanding of these fundamental ideas and how they contribute to compound returns.

The Importance of Time

The concept of compound interest is based on the idea that time is a critical factor in the growth of an investment. The longer an individual invests their money, the more significant the impact of compound interest will be. In fact, many financial experts consider time to be the most important factor in maximizing the benefits of compound interest.

Read Also: Diversifying Your Income Streams for Financial Security

According to Investopedia, “The earlier an individual starts investing, the longer their money has to grow and compound, resulting in a larger balance at retirement.” This highlights the importance of starting to invest and saving at a young age, as the longer an individual has to invest, the more significant the impact of compound interest will be. Additionally, Bankrate states, “The longer the time frame, the more compound interest can help your money grow.” This emphasizes the importance of a long-term investment strategy, as the exponential growth from compound interest can only be fully realized over a longer period of time.

The importance of time in the growth of compound interest cannot be overstated. By starting to invest and save at a young age, and adopting a long-term investment strategy, individuals can maximize the benefits of compound interest and achieve their financial goals.

The Impact of Regular Contributions

The impact of regular contributions on compound returns can be substantial, as regular contributions can greatly increase the amount of money an investor has invested and therefore the amount of compound interest earned.

Compound interest is the interest earned on an investment’s principal, as well as on any previously accumulated interest. By making regular contributions, an investor adds to the principal, which increases the amount of interest earned over time. Over time, the interest earned on the principal grows and compounds, leading to a much larger final investment balance compared to making a one-time investment of the same amount.

For example, if an investor invests a one-time amount of ₦100,000 at a 10% p.a. interest rate, after 20 years the investment balance would be ₦627,219.07. However, if the same investor contributes ₦5,000 per month for 20 years at a 10% p.a. interest rate, the investment balance would be ₦1,678,066.14, more than two and a half times greater than the one-time investment.

In addition to the benefits of compounding, regular contributions can help to average out market fluctuations, as the investor is purchasing more units when the price is low and fewer units when the price is high. This is known as dollar-cost averaging and can result in a lower average cost per unit and potentially higher returns over the long term.

Overall, making regular contributions to an investment account can have a significant impact on compound returns, helping investors to accumulate a larger investment balance over time. It’s important to start investing as early as possible and to make consistent contributions in order to take advantage of the benefits of compounding and dollar-cost averaging.

This is why Cowrywise build to ensure they set up proper structures to ensure regular contributions to savings and investment plans. With automation, an investor on Cowrywise can set daily, weekly and monthly regular top-ups on their account to keep enjoying the significant impact of compounding.

The impact of regular contributions on investment returns is clear and substantial. Warren Buffett, a famous investor, has often emphasized the importance of consistent contributions in achieving investment success. He said, “Do not save what is left after spending, but spend what is left after saving.” This quote highlights the importance of making consistent saving and investing a priority, rather than an afterthought.

The Importance of Dollar-cost Averaging

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money into a particular investment, regardless of its price. This strategy can be used to overcome short-term setbacks and obstacles in investing because it helps to average out the cost of the investment over time, reducing the impact of short-term price fluctuations.

For example, if an investor starts investing ₦50,000 per month into a stock that is currently trading at ₦100 per share, they would receive 500 shares. If the stock price drops to ₦75 per share the following month, the investor would receive 666.67 shares. As the stock price increases as well, the investor will continue to purchase fewer shares, but the overall value of their investment will increase.

This is because the investor will have a larger holding of shares that are worth more, and the increased value of their investment will compound over time. Over time, the average cost per share will be lower, as the investor buys more shares when the price is lower and fewer shares when the price is higher.

In this way, dollar-cost averaging can help investors overcome the fear of investing at the wrong time or when prices are high. By investing a fixed amount regularly, investors can take advantage of lower prices to buy more shares, and avoid missing out on potential gains.

Additionally, dollar-cost averaging can help to reduce the overall volatility of a portfolio, as the investor is not fully exposed to the ups and downs of the market. By investing consistently over time, the investor can benefit from the long-term performance of the investment, rather than being impacted by short-term price movements.

Dollar-cost averaging is an effective strategy for building wealth over the long term. By consistently making contributions to an investment portfolio, regardless of market conditions, individuals can take advantage of lower prices during market downturns and higher prices during market upturns. As Warren Buffett said, “If you’re investing in a wonderful business, you want to buy more of it.

The Concept of Time Value of Money

Time value of money (TVM) is a fundamental principle in finance. It refers to the idea that money has a different value depending on when it is received. In other words, the value of money received today is greater than the same amount received in the future due to the opportunity cost of not being able to invest that money and earn a return.

When it comes to compounding, TVM plays a crucial role. The longer the investment is held, the greater the opportunity for compound interest to grow. This is because the interest earned in a given period is reinvested and earns interest in subsequent periods. As a result, the investment balance grows at an exponential rate over time.

To illustrate this concept, consider the following example:

If you were offered the choice between receiving ₦1m today or ₦1m in one year, most people would choose to receive the money today. This is because you can immediately invest the money and earn returns on it. If you were to receive the ₦1m in one year, you would have missed out on a year’s worth of potential investment returns.

Although compound interest burns slowly at first, it might eventually ignite a significant financial inferno. It’s a strong force that can have a big long-term impact on the returns on your investments. It’s a straightforward idea: interest on your investment grows interest on top of your principle balance and accrues interest over time.

When making investing plans today, take into account compound interest for the following reasons:

- Long-term growth: Compound interest can help your investment grow significantly over the long term. The earlier you start investing, the more time your money has to compound, resulting in potentially larger returns in the future.

- Passive income: By investing in an interest-bearing account, you can earn passive income from the interest earned on your investment. This can help provide a stable source of income for your future.

- Potentially higher returns: Compound interest can provide a higher return compared to simple interest. The longer your investment compounds, the greater the potential for returns.

- Tax-efficient: In many cases, compound interest is tax-deferred. This means that you only pay taxes on the interest earned when you withdraw the funds.

Conclusion

Compound interest benefits investors across the spectrum. Banks benefit from compound interest lending money and reinvesting interest received into additional loans. Depositors benefit from compound interest receiving interest on their bank accounts, bonds, or other investments.

The long-term effect of compound interest on savings and investments is indeed powerful. Because it grows your money much faster than simple interest, compound interest is a central factor in increasing wealth. It also mitigates a rising cost of living caused by inflation.

For young people, compound interest offers a chance to take advantage of the time value of money. Remember when choosing your investments that the number of compounding periods is just as important as the interest rate.