Although achieving financial freedom may seem impossible, it is possible if a sound financial plan based on active and passive income is appropriately implemented. Passive income streams produce money on their own without your effort, but active income demands more direct, hands-on labor.

Through comprehension and utilization of the potential of both active and passive income, people can fulfill their financial objectives, modify their way of life, and maximize their tax plan. You can find strategies to make both active and passive income with the assistance of a financial counselor.

What Is Active Income?

Money earned via labor, such as commissions, compensation from self-employment, or other sources, is referred to as active income. It necessitates hands-on participation in labor or service delivery. Physicians, engineers, instructors, salespeople, and graphic designers are among the professions or careers that typically bring in a living wage.

Income can be divided into three categories: portfolio income, active income, and passive (or unearned) income. The most typical type of active income is money obtained from an employer in the form of a paycheck.

For the self-employed or anyone else with an ownership interest in a business, income from business activities is considered active if it meets the Internal Revenue Service (IRS) definition of material participation. That means at least one of the following is true:

- The taxpayer works 500 or more hours in the business during the year.

- The taxpayer does the majority of the work in the business.

- The taxpayer works more than 100 hours in the business during the year, and no other staff works more hours than the taxpayer.

If someone receives income from a business in which they don’t actively participate, then that is considered passive income. Portfolio income, meanwhile, is income from investments, such as dividends and capital gains.

These different types of income can be taxed differently, depending on the law at the time. For example, portfolio income is currently taxed at lower rates than active income.

Types of Active Income

Active income can come from a variety of sources, including salaries and wages, self-employment as well as commissions and bonuses.

Salaries and wages. The most common type of active income comes from salaries and wages, which are the regular payments individuals receive for doing their jobs. This form of income requires direct involvement and time investment in work-related activities. Many consider this to be trading your time directly for money.

Examples of specific jobs and their median annual salaries include software developers ($109,020), registered nurses ($77,600), and high school teachers ($61,820), as reported by the Bureau of Labor Statistics.

Self-employment. Income that comes from self-employment, including consulting and freelance work, also falls under the category of active income. Instead of a company or organization compensating you for your time and work, self-employed workers generate their own business. It’s important for these types of workers to understand the intricacies of self-employment taxes and deductions, as well as navigate the fluctuating nature of self-employment income.

Commissions and bonuses. These are additional payments earned based on individual achievements, such as sales or project completion. This type of income can vary greatly and depend on the individual’s productivity and success.

Advantages of Active Income

Active Income, earned through direct and consistent work, presents several key advantages integral to most individuals’ financial health and career development. Let’s look at some advantages of Active Income:

a) Immediate and predictable cash flow: Active Income offers a steady and predictable source of funds, usually in regular paychecks. This consistency is crucial for budgeting, planning, and meeting immediate financial obligations like bills and everyday expenses.

b) Career development and growth: It often comes from employment or running a business, which inherently provides opportunities for professional growth. Individuals can advance in their careers, gain new skills, and increase their earning potential over time.

c) Benefits and perks: Besides the monetary compensation, Active Income roles often come with additional benefits such as health insurance, retirement contributions, paid vacations, and other bonuses that enhance overall financial stability and quality of life.

d) Social interaction and networking: Working in a traditional Active Income setting often involves collaboration and exchange with colleagues, clients, or customers, offering valuable networking opportunities and fostering interpersonal skills.

e) Sense of achievement: Earning Active Income typically results from tangible efforts and achievements, providing a sense of accomplishment and contributing to personal and professional satisfaction.

What Is Passive Income?

Passive income is the money that comes in automatically from the assets you own, a product you’ve made, or a system you’ve put up, whereas active income requires you to exchange time for money. However, passive income isn’t a free source of funds. It involves a one-time payment or some up-front work, similar to buying stocks or buying and maintaining rental real estate.

Types of Passive Income

Like active income, passive income can flow from different types of streams. Common types of passive income include dividends and interest, rental income, royalties and capital gains.

Dividends and interest income. Dividends and interest income are common forms of passive income. For example, if someone were to invest $10,000 at a 5% annual interest rate for 20 years, it could potentially grow to over $26,500. Examples of companies with a good track record of paying dividends include blue-chip stocks such as Procter & Gamble, Johnson & Johnson and McDonald’s.

Rental income. Rental income is another form of passive income where individuals earn money from renting out properties. It is essential to find the right rental property and manage it well to maximize passive income. Rental property investing strategies include targeting high-demand areas and focusing on cash-flow-positive investments.

Royalties. Royalties are the income that’s earned from allowing others to use one’s creative or intellectual property. Monetizing intellectual property or creative works for earning royalties can involve writing books, composing music, developing software, licensing patented inventions or creating educational material.

Capital gains. Capital gains on stock investments or real estate, such as purchasing a property and selling it for a profit, can also bring in passive income. For example, consider an individual who buys a house for $200,000 and sells it later for $250,000, potentially resulting in a $50,000 increase or capital gain. Regarding tax implications, understanding the potential impact of taxes on profit is crucial, as long-term capital gains (assets held for more than a year) often have lower tax rates compared to short-term capital gains or regular income taxes.

Advantages of Passive Income

Passive Income, known for its capacity to generate earnings with minimal ongoing effort, offers several compelling advantages, making it a highly sought-after goal in personal finance management. Here are some benefits of Passive Income:

a) Financial independence and security: It provides a steady flow of income without the need for continuous, active work, thereby reducing reliance on a traditional job. This regular cash flow can be a safety net during economic downturns or personal emergencies.

b) Time freedom: It frees up time, allowing individuals to focus on their passions and hobbies, or spend more time with family and friends. It decouples the direct relationship between time and money, providing the luxury of time, often consumed by a traditional 9-to-5 job.

c) Diversification of income sources: Having multiple income streams through various passive sources can reduce the financial risk of relying solely on Active Income. This diversification is a hedge against job loss or economic downturns.

d) Potential for scalability: Unlike Active Income, which is often limited by the number of hours one can work, Passive Income has the potential to scale. For instance, digital products can be sold to unlimited customers without additional effort.

e) Tax benefits: Certain types of Passive Income, such as real estate investments, offer tax benefits like depreciation and lower capital gains taxes, potentially increasing the net income compared to active earnings.

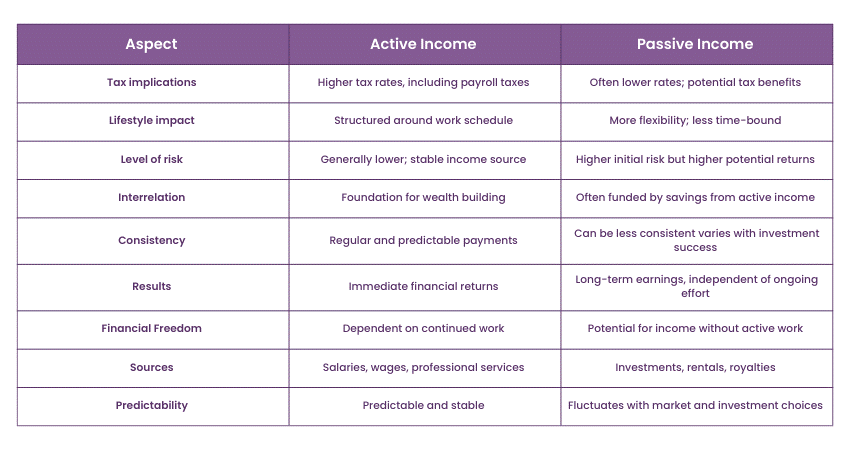

Key Differences Between Active and Passive Income

It is essential to comprehend the primary distinctions between active and passive income in order to plan and manage finances effectively. These variations cover a wide range of topics, including risk levels, lifestyle effects, and tax implications.

Read Also: 10 Passive Income Ideas You Can Start Today

Let us examine these things in greater detail:

1) Tax implications

Active Income is typically taxed at a higher rate than ordinary income. It often includes additional tax burdens like Social Security and Medicare taxes in many countries. On the other hand, with a passive income, you can enjoy a more favourable tax treatment. For example, income from real estate investments can benefit from deductions like depreciation, and dividends may be taxed lower than ordinary income.

2) Impact on lifestyle

Active Income demands a significant time commitment, often leading to a structured lifestyle centred around a work schedule. On the contrary, Passive Income offers more flexibility and can free up time, allowing for travel, hobbies, and spending more time with family.

3) Level of risk

Active Income can be generally perceived as more stable and predictable, especially with regular employment. Passive Income can involve higher initial risk, especially in investments like real estate or stocks, but offers potentially higher long-term returns.

4) Interrelation

Active Income is often used as a foundation to build wealth, which can then be invested to generate Passive Income. On the contrary, Passive Income requires initial capital or effort, often from savings accumulated through Active Income.

5) Consistency

Active Income offers regular, predictable earnings, usually through a steady paycheck. Meanwhile, Passive Income can be less consistent, especially in the early stages of fluctuating markets.

6) Results

In Active Income, there are immediate financial returns for work done but are limited by the number of hours one can work. On the other hand, Passive Income takes time to build but can result in significant, ongoing earnings without proportional effort.

7) Financial freedom

Active Income tends to tie financial stability to continued employment or business operation. Meanwhile, passive income is often seen as a pathway to financial independence, providing earnings without active work.

8) Sources

Active Income comes from jobs, professional services, or active business operations. On the contrary, Passive Income originates from investments, rental properties, royalties, and other sources that do not require daily involvement.

9) Predictable

Active Income is more predictable and stable, with known and regular payment schedules. On the contrary, Passive Income can fluctuate based on market conditions, investment performance, and other factors.

You can make more money and reach your financial objectives more quickly by utilizing both active and passive income streams. For instance, a paid worker who owns many rental properties can utilize their rental income to invest in new passive income streams or use it to supplement their income from their full-time employment. This is how strengthening your financial situation can be achieved by combining active and passive revenue sources.

Diversification of Your Income Sources

Having multiple income streams helps protect against financial uncertainties, such as job loss or investment changes. Examples of individuals who have successfully combined active and passive income streams include bloggers who rely on advertising, sponsored content, and affiliate marketing; landlords who engage in real estate rental income while maintaining a day job; or income investors whose portfolios supplement the earnings from their full-time jobs.

Achieving Financial Goals and Flexibility

Reaching retirement goals or financial freedom is more achievable when having a well-balanced approach to active and passive incomes, often with the guidance of a financial advisor.

Maximizing Tax Benefits

Combining both active and passive income sources can lead to potential tax advantages, such as the ability to offset capital gains with losses or tax-advantaged investment strategies. With a more diverse set of assets and income sources, you’re in a better position to take advantage of some favorable tax laws.

What is the Easiest Form of Passive Income?

Dividend stocks

Dividend stocks pay out a portion of a company’s earnings to shareholders on a regular basis, usually quarterly. Generating passive income through dividend stocks is easy since most of the best online brokerage apps offer dividend payments or reinvestment as a perk.

However, passive income through dividend stocks is not guaranteed, and its success is largely tied to market conditions. Dividends also don’t tend to generate substantial income unless you invest a large chunk of change.

Coca-Cola (KO), for example, paid a quarterly dividend of $0.44 per share in 2024, which provided $1.76 for each share investors owned throughout the year. Let’s say shares of Coca-Cola were selling for $60. You would need to buy nearly $410,000 worth to make $12,000 in dividends for the year.

Bonds

When you purchase a bond, you’re essentially lending money to an issuer (usually the government or a company) for a set period of time. In return, you earn regular interest payments along with the total principal balance when it reaches maturity.

There are different types of bonds and bond funds, each with its own risks and interest rates. Government bonds, for example, are issued by the US Treasury and are recognized as one of the least risky investments. But safer investments generally produce less income than comparatively riskier options like corporate bonds.

Peer-to-peer lending

Peer-to-peer lending (P2P) allows individuals to borrow and lend money directly to one another without the use of a traditional bank. Your peers essentially act as a bank, providing money to borrowers who receive interest in return.

Money borrowed through peer-to-peer lending is generally between $1,000 and $25,000 and typically takes place online through a digital platform or marketplace.

High-yield savings and CDs

Storing cash in a savings account or investing in certificates of deposits (CDs) doesn’t usually yield high enough returns to be considered a valuable source of passive income. But as a result of the Federal Reserve raising interest rates, high-yield savings and CDs were paying between 3-5% in 2023.

Both come with the added benefit of FDIC protection and without the worry of market risk and volatility. This means that a depositor can earn a predictable return on the money added to the account.

Real estate

Renting out a property or a portion of a property can be an excellent way to generate passive income or offset the cost of owning the property. You can access real estate investments for passive income online. Also, platforms like Airbnb and Vrbo are some of the most common platforms used to list your property’s availability to potential guests.

Before you rent, whether through an online market or on your own, you may want to familiarize yourself with any rules and regulations in your area. There may also be other potential costs that should be factored in, such as property maintenance issues that may require you to hire someone.

Online courses and products

You can try creating digital products for income by selling ebooks, software, sewing, and other fiber arts patterns online.

“Since I already knew how to create guides, infographics, and templates for my students in the classroom, I implemented the same strategy to monetize my ebooks, newsletters, and other forms of digital assets,” says Melissa Jean-Baptiste, a former educator and founder of the Millennial In Debt financial literacy blog. “I didn’t have to go learn all new skills or take an expensive certification. Instead, I again leaned into my education skills and used that to make money passively with zero to very little overhead,” she adds.

That said, creating high-quality digital products can be time-consuming. It also requires a level of skill and craftsmanship to conceive profitable items.

Affiliate marketing

Affiliate marketing is an online business model that allows an individual to earn a commission from sales through referrals. Through this method, affiliates use their website or social media accounts to promote products or services for other companies. When a visitor clicks on a link and makes a purchase, the affiliate earns a commission.

“I love that I can get paid for promoting products and services that I know and love,” Grant says. Keep in mind that if you’re using affiliate referral programs, you should disclose this to those you’re marketing to.

The potential income through affiliate marketing can vary by industry as well as the brand. Some companies may pay between $5-25 for every person who signs up through your link, while others may pay $75 or more.

Royalties

Royalties are payments made to individuals or businesses for the ongoing use of their intellectual property, such as music, books, patents, and trademarks. These payments are typically a percentage of total sales generated using copyrighted material.

How much you can make through royalties will largely depend on the type of product you produce as well as the frequency in which it is used. For example, if you self-publish a book, you have the ability to change the price and have great control over your income potential.

Keep in mind that royalties on music function differently. On some music streaming platforms, it could take, for example, 250 plays before you make a single dollar. Notoriety and marketing also majorly affect how much money you can make.

Renting out a car

Like renting out a home or a room, you can also rent out your car to generate income. Platforms like Turo enable people to list their cars for rental and earn rental payments. However, how much you can actually make varies by car type, condition, availability, and mileage.

There may be some upfront costs in terms of cleaning and maintaining the car, but once listed, you can begin generating income. Remember also that some rental markets are better than others and that the type of car you list could be more attractive to certain buyers than others.

Renting out tools and equipment

Like peer-to-peer lending or renting out your car, you can rent tools like saws, drills, and ladders at an hourly rate. Online marketplaces, like ShareGrid, allow folks to rent out camera equipment. Rental, another online marketplace, offers a much broader range of items to rent out, such as baby strollers and bikes.

Ensure to consider maintenance costs for rental equipment and have the appropriate insurance. With the right rental market and demand, there may be opportunities to scale and expand your earning potential.

Bottom line

Achieving financial security can be facilitated by distributing your income between active and passive sources. Passive income comes from money gained automatically from an investment, product, or system that you have built, whereas active income requires exchanging time and effort for money.

To fully utilize the possibilities of both active and passive income streams, you must customize your strategy to your particular financial situation, goals, and available resources.