Have you ever checked your bank account to ensure that your next salary arrives before your rent is due? Perhaps you splurged on something expensive on an installment plan, cleverly spreading your payments across multiple credit card statements?

If so, you have already engaged in cash flow forecasting.

In accounting, cash flow forecasting is a method that allows businesses to estimate net income over a certain time period, assisting business owners in meeting obligations, monitoring spending, and planning for future growth.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the amount of cash that will enter and leave a business over a given period.

Let’s say that an interior design consulting business wants to run a 12-month cash flow forecast. If this company anticipates an inflow of $80,000 and an outflow of $30,000 over the next 12 months, it can forecast a net cash flow (or net income) of $50,000 for that period of time.

There are two different methods of cash flow forecasting: the direct method, which deals with known income and expenses, and the indirect method, which deals with projected income and expenses.

- Direct cash flow forecasting. Direct forecasting deals with known costs and this method is generally appropriate for short-term forecasting. A business might use direct cash flow forecasting at the beginning of a month, for example, to make sure that it will have enough working capital to pay end-of-month bills.

- Indirect cash flow forecasting. Indirect cash flow forecasting is the method used to make long-term predictions, and it involves using projected balance sheets (also known as pro forma balance sheets) and projected income statements. The indirect method also accounts for factors that affect profitability but don’t affect cash balance, such as depreciation on buildings and equipment.

Cash flow forecasting provides many strategic advantages, from helping businesses pay off debt to maximizing returns on current assets.

- It can help businesses make informed decisions about cash outflow. Business owners are constantly prioritizing potential investments. Whether you’re targeting a new hire, a planned marketing expenditure, or an investment in facilities, predicting net cash flow can help you time expenditures strategically.

- It can help businesses identify cash outflow patterns. By tracking outflows, cash flow forecasting can help you identify potential opportunities to eliminate unnecessary expenses. It can also help you ensure that all of your bills don’t come due on the same day, which would require you to carry an unnecessarily large amount of cash on hand.

- It can help businesses project growth or manage debt repayment timelines. Being able to anticipate profits and losses over the course of a quarter, a year, or more can help businesses plan for the future. For example, if your business took out a start-up loan, cash flow projections can help you develop a repayment timeline, and reviewing monthly cash flows can help you evaluate if you’re on target to meet that goal. The same is true of accrued profits. You might not be able to make a new hire today, but cash flow forecasting can tell you at what point it might be wise to add to your team.

- It can help you put your funds to work. Businesses should operate with enough working capital that they are able to cover all planned expenses. Most also keep some cash in reserve. Beyond this, letting cash pile up in your business bank account is unwise. That cash is better invested—either in markets or in the growth of your business. Cash flow forecasting can help you free up funds for income-generating activities.

How to Forecast Cash Flow

A well-designed forecasting model enables organizations to plan for future cash shortages and surpluses more effectively. However, a well-designed forecasting model will appear different for each organization because the optimal way to create the model is dependent on the organization’s specific business objectives.

The following is the process we advocate for creating a cash forecasting model that will give your firm the visibility it needs to make smart business decisions with its cash.

1. Determine Your Business Objective

The more you tailor your forecasting model to a specific business objective, the more likely it is that your model will provide useful insights. So the first step in building an effective model is to hone in on the objective you want it to support.

We find that organizations most commonly use cash forecasts for one of the following objectives:

- Short-term liquidity planning: Monitoring your business’s cash balance on a day-to-day basis to meet short-term obligations like salaries or vendor payments

- Interest and debt reduction: Planning for payments on any loans or debt your organization has taken on

- Covenant and key date visibility: Forecasting cash levels on key reporting dates, such as a month, quarter, or year-end

- Liquidity risk management: Identifying liquidity shortages that might arise, so you can plan to address them

- Growth planning: Managing working capital to fund activities that will help grow the business

It’s worth noting that there is often overlap between a forecasting model that best supports one objective and a model that best supports another. For example, businesses that wish to design a model to support liquidity risk management could also find that model useful for interest and debt reduction.

The extent to which there is an overlap will depend on the next two steps.

2. Choose a Reporting Period

Your reporting period refers to the granularity with which you project cash levels. The most common reporting periods are daily, weekly, and monthly. The best reporting period to choose for your forecasting model will depend on the business objective you selected above and how far into the future you wish to forecast cash flow.

Here are three of the most common reporting periods and the business objectives they’re best suited to support.

- Daily Reporting

Daily reporting classifies cash flow data on a daily basis. Daily Cash Forecasting is particularly useful for short-term liquidity management, where companies require a detailed view of cash positions and use a cash forecasting model to manage the day-to-day cash requirements of the business.

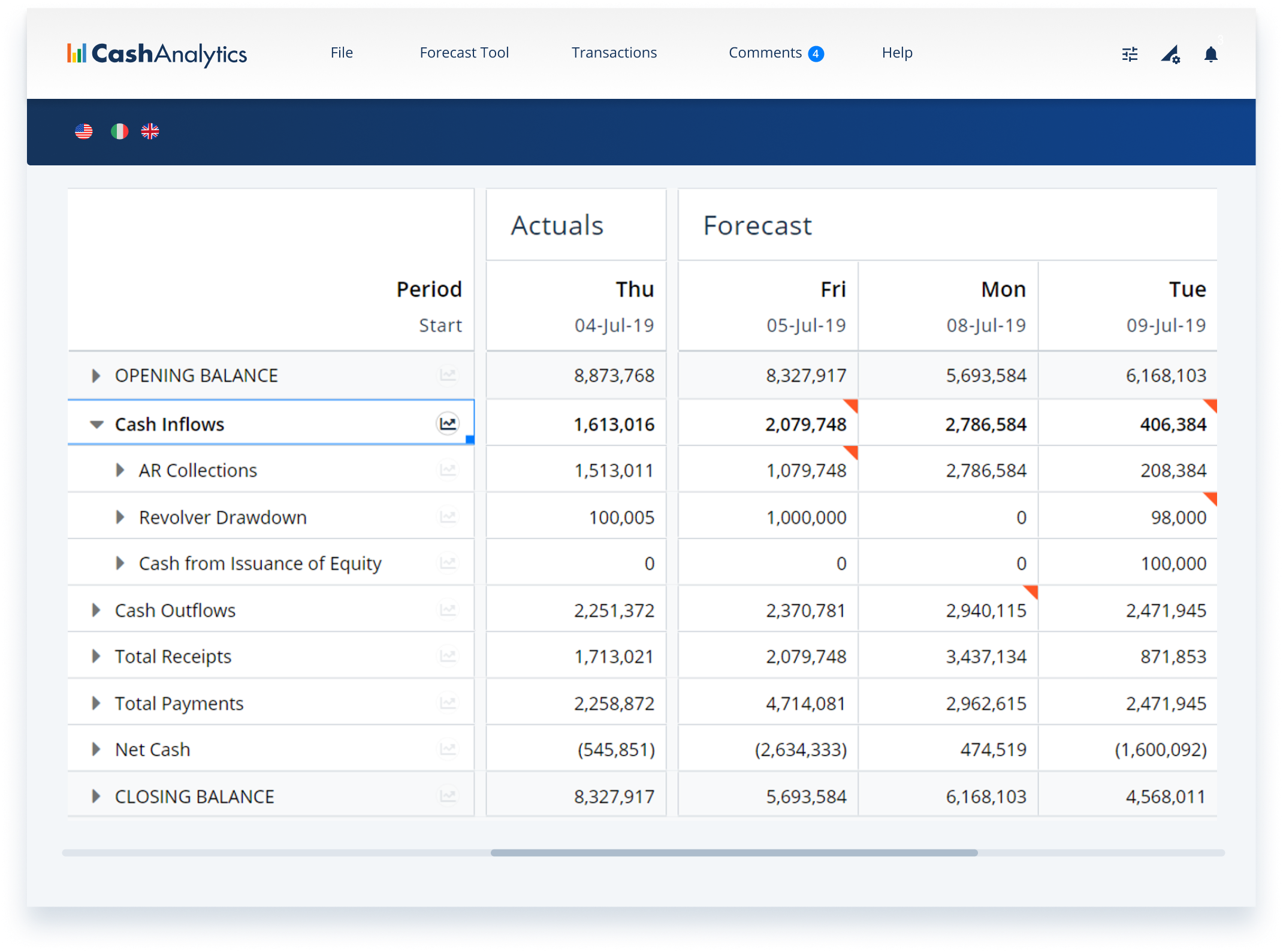

The screenshot below shows an example of a daily cash forecasting template, where each column represents a single day and each row details cash inflows and outflows in various categories:

Gaining an accurate view of liquidity levels on a daily basis requires a high level of detail and granularity. So cash flows are often tracked on a customer or supplier basis rather than broader cash classifications, such as trade payments or receipts.

Gaining an accurate view of liquidity levels on a daily basis requires a high level of detail and granularity. So cash flows are often tracked on a customer or supplier basis rather than broader cash classifications, such as trade payments or receipts.

Daily forecasting periods are best for reporting cash flows up to four weeks into the future.

- Weekly Reporting

Weekly reporting classifies cash flow predictions on a weekly basis. Weekly reporting periods are particularly useful for companies that are planning for debt repayments, have debt covenants they must uphold from lenders, require reporting date visibility, or are trying to manage future liquidity risks.

Read Also: 10 Strategies to Increase Cash Flow for Small Businesses

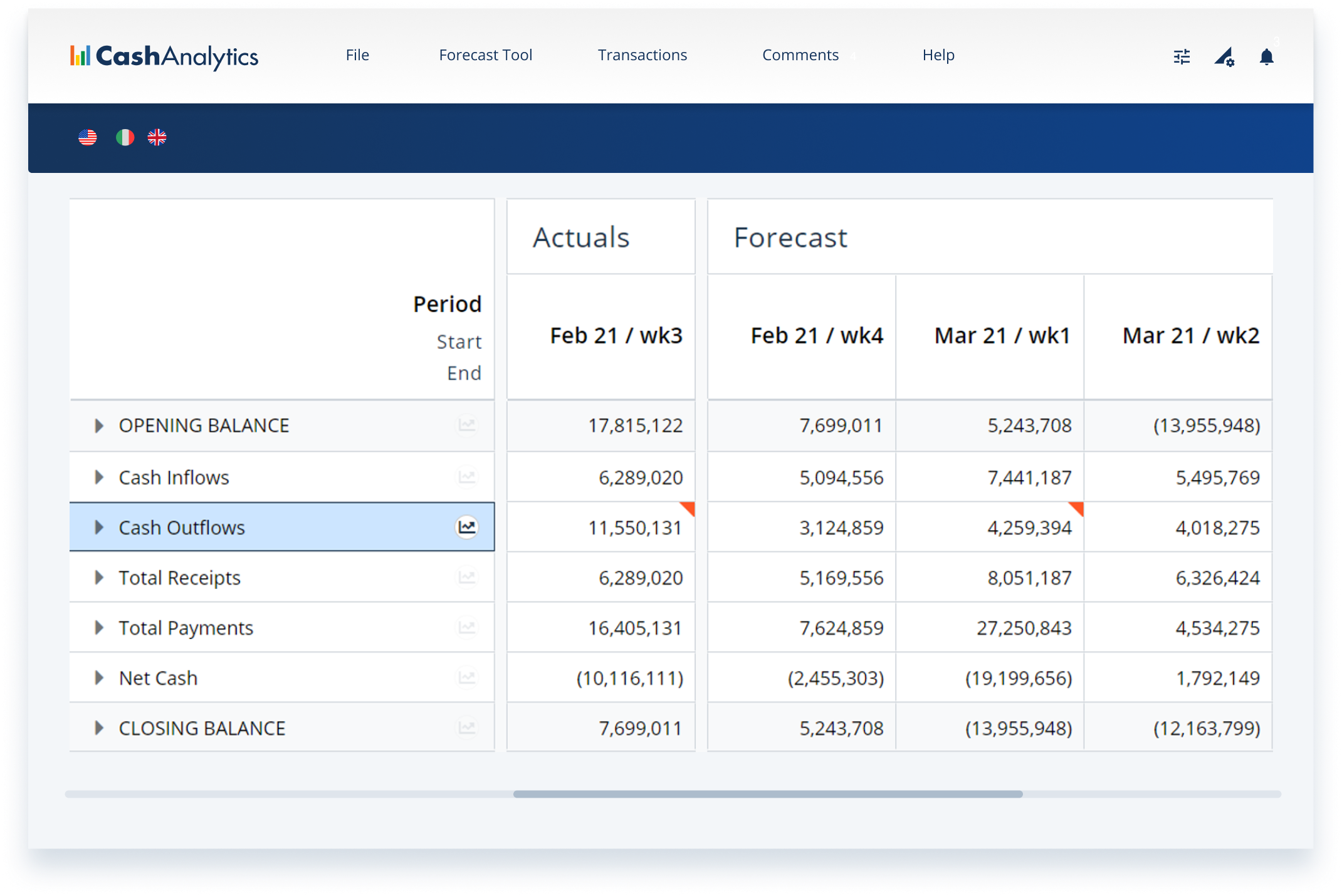

The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week:

The most regularly used weekly forecasting model is a 13-week Cash Flow Forecast because it provides both a reasonable degree of accuracy and a quarterly view of upcoming cash flows at all times.

Weekly forecasting periods are best for forecasting one to four months into the future.

- Monthly Reporting

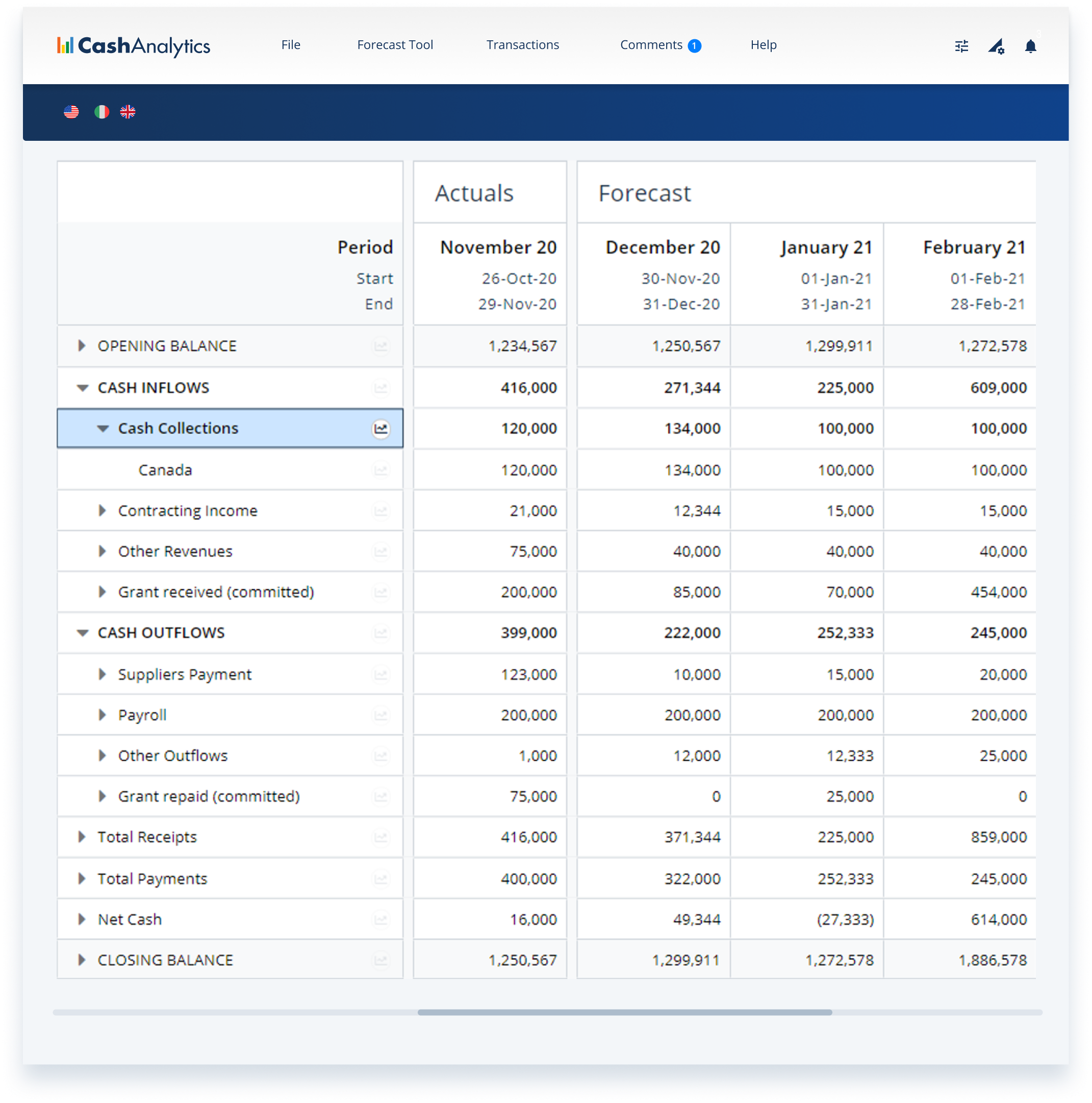

Monthly reporting classifies cash flow positions on a monthly basis. Monthly forecasting periods are ideal for longer-term planning purposes and are a logical extension of budgeting processes. The screenshot below shows an example of a monthly cash forecast template, with each column containing cash flows for a different month:

Monthly forecasting periods are best for forecasting 12 to 18 months into the future. But they can also be used as part of a mixed period forecast, where the first quarter is reported weekly and subsequent quarters are reported monthly.

3. Choose a Forecasting Method Based on Available Data

Your forecasting method is the data and data collection process you use to populate the cash inflows and outflows in your model. There are two forecasting methods you’ll need to choose between:

- Direct forecasting. Uses actual cash flow data from your enterprise resource planning (ERP) systems and bank accounts to populate your model. Direct forecasting is best suited for daily and weekly forecasting periods as access to accurate cash flow data more than 90 days into the future is often limited.

- Indirect forecasting. Compares balance sheets between accounts receivable or accounts payable to predict future liquidity levels. Indirect forecasting is best suited for medium to long-term views, as it doesn’t typically provide the kind of detail that short-term reporting often requires.

Generally speaking, direct forecasting is the most accurate method as long as you have access to actual cash flow and can collect it reliably.

How do You Create a Simple Cash Flow Model?

Many factors and processes come into play when creating a cash flow forecast. Here is a step-by-step guide to help you prepare one for your business.

1. Select a reporting period

The reporting period for your cash flow forecast depends on your goals and available data. But as a general rule, the forecasting period should provide reliable projections that align with your business objectives.

For instance, short-period forecasts are ideal for short-term liquidity planning for two to four weeks. Meanwhile, medium-period forecasts are useful in reducing interest and debt and managing liquidity risk for two to six months into the future.

2. Select a forecasting method

There are two types of forecasting methods: direct and indirect. The former is typically for creating short-term forecasts. The latter is for long-term forecasts.

Direct forecasting is based on cash accounting. This type of accounting method recognises that a transaction only happened if there was an exchange of cash. It involves analysing your organisation’s cashflow like payments made to suppliers and employees as well as receipts from customers.

On the other hand, indirect forecasting is based on the accrual method. In contrast to cash accounting, this method recognises transactions when they are earned and not when the payments are received. Not one forecasting method is better than the other. Use the one based on your chosen cash flow forecasting period and the available data needed to create your forecasting model.

3. Gather the data you need for your report

The key to having an accurate cash flow forecast is analysing the right data. For example, gathering receipts from the previous year or forecasting period can help you get accurate cash outflows.

You can use a receipt tracking software to manage, automate, track, and reconcile your business expenses in one platform. Make sure the software is user-friendly and accessible. Your receipt tracking software should also be able to integrate with your accounting tools for you to generate an accurate financial report.

4. Determine the beginning balance

The starting point of every cash flow forecast is your beginning or opening balance. The closing balance of the last period will typically be brought forward as the opening balance for the current period.

5. Estimate the next period’s cash inflows

Next, you should look at trends from your previous forecasting period to predict your cash inflows for the succeeding period. Gather all the sources you’ll need to analyse—revenues, tax refunds, sales made on credit, loans or payments people owe you, grants, and royalties or license fees for a more accurate prediction

6. Estimate the next period’s cash outflows

Making estimates of your potential cash outflows or expenses can help you determine if the company has enough funds to continue or expand its operations. Cash outflow estimates also allow you to check if your expenses exceed your cash inflows, which can lead to financial strain.

Track all the relevant or recurring expenses for your cash outflow forecast—rent, utilities, insurance, supplies, loan repayments, and new assets. You can export data from your expense management software to automatically generate a report of cash outflows.

7. Determine the closing balance

Your closing balance will be your beginning balance in your next cash flow forecasting period. You can calculate your closing or ending balance by subtracting the expenses from the income and then adding the outcome to the beginning balance.

Beginning balance + projected inflows – projected outflows = Closing balance

You can repeat this process for each forecasting period and keep a running total of your weekly or monthly cash flows to get an accurate forecast over time.

How do you Calculate Cash Flow Forecast for a Business?

1. Free cash flow formula

One of the most common and important cash flow formulas is free cash flow (or FCF). While a traditional cash flow statement (like the kind you can get from Wave reports) gives you a picture of your business’s cash at a given time, that doesn’t always help with planning and budgeting—because it doesn’t truly reflect the cash you have available, or free to use.

Can you afford to invest in that new software? Do you have enough cash on hand to pay for that virtual assistant when their invoice comes due? How much cash do you have free to spend on thank you cards for your clients?

Calculating the cash you have available to spend (via the FCF formula) helps answer those questions and others like them.

- How to calculate free cash flow

Calculating your business’s free cash flow is actually easier than you might think. To start, you’ll need your company Income Statement or Balance Sheet to pull key financial numbers.

First, let’s get some important financial terms straight.

- Net income: The total income left over after you’ve deduced your business expenses from total revenue or sales. You’ll find this on your Income Statement.

- Depreciation/Amortization: Many of your business assets (like equipment) lose value over time. Depreciation is the measurement of how that value decreases. Amortization, on the other hand, is a method of breaking down the initial cost of an asset over its lifetime. You’ll find depreciation and amortization on your Income Statement.

- Working Capital: Working capital is the difference between your assets and liabilities and represents the capital used in the day-to-day operation of your business. You can calculate your working capital using the total assets and liabilities on your Balance Sheet.

- Capital Expenditure: Capital expenditures include money your business spends on fixed assets, like land, real estate, or equipment. You can find your capital expenditure on the Statement of Cash Flows.

With that knowledge in hand, the basic formula for free cash flow looks like this:

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

2. Operating cash flow formula

Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow.

While free cash flow gives you a good idea of the cash available to reinvest in the business, it doesn’t always show the most accurate picture of your normal, everyday cash flow. That’s because the FCF formula doesn’t account for irregular spending, earning, or investments. If you sell off a large asset, your free cash flow would go way up—but that doesn’t reflect typical cash flow for your business. When you need a better idea of typical cash flow for your business, you want to use the operating cash flow (OCF) formula.

For example, if you’re looking to secure outside funding from a bank or venture capital firm, they’re more likely to be interested in your operating cash flow. The same goes if you begin working with an accountant or financial consultant, so it’s important to understand what OCF looks like for you before seeking funding.

- How to calculate operating cash flow:

Just as with our free cash flow calculation above, you’ll want to have your Balance Sheet and Income Statement at the ready, so you can pull the numbers involved in the operating cash flow formula.

There’s one other financial metric you’ll need to know for this calculation:

- Operating Income: Also called Earnings Before Interest and Taxes (or EBIT) and profit, your operating income subtracts operating expenses (like wages paid and cost of goods sold) from total revenue. You can find operating income on your Income Statement.

The basic OCF formula is:

Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital

Finally

Calculating cash flow formulae may not excite you as a small business owner, but running out of cash is not something any business owner wants to deal with.

Keeping track of cash flow into and out of your organization gives you a more complete picture of its financial health. You may predict and fix cash flow problems before they occur, as well as streamline your operations to make cash flow problems a thing of the past.