When it comes to finance management, one topic that comes to mind is Compound Interest. If you fully understand what compound interest is and you apply it to your finance, it will help you earn a higher return on your savings and investments, but it can also work against you when you’re paying interest on a loan.

This ultimate guide is aimed at helping you better understand what compound interest is, how it works, how to calculate it, and the benefits of applying it to your finance management.

- What is Compound Interest?

- How does Compound Interest work?

- How to Calculate Compound Interest

- Advantages and Disadvantages of Compound Interest

- Best Accounts for Compound Interest

- Compound Interest Investment

- What is the Compound Growth Rate

- How to Calculate the Compound Growth Rate?

- Compound Interest and Retirement Investing

- What Makes Compound Interest Powerful?

- How to Get Compound Interest

- Example of Compound Interest in Real Life

- Monthly Compound Interest Calculator

- Compound Interest Formula

- How Does Compound Interest Make Your Money Work For You?

- Can Compound Interest Make You Rich?

- Who Pays Compound Interest?

- How Long Does it Take For Compound Interest to Work?

- What Will 100k Worth in 20 Years?

- How is Compound Interest Used in Banks?

- Compound Interest Real Life Problems

- Example of Real Life Application of Compound Interest

- Best Example of Compound Interest

What is Compound Interest?

Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Compound interest can be thought of as “interest on interest,” and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount.

Read Also: How to Budget for Personal Finance

Apart from compound interest, we also have simple interest.

- Simple interest is calculated on the principal, or original, amount of a loan.

- Compound interest is calculated on the principal amount and also on the accumulated interest of previous periods, and can thus be regarded as “interest on interest.”

There can be a big difference in the amount of interest payable on a loan if interest is calculated on a compound rather than simple basis. On the positive side, the magic of compounding can work to your advantage when it comes to your investments and can be a potent factor in wealth creation.

While simple interest and compound interest are basic financial concepts, becoming thoroughly familiar with them may help you make more informed decisions when taking out a loan or investing.

How does Compound Interest work?

To understand compound interest, first, start with the concept of simple interest: you deposit money, and the bank pays you interest on your deposit.

For example, if you earn a 5% annual interest, a deposit of $100 would gain you $5 after a year. What happens the following year? That’s where compounding comes in. You’ll earn interest on your initial deposit, and you’ll earn interest on the interest you just earned.

Therefore the interest you earn the second year will be more than the year before because your account balance is now $105, not $100. So even though you didn’t make any deposits, your earnings will accelerate.

- Year One: An initial deposit of $100 earns 5% interest, or $5, bringing your balance to $105.

- Year Two: Your $105 earns 5% interest, or $5.25; your balance is now $110.25.

- Year Three: Your balance of$110.25 earns 5% interest, or $5.51; your balance is now $115.76.

The above is an example of interest compounded yearly; at many banks, especially online banks, interest compounds daily and gets added to your account monthly, so the process moves even faster.

Of course, as you can imagine, if you’re borrowing money, compounding works against you and in favor of your lender instead. You pay interest on the money you’ve borrowed; the following month, if you haven’t paid, you owe interest on the amount you borrowed plus the interest you accrued.

How does Compound Interest work on a Loan

Compound interest is the interest that is added to a loan’s principal as it accumulates. This causes the rate at which the interest grows to increase over time.

Compound interest is added to the principal as it accumulates. That means that even though the interest percentage remains the same, the amount of interest added will be higher after each compounding.

As an example, imagine that you took out a $100 loan at a 10% monthly interest rate, and you plan to pay it back in three months. With a simple interest rate, you’ll pay $130, because of the $100 principal, plus $10 in interest for each of the three months. Simple!

Now imagine that a $100 loan has a compound interest rate of 10%. Assuming the interest compounds every month and you’re still going to be paying it back in three months, you’ll end up paying $133.10. That’s because after the first month, $10 will be added to the principal, bringing it up to $110. The second month, 10% of $110, or $11, will be added to the principal, totaling $121. Finally, for the third month, $12.10 will be added to the principal, for a total payment of $133.10.

Of course, it’s never going to be that simple in real life, so you’ll likely need a calculator.

Many loans use compound interest, so it’s up to you to be certain what kind of interest any given loan might have before you borrow. Credit card loans and student loans are two kinds of loans that are likely to use compound interest.

Many student loans even compound interest daily. It’s important that your payments are amortized, which means that each payment pays off part of the interest as well as the principal. Without a proper payment schedule, you could end up paying off the interest on a compound loan forever as the principal keeps growing.

How long does it take for Compound Interest to work?

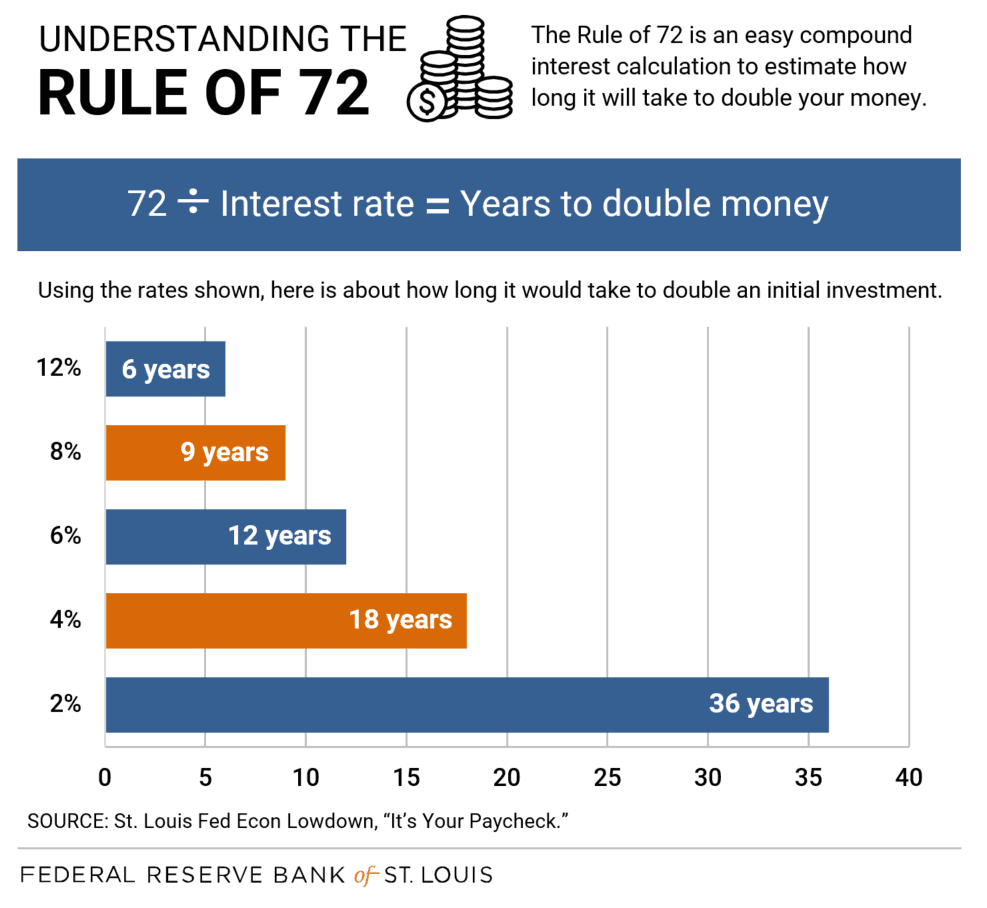

Calculating the length of time it takes for compound interest to work gave birth to “The Rule of 72”. What is the rule of 72?

The Rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. Simply divide 72 by the interest rate to determine the outcome.

For example, at a 2 percent interest rate, it would take 36 years to double your money. At a 12 percent interest rate, it would only take six years to double your money.

You can also use the Rule of 72 to approximate how much an amount would grow over a time period. Let’s say you wanted to set aside $5,000. How would your investment grow after 36 years with a 2 percent versus 8 percent interest rate? (We’ll assume you don’t make any additional contributions to the principal and that interest is compounded annually.)

How long will it take to double your money at 2 percent interest?

- Using the Rule of 72: We know that 72÷2=36, so $5,000 would double to $10,000 during our 36-year time frame.

- Using Investor.gov compound interest calculator: The result is pretty close. The calculator shows $5,000 would be worth about $10,200 after 36 years.

How long will it take to double your money at 8 percent interest?

- Using the Rule of 72: Time for math. If we divide 72÷8, the answer is nine. That means your $5,000 would double in about nine years. But wait—you have 36 years. Your money will double four times in that period (36÷9=4)! The first nine years, it doubles to $10,000. After 18 years, that amount doubles to $20,000. After 27, that amount doubles to $40,000. And finally, $40,000 doubles to $80,000 at 36 years.

- Using Investor.gov compound interest calculator: Close again; $5,000 would be worth about $79,840 after 36 years.

Got the hang of the Rule of 72? Try estimating how $5,000 would grow at 12 percent over 36 years. Click the “1” at the end of this sentence for the answer.

These examples illustrate the importance of the interest rate and duration of your investments. With that being said, risk tolerance should always be considered with higher interest rates; a higher rate of return generally comes with additional risk.

How does Compound Interest work on Stocks

Here is an example to better explain how compound interest works on stocks. A $10,000 investment earning 5% a year will be worth $26,533 in 20 years. If you can increase that return to 10%, the future value grows to $67,275. There are many compound interest calculators on the Internet that you can play with to get a feel for how the level of returns over various time periods has a profound impact on your results.

Most market participants think of compounding only in terms of a specific stock or in the form of a bank account where interest is constantly reinvested. The thing they overlook is that compounding is primarily a function of making sure that the assets you are investing in stay near their highs at all times. With a bank account, you don’t have this problem. The dollars you invest don’t go down in value, but with stocks that is the primary consideration.

Typically, people try to copy what they think Warren Buffett does. They buy just a few great stocks that they are sure will continue to rise steadily over a long period. In retrospect, it is easy to find things such as Apple Inc. (AAPL) , Microsoft Corp. (MSFT) and Facebook Inc. (FB). It is a much more difficult process when you try it on a prospective basis. What stock can you buy today that will act as Apple has over the past 20 years? If we knew that with great certainty we’d all be on our yachts in the Caribbean.

The big risk with compounding is that you are in the wrong asset. Compounding works in reverse as well. Holding a stock that doesn’t appreciate for many years is the more common situation that investors face and is extremely costly.

One way to reduce the risk of picking the wrong stock is to think of your portfolio as a single asset. It doesn’t much matter what stocks you may hold at any particular time as long as your portfolio remains near its highs. That is how a trader can harness the power of compounding.

If you think of your portfolio of stocks as a single asset it changes your focus. Rather than just try to find a few good stocks to hold, you focus on carefully managing the stocks you do hold. Those that don’t help keep your account near highs are eliminated and those that help it grow faster are added. If you do this effectively, your asset base will grow and the compounding effect will be of great benefit.

How does Compound Interest work with ETF?

An ETF holds real businesses within it. Most of those businesses pay dividends. Each year, on aggregate, dividend payouts increase. That doesn’t mean the dividend yields increase. But the cash payout increases for each share held. The dividend yield is determined by dividing the price of the stock (or the ETF) by the dividends received.

Let’s say a stock was valued at $10. If the dividend payout were 20 cents per share, we would have a dividend yield of 2%. Next year, that dividend payout could increase to 25 cents. Now imagine the stock price doubling to $20 per share. The dividend payout would still have increased to 25 cents, from 20 cents, but the posted dividend yield would now be lower, relative to the new price. The new dividend yield would be 1.25%.

However, when you keep adding the increasing cash payouts (of the increasing dividends) to buy more shares, those new shares throw off more dividends, which in turn can buy more shares. So there’s a compounding effect here.

There’s also a compounding effect with the ETF’s price. It does not increase at a linear dollar level. As I explained in my book, Millionaire Teacher (2nd edition) on pages 90-100, a stock’s price (or an ETF’s price level) increases in proportion to the growth of the businesses that it holds within it. Long term, there is a one to one correlation. By long-term, I’m referring to periods of 15 years or longer.

Let’s say you have an ETF that trades at $10 per unit. If it grew by 10% linearly per year, it would increase by $1 every year. After 21 years, it would be worth $31. But that’s not what happens with business growth. Business growth increases exponentially. It compounds. Like business growth, the year-to-year growth of a stock or ETF’s price isn’t measured based on the year you first bought your ETF.

It’s measured based on what level the ETF was at the previous year. That means, if this ETF grew in price at a compounding rate of 10% per year it wouldn’t have increased by $1 in its 21st year if it gained 10%. It would have increased by $6.72 in its 21st year. Over 21 years, the price of the ETF would have increased to about $74.

How does Compound Interest work on Credit Cards?

When you make a charge on your credit card, the bank that issued the card pays the vendor the amount owed and you pay back the money borrowed, in addition to interest. Interest is a percentage-based surcharge, generally between 7 percent and 36 percent, paid for the privilege of borrowing the bank’s money. Compound interest arises when interest is added to the principal and that added interest earns interest.

With compound interest, the interest owed becomes part of the principal. If you borrowed $1,000 and you’re charged 2 percent per day until the end of the month, you are dealing with compound interest. At the end of the first day, you would owe $1,020.

At the end of the second day, you’d owe 1,040.4 ($1,020 multiplied by 0.02 and added to $1,020). At the end of the third day, you’d owe 1,061.21 ($1,040 multiplied by 0.02 and added to $1,040), and so on. If you have a high-interest rate, your balance can increase exponentially as you continue to pay interest on the interest.

How does Compound Interest work with Mutual Funds

Mutual funds are designed to make the most out of the power of compounding. Investors gain when the value of fund units goes up. If you invest with a long-term horizon, then the power of compounding will be unleashed to the fullest, which helps you grow your investment. This is particularly the case in mutual funds as the returns generated in the form of capital gains are reinvested to create additional profits.

If you choose to invest Rs 1,000 a month in a mutual fund scheme for the next ten years, and if the rate of return is 8% per annum, then you will notice that your investment of Rs 1,20,000 in 10 years will yield you a profit of Rs 1,82,946. Now if you choose to invest it further for say another ten years, then money now reinvested will grow even faster to fetch you Rs 3,94,967. A unique feature of compounding is that your existing investment, along with the return on investment and the new investment each month, all contribute towards further gains.

Below is an example.

Here is another example. Consider a mutual fund opened with an initial investment of $5,000 and subsequent ongoing annual additions of $2,400. With an average of 12% annual return over 30 years, the future value of the fund is $798,500.

The compound interest is the difference between the cash contributed to and the actual future value of the investment. In this case, by contributing $77,000—or a cumulative contribution of just $200 per month over 30 years—compound interest comes to $721,500 of the future balance.

How does Compound Interest work on 401k

Compounding means that you keep earning interest or growth on the interest or growth you’ve already earned. If you have $2,000 in your 401k account and it grows by 8 percent, you end up with $2,160. If you just got 8 percent on the same $2,000 in the second year, you’d get another $160, giving you $2,320.

However, if your account compounds, the entire $2,160 would grow at 8 percent, leaving you with $2,332.80. That extra $12.80 might not seem like a lot, but it adds up quickly. At 8 percent uncompounded, your money doubles in 12.5 years. With yearly compounding, it doubles after nine years.

Growth in a 401k depends on what you buy. If your 401k holds funds in stocks that don’t pay dividends, no cash is coming out to compound even if the shares keep growing in value. When cash from your investments goes into your 401k account, that cash has to be reinvested into something for you to enjoy the benefits of compounding.

Otherwise, you could have a bond fund paying you 5 percent, then have the interest sitting in a cash account, uninvested and not earning. The best way to ensure you are getting all of your compound growth is to talk to your plan administrator and see how your investment’s returns are reinvested.

How does Compound Interest work in Roth IRA

Whenever the investments in your account earn a dividend or interest, that amount is added to your account balance. How much the account earns depends on the investments they contain. Remember, IRAs are accounts that hold the investments you choose (they are not investments on their own). Those investments put your money to work, allowing it to grow and compound.

Your account can grow even in years in which you aren’t able to contribute. You earn interest, which gets added to your balance, and then you earn interest on the interest, and so on. The amount of growth your account generates can increase each year because of the magic of compound interest.

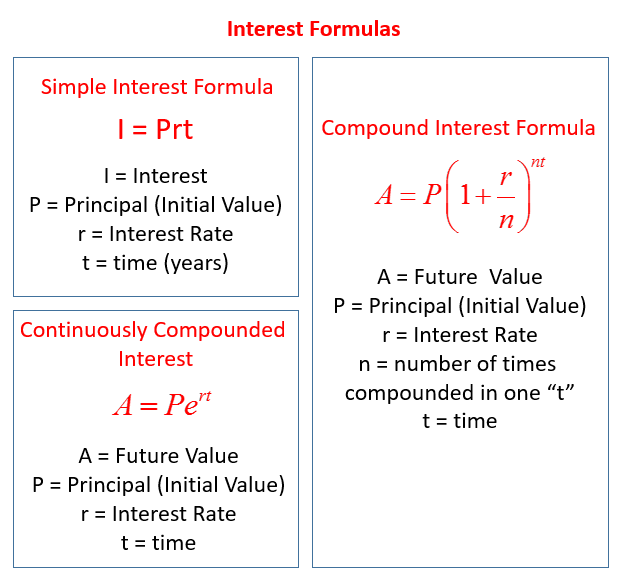

How to Calculate Compound Interest

You can calculate compound interest in several ways to gain insight into how you can reach your goals and help you keep realistic expectations. Any time you run calculations, examine a few “what-if” scenarios using different numbers and see what would happen if you save a little more, or earn interest for a few years longer.

Online calculators work the best, as they do the math for you and can easily create charts and year-by-year tables. But many people prefer to look at the numbers in more detail by performing the calculations themselves. You can use a financial calculator that has storage functions especially for formulas or a regular calculator, as long as it has a key to calculate exponents.

Use the following formula to calculate compound interest:

A = P (1 + [ r / n ]) ^ nt

To use this calculation, plug in the variables below:

- A: The amount you’ll end up with

- P: Your initial deposit, known as the principal

- r: the annual interest rate, written in decimal format

- n: the number of compounding periods per year (for example, monthly is 12 and weekly is 52)

- t: the amount of time (in years) that your money compounds

Example: You have $1,000 earning 5% compounded monthly. How much will you have after 15 years?

- A = P (1 + [ r / n ]) ^ nt

- A = 1000 (1 + [.05 / 12]) ^ (12 * 15)

- A = 1000 (1.00417) ^ (180)

- A = 1000 (2.11497)

- A = 2113.70

After 15 years, you’d have roughly $2,114. Your final number may vary slightly due to rounding. Of that amount, $1,000 represents your initial deposit, while the remaining $1,114 is interest.

A sample spreadsheet on Google Docs shows how it works along with a download copy to use your numbers.

Spreadsheets

Spreadsheets can do the entire calculation for you. To calculate your final balance after compounding, you’ll generally use a future value calculation. Microsoft Excel, Google Sheets, and other software products offer this function, but you’ll need to adjust the numbers a bit.

Using the example above, you can do the calculation with Excel’s future value function:

=FV(rate,nper,pmt,pv,type)

Enter each of your variables into separate cells and then refer to those cells so that you don’t have to get everything right in one shot. For example, Cell A1 might have “1000,” Cell B1 might show “15,” and so on.

The trick to using a spreadsheet for compound interest is using compounding periods instead of simply thinking in years. For monthly compounding, the periodic interest rate is simply the annual rate divided by 12 because there are 12 months or “periods” during the year. For daily compounding, most organizations use 360 or 365.

- =FV(rate,nper,pmt,pv,type)

- =FV([.05/12],[15*12], ,1000,)

Notice that you can leave out the pmt section, which would be a periodic addition to the account. If you were adding money monthly, this might come in handy. Type is also not used in this case.

Compound Interest Calculators

For individuals who are not too good with Maths, there are online compound interest calculators to help. Here are some of them.

- The Calculator Site

- Investor.gov

- Calculatorsoup

- MoneyChimp

- Bankrate

Compound Interest Examples

Example 01:

Find the compound amount and compound interest on the principal Rs.20,000 borrowed at 6% compounded annually for 3 years.

Solution:

Let P = 20000, r = 6%, n = 3

using formula

A=P(1+r)n=20000(1+.06)3=23820.32A=P(1+r)n=20000(1+.06)3=23820.32

The compound interest =23820.32–20000=3820.32=23820.32–20000=3820.32

Example 02:

Find the compound amount which would be obtained from the interest of Rs.2000 at 6% compounded quarterly for 5 years.

Solution:

Let principal = 2000, r=6%=64×100=.015r=6%=64×100=.015, n=5×4=20quartersn=5×4=20quarters

∴A=P(1+r)n=2000(1+.015)20=2693.71∴A=P(1+r)n=2000(1+.015)20=2693.71

Example 03:

Find compound interest on Rs.2500 invested at 6% per annually, compound semi-annually for 8 years.

Solution:

Let Principal = 2500, r=6%=0.06616=0.03r=6%=0.06616=0.03, n=8×2=16n=8×2=16

We know that

A=P(1+r)n=2500(1+.03)16=4011.73

The compound interest = 4011.73–2500=1511.73

Daily Compound Interest Formula

Daily compounding is basically when our daily interest/return will get the compounding effect. The concept is such that it assumes that the interest earned every day is reinvested at the same rate and will get increased as the time passes. That is the reason that if we annualized the daily compound interest, it will be always higher than the simple interest rate.

Formula For daily compound interest:

Generally, the rate of interest on investment is quoted on a per annum basis. So the formula for an ending investment is given by:

Ending Investment = Start Amount * (1 + Interest Rate) ^ n

Where n – Number of years of investment

This formula is applicable if the investment is getting compounded annually, means that we are reinvesting the money on an annual basis. For daily compounding, the interest rate will be divided by 365 and n will be multiplied by 365, assuming 365 days in a year.

So

Ending Investment = Start Amount * (1 + Interest Rate / 365 ) ^ (n * 365)

How to Solve Compound Interest Problems

In compound interest, the principal amount with interest after the first unit of time becomes the principal for the next unit.

Say, when compounded annually for 2 years, the principal amount with interest accrued at the end of first year becomes the principal for the second year.

Compound Interest Formula:

Amount = Principal * [1 + Rate of Interest/100]Time period

Abbreviated as Amount = P * [1 + R/100]t, when compounded annually.

Sometimes, the interest is also calculated half-yearly or quarterly.

When compounded semi-annually or half-yearly,

Amount = P[1 + (R/2)/100]2t

When compounded quarterly,

Amount = P[1 + (R/4)/100]4t

The present worth of Principal P due t years hence is given by:

P/[1+ R/100]t

Sample problems and solutions

Let us work on some examples to understand the concepts and differences.

Problem 1. A sum of Rs. 25000 becomes Rs. 27250 at the end of 3 years when calculated at simple interest. Find the rate of interest.

Solution:

Simple interest = 27250 – 25000 = 2250

Time = 3 years.

SI = PTR / 100 → R = SI * 100 / PT

R = 2250 * 100 / 25000 * 3 → R = 3%.

Problem 2. Find the present worth of Rs. 78000 due in 4 years at 5% interest per year.

Solution:

Amount with interest after 4 years = Rs. 78000

Therefore, simple interest = 78000 – Principal.

Let the principal amount be p.

78000 – p = p*4*5/100 → p=13000

Principal = 78000 – 13000 = Rs. 65000

Problem 3. A certain principal amounts to Rs. 15000 in 2.5 years and to Rs. 16500 in 4 years at the same rate of interest. Find the rate of interest.

Solution:

The amount becomes 15000 in 2.5 years and 16500 in 4 years.

Simple interest for (4-2.5) years = 16500 – 15000

Therefore, SI for 1.5 years = Rs. 1500.

SI for 2.5 years = 1500/1.5 * 2.5 = 2500

Principal amount = 15000 – 2500 = Rs. 12500.

Rate of Interest = 2500 * 100 / 12500 * 2.5 → R = 8%.

Advantages and Disadvantages of Compound Interest

Even though a lot of advantages exist in the compound interest theory, compounding can also work against consumers who have loans that carry very high-interest rates, such as credit card debt. A credit card balance of $20,000 carried at an interest rate of 20% compounded monthly would result in a total compound interest of $4,388 over one year or about $365 per month.

On the positive side, the magic of compounding can work to your advantage when it comes to your investments and can be a potent factor in wealth creation. Exponential growth from compounding interest is also important in mitigating wealth-eroding factors, like rises in the cost of living, inflation, and reduction of purchasing power.

Mutual funds offer one of the easiest ways for investors to reap the benefits of compound interest. Opting to reinvest dividends derived from the mutual fund results in purchasing more shares of the fund. More compound interest accumulates over time, and the cycle of purchasing more shares will continue to help the investment in the fund grow in value.

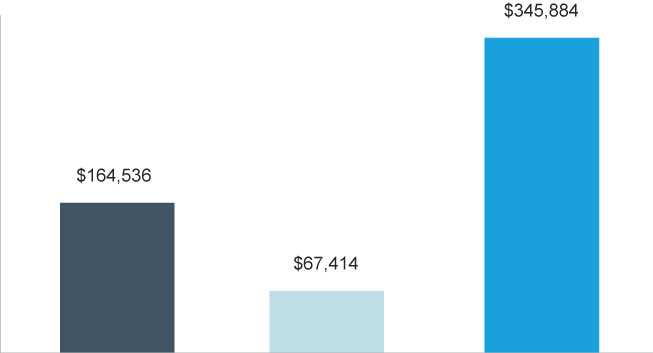

Consider a mutual fund investment opened with an initial $5,000 and an annual addition of $2,400. With an average of 12% annual return of 30 years, the future value of the fund is $798,500. The compound interest is the difference between the cash contributed to investment and the actual future value of the investment.

In this case, by contributing $77,000, or a cumulative contribution of just $200 per month, over 30 years, compound interest is $721,500 of the future balance. Of course, earnings from compound interest are taxable, unless the money is in a tax-sheltered account; it’s ordinarily taxed at the standard rate associated with the taxpayer’s tax bracket.

Best Accounts for Compound Interest

Comenity Direct – 1.70% APY, $100 minimum opening deposit

Comenity Direct launched in April 2019. It’s an online-only bank that offers a high-yield savings account and CDs. Since it launched, Comenity Direct has offered a competitive yield on its savings account. The bank offers five terms of CDs. Comenity Direct is a brand of Comenity Capital Bank.

Comenity Direct launched in April 2019. It’s an online-only bank that offers a high-yield savings account and CDs. Since it launched, Comenity Direct has offered a competitive yield on its savings account. The bank offers five terms of CDs. Comenity Direct is a brand of Comenity Capital Bank.

Unlike the Comenity Direct CDs, which have a $1,500 minimum requirement, the high-yield savings account only requires $100 to open an account.

Popular Direct – 1.70% APY, $5,000 minimum opening deposit

Popular Direct offers a savings account and term CDs. Both the Popular Direct savings account and its CDs are for established savers since the CDs have a $10,000 minimum deposit requirement and the Ultimate Savings account requires a $5,000 minimum deposit.

All Popular Direct deposit accounts are opened through Popular Bank.

UFB Direct – 1.70% APY, $100 minimum opening deposit

UFB Direct is an online bank that offers a money market account and savings account. UFB Direct is a division of Axos Bank. It’s listed as a deposit accepting website under Axos Bank’s FDIC certificate.

The UFB High Yield Savings account offers a competitive yield on balances $10,000 and higher.

Vio Bank – 1.60% APY, $100 minimum opening deposit

Vio Bank, established in 2018, is the national online division of MidFirst Bank. MidFirst Bank has been an FDIC-insured bank since 1934 and was established in 1911. Vio Bank offers both a High-Yield Online Savings account and CDs.

Vio Bank’s High-Yield Online Savings account has one of the top yields around, and all balances receive this APY.

HSBC Direct – 1.60% APY, $1 minimum opening deposit

HSBC Direct products are offered in the U.S. by HSBC Bank USA, N.A.

HSBC Direct offers a savings account, a checking account and CDs. The HSBC Direct Savings account only requires $1 to open and there’s no monthly maintenance fee.

Your initial deposit needs to be new money, which are deposits and investments not previously held by any members of the HSBC Group in the U.S.

There is a $10 monthly service fee if you have a checking and savings account linked and don’t meet the requirements to have the fee waived.

Live Oak Bank – 1.55% APY, $0 minimum opening deposit

Live Oak Bank has been around since 2008. Live Oak Bank, which has its headquarters in Wilmington, North Carolina, offers a savings account and seven terms of CDs.

The online savings account, which is a personal account, offers a competitive yield and doesn’t have any monthly maintenance fees. There’s no minimum amount required to open this savings account.

Citibank – 1.55% APY, $0 minimum opening deposit

The Citi Accelerate Savings account has a competitive APY in select markets. It’s not available in some larger states, such as California and New York. The savings account doesn’t require a minimum balance to open the account.

There is a $4.50 monthly service fee if your savings account isn’t linked to a Citi checking account. You can avoid this fee by keeping an average monthly balance of at least $500 in your savings account if it’s not linked to a Citi checking account.

There is a $10 monthly service fee if you have a checking and savings account linked and don’t meet the requirements to have the fee waived.

CIT Bank – 1.55% APY, $100 minimum opening deposit

CIT Bank is CIT’s national direct bank and offers two savings accounts: the Savings Builder and the Premier High Yield.

You’ll need to either have $25,000 or more in the account or make at least one monthly deposit of at least $100 to earn the top APY in the Savings Builder account.

CIT Bank also launched its eChecking account in November 2019.

BrioDirect – 1.55% APY, $25 minimum opening deposit

BrioDirect is Sterling National Bank’s online brand. All BrioDirect savings deposit products are provided by Sterling National Bank, which was founded in 1888.

BrioDirect offers one of the highest APYs on its savings account. In addition to its savings account, BrioDirect also offers a checking account and 13 different terms of CDs.

Marcus by Goldman Sachs – 1.30% APY, $0 minimum opening deposit

Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA. Marcus offers a variety of CDs, three no-penalty CD terms and a competitive yield on its savings account.

Marcus by Goldman Sachs now has an app available on iOS and one coming to Google Play this spring, according to Marcus’ website.

American Express National Bank – 1.50% APY, $0 minimum opening deposit

American Express has been offering personal savings accounts to the general public for more than 10 years. The savings account doesn’t have a minimum balance requirement or monthly fees and has a competitive APY.

American Express has seven terms of CDs. But the APYs get more competitive starting with the 18-month CD and their other longer-term CDs.

Capital One Bank – 1.50% APY, $0 minimum opening deposit

Capital One has both a brick-and-mortar presence and is an online bank. It offers competitive yields across nine CD terms.

Capital One CDs and its 360 Performance Savings account don’t have minimum balance requirements. Its savings account earns the same competitive APY on all balances.

Barclays Bank – 1.30% APY, $0 minimum opening deposit

Barclays has a competitive yield on its savings accounts and CDs. It’s also known for its credit cards.

Barclays Bank doesn’t have minimum balance requirements to open its savings accounts and CDs, so it’s an option for savers of all levels. Besides a savings account, Barclays also offers nine CD terms. These CDs have a 14-day grace period to withdraw your money without being penalized. Many banks have only a 10-day grace period, though these vary at different banks.

Compound Interest Investment

An investor who opts for a reinvestment plan within a brokerage account is essentially using the power of compounding in whatever they invest. Investors can also experience compounding interest with the purchase of a zero-coupon bond.

Traditional bond issues provide investors with periodic interest payments based on the original terms of the bond issue, and because these are paid out to the investor in the form of a check, interest does not compound.

Zero-coupon bonds do not send interest checks to investors; instead, this type of bond is purchased at a discount to its original value and grows over time. Zero-coupon bond issuers use the power of compounding to increase the value of the bond so it reaches its full price at maturity.

Compounding can also work for you when making loan repayments. Making half your mortgage payment twice a month, for example, rather than making the full payment once a month, will end up cutting down your amortization period and saving you a substantial amount of interest.

A lot has been said about the power of compound interest and how it can help grow your money. The table below shows the investment part of compound interest.

As you can see, simply socking away one lump sum and leaving it could turn $1,200 into nearly $40,000 over 40 years. Not only have you earned interest, but you’ve earned interest on your interest. And all you had to do was invest your first paycheck.

That said, let’s be honest: $37,691 ain’t what it used to be. So let’s make one small revision and invest $1,200 every year. Behold compound interest.

And the best part about compound interest is that it works the same for everyone, whether you have $20 to invest or $200,000. Go ahead, tinker with this compounding calculator to see what we mean.

What is the Compound Growth Rate

The compound growth rate is a measure used specifically in business and investing contexts, that indicates the growth rate over multiple time periods. It is a measure of the constant growth of a data series. The biggest advantage of the compound growth rate is that the metric takes into consideration the compounding effect. Thus, it is especially significant in the assessment of returns from investments.

Unlike average growth rates that are prone to volatility levels, compound growth rates are not affected by volatility. Therefore, they are more relevant in the comparison of different data series.

How to Calculate the Compound Growth Rate?

The formula for calculating the compound growth rate is:

Where:

- Vn – the ending value

- V0 – the beginning value

- n – the number of periods

Example

Five years ago, Sam invested $10,000 in the stocks of ABC Corp. Below, you can see the total value of his investment at the end of each year:

- Year 1: $10,500

- Year 2: $8,500

- Year 3: $9,750

- Year 4: $10,700

- Year 5: 11,500

Sam wants to determine the steady growth rate of his investment. In such a case, the steady growth rate is equal to the compound annual growth rate (CAGR). The CAGR of his investment is calculated in the following way:

Over the five-year period, Sam’s investment grew by 2.8%. Please note that we used $10,000 as the beginning value because it was the amount of the initial investment.

Compound Interest and Retirement Investing

Prudent retirement planning usually looks at a 30 year investment period before retirement draw-downs begin. Therefore, over such a long period, the power of compound interest can significantly impact final retirement outcomes for investors.

The sooner an investor starts saving for their retirement and the more of their investment earnings that they reinvest, the more the power of compound interest will dramatically increase their retirement outcomes.

What Makes Compound Interest Powerful?

Compounding happens when interest is paid repeatedly. The first one or two cycles are not especially impressive, but things start to pick up after you add interest over and over again.

Frequency: The frequency of compounding matters. More frequent compounding periods—daily, for example—have more dramatic results. When opening a savings account, look for accounts that compound daily. You might only see interest payments added to your account monthly, but calculations can still be done daily. Some accounts only calculate interest monthly or annually.

Time: Compounding is more dramatic over long periods. Again, you’ve got a higher number of calculations or “credits” to the account when money is left alone to grow.

Interest rate: The interest rate is also an important factor in your account balance over time. Higher rates mean an account will grow faster. But compound interest can overcome a higher rate. Especially over long periods, an account with compounding but a lower rate can end up with a higher balance than an account using a simple calculation. Do the math to figure out if that will happen, and locate the breakeven point.

Deposits: Withdrawals and deposits can also affect your account balance. Letting your money grow or regularly adding new deposits to your account works best. If you withdraw your earnings, you dampen the effect of compounding.

Starting amount: The amount of money you start with does not affect compounding. Whether you start with $100 or $1 million, compounding works the same way. The earnings seem bigger when you start with a large deposit, but you aren’t penalized for starting small or keeping accounts separate.

It’s best to focus on percentages and time when planning for your future: What rate will you earn, and for how long? The dollars are just a result of your rate and timeframe.

How to Get Compound Interest

Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total initial amount of the loan is then subtracted from the resulting value.

The rate at which compound interest accrues depends on the frequency of compounding, such that the higher the number of compounding periods, the greater the compound interest. Thus, the amount of compound interest accrued on $100 compounded at 10% annually will be lower than that on $100 compounded at 5% semi-annually over the same time period.

Because the interest-on-interest effect can generate increasingly positive returns based on the initial principal amount, it has sometimes been referred to as the “miracle of compound interest.”

Example of Compound Interest in Real Life

Compound interest can either help or hurt you, depending on whether you’re saving or borrowing money.

- Savings accounts, checking accounts and certificates of deposit (CDs). When you make a deposit into an account at a bank that earns interest, such as a savings account, the interest will be deposited to your account and added to your balance. This helps your balance grow over time.

- 401(k) accounts and investment accounts. Earnings in your 401(k) and investment accounts also compound over time. The percentage that stocks gain from day to day are calculated based on their performance the day before, meaning they compound each business day. If you reinvest your dividends and make regular deposits, you can help your balance grow even faster.

- Student loans, mortgages and other personal loans. Compound interest works against you when you borrow. When you borrow money, you accrue interest on any money you don’t pay back. If you don’t pay the interest charges within the period stated in your loan, they’re “capitalized,” or added to your initial loan balance. After that, future interest accrues on the new, larger loan balance. Calculate how much your interest will add up to (and how much extra payments can save you).

- Credit cards. Each month, your credit card charges interest on your balance on the card. If you never charge anything else to the card and you pay the accrued interest each month, your balance will stay the same. But if you don’t pay enough to cover the month’s new interest, it will be added to your credit card balance. Then, the next month’s interest is calculated based on that higher amount. Over time, this can cause your balance to skyrocket.

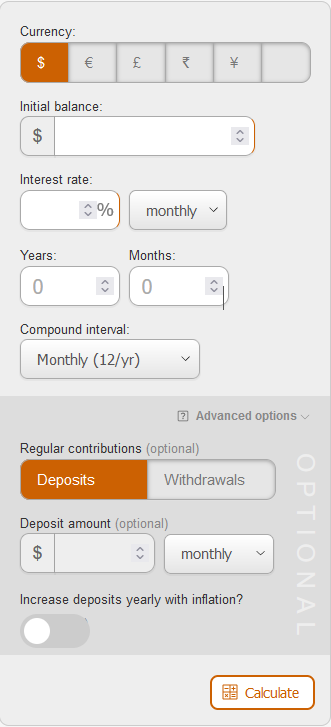

Monthly Compound Interest Calculator

You can use a compound interest calculator to create a projection of how much your savings or investments might grow over a period of time using the power of compound interest. Below is an example of a monthly compound interest you can use.

Compound Interest Formula

Compound interest is calculated using the compound interest formula. To calculate your future value, multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Subtract the initial balance if you want just the compounded interest figure. A = P(1+r/n)(nt)

Where:

- A = the future value of the investment or loan

- P = the principal investment or loan amount

- r = the interest rate (decimal)

- n = the number of times that interest is compounded per period

- t = the number of periods the money is invested for

How Does Compound Interest Make Your Money Work For You?

Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Compounding can create a snowball effect, as the original investments plus the income earned from those investments grow together.

If you saved $50 a month for 10 years and never invested it or earned any interest on it, you’d have $6,000 after 10 years. But if you invested $50 a month for 10 years and earned 8% each year on your investment, you would end up with about $9,150. In other words, you’d have 50% more money.

The chart below shows another example of the power of compounding.

As you can see, Investor 1, who started at age 18 but only invested for 10 years, accumulated more at retirement than Investor 2, who invested for 25 years. However, Investor 3, who invested from age 18 to age 67, accumulated significantly more than either of them.

Can Compound Interest Make You Rich?

To reap the benefits of compounding, remember that time is your best friend. The earlier you start investing, the more your money will grow.

Let’s look at two friends, Jack and Jill.

Jack starts investing at age 25. He invests $20,000 every year for a total of 10 years. Thereafter, he stops contributing to his investment portfolio and leaves his money invested for the next 30 years.

Jill starts investing later than Jack. She begins at age 35 and invests $20,000 every year for 30 years.

Can you tell who will be richer in retirement?

The graph above shows why you benefit from investing as soon as possible. Jack invests for only 10 years, but ends up with more money than Jill, who started investing later. This is despite the fact that Jill’s total amount invested is $400,000 more than Jack’s.

Give it time

You can also see that the graph above gets progressively steeper with time. This reflects how compounding builds on itself to accelerate your wealth creation.

Warren Buffett exemplifies this best. It took him roughly 56 years to build a net worth of $1 billion. But to turn $1 billion to $60 billion took only 27 years. Thanks to the power of compounding, the largest increases in his net worth took place in the later years of his investments. This is also why patience and a long-term perspective is important when investing.

Who Pays Compound Interest?

Compound interest is the money your bank pays you on your balance — known as interest — plus the money your interest earns over time. It’s a way to make your cash work for you. How quickly your money grows is determined by your rate, bank balance and the number of times your bank pays interest, or “compounds.”

You have several options to take advantage of compounding interest to build wealth. All of these investing strategies generate compound interest:

- Savings accounts: Banks lend out the cash that you put into savings accounts and pay you interest in exchange for not withdrawing the funds. Savings accounts that compound daily, as opposed to weekly or monthly, are the best because frequently compounding interest increases your account balance the fastest. You can open a savings account with any local or online bank.

- Money market accounts: These are mostly the same as savings accounts except that money market accounts enable you to write checks and make ATM withdrawals. Money market accounts often pay slightly higher interest rates than savings accounts. The downsides of money market accounts are that most have limits on the number of transactions you can complete each month and sometimes charge a fee if your balance falls below a certain amount.

- Zero-coupon bonds: These bonds generate the equivalent of compound interest to compensate for the risk associated with holding zero-coupon bonds. A zero-coupon bond holder purchases a bond at a steep discount, receives no interest payments (coupons) in exchange for holding the bond, and is paid the bond’s face value when the bond is due. The risk is that the company may not be financially able to repay the bond’s full face value at the end of the term.

- Dividend stocks: Stocks that pay dividends generate compound interest if you reinvest the dividends. You can instruct your brokerage to automatically reinvest all dividend payments you receive by buying more shares.

While savings accounts and money market accounts are both extremely safe options, you are unlikely to find an account that pays even 1% interest. To significantly profit from compounding interest, it’s important to diversify your money into different types of accounts and investments.

How Long Does it Take For Compound Interest to Work?

The Rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. Simply divide 72 by the interest rate to determine the outcome.

For example, at a 2 percent interest rate, it would take 36 years to double your money. At a 12 percent interest rate, it would only take six years to double your money.

You can also use the Rule of 72 to approximate how much an amount would grow over a time period. Let’s say you wanted to set aside $5,000. How would your investment grow after 36 years with a 2 percent versus 8 percent interest rate? (We’ll assume you don’t make any additional contributions to the principal and that interest is compounded annually.)

How long will it take to double your money at 2 percent interest?

- Using the Rule of 72: We know that 72÷2=36, so $5,000 would double to $10,000 during our 36-year time frame.

- Using Investor.gov compound interest calculator: The result is pretty close. The calculator shows $5,000 would be worth about $10,200 after 36 years.

How long will it take to double your money at 8 percent interest?

- Using the Rule of 72: Time for math. If we divide 72÷8, the answer is nine. That means your $5,000 would double in about nine years. But wait—you have 36 years. Your money will double four times in that period (36÷9=4)! The first nine years, it doubles to $10,000. After 18 years, that amount doubles to $20,000. After 27, that amount doubles to $40,000. And finally, $40,000 doubles to $80,000 at 36 years.

- Using Investor.gov compound interest calculator: Close again; $5,000 would be worth about $79,840 after 36 years.

Got the hang of the Rule of 72? Try estimating how $5,000 would grow at 12 percent over 36 years. Click the “1” at the end of this sentence for the answer.

These examples illustrate the importance of the interest rate and duration of your investments. With that being said, risk tolerance should always be considered with higher interest rates; a higher rate of return generally comes with additional risk.

What Will 100k Worth in 20 Years?

How much will savings of $100,000 grow over time with interest? What if you add to that investment over time?

Interest calculator for a $100k investment. How much will my investment of 100,000 dollars be worth in the future? Just a small amount saved every day, week, or month can add up to a large amount over time. In this calculator, the interest is compounded annually. $100,000 investment by time and interest

| Year | 2% | 4% | 6% | 8% | 10% |

|---|---|---|---|---|---|

| 0 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| 1 | 102,000 | 104,000 | 106,000 | 108,000 | 110,000 |

| 2 | 104,040 | 108,160 | 112,360 | 116,640 | 121,000 |

| 3 | 106,121 | 112,486 | 119,102 | 125,971 | 133,100 |

| 4 | 108,243 | 116,986 | 126,248 | 136,049 | 146,410 |

| 5 | 110,408 | 121,665 | 133,823 | 146,933 | 161,051 |

| 6 | 112,616 | 126,532 | 141,852 | 158,687 | 177,156 |

| 7 | 114,869 | 131,593 | 150,363 | 171,382 | 194,872 |

| 8 | 117,166 | 136,857 | 159,385 | 185,093 | 214,359 |

| 9 | 119,509 | 142,331 | 168,948 | 199,900 | 235,795 |

| 10 | 121,899 | 148,024 | 179,085 | 215,892 | 259,374 |

| 11 | 124,337 | 153,945 | 189,830 | 233,164 | 285,312 |

| 12 | 126,824 | 160,103 | 201,220 | 251,817 | 313,843 |

| 13 | 129,361 | 166,507 | 213,293 | 271,962 | 345,227 |

| 14 | 131,948 | 173,168 | 226,090 | 293,719 | 379,750 |

| 15 | 134,587 | 180,094 | 239,656 | 317,217 | 417,725 |

| 16 | 137,279 | 187,298 | 254,035 | 342,594 | 459,497 |

| 17 | 140,024 | 194,790 | 269,277 | 370,002 | 505,447 |

| 18 | 142,825 | 202,582 | 285,434 | 399,602 | 555,992 |

| 19 | 145,681 | 210,685 | 302,560 | 431,570 | 611,591 |

| 20 | 148,595 | 219,112 | 320,714 | 466,096 | 672,750 |

How is Compound Interest Used in Banks?

Many bank accounts, such as savings accounts and money market accounts, as well as investments, pay interest. As a saver or investor, you receive the interest payments on a set, pre-determined schedule, such as daily, monthly, quarterly or annually. And deposits in those accounts will compound the interest you earn, paying additional interest on interest you’ve already earned.

Depending on the account, interest can compound on different schedules. A basic savings account, for example, might compound interest daily, weekly, or monthly.

It’s important to note that the schedule for compounding interest and paying out the interest may differ. For example, a savings account may pay interest monthly, but compound it daily. Each day, the bank will calculate your interest earnings based on the account balance, plus the interest that you’ve earned that it has not paid out.

Compound Interest Real Life Problems

The following tables give the formulas for Simple Interest, Compound Interest, and Continuously Compounded Interest.

Example of Real Life Application of Compound Interest

Let’s now look at the scenario where you want to build a retirement savings of $1.5 million. How much do you need to save in order to reach this retirement goal?

Well, it depends on when you start saving.

Let’s again look at three different examples.

- Carly starts saving $500/month from the age of 20

- Tom starts saving $1000/month from the age of 30

- Sarah starts saving $2000/month from the age of 40

Assumptions

- Annual interest rate of 7%, compounded monthly

- Annual 5% increase in contributions

- Portfolio value of $0 at the start of investing

Note: Why a 5% increase in annual contributions? This may seem unobtainable but when you factor in inflation, cost-of-living raises, employer contributions, education and experience with saving, as well as fending off lifestyle increases over time, this is quite do-able.

Results

- Carly is able to retire at the age of 54. The total amount deposited over 34 years is $510,000. Her portfolio value upon retiring is $1.5 million. If she actually waits to retire at the age of 60, she will have just over $2.5 million saved.

- Tom is able to retire at the age of 57. The total amount deposited over 27 years is $650,000. His portfolio value upon retiring is just over $1.5 million. If Tom holds off for just 3 more years, he will have over $2.1 million in retirement savings.

- Sarah is able to retire at the age of 60. The total amount deposited over 20 years is $790,000. Her portfolio value upon retiring is $1.55 million.

Take away

With the power of compound interest, the earlier you start saving, the less you have to save over time. Start early and then let compounding interest do the majority of the work for you.

If you start late, the more you will have to save in order to make up for the lack of time and compound interest effects.

Best Example of Compound Interest

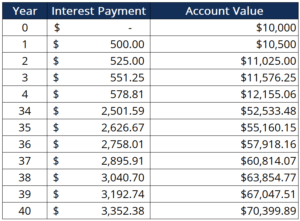

Sam wants to start saving and decides to deposit money into a high-interest savings account. He deposits an initial $10,000, which is to be compounded yearly at a rate of 5% per month. Sam is currently 20 years old and plans to retire at 60, which means that he can avail himself of a 40-year time horizon over which to accumulate interest.

Taking into account the given information, the table below calculates how much Sam’s account value would be at the end of his time horizon:

Here, we see that the account value at the end of the 40-year period is about $70,000. It shows the power of compound interest, as Sam was able to multiply his money seven-fold without actively managing the investment. We see how as interest accumulated on the principal, the interest payment in each succeeding period increased.

Read Also: How Personal Finance is Evolving Through Mobile Apps

The example above also assumes that Sam never deposited additional money into his savings account. Had Sam deposited an additional $10,000 early on in his time horizon, the final account value would have been dramatically higher.

Conclusion

When people think of interest, they often think of debt. But interest can work in your favor when you’re earning it on the money you’ve saved and invested.

Compound Interest will make a deposit or loan grow at a faster rate than simple interest, which is interest calculated only on the principal amount.

Not only are you getting interest on your initial investment, but you are getting interest on top of interest! It’s because of this that your wealth can grow exponentially through compound interest, and why the idea of compounding returns is like putting your money to work for you.

Time is your best friend and the one thing that makes compound interest so effective. Saving now and starting early will pay dividends in your future and help you accumulate extra money. That’s the power of compound interest and why it pays to start saving now.