In the ever-changing world of cryptocurrencies, more investors than ever before are seeing positive returns on investments in digital currencies such as Bitcoin and Ethereum. However, given the high gains on offer, these investors are frequently eager to reduce their tax liabilities.

This article will look at nine techniques for avoiding cryptocurrency taxes, giving investors useful insights into complex tax legislation. We’ll also go over the many forms of cryptocurrency taxes before addressing whether it’s lawful to dodge them.

CNBC estimated that one in every five Americans (20%) had invested in, traded, or used cryptocurrencies. This data emphasizes the expanding use of digital currencies, as well as the difficulties that lawmakers have when enforcing tax rules.

Given the market’s rapid expansion, many people are keen to understand how to avoid paying taxes on Bitcoin. Keeping that in mind, let’s take a closer look at the tactics stated above:

1. Buy Items on BitDials

Kicking off our discussion of how to avoid crypto tax is a strategy that many investors likely already do – buy items with their cryptocurrency holdings, but who accepts Ethereum and other altcoins in 2024? This process has become increasingly accessible in recent years, with more merchants than ever opting to accept crypto payments.

But what can you buy with Bitcoin and other cryptos – and how can this lower an investor’s tax liability? In terms of the former, investors can purchase thousands of products online, ranging from high-end watches to automobiles. So, if you’re looking to buy a Rolex with Bitcoin, BitDials has you covered. Some online stores even allow crypto-savvy individuals to buy homes using Bitcoin, Ethereum, and other altcoins.

When it comes to how to pay less tax on cryptocurrency, the process of buying items doesn’t directly lower taxes. However, this approach can help reduce the investor’s overall tax burden, especially if they sell their crypto holdings at a loss. This tactic is referred to as “tax loss harvesting,” which we’ll explore in more detail later in this article.

An example would be if an investor bought one of the best altcoins (e.g., Ethereum) when it was valued at $4,500 and sold when its value dropped to $2,000. No capital gains are made in this example, and the investor can use the $2,000 received from the position to buy items online rather than reinvesting and potentially heightening their tax liability once more.

In this instance, those wondering how to avoid crypto taxes may wish to check out BitDials. BitDials is a premier online marketplace designed for crypto-savvy shoppers. The marketplace supports and accepts DOGE and other various digital currencies, such as BTC, ETH, and USDT, and ships worldwide. You can also pick up your products in person at their partner stores in Frankfort, Paris, Amsterdam, Madrid, and Prague

Swiss-based BitDials has been in operation since 2016, building up a solid reputation within the crypto community. The marketplace’s standout feature is its diverse product selection, which contains luxury jewelry, cars, watches, and even charter flights.

Thus, crypto investors can buy a watch with Bitcoin while lowering their tax liability through the aforementioned tax loss harvesting process. Making purchases at BitDials is straightforward – all that’s required is a supported cryptocurrency wallet and an appropriate amount of crypto to cover the purchase total and any related network fees.

BitDials also has a dedicated customer support team on hand 24/7 to handle customer queries and issues. This team can be contacted through the live chat box on each page – although shoppers can also use their contact form.

Finally, BitDials will also source your desired watch if it’s not available on their website using their extensive network. If you contact them with a request they will get back to you within 24 hours with a price and timeline. Any other luxury products can be suggested, too, giving you the freedom to spend your crypto on the products you truly want.

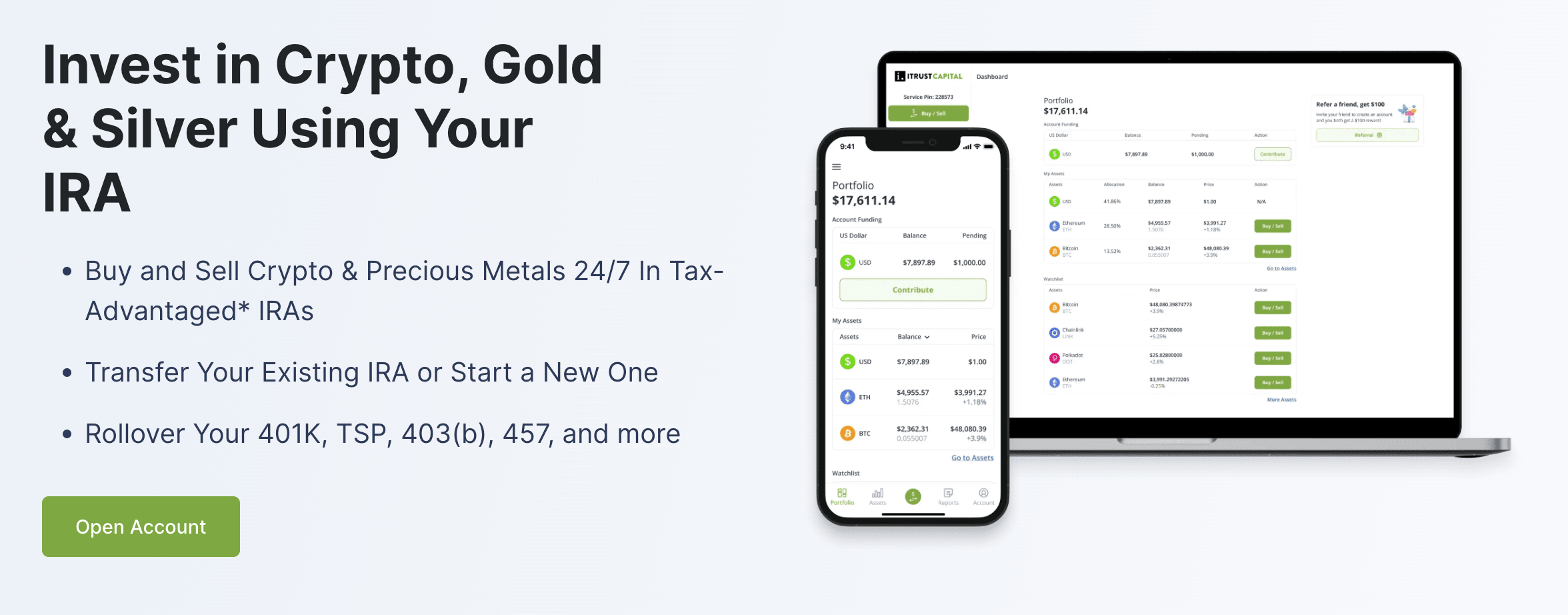

2. Invest Using an IRA

Another popular strategy for how to avoid capital gains tax on crypto is to invest using a tax-efficient product like an Individual Retirement Account (IRA). An IRA is a type of savings account designed to help individuals save for retirement. These accounts have some unique tax advantages that “regular” savings accounts don’t have.

There are different types of IRAs, but using a Traditional IRA as an example, holders do not pay taxes on capital gains until the money is withdrawn at retirement. This is because contributions are tax-deductible, so investors don’t need to worry about their tax burden until the end of the product’s lifespan.

Another type of IRA is a “Roth IRA.” With a Roth IRA, contributions are made in after-tax income, meaning that withdrawals are tax-free. Importantly, this also means that any capital gains made within the Roth IRA are tax-free (subject to certain conditions). If an investor purchases BTC using a Roth IRA and the coin triples in value, no tax would be paid on the profits.

Read Also: How Much Does an Employee Pay for Social Security FICA Taxes?

So how do you avoid tax on crypto using one of these IRAs? The most popular approach is to partner with an IRA provider that permits crypto investments. These tend to be called “cryptocurrency IRAs,” although some providers also offer self-directed IRAs that allow crypto purchases.

Holders of these IRAs can access the best cryptocurrency to invest in and make purchases through the provider’s own setup. This simplifies the process and helps investors lower (or avoid) taxes. However, those with advanced queries may wish to consult a tax professional to ensure they meet the defined tax requirements.

3. Have a Long-Term Investment Horizon

Those wondering how to avoid paying tax on cryptocurrency may also consider holding their crypto assets long term. This strategy can work in two ways – avoiding tax altogether or significantly lowering the tax burden.

In terms of the former, the way that investors can avoid paying taxes is not to sell their crypto holdings. Tax is only calculated on the capital gains made from an investment position – and capital gains only occur when the trade is exited, and a profit is made. If the position is never exited, then there’s nothing to tax.

Naturally, this option won’t appeal to many people since it means they can never really “access” their crypto to utilize for spending purposes. Thus, most people prefer to opt for the second approach, which is to hold crypto for a sufficient period to qualify for the long-term capital gains rate – which is lower than the short-term capital gains rate.

According to the crypto tax specialist Koinly, crypto assets qualify for this lower rate when they’ve been held for 365 days (or one year). By doing this, investors can lower their tax burden significantly.

Interestingly, single people who make a taxable income of less than $44,625 won’t be charged capital gains at all. Moreover, those with a taxable income of between $44,625 and $459.750 will only be charged 15% on their capital gains. Finally, the highest tax bracket for long-term capital gains is only 20%, so it’s best to have a long-term investment horizon when looking to minimize tax.

4. Gift Crypto to Family Members

Gifting Bitcoin to avoid tax is a relatively straightforward tactic that crypto investors can employ. Regardless of whether it’s Bitcoin or another top new cryptocurrency, the act of “gifting” is usually not considered a taxable event. By doing this, investors and the gift recipient will not have to pay taxes on the gift amount.

There are some rules to be aware of for this approach. For example, based on current US regulations, crypto investors can only gift $17,000 per person per year before having to file a gift tax return. Moreover, the person receiving the crypto will still have to pay tax on any capital gains made after they acquired it.

Notably, US citizens have a “gift and estate tax exemption” of $12.92 million in their lifetime ($25.84 million for married couples). Crypto investors can utilize this exemption to avoid any gift tax that might otherwise have accrued.

Ultimately, this approach can’t help investors avoid crypto tax entirely, as there will still be tax owed upon sale – assuming a positive return is made. However, it will help keep crypto holdings in the family, which can be highly beneficial.

5. Relocate to a Different Country

Those who invest in the best crypto under $1 and see their investment explode in value may wish to consider relocating. When it comes to how to avoid crypto tax, relocating is one of the most complex and arduous approaches. However, it can also be one of the most effective for reducing (or removing) a tax burden.

The most popular location in this regard is Puerto Rico. Puerto Rico is still a US territory but has its own tax system that offers some enticing benefits for investors. The most notable advantage is that Puerto Rico doesn’t charge any taxes whatsoever on capital gains made through investing.

Thus, if an investor purchased BTC at $20,000 and it rose to $200,000, they’d not have to pay any taxes on accrued profits. The purchase doesn’t have to be made before moving to Puerto Rico; however, unrealized gains before relocating will still be subject to regular taxation.

Another viable location for those wondering how to avoid crypto taxes is Portugal. Portugal doesn’t charge any tax on profits made through cryptocurrency investing. However, to benefit from these tax laws, investors must be a residents of Portugal, which can be a lengthy process.

6. Donate Crypto to Charity

Another option for those researching how to not pay taxes on Bitcoin is to donate cryptocurrency to charity. This is a quick and easy way for investors to lower their tax burden since more charities than ever now accept crypto donations. Some examples include the American Red Cross and Save the Children US.

Generally speaking, donations are considered tax-deductible actions in the US and are, therefore, not subject to taxation. The critical element to remember is that the charity has to be qualified and registered in the country. Thus, crypto investors should research their chosen organization to ensure donations will be eligible for tax exemption.

Another important aspect relevant to crypto donations is that investors can avoid paying taxes on any value appreciations that might have occurred. Moreover, these investors can also deduct the “fair market value” of the donated crypto from their taxable income.

However, in many cases, the entire amount cannot be deducted. The specific amount that is deductible depends on the investor’s adjusted gross income (AGI). Regardless, even if only a small amount is considered deductible, making crypto donations still allows investors to minimize their tax liability while also supporting a good cause.

7. Offset Gains with Appropriate Losses

Many opt to make long-term crypto investments to benefit from gradual price appreciations, which is more likely with “established” cryptos like Bitcoin and Ethereum. However, when it comes to how to avoid crypto tax, it’s essential to be aware that losses from other investments are a way to reduce the overall tax burden in a specific tax year.

We’ve briefly touched on this earlier, but this tactic is called “tax-loss harvesting.” Essentially this means that when a crypto asset is sold at a loss, it is defined as a “capital loss,” which can be used to offset gains made elsewhere.

For example, if a crypto investor makes a profit of $20,000 on their Bitcoin investment but loses $7,000 on their Solana investment, they will be able to reduce their taxable gains by $7,000. Thus, instead of being taxed on $20,000, the investor will only be taxed on $13,000.

This process is widespread – especially in the equity market. Many investors “cut their losses” towards the end of the year when annual income taxes are due, which is a popular way to reduce the tax burden.

Another benefit of this approach is that if an investor doesn’t make any capital gains and instead makes a capital loss, this loss can be deployed to offset other ordinary income. The claimable amount is currently set at $3,000, although anything that isn’t claimed can be carried over to future years.

8. Sell Crypto During Low-Income Periods

In many cases, figuring out how to not pay taxes on Bitcoin can be impossible since the system is designed to ensure those making investment returns must contribute to society through taxation. However, another straightforward way to minimize the tax burden is to sell crypto holdings during a low-income period.

This works because an individual’s tax liabilities are determined by how much money they make. Naturally, the more money someone makes, the more tax they pay since they’ll fall into a higher tax bracket. This also works the opposite way – those who make less money will not have to pay as much tax.

Due to this, investors wondering how to avoid crypto taxes can opt to “cash in” on their investments during times in their life when their income level has dropped. For example, if an investor has been unemployed for an extended period, their income level will naturally be lower, presenting an excellent opportunity to sell their crypto.

By taking this approach, investors may fall into a lower tax bracket, meaning they’ll benefit from a lower tax rate. However, this also must be balanced by the fact that overall income will be less than usual – so actual financial well-being may still be worse.

9. Utilize Crypto Tax Software

The final strategy we’ll discuss in this guide on how to avoid crypto taxes is utilizing effective crypto tax software solutions. This is a widely used strategy since it ensures investors aren’t underreporting (or failing to report) any crypto-based gains they’ve made.

As such, crypto tax software can help investors avoid fines associated with these two actions. Moreover, some of the best software applications even have built-in tax advice features; for example, they might highlight the most effective time for a crypto investor to sell their assets to benefit from tax-loss harvesting.

Finally, this tax software ensures that gains and losses are accurately reported, which gives investors confidence that they aren’t paying too much tax. Since these software applications usually generate the necessary tax reports for investors, they even ensure late submission penalties aren’t a concern.

Are You Legally Allowed to Avoid Tax on Crypto?

As highlighted, cryptocurrencies differ significantly from “traditional” currencies like the US Dollar and the Great British Pound. The critical difference is that, unlike these currencies, cryptocurrencies aren’t controlled by a centralized entity. Given this distinction: is it legal to avoid tax on crypto?

Put simply – yes, it is. This may come as a surprise to many readers, given the connotations of “avoiding” tax. However, at least in the US, tax avoidance refers to the use of legal methods to lower an individual’s or business’ tax burden. Thus, all the strategies discussed in this guide ultimately fall into this “tax avoidance” category.

In contrast, is “tax evasion.” As noted by Cornell Law School, tax evasion involves using illegal means to avoid paying taxes. This usually consists of an individual or business lying about how much money they’ve earned, either by underreporting income or exaggerating their deductibles.

Given this information, the key for investors is to ensure they’re truthful and accurate when filing their tax returns. Technological advances now mean that the IRS can easily track crypto transactions since brokers and exchanges must record what occurs on their platforms. Even if a broker/exchange doesn’t wish to hand over client data, the IRS can demand it legally.

The only way the IRS can’t view a citizen’s crypto holdings is if they are stored on an external hardware wallet. Since these wallets aren’t connected to the internet, there’s no way for any entity to access them and analyze the contents. Regardless, crypto investors must still ensure they’re reporting accurately to stay within the confines of the law.