Maintaining a debt free life can be assured if you acquire money management skills early in life because many people learn these money management skills throughout their life and often only after debts have become unmanageable.

If you are considering a debt free life, becoming a money management expert will be helpful as money management skills will help you organize your personal finances more efficiently. Better still, you can help others by providing financial advice on how to improve or manage their personal finances for a minimal fee.

- How Can I Live a Debt Free Life?

- How You Can Implement Money Management Skills

- What Are The 3 Basic Steps to Better Money Management?

- What Are The 5 Principles of Money Management?

- How to Become a Self-Taught Finance Expert

- How to Become a Certified Financial Expert?

- What is The Best Money Management App?

- What is The Best Free Money Management Software?

- How Can I Improve my Money Management Skills?

- How Does Wealth Management Make Money?

- What is Meant by Money Management?

- Who Are The Top Money Managers by Assets

- Are Money Management Apps Safe?

- How do You Create a Money Management Spreadsheet?

- What Does The Bible Say About Money Management?

- What is The Best Money Management Company?

- How do I Find The Best Money Manager?

How Can I Live a Debt Free Life?

Learn Money Management Skills

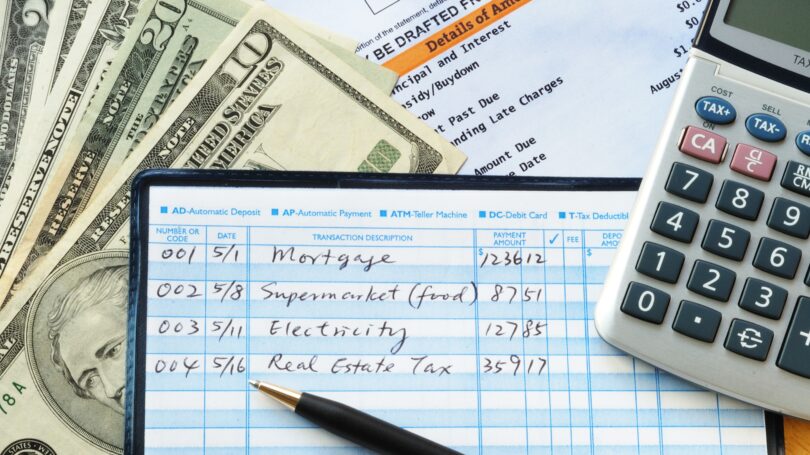

Money management can be simply defined as a way of using different financial methods to handle income and expenditure efficiently. The first step to learn money management skill is by using simple tools such as financial budget including a spending diary to monitor exactly where money is going and what can be cut back on to minimize outgoings.

Read Also: Make Money With Government Bonds

You can apply the option of setting up a monthly budget and stick to it to reduce your spendings though this can be difficult in the beginning but it can soon become second nature once the savings become substntial.

Cut Back On Unnecessary Spendings

If you are heavily dependent on credit cards when purchasing items then you are ignorantly wasting your hard earned money on interest fees. You should always keep a watch on your credit tools to keep abreast of interest payments on usage of the card annually.

Though there are some credit products that are unavoidable such as mortgages, you can avoid interest fees payment by making use of your debit cards and cash for your shopping.

Organize Your Debt Repayments

If you are a monthly salary earner, you should take the step of organizing all debt repayments to leave bank accounts on same day. It should be noted that the repayment date should be as close to the salary paid into the bank date as possible. Doing this will limit the chances of spending on the salary before repayments are made to creditors.

This way, the chance of missing debt repayments and incurring late and missed penalty fees is eliminated. By logic, if you incur late penalty fees every month, you will be wasting hundreds of pounds or dollars in charges every year.

Financially Live Below Your Means

Living below your means does not really mean living like a pauper or a monk but it means becoming financially responsible. You will eliminate the need to borrow or use credit when you live below your means thereby helping you to save money and stay out of debt.

You will notice healthier bank balance in few months if you observe responsible spending habit as this could mean cutting down on night outs, clothes shopping and unnecessary impulse purchases.

Pay Off Debts Quickly

Debts usually come with different repayment tenure and will always come with interest charges. You can prioritize interest applicable debts in order of importance. You should start paying debts that come with higher amounts of interest first in order to clear debt efficiently though this means paying extra to clear high interest debts or finding ways to limit the interest amounts.

You can transfer debts to zero per cent interest credit cards with long introductory interest-free periods as a viable solution to repaying debts without interest.

How You Can Implement Money Management Skills

You can explore a number of ways to put money management skills into practice. These ways or methods include:

1. Never incur missed or late payments charges on loans, credit cards and overdrafts.

2. Have a budget before shopping and stick to it to avoid impulse purchases.

3. Ignore easy credit payment options when making daily purchases.

4. Pay certain bills on time to get discounts from providers.

5. You can economize in the home by looking for the best deals with services such as fuel bills.

6. You should recognize that some purchases are simply unnecessary.

7. Adhere to monthly budgets for a few months without fail to see how much money you have actually saved.

Following all these tips will definitely make you a money management expert for a debt free life.

What Are The 3 Basic Steps to Better Money Management?

While there’s never a bad time to make a financial fresh start, it makes sense to rethink how you’re managing your money.

“It’s a really good time to start a budget because all your big numbers are coming in,” says Jon Brodsky, U.S. CEO of Finder, a comparison website for financial services and products. W-2 and 1099 tax forms compile income information while year-end summaries from credit card issuers such as Chase and Discover make it easy to review annual spending patterns.

However, creating a budget is only one part of how to manage money better, and if you start there, you’ll miss a few critical steps. These include mapping out your current finances and prioritizing your spending needs.

Here are three steps to take to manage your money properly:

Understand Your Current Financial Situation

Before you can start managing your money better, you need to know how much of it you have. “I don’t think you can move forward without knowing where you are,” says David Curry, a certified financial planner and principal and co-founder of East Paces Group, an investment advisory firm in Atlanta. He recommends people start with a comprehensive financial plan which can inventory your cash flow, income, savings, investments and more.

While a financial planner can create a formal financial plan for you, there is no need to hire someone to get started. The most basic step to understanding your current financial situation is to sit down and record all your regular monthly income and expenses, says Wendy Terrill, a retirement planning consultant and the founder and CEO of financial planning firm Assurance & Guarantee in Graham, North Carolina. “A lot of people are surprised when they put pen to paper,” she says.

If needed, save receipts for a month to determine where money is spent beyond major bills like rent, utilities and debt payments. For some people, it can be a wake-up call to realize how much is being spent on items such as groceries or dining out.

Set Personal Priorities and Finance Goals

Once you have laid out your current financial situation, it’s time to determine whether it aligns with your values. For instance, if spending weekends with your family is a priority, paying for a housekeeping service may free up valuable time and be a smart use of money.

However, it may not make as much sense if travel is a bigger priority. In that case, the money spent for housekeeping may be better spent on vacations.

“I think it’s all about having goals,” says Timothy McGrath, a certified financial planner and managing partner with Riverpoint Wealth Management in Chicago. Defining what you’d like to achieve with your money can make the process of creating a viable budget much easier.

Create and Stick to a Budget

Writing a budget designating how your income will be spent each month isn’t necessarily hard for many people. Following it, though, can be a challenge. “That right there is the hardest part,” Terrill says. People may not have the self-discipline to limit impulse purchases, or they may feel too restricted by having to plan their spending in advance.

However, the reward for sticking to a budget is having cash available to spend on those items most important to you. What’s more, it will be easier to follow a budget that is written with your priorities and goals in mind.

If you discover there isn’t enough money to pay for everything you’d like, look for ways to whittle down expenses. While eliminating small, recurring purchases such as duplicative streaming services or takeout coffee is often suggested, Brodsky encourages people to think big.

For example, “If you rent and your lease is up, move somewhere cheaper,” he says. As long as it doesn’t dramatically change your quality of life, making significant changes like this will have the most profound impact on your finances.

What Are The 5 Principles of Money Management?

Personal finance can be a complex subject, and it’s easy to get overwhelmed with all the information that’s out there. You could spend hours reading about how to handle money, with little to show for it after.

But money matters don’t have to be so complicated. There are a few key principles that can make or break you, and if you want to build a strong financial future, then you need to know them by heart.

1. Spend less than you earn

This first principle is by far the most important. The only way you can be successful is by having more income than expenses every month.

By spending less than you earn, you can put money away for the future instead of living paycheck to paycheck or sinking deeper into debt because you can’t pay your bills.

One popular piece of advice is that you should save at least 20% of your income in a high-quality bank account. That’s a smart goal for most people, but if you can save even more, you absolutely should.

2. Maximize your income

Although it doesn’t get talked about enough in the world of personal finance, increasing your income is the best way to save more money, rather than pinching pennies.

The amount you can save by reducing your spending is limited. Sure, you can make cuts here and there, but that doesn’t work forever. Eventually, you’ll reach the point where there are no more cuts left to make.

Instead of trying to budget your way to being rich, you’re much better off looking for ways to make more money. Negotiating a raise, finding a higher-paying job, freelancing, or starting a business on the side are all ways you can bring more money in.

3. Plan for emergencies

Emergencies are a fact of life. If you’re not ready for them, they can cost you a lot of money. There are two ways to prepare for emergency expenses:

- Putting money into an emergency fund

- Making sure you have all your necessary insurance coverages

Your emergency fund is the money you’ll use for any unexpected bills that come your way. Ideally, you should have three to six months of living expenses in your emergency fund. It takes some time to save that much, but any money you save is better than nothing. Get your emergency fund started by opening a high-interest savings account and depositing whatever you can manage every month.

People often skimp on insurance, only to wish they hadn’t when they get hit with a huge bill later. At a minimum, you should have:

- Health insurance

- Renter’s or homeowner’s insurance

- Auto insurance

4. Build your credit

Like it or not, your credit score can have a significant impact on your everyday life. If you ever want to get one of the top credit cards or borrow money at a low interest rate, then your credit score will play a key role. That’s not all it does, though: Your credit can also determine your car insurance rates, whether you pay a deposit when setting up utilities, and even whether you get hired for certain jobs.

The good news is that, despite the confusion about credit scores, it’s not hard to build yours. You’ll need a credit card that you use and pay off every month, as this helps you build a record of responsible borrowing. If you’ve had trouble qualifying for a credit card, secured credit cards are a good place to start.

Just make sure you’re paying your bills by the due date and not using too much of your available credit. Those are the building blocks of an excellent credit score.

5. Save for retirement

Retirement, a.k.a. that thing most people start thinking about much later than they should. The sooner you start contributing to a retirement account, the better off you’ll be.

It’s imperative that you start saving for retirement early and take advantage of the tax breaks offered through 401(k)s and individual retirement accounts (IRAs). You’ll give your money plenty of time to accumulate through compound interest, which is the smartest way to build wealth.

What’s important here is that you save something every month for retirement. Whether it’s $50, $100, or over $1,000, later on you’ll appreciate that you got into the habit of saving. So long as you invest the money responsibly, your contributions will grow many times over throughout your career.

How to Become a Self-Taught Finance Expert

So you want to become a financial expert, but you don’t know where to start? Have no fear, because a wealth of information is at your fingertips, and getting started is easy. From a primer on personal finances to advanced securities analysis, anyone interested in learning can get access to the necessary resources.

Read Up on Financial Topics

The library, your local bookstore, and multiple online retailers offer literally thousands of books on every conceivable financial topic. From financial history and Wall Street villains to hedge fund analysis and day-trading strategies, there’s a book for every topic.

For a basic introduction to sound financial concepts, you can’t do much better than The Richest Man in Babylon. It’s a tiny little book, written in an uncomplicated style. It also captures the wisdom of the ages in an easy-to-follow manner.

Once you’ve covered that, the famous “… for Dummies” series provides insight into everything from budgeting to mutual funds. Managing Your Money for Dummies and Mutual Funds for Dummies are two titles that will help you expand your knowledge of basic concepts.

By the time you finish these three books, you are likely to have identified specific items that you would like to learn more about. For these inquiries, there’s no better place to go for fast, easy access to information than online. Investopedia and similar sites provide access to a wealth of information that will keep you busy for weeks, if not months, including newsletters that will keep you updated on a daily basis.

Google and other search engines let you hone in on specific topics, and many mutual fund companies and financial services firms offer a wealth of free information. A visit to their websites can offer everything from general education on a wide array of products to economic forecasts and economic insights from professional market-watchers.

With just a little effort, you can identify and follow comments from your favorite economists, investment strategists, portfolio managers, and other experts.

Take a Finance Course

Thousands of in-person and online courses are available to help educate you about finance and investing. Many universities offer free or paid online courses that you can take at any time. We created the Investopedia Academy in 2018 to help people learn everything from investing, trading, and money management to personal finance.

Hit the Books Again

After you have covered the basics and want a solid overview at a more detailed level, The Wall Street Journal Guide to Understanding Money & Investing is a great place to start. When you are done with that, your local library or bookstore will contain a variety of magazines covering both timely and general financial services topics.

When you are ready to learn about equities, Value Line is a great research and publishing firm that provides an introduction into how you can begin to research and analyze stocks. Even if you choose not to conduct your own stock analysis, the website is worth a visit.

If you made it this far, you are clearly serious about your endeavor. Now it’s time to make your quest a daily habit. Subscribing to the The Wall Street Journal will give you a daily overview of the issues impacting global business operations. The WSJ also has a great “Money and Investing” section.

Barron’s is another fine publication read by many professionals in the financial services industry. There are many other top-quality publications dedicated to various aspects of the financial services world. Find one that matches your interests and read it.

Talk to Financial Services Professionals

Once you have a solid understanding of the various aspects of the financial services world, it is time to spend some time talking to the experts. Financial services professionals make a living with their expertise and can help you learn about everything from mortgages and debt management to retirement planning and estate planning.

Some of these topics are covered in seminars, others in one-on-one consultations. You can even pick up a thing or two just by having an informal conversation. Talk to a professional financial advisor, talk to your banker, talk to your accountant, and talk to your attorney. Then listen and learn as they share their knowledge.

How to Become a Certified Financial Expert?

Business owners hire financial experts to help them achieve their financial goals with the optimum utilization of the resources. However, that is not the only job opportunity for financial experts. People seek out these experts to plan their children’s education, suggest investment products, prepare a retirement life, or plan a marriage.

Considering the growing demand for financial experts, a financial advisor can make a perfect profession for students who want a decent career. In this post, we’ll talk about the ways to become a certified financial expert. So, keep reading.

You Need a Degree First

As we said before, the financial advisor is a qualified professional who is responsible for assisting businesses and clients in finance-related decisions. As a finance expert, you are supposed to provide the client with a proper financial strategy that could promote savings and result in higher ROI. To achieve this position, you need the relevant certifications first.

The first step to becoming a financial expert is achieving a bachelor’s degree in economics, mathematics, finance, business management, and accounting. During the graduation period, you can also study some finance-special courses or get advising training to improve your knowledge in this field.

The role of financial advisors is not confined to planning the business’s finances efficiently. It can also involve investment or debt decisions. The competition in this industry is getting tougher. That being said, you need to achieve at least a bachelor’s degree to prove your worth.

Further education is not mandatory, but it will help you improve yourself and stay up-to-date with the latest trends in this industry.

Achieve Necessary Licenses

Whether or not you need a license to continue your career as a financial advisor depends on your state laws. Moreover, the type of financial expert you want to become also determines the license requirement.

For instance, advisors who are willing to help businesses and clients with stock trading and investment decisions will need a license to do that. Even a suggestion that is based on investments and stock market requires a license. Similarly, financial experts working for insurance companies or clients need a license.

As much as these licenses are essential, they can be super hectic and expensive. You need to take several courses and training to prove that you are worth the job. Some of these licenses include:

- FINRA Licenses: Series 6 & Series 7 – aspiring financial experts who manage to pass this exam to get the license for selling securities such as insurance premiums and mutual funds. This license does not allow the stocks and bonds investment advising.

- NASAA Licenses: Series 65 and Series 66 – The license exam is conducted to test the individuals’ financial knowledge, understanding customer’s requirements, and economic concepts.

A Certified Financial Expert

Becoming a certified financial expert will be the best option for your career as it opens up more opportunities for you. To become a certified financial expert, you need to achieve proper training, certification, and the minimum level of experience.

All in all, you must get the required certification courses in finance and become a reputable financial advisor if you want better jobs.

What is The Best Money Management App?

The best budgeting apps help you understand your income and spending, so you have maximum control over your money. Budgeting apps may connect to your bank account and credit cards to automatically download transactions and categorize your spending to match the budget you choose.

The best budgeting apps come at an affordable price point, are easy to use and integrate with your accounts, and have features that match your budgeting style.

1. You Need a Budget (YNAB)

You Need a Budget (YNAB) earns the top spot because of the company’s renowned budgeting philosophy and reputation. YNAB says new budgeters typically save $600 in their first two months and more than $6,000 in their first year. Although YNAB is the most costly option on our list, the company offers a 34-day free trial.

2. Mint

Mint stands out for a few reasons. It’s one of the most popular budgeting apps available, with over 25 million users. The app is free and easy to use for budgeters of all levels. You can also set up bill payment reminders, track investments, and access your TransUnion credit score—all of which makes Mint our choice for the best free budgeting app.

3. Simplifi by Quicken

Simplifi by Quicken earns high marks because it offers a personalized spending plan with real-time updates of how much you have left to spend throughout the month. The app syncs your bank accounts to show you where you stand and your progress on financial goals. Simplifi by Quicken also tracks your monthly bills and subscriptions, including those you don’t use.

4. PocketGuard

PocketGuard made the cut because the app helps curb overspending. The company uses an algorithm to track your income, expenses, and savings goals to tell you how much you can spend every day. These spending limits make it easier to quit overspending and take control of your financial goals.

5. Personal Capital

Personal Capital scores high because the company offers the best free tools for wealth building. You can sync your financial accounts in one place to track your net worth, plan for the future with the Retirement Planner, and use the Fee Analyzer to check portfolio fees.

6. Zeta

Zeta is one of the few free budgeting apps designed specifically for couples, joint finances or not. The app caters to all types of couples, including those who are living together, engaged, married, or new parents. You can sync various accounts to track spending, see your net worth, and manage bills together.

You can also sign up for a joint no-fee banking account and cards with features like early access to direct deposit, digital checks, access to the MoneyPass ATM network, contactless payments, and bill pay. All of these enhanced features make Zeta our choice as best for couples.

What is The Best Free Money Management Software?

Managing your money successfully includes keeping a close eye on your expenses. One way to do that is to take advantage of free software and services. Free personal finance software can be surprisingly robust, helping you track spending, create and manage budgets, and run reports.

Whether your computer runs on Windows or macOS (or even Linux) or you do all your budgeting on your phone, you’ll find a no-cost selection below for tracking your finances and planning for the future.

Mint

Mint is a free online budget planner from Intuit, the makers of TurboTax and Quickbooks. This app brings all of your financial data together, showing you an overview of your budget, spending, bills, and credit score.

You can create your own budget, set goals and reminders, and sync your data between web and apps. Security is enhanced by encryption and multi-factor authentication. You can also use Mint to track your investments and portfolio.

Access Mint via the web or phone apps for iOS and Android.

GnuCash

GnuCash is desktop software; its features include tracking bank accounts, stocks, income, and expenses. GnuCash is based on double-entry accounting for balanced books and you can run a number of reports to see your financial data. GnuCash also offers small-business accounting tools that let you manage customers and vendors, handle invoicing and bill payment, and even payroll.

GnuCash is compatible with Windows, Mac OS X, GNU/Linux, BSD, and Solaris. There is a companion app for Android that will let you track expenses on the go and later import them into the desktop software.

AceMoney Lite

AceMoney Lite bills itself as the best Microsoft Money or Quicken alternative. You can manage your budgets, track your finances in multiple currencies, keep an eye on your investments and analyze your spending habits. You can also do online banking. As this is the lite version, you’re limited to two accounts; the full version supports unlimited accounts.

AceMoney Lite is compatible with Windows and Mac OS X.

Personal Capital

Personal Capital offers free financial software for tracking investments and planning for retirement, in addition to its tools for cash flow, spending, budgeting and net worth. Personal Capital’s focus is on investments, showing you the performance of your portfolio over time and helping you make decisions for the future, so its budgeting components aren’t as robust as other software.

If you’re not an investor or prefer fine-tuning your budget to getting the broad view, Personal Capital may not be the best fit. However, if you want to save for college or retirement, its free tools will show you whether you’re on track.

Personal Capital can be accessed via the web or apps for Android and iOS.

Buddi

Buddi is an open-source budget software that runs on Windows, Mac, and Linux systems and has been translated into multiple languages. Buddi can encrypt financial data with a password, and it’s designed to be easy to use even if you have no financial background.

Features include budgeting, tracking accounts, and personal finance reports, but you will have to enter transactions manually. Free plugins add more features, and the online user manual is easy to read and use.

Buddi is compatible with Windows, Mac OS X, and Linux.

How Can I Improve my Money Management Skills?

Just because you didn’t learn good financial skills in school doesn’t mean that you can’t learn them now. Here are some tips you can follow to get better at managing money.

1. Make a budget—and stick to it.

Do you know where all your money goes? Do you know how much money you spend on things like going out to eat, seeing a movie, buying beer, or purchasing clothes? Most people don’t. Are you one of those people who just prays every day that you don’t overdraw your bank account?

If so, make your budget. Go back through your checkbook or bank statements for the last year and write down how much you spent in each category. You will probably be surprised at how much of your money is “wasted” on things you weren’t even aware of.

2. Be a conscious consumer.

When you go to the grocery store, do you have a list? Do you look at prices? Do you use coupons? There are many online resources and apps that can help you be more focused on what you are actually spending.

Don’t “sleep walk” through life. Be aware of every single cent you spend! When people don’t do that, their money tends to just evaporate. It takes a bit of effort to look for coupons, make lists, examine the prices at the stores where you shop, but it’s worth it in the long run. And, it makes a BIG difference.

3. Balance your checkbook.

These days, most people just rely on looking at their bank balance online. But if you only do that, then it allows you to not care what you are spending in the moment. But if you hold yourself accountable by recording everything, then you will not over-spend or overdraw your account.

4. Have a plan and a vision.

In order to accomplish anything, you have to have a plan, right? I mean, if you wanted to go to San Francisco but you didn’t have Mapquest or a GPS to calculate your route, you would never get there! Instead, you would just drive aimlessly into nowhere.

That metaphor is pretty much what happens to you when you don’t have a financial plan. You often ask yourself, “Where did that money go?” But if you have a plan and a budget (see #1), then you will know exactly where your money has gone.

5. Think like an investor.

Our educational system does not teach us anything about how to handle money—especially when it comes to how to grow it. But think about it. Did the wealthiest people in the world just save $500 a month and leave it at that? Of course not! They learned how to turn that $500 a month into $1,000. Then $10,000. Then $100,000. And so on. You get the point.

You can’t expect to have a solid financial future if you’re not thinking about how to grow your money. So if you start to think like an investor, you’ll see your nest egg expand.

6. Work together with your partner/spouse on the same financial goals.

If you’re married or in a partnership where you share money, then you need to work together. Frequently, one person will be a saver, and the other will be a spender. This doesn’t work! So it’s important that both you and your partner get on the same page about your financial goals.

Sit down together and make your budget. Meet with a financial adviser so you can learn how to invest your money wisely. But if nothing else, you need to make sure that the two of you have the same goal and vision. And that you actually stick to it!

7. Commit to saving money.

Speaking of sticking to something, commitment is everything. You can’t do anything half-way. You can’t “sometimes” do something and “sometimes not.” You have to be consistent! You have to stay the course!

It’s kind of like losing weight. If you only occasionally eat less and exercise more, you MIGHT lose some weight. But chances are, you’ll probably just go back to your old habits. So that’s why you need to commit to saving money and building your future. Otherwise, you might as well not even bother!

How Does Wealth Management Make Money?

People who have a high net worth may need more services than those offered by traditional financial advisors. Those with millions—perhaps even billions of dollars—may have complex portfolios, complicated tax situations, and other needs that are unlikely to apply to average investors.

Wealth managers often have access to a wider range of financial products and services. Although clients pay a fee, they receive strategies designed with their finances in mind.

Services offered by wealth managers may include:

- Investment management and advice, including retirement planning

- Legal and estate planning

- Accounting and tax services

- Review of health care and Social Security benefits

- Charitable giving plans

- Help with starting or selling a business

If you don’t have a high net worth, you likely don’t need a wealth manager. You may instead prefer to pay for a financial or investment advisor who can help you grow your money over time.

A financial advisor may be able to help you build your wealth. On the other hand, a wealth manager can help you manage your money once you’ve already achieved a high net worth.

What is Meant by Money Management?

Money management refers to the processes of budgeting, saving, investing, spending, or otherwise overseeing the capital usage of an individual or group. The term can also refer more narrowly to investment management and portfolio management.

The predominant use of the phrase in financial markets is that of an investment professional making investment decisions for large pools of funds, such as mutual funds or pension plans.

Money management is a broad term that involves and incorporates services and solutions across the entire investment industry.

In the market, consumers have access to a wide range of resources and applications that allow them to individually manage nearly every aspect of their personal finances. As investors increase their net worth, they also often seek the services of financial advisors for professional money management.

Financial advisors are typically associated with private banking and brokerage services, offering support for holistic money management plans that can involve estate planning, retirement, and more.

Investment company money management is also a central aspect of the investment industry. Investment company money management offers individual consumers investment fund options that encompass all investable asset classes in the financial market.

Investment company money managers also support the capital management of institutional clients, with investment solutions for institutional retirement plans, endowments, foundations, and more.

Who Are The Top Money Managers by Assets

Global investment managers offer retail and institutional investment management funds and services that encompass every investment asset class in the industry. Two of the most popular types of funds include actively managed funds and passively managed funds, which replicate specified indexes with low management fees.

The list below shows the top 5 global money managers by assets under management (AUM) as of Q1 2021:

BlackRock Inc.

In 1988, BlackRock Inc. was launched as a $1 division of the BlackRock Group. By the end of 1993, it boasted $17 billion in AUM and, by 2020, that number swelled to a whopping $8.68 trillion.

BlackRock’s exchange traded fund (ETF) division, called iShares, has more than $2 trillion in AUM globally, amounting to roughly a quarter of the group’s total assets. Overall, the firm employs approximately 13,000 professionals and maintains offices in more than 30 countries around the world.

The Vanguard Group

The Vanguard Group is one of the most well-known investment management companies, catering to over 30 million clients across 170 countries. Vanguard was founded by John C. Bogle in 1975, in Valley Forge, Pennsylvania, as a division of Wellington Management Company, where Bogle was previously chair.

Since its launch, Vanguard has grown its total assets to beyond $7 trillion, becoming the world’s second-largest asset manager thanks to the popularity of its low-cost investment funds.

Fidelity Investments

Fidelity Management & Research Company was founded in 1946 by Edward C. Johnson II. As of Dec. 2020, Fidelity had more than 35 million customers with $9.8 trillion in total assets and $4.9 trillion in AUM. The firm offers hundreds of mutual funds, including domestic equity, foreign equity, sector-specific, fixed-income, index, money market, and asset allocation funds.

PIMCO

Global asset management firm Pacific Investment Management Company LLC (PIMCO) was co-founded in 1971, in Newport Beach, California, by bond king Bill Gross. Since its inception, PIMCO has grown its AUM to $2.21 trillion. The firm houses over 775 investment professionals, each averaging 14 years of investment experience. With over 100 funds under its banner, PIMCO is widely regarded as a leader in the fixed income sector.

Invesco Ltd.

Invesco Ltd. has been offering investment management services since the 1940s. In February of 2021, the firm announced that it had $1.35 trillion in AUM, across its 100-plus mutual fund products. Invesco also offers over 100 ETFs through its Invesco Capital Management LLC division.

Are Money Management Apps Safe?

Apps can make quick work of managing and tracking your spending by linking your financial accounts, categorizing your expenses and showing you exactly where your money is going. But are budgeting apps safe?

In general, they are designed to protect your financial information, but you can’t be blamed for wondering, especially considering how many companies have been hacked in recent years. Below, we’ll look at some of the most popular budget tracking apps and break down what they do as well as what makes them secure.

Budget tracking apps are pretty safe, according to Pieter VanIperen, the managing partner of PWV Consultants, a group of experts in the tech, security and design industries. VanIperen is also an adjunct professor of code security at New York University.

But before you breathe too easily, be aware that the person using the budget tracking app may not be so safe.

“The main thing to remember is that people are easier to hack than machines,” VanIperen says. “As long as you are practicing good cyber-hygiene – like not reusing passwords and not clicking on random links that are texted or emailed to you – then budget tracking apps that have been vetted are just as safe as the app of your financial institution.”

So the budget tracking app you are using is probably fine. But could a hacker, say, invade your computer or device and find out your password to your budget tracking app and steal your financial information? Yes.

How do You Create a Money Management Spreadsheet?

Dan Bricklin and Bob Frankston created the first financial spreadsheet program in 1979. Since then the technology has been adopted by businesses, banks, and governments, who use spreadsheets for creating budgets, tracking spending, and creating reports for their financial matters.

Much like a business, a person benefits from using a spreadsheet for their finances because it places all the information in one easy-to-read place. This helps you to see how much income you have, as well as how your money is spent, which allows you to budget your money appropriately for your needs.

The Consumer Financial Protection Bureau (CFPB) recommends creating a budget spreadsheet/worksheet to track your income and expenses to assist you in creating a realistic budget for yourself.

While it is possible to create a spreadsheet yourself to help you with your financial planning, it is not necessary. Many sources are available for you to use, having already done most of the work for you in creating money management sheets.

Vertex42 Spreadsheets

Vertex42 lists over a dozen free budget and personal finance spreadsheets that work with Microsoft Excel, as well as some that are compatible with LibreOffice Calc, Apache OpenOffice Calc, and Google Sheets.

You’ll find spreadsheets for monthly and yearly household and personal budgets, Christmas gift budgets, business budgets, wedding budgets, and the Money Management Spreadsheet for Kids.

For those who want to track expenses against a budget, the Money Management Template is an excellent Excel or Calc spreadsheet that does not require the use of macros.

Many of these spreadsheets include a demo video or tutorial, making the option more attractive for those not familiar with spreadsheets.

It’s Your Money Budget Spreadsheets

It’s Your Money lists seven free budgeting spreadsheets, including a Cash Flow Budget Spreadsheet inspired by Dave Ramsey’s budgeting methods. The Box Budget Spreadsheetbreaks down each month into four weeks, giving you an easy visual of your expenses, savings, and income.

These spreadsheets work with Microsoft Excel with macros enabled, and some work with OpenOffice Calc (free). It’s Your Money offers an assortment of free or low-cost personal money management spreadsheets.

PearBudget Free Budget Spreadsheet

PearBudget is a free, comprehensive household monthly finance spreadsheet that can be downloaded and used with Microsoft Excel or any other spreadsheet software that supports Excel files. An analysis tab analyzes expenses by different categories and shows the difference between actual and budgeted spending.

PearBudget also offers an updated online version of the budget spreadsheet that does not require a download and is available for a free 30-day trial.

Google Sheets

Use the Google docs template gallery for Google Sheets to find some great options for budgets:

- Monthly budget: A very simple budget spreadsheet using a percentage of income for budgeting, designed for those with non-complicated scenarios.

- Yearly budget template: A detailed yearly and monthly budget tracking spreadsheet. This budget spreadsheet lets you project income and savings as well as keep a record of actual income and savings.

If you prefer using Google Drive spreadsheets, you can also find some of the Vertex42 budget spreadsheets in the Google Drive templates.

Tiller Money

Tiller is a company that offers spreadsheet integration with your bank account, providing options to create reports from the sheets that are created. You can also customize everything so that you can view what is important to you with your money.

Microsoft Office Templates

Microsoft has a large number of financial templates for use. You can find one for household expenses, holiday shopping, a college budget, and more.

What Does The Bible Say About Money Management?

Numerous stories and sayings from the Bible, written thousands of years ago, illustrate basic financial concepts that are as relevant as ever in the modern world.

1. Set Priorities

Proverbs 24:27 – Put your outdoor work in order and get your fields ready; after that, build your house.

This piece of advice from Proverbs seems a little surprising at first. To a modern reader, it’s not clear why planting the field should be a higher priority than building the house, since both appear to be necessities of life rather than luxuries.

However, if you think about it, the answer to the question becomes obvious: Your “field” isn’t just something you need for survival – it’s actually a means of survival. If you’re a farmer, your crops are your source of livelihood. If your field isn’t properly planted and prepared, you won’t have the money you need to build a house or provide for any of your other needs.

Today, few people rely on actual fields for their income. However, we all have certain basic needs that we have to meet in order to survive. And to meet those needs, most of us need some form of gainful employment. What good is a house if you don’t have the means to put food on the table, or pay the rent or mortgage?

So in modern terms, this proverb means that you need to set priorities with your money. Make sure you save enough to cover the essentials – what you need to keep yourself alive and able to work – before spending money on creature comforts. In other words, set aside money to pay all the bills before you spend any on new clothes.

2. Make a Budget

Luke 14:28-30 – Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it? For if you lay the foundation and are not able to finish it, everyone who sees it will ridicule you, saying, “This person began to build and wasn’t able to finish.”

This Biblical saying is about budgeting. You know you need to cover the cost of necessities first – but those costs don’t always come up right away, so you need to plan for them or make a budget. Some major expenses, such as rent payments, only come due once per month.

Others, like home insurance premiums, only come due once annually. Planning ahead and saving for those intermittent (but known) expenses is a key component of budgeting.

For example, suppose you earn $600 weekly. Out of that, you spend $50 on groceries, $10 on gas for your car, and $40 to pay the monthly electric bill, which happens to be due this week.

At this point, you might think you’ve covered all your essential expenses, and the remaining $500 is free to spend as you like. However, if you just blow through that “extra” $500 every week, you’ll be in for a rude awakening when your $700 rent is due at the end of the month.

By sitting down with a pen and paper – or a computer and budgeting software, such as Mint – you can figure out exactly which expenses you have to cover – not just in the immediate future, but over the long term.

Then you can determine how much money you need to set aside to cover all your financial needs, from paying your weekly grocery bill, to financing your retirement years down the line. That way, you can make sure your “tower” – your personal finances – can be completed, from bottom to top.

3. Build an Emergency Fund

Genesis 41:34-36 – Let Pharaoh appoint commissioners over the land to take a fifth of the harvest of Egypt during the seven years of abundance. They should collect all the food of these good years that are coming and store up the grain under the authority of Pharaoh, to be kept in the cities for food. This food should be held in reserve for the country, to be used during the seven years of famine that will come upon Egypt, so that the country may not be ruined by the famine.

In this passage from Genesis, Joseph interprets a dream the Pharaoh has had about seven fat cows grazing by a river that get swallowed up by seven skinny cows. Joseph concludes that the seven fat cows in the dream represent seven years of prosperity for Egypt, which will be followed by seven years of famine. To plan ahead for this disaster, Joseph advises the Pharaoh to store up grain during the seven good years and use that stored grain to get the country through the seven hard years to follow.

No matter whether you believe Joseph had a divine gift for interpreting dreams, there’s no denying that the advice he gives the Pharaoh is fundamentally sound. It always makes sense to save resources in good times so you have them to help you get through lean times.

In modern-day America, “lean” years are less likely to be a literal famine than some sort of financial crisis, such as a job loss or a health problem that saddles you with hefty medical bills. Regardless, Joseph’s basic strategy – setting aside money for future emergencies – still holds true.

Of course, present-day financial experts tend to modify Joseph’s advice a little bit. Instead of storing up cash for seven years, they say you should set aside roughly six months’ worth of living expenses in an emergency fund (more if you’re self-employed or have a fluctuating income).

And since you can’t predict exactly when a financial crisis will hit the way Joseph could, this money should be kept in cash or safe investments that should hold their value, so your money is there to draw on whenever you happen to need it.

4. Avoid Debt

Proverbs 22:7 – The rich rule over the poor, and the borrower is slave to the lender.

This proverb takes no skill to interpret. It describes debt as a kind of slavery – and modern Americans appear to agree. A survey by the Pew Charitable Trusts found that for many Americans, debt is a condition that lasts a lifetime and is impossible to escape.

The survey found that 80% of all Americans are in debt, and a majority of the oldest Americans are still carrying some form of debt in retirement. And 70% of those surveyed said debt was a necessity in their lives – something they didn’t want, but still couldn’t imagine living without.

All that debt takes a toll on those who carry it, both mentally and physically. A 2014 article in Health reports that high levels of debt are associated with anxiety, depression, and relationship problems. Debt can also be linked to high blood pressure, lowered immunity, and a host of physical symptoms, including headaches, back pain, and ulcers.

However, the Pew survey also found some signs that Americans’ attitudes toward debt are changing. Younger Americans – those in the Millennial generation – are more likely to take a negative view of debt, saying it has burdened them rather than expanded their opportunities. They’re also more inclined to say the way Americans use debt is irresponsible. And in their own lives, they’re less likely to take on new debt, such as credit card debt or mortgages.

These young Americans, it appears, have taken the Bible’s advice about debt to heart. They view debt as a type of enslavement, and they want to avoid new debt and pay off the debts they already owe.

5. Diversify Your Investments

Ecclesiastes 11:2 – Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.

This line from Ecclesiastes is a short, clear explanation of why it makes sense to diversify your investments. Nearly any type of investment can fall victim to “evil” of some sort, whether it’s a plague of locusts that wipes out a grain crop, or a market crash that reduces the value of stocks or real estate. So it makes sense to put money into many different types of investments so that a single disaster can’t cost you everything you have.

For instance, if you were a merchant in Biblical times, hoping to make money by trading cloth or spices with neighboring countries, it wouldn’t make sense to load all your cargo onto a single ship. If that one ship sank, you’d lose everything you had in one blow.

However, if you divided up your cargo among seven or eight ships, all headed along different routes, the chances that all of them would sink would be very low. So even if you lost one or two ships, you could still hope to earn enough from the others to make a profit.

It’s a basic principle of investing that the more you diversify, the more you reduce your risk. Investing in 100 different stocks – for instance, by buying shares in an index fund – is far safer than investing in just a single stock.

Admittedly, there are some who argue that diversification is a myth. Their claim is that you can earn a much better return by putting all your eggs in one basket – as long as it’s the right basket.

However, it takes a true genius to figure out which basket is the right one, and investors who try it are far more likely to end up losing their shirts than becoming millionaires overnight. For the ordinary investor, diversifying to reduce risk is a much safer and sounder plan.

What is The Best Money Management Company?

We have put together a list of the top investors and wealth management companies — Betterment, Vanguard, Moneyfarm, Robinhood, Advizr, Nutmeg, Wealthfront, Habito, Hydrogen, Sigfig, Scalable Capital, Mint, Wealthsimple, and Charles Schwab. We’ll share how each of these top firms are positioning themselves for success as we transition into the new normal.

Betterment

Betterment is the most popular AI-powered robo-advisor in the U.S. and has more than $6 billion in AUM. The company does not require a minimum deposit and charges only 0.25% of AUM annually for its basic plan, making it accessible to even the newest investors.

Betterment realizes that customer focus is key in the times of COVID-19, and has advisors readily available to help investors sort out questions and challenges concerning their retirement accounts.

Vanguard

Vanguard had about $6.2 trillion in global assets under management, as of January 31, 2020. Vanguard is good for low-cost investing, with a $0 stock trading commission, making it ideal for buy-and-hold investors and retirement savers. However, active traders may require a more robust trading platform.

Moneyfarm

Moneyfarm is a robo-advisor that operates in Italy and the United Kingdom, that is very convenient and low-maintenance. It will conduct research and invest money in the way it believes is best for each client’s personal needs, and not just what is popular at the time. Customers can start a general investment account, or transfer their existing ISA account to the platform, and then simply watch their money work for them.

Robinhood

Robinhood offers free stock options, exchange-traded fund (ETF) and cryptocurrency trades, and its account minimum is $0. It is a great choice for those looking for low limits or trade crypto, but does not offer mutual funds or bonds.

Advizr

Advizr was acquired by Orion Advisor Services, LLC (Orion), the premier portfolio management solution provider for registered investment advisors, in 2019. It is one of the least expensive options on the market, as their full package of financial planning software tools, client PFM portal, and account aggregation benefits are available for only $75 per month.

Advizr is newer to the marketplace and is not as robust as some of the bigger players, but it is growing in popularity among smaller firms or advisors looking for an intuitive, easy-to-use platform. The company collects client data and runs tests to determine appropriate recommendations.

Nutmeg

Nutmeg launched in the UK in 2011 and offers investors a cheaper alternative to traditional wealth management services by focusing on exchange traded funds (ETFs) and tracker funds that carry lower charges. They also specialize in import substitution industrializations (ISAs) and pensions, and are ideal for those looking for someone to manage their portfolio and help them make tactical decisions.

Wealthfront

Wealthfront launched the Wealthfront Cash Account in 2019, offering a 2.24% interest rate and FDIC insurance that covers balances up to $1 million. They offer a low 0.25% management fee, free management of accounts with balances under $5,000, and one of the strongest tax-optimization services to help those with taxable accounts enhance their tax efficiency.

Habito

Habito targets home buyers and tries to remove the friction of mortgage applications. The company is best known for offering transparency, an easy-to-use platform, and a quick application process. It may require clients to have some mortgage knowledge and is not well suited for those who have had debt issues in the past

Hydrogen

Before launching in 2017, Hydrogen started as a product offering of consumer fintech company Hedgeable. Hydrogen launched as a standalone platform with the mission of allowing teams to deploy financial applications anywhere in the world.

Hydrogen has gained popularity due it’s quick application process, straightforward website, and online-only approach that does not require clients to travel to a physical space. This is a good fit for more experienced investors, as some mortgage knowledge may be required and it is not ideal for those who have had debt issues in the past.

SigFig

SigFig is an robo-advisor backed by UBS, New York Life, Santander InnoVentures, Eaton Vance, and Comerica Bank. They offer low-cost portfolio management, with no fee for the first $10,000 invested, with a competitive rate of 0.25% going forward. SigFig’s $2,000 minimum investment is higher than that of competitors, but many clients find that its unlimited free financial counseling and innovative portfolio tracking tools more than makes up for this.

Scalable Capital

Scalable Capital started in Munich, Germany in 2016, and has since grown to be one of Europe’s fastest growing digital wealth managers, investing over £1.3 billion of assets for about 50,000 clients. It provides the strongest and most consistent returns on low to medium risk portfolios, but is unlikely to be a top performers due to its heavy focus on risk management.

In contrast to services like Nutmeg and Moneyfarm, Scalable Capital has a minimum investment amount of £10,000, which has gotten them higher investments from the average client, but could scare away some newer investors.

Mint

Mint is a popular financial tool that was founded in 2009 by Inuit, the company that also created Quickbook for bookkeeping and accounting, and TurboTax for the completing, filing, and paying of taxes. Its mission is to keep individuals more informed about their financial health, whether they are looking for a general overview or want to explore its more robust features.

Mint has an impressive website and mobile app, which syncs with other accounts and categorizes transactions. Users can check their net worth, set budgets, and create goals. While there is no fee to sign up, users will encounter advertisements. In addition, some might have to adjust their settings to avoid frequent notifications.

Wealthsimple

Wealthsimple could be a good fit for investors of all ages looking to save money and take the next step in ensuring long-term financial security. They are a socially responsible investment option, and have live representatives readily available to help clients. Wealthsimple’s fees are higher compared to the average robo-advisor, but they offer an account minimum of $0, which is useful for investors who are just starting out.

Charles Schwab

Charles Schwab is a well-known wealth management company that went public in January of 2003. It caters to beginner investors with its $0 account minimum, as well as to active traders with its $0 commission for stock, options and exchange-traded funds. The company also charges no annual or inactivity fees. They also have an above-average mobile app, and offer sophisticated tools and trading platforms.

How do I Find The Best Money Manager?

An advisor’s compensation is about more than just how you’re billed. A fee-based advisor is more likely to be a fiduciary, who won’t be swayed by conflicts of interest, while an advisor who earns commissions may be incentivized to place you in investments that earn her the highest commission.

If you’re working with a fiduciary financial advisor, he or she is legally bound to put your needs before their own. A financial professional who has a suitability requirement is legally bound to provide products that are suitable for your needs, but they may not be the very best for you.

That doesn’t mean somebody who upholds the suitability standard isn’t going to look out for you – but it does mean that the rules for those advisors are less stringent.

Registered investment advisors, investment advisor representatives and certified financial planners all carry fiduciary-level responsibility. You can easily spot these titles on business cards, websites and email signatures. Chartered retirement planning counselor and accredited investment fiduciary are other designations that indicate a fiduciary responsibility.

When choosing a financial advisor, think about what services you’re looking for. Are you seeking help with financial and retirement planning, or simply someone to help you buy and sell investments? If it’s the former, you’d likely be better served by a fee-only advisor. With the latter, a commission-based advisor could help you keep costs down by not charging for unneeded services.

As for where to find a financial advisor, there are several places to look:

- Use an online advisor search.U.S. News has an online database of financial advisors across the country. You can use the search to find advisors in your area and learn more about their specialties and experience.

- Ask friends, family or colleagues for recommendations. Obviously, you’ll be more likely to find somebody who will work with you if your friends, family members or colleagues are in a similar tax bracket as you are.

- The Garrett Planning Network. Garrettplanningnetwork.com offers a map of the United States where users can click on a state and find a list of financial advisors who cater to the middle class.

- The National Association of Personal Financial Advisors. The association’s website, napfa.org, allows you to find a financial advisor near you.

- Robo advisors. You may want to consider an automated portfolio management service as a cost-effective option. For example, with Schwab Intelligent portfolios, you don’t pay advisory fees or commissions, though you will need $5,000 to get started. Meanwhile, Wealthfront, another popular robo advisor, has a $500 minimum account requirement, and only charges an annual advisory fee of 0.25% on all assets under management.

- Search engines. This one may seem like a no-brainer, but the power of search engines can’t be overlooked. Chances are a search engine is how you found your way here. So if none of the above prove fruitful, consider a quick Google search for “financial advisor near me” or “financial advisor for the middle class.” If you know you want someone to help with financial planning as opposed to just buying and selling, you may want to include “fiduciary” in your search terms. This way, you’ll be able to locate fee-only advisors and not commission-based brokers.

- The Accredited Financial Counselor website. “I would strongly encourage true middle-income people to look (at afcpe.org) for an accredited financial counselor,” says Justin Chidester, who is both an accredited financial counselor and a certified financial planner – as well as the owner of Wealth Mode Financial Planning in Logan, Utah.

You’ve probably heard of certified financial planners, but accredited financial counselors have been around for a while too, according to Chidester.

Read Also: 10 Hot Tips For Investing In The Stock Market

“They often have a focus on helping low- and middle-income people, at affordable prices, with topics relevant to everyone – saving, budgeting, paying debt, improving credit, preparing to buy a home and working through poor habits with money,” Chidester says.

He adds that they can’t legally provide investment or insurance advice, but they can provide great education about any financial topic and point you in the right direction for those things.

Bottom Line

Navigating the world of money management can be intimidating. Whether it is starting out with a financial plan or the daunting task of performing math, beginners need somewhere to start to build up their money management skills.

Start with setting financial goals that are realistic and work well within a budget.

Once a budget is in place, it is important to remain consistent and think of where to invest your money beyond your checking account.

Avoid overspending with credit cards by setting limits and staying on top of payments.

Putting these recommendations into action will assist money management beginners and help them avoid money mistakes.