Although it’s been in business for over a century, US Bank is well-positioned as a modern mortgage lender, with excellent loan offerings and tech-forward convenience. It offers online pre-qualification and preapproval, a fully digital loan application and a mobile app — all aimed at closing loans on time and with less stress.

Let us now take a closer look at the US Bank and some of the product offers available.

- How Can You Save Money With US Bank Mortgage Rates Comparison?

- Is US Bank Good For Mortgages?

- Do Mortgage Rates go Down When The Fed Cuts Rates?

- What Are Mortgage Rates Today US Bank?

- Which Bank Has Lowest Mortgage Rates?

- Bank of America Mortgage Rates

- Refinance Rates

- Wells Fargo Mortgage Rates

- U.S Bank Home Mortgage Contact Number

- U.S Bank Mortgage Complaints

- Is it Worth Refinancing For 1 Percent?

- Refinancing for a 1 percent lower rate

- Should I Refinance my Mortgage Now?

- Should I Lock my Mortgage Rate Today?

- How do You Negotiate Mortgage Rates?

- Why You Should Not Refinance Your Mortgage?

- Should I Pay off Credit Cards Before Refinancing?

How Can You Save Money With US Bank Mortgage Rates Comparison?

U.S. Bank offers one standard savings account that earns the same APY, regardless of your balance. While the bank is known for innovating, U.S. Bank’s savings account offers a very low-interest rate. People looking for a competitive savings rate should look elsewhere.

U.S. Bank earned a 2.7 out of 5 in Bankrate’s overall rating.

U.S. Bank’s yield is very low. If you open its standard savings account you will earn almost no interest, which is the case at many bigger banks. Savers could get a much higher payout by opening an account with an online bank competitor, such as BMO Harris, CIT Bank or Marcus by Goldman Sachs.

Is US Bank Good For Mortgages?

U.S. Bank offers fixed- and adjustable-rate mortgages, government-backed FHA and VA loans, jumbo loans, home equity loans and lines of credit, and mortgages for low-to-moderate-income borrowers.

Read Also: Reverse Mortgages

Construction, home renovation and vacant lot loans also are available, but only in the states where U.S. Bank has physical locations.

U.S. Bank has a few products that may not be available from some smaller lenders, though you won’t find them mentioned on its website. One such product is the simultaneous second mortgage. Also known as a “piggyback” or 80-10-10 mortgage, the loan is typically used by borrowers with strong credit in areas with high real estate prices who can’t come up with a traditional 20% down payment.

U.S. Bank also provides expanded mortgage financing for physicians who are in residencies. The program offers home loans with higher loan-to-value guidelines and some leeway on debt-to-income ratios. Again, this loan isn’t advertised on the U.S. Bank website, so if you’re a medical professional, contacting a loan officer is the best way to learn more about this option.

The bank also assists borrowers in locating down payment assistance programs where they live.

Do Mortgage Rates go Down When The Fed Cuts Rates?

A rate cut can prove beneficial with home financing, but the impact depends on what type of mortgage the consumer has, whether fixed or adjustable, and which rate the mortgage is linked to.

For fixed-rate mortgages, a rate cut will have no impact on the amount of the monthly payment. Low rates can be good for potential homeowners, but fixed-rate mortgages do not move directly with the Fed’s rate changes. A Fed rate cut changes the short-term lending rate, but most fixed-rate mortgages are based on long-term rates, which do not fluctuate as much as short-term rates.

Generally speaking, when the Fed issues a rate cut, adjustable-rate mortgage (ARM) payments will decrease. The amount by which a mortgage payment changes will depend on the rate the mortgage uses when it resets.

Many ARMs are linked to short-term Treasury yields, which tend to move with the Fed or the London Interbank Offered Rate (LIBOR), which does not always move with the Fed. Many home-equity loans and home-equity lines of credit (HELOCs) are also linked to prime or LIBOR.

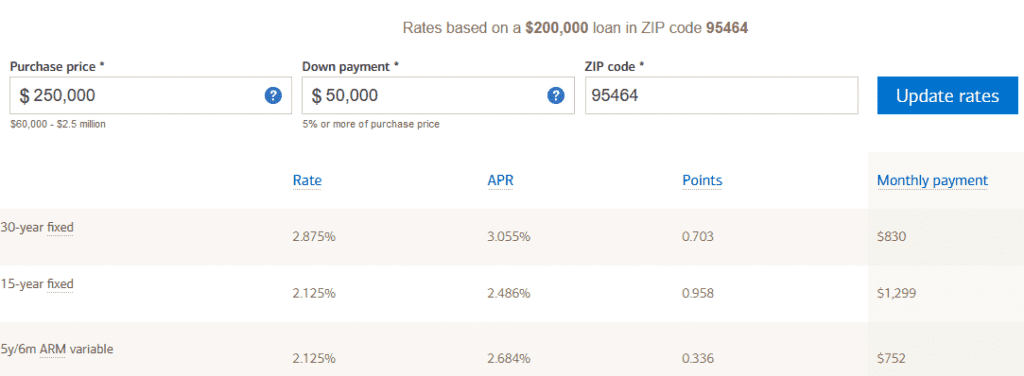

What Are Mortgage Rates Today US Bank?

The current mortgage rates listed below assume a few basic things about you, including, you have very good credit (a FICO credit score of 740+) and you’re buying a single-family home as your primary residence.

Check out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans U.S. Bank offers. If you decide to purchase mortgage discount points at closing, your interest rate may be lower than the rates shown here.

| Term | Rate | APR |

|---|---|---|

| 30-year fixed | 3.125% | 3.193% |

| 20-year fixed | 2.875% | 2.971% |

| 15-year fixed | 2.250% | 2.372% |

| 10-year fixed | 2.125% | 2.304% |

Which Bank Has Lowest Mortgage Rates?

A house is likely the biggest purchase of your life, and you will need a mortgage to buy one, unless you are flush with cash. The best mortgage lender not only saves you money but also takes stress out of the homebuying process. This guide can help when you are ready to choose a mortgage lender.

Note, the average rates shown in this table are from 2019 — the most recent data available.

Mortgage rates have fallen quite a bit since then, so your own rate is likely to be lower.

However, last year’s averages can still be used as a tool to compare lenders side by side.

| Mortgage Lender | Average 30-Year Mortgage Rate in 2019 |

| USAA* | 3.98% |

| Veterans United* | 4% |

| Navy Federal CU* | 4% |

| Bank of America | 4.05% |

| Guaranteed Rate | 4.12% |

| PNC | 4.13% |

| Caliber Home Loans | 4.15% |

| loanDepot | 4.15% |

| Freedom Mortgage Corp. | 4.15% |

| Guild Mortgage Co | 4.15% |

| New American Funding | 4.16% |

| Quicken/Rocket | 4.16% |

| Finance of America Mortgage | 4.21% |

| Chase | 4.22% |

| Wells Fargo | 4.22% |

| Movement Mortgage | 4.24% |

| Stearns Lending | 4.24% |

| Flagstar Bank | 4.28% |

| HomeBridge Financial Services | 4.28% |

| Academy Mortgage Corp | 4.30% |

| Fairway Independent | 4.33% |

| PrimeLending | 4.36% |

| Mr. Cooper | 4.44% |

| US Bank | 4.66% |

Bank of America Mortgage Rates

A fixed-rate mortgage offers you consistency that can help make it easier for you to set a budget. Your mortgage interest rate, and your total monthly payment of principal and interest, will stay the same for the entire term of the loan.

Mortgage rates valid as of May 2021 and assume borrower has excellent credit (including a credit score of 740 or higher). Estimated monthly payments shown include principal, interest and (if applicable) any required mortgage insurance.

ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a 10y/6m ARM; the 6m shows that the interest rate is subject to adjustment once every six months thereafter).

Refinance Rates

On Monday, May 17, 2021, the benchmark 30-year fixed refinance rate is 3.100% with an APR of 3.250%. The average 15-year fixed refinance rate is 2.390% with an APR of 2.610%. The 5/1 adjustable-rate refinance (ARM) rate is 3.020% with an APR of 4.030%, according to Bankrate’s latest survey of the nation’s largest refinance lenders.

| NBT Bank, NA | 3.125%30 year fixed refinance | 3.134% | $708 | $2,570 | |

| Bank of America, NA | 3.125%30 year fixed refinance | 3.182% | $3,054 | $2,570 | |

| Santander Bank, N.A. | 3.250%30 year fixed refinance | 3.277% | $2,004 | $2,611 | |

| Citizens Bank, NA | 3.375%30 year fixed refinance | 3.398% | $750 | $2,653 |

Mortgage rates change all the time, driven by factors like the economy, Treasury bond rates and demand. Lenders nationwide provide weekday mortgage rates to our comprehensive national survey of the most current rates available.

The interest rate table below is updated daily. Use these as a guide to what’s available, but keep in mind your rate may vary depending on your qualifications and the lender you choose.

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 3.100% | 3.250% |

| 20-Year Fixed Rate | 3.010% | 3.170% |

| 15-Year Fixed Rate | 2.390% | 2.610% |

| 10/1 ARM Rate | 3.210% | 4.040% |

| 7/1 ARM Rate | 3.010% | 3.880% |

| 5/1 ARM Rate | 3.020% | 4.030% |

| 30-Year VA Rate | 2.660% | 2.860% |

| 30-Year FHA Rate | 2.800% | 3.650% |

| 30-Year Fixed Jumbo Rate | 3.110% | 3.180% |

| 15-Year Fixed Jumbo Rate | 2.390% | 2.450% |

| 7/1 ARM Jumbo Rate | 3.070% | 3.810% |

| 5/1 ARM Jumbo Rate | 2.740% | 3.870% |

Wells Fargo Mortgage Rates

Interest rates for mortgages below may include up to 0.5 discount points as an upfront cost to borrowers. Rates for refinancing assume no cash out.

| Product | Interest Rate | APR |

|---|---|---|

| Conforming and Government Loans | ||

| 30-Year Fixed Rate | 3.000% | 3.102% |

| 30-Year Fixed-Rate VA | 2.375% | 2.621% |

| 20-Year Fixed Rate | 2.875% | 2.991% |

| 15-Year Fixed Rate | 2.250% | 2.469% |

| 7/6-Month ARM | 2.125% | 2.558% |

| 5/6-Month ARM | 2.000% | 2.547% |

| Jumbo Loans– Amounts that exceed conforming loan limits | ||

| 30-Year Fixed-Rate Jumbo | 2.875% | 2.938% |

| 15-Year Fixed-Rate Jumbo | 2.750% | 2.830% |

| 7/6-Month ARM Jumbo | 2.375% | 2.633% |

| 10/6-Month ARM Jumbo | 2.500% | 2.663% |

U.S Bank Home Mortgage Contact Number

By phone:

800-365-7772

By email:

USBHM515ServicingMailbox@usbank.com

By mail:

U.S. Bank Home Mortgage

Attn: Customer Service Research

PO Box 21948

Eagan, MN 55121

U.S Bank Mortgage Complaints

For Purchase

877-303-1637

For Refinance

877-303-1640

Customer Service

800-365-7772

Is it Worth Refinancing For 1 Percent?

Homeowners who can lower their mortgage rate by 1 percent or more are generally in a great position to refinance. But what if you can only lower your rate by 0.5 percent — or even 0.25 percent?

The answer might be yes, especially if you can get the lender to cover your closing costs and still generate savings.

The ‘right’ amount to lower your mortgage rate is not set in stone. It depends on your refi goals and how much you want to pay upfront to get your rate as low as possible.

Refinancing for a 1 percent lower rate is often worth it. One percent is a significant rate drop, and will generate meaningful monthly savings in most cases.

For example, dropping your rate 1 percent — from 3.75% to 2.75% — could save you $250 per month on a $250,000 loan. That’s nearly a 20% reduction in your monthly mortgage payment.

Those monthly savings can be put toward daily living expenses, emergency funds, investments, or paid back into your mortgage to pay the loan off early and save you even more in interest.

Refinancing for a 1 percent lower rate

| Loan Balance | $250,000 |

| Current Interest Rate | 3.75% |

| New Interest Rate | 2.75% (-1%) |

| Monthly Savings | $250 |

| Closing Costs | $5,000 (2%) |

| Time to Break Even | 20 months (1.6 years) |

| Worth It? | Yes, if you keep the loan ~2 years or longer |

Keep in mind, ‘breaking even’ with your closing costs isn’t the only way to determine if a refinance is worth it.

A homeowner who plans to move or refinance again before the break-even point might opt for a no-closing-cost refinance.

Should I Refinance my Mortgage Now?

With mortgage rates near rock bottom, it’s a good time to refinance a mortgage, right? Sure, in many cases, no doubt.

As a matter of fact, 17% of U.S. homeowners with a mortgage on their primary residence refinanced in 2020, according to a September NerdWallet survey conducted online by The Harris Poll among 1,413 U.S. homeowners. And nearly one-third (31%) of homeowners with a mortgage on their primary residence said they were considering refinancing within the next 12 months, according to the survey.

To know if it’s the right time to refinance, first determine how long you plan to stay in your home, consider your financial goals and know your credit score. All of these things, along with current refinance interest rates, should play a role in your decision about whether — and when — to refinance.

The usual trigger for people to start thinking about a refinance is when they notice mortgage rates falling below their current loan rate. But there are other good reasons to refinance:

- If you’re looking to pay off the loan quicker with a shorter term.

- You’ve gained enough equity in your home to refinance into a loan without mortgage insurance.

- You’re looking to tap a bit of your home equity with a cash-out refinance.

Should I Lock my Mortgage Rate Today?

The decision to lock in your mortgage rate could save you thousands – or it could cost you thousands. With that, you’ll have to weigh the pros and cons for your particular situation.

You’ll make your decision on an interest rate lock when you’re approved for a mortgage. At that point, you can lock in your rate or wait until closing to do so.

As with all financial decisions, there are pros and cons to locking in your mortgage rate. Here’s what you need to consider.

Pros Of Locking Immediately

Locking in your interest rate can be tempting, here’s why:

- Mortgage rates could rise after you lock. The threat of a higher mortgage interest rate can be a strong reason to lock in a rate that you’re comfortable with.

- Peace of mind. You won’t have to worry about interest rates rising to create an unaffordable mortgage payment.

If you’re presented with a reasonable mortgage rate that you’re happy with, locking it in can provide peace of mind throughout the closing process.

Cons Of Locking Immediately

But there are some downsides to locking in your rate right away, including:

- Interest rates may fall after you lock in. You could miss out on the chance to score an even lower interest rate.

- Letting the lock expire has consequences. If you lock in a mortgage rate but ultimately allow it to expire, the lender might charge you hundreds of dollars.

The big disadvantage is the potential for a missed opportunity on a lower mortgage rate.

If you decide not to lock in your rate right away, here’s what you should keep in mind.

Communicate With Your Lender

First things first, talk with your lender about the decision to hold off. Ask your lender what costs are associated with locking in a mortgage rate. Make sure that you are comfortable with the cost.

Also, ask how long a lock will last. Rate locks often last 15 – 60 days. But the exact time frame will vary based on the lender.

Finally, ask about the process to lock in your rate when you are ready.

Watch The Markets

Monitoring the mortgage rate markets can help you decide when the right moment is to lock in your rate. You can check in regularly with Rocket Mortgage® to see the current interest rates.

Remember that no one can predict the future. With the volatility of the markets, it can be difficult to pick out the lowest point for mortgage rates. But as long as you lock in an affordable rate that you are comfortable with, it can be worth watching the markets.

How do You Negotiate Mortgage Rates?

As a soon-to-be homeowner, one of the most important steps of buying a home is securing an affordable mortgage rate. To secure the lowest rates, you may have to negotiate.

With that in mind, there are things home buyers should do when negotiating your mortgage rates. Armed with this knowledge, you should be able to use your negotiating power to the fullest and find lower rates. Here are five ways to negotiate a better mortgage rate:

1. Compare multiple lenders and loan rates

One personal finance tip shared all the time is to shop around for mortgage rates. This tip is popular because it is true. The rate you were given can vary between mortgage lenders, so it’s important to get quotes from multiple companies before applying for a loan.

In today’s interest rate environment, in particular, it’s possible to secure a historically low rate. At the time this article was written, the average interest rate on a 30-year fixed-rate loan is 2.87%. That’s more than half a point lower from the average rate at this time last year, which was 3.57%.

2. Ask a bank or lender to match other mortgage offers

It’s important to note that those rate quotes can also serve a secondary purpose. Often, you can ask lenders to match other mortgage offers. If you choose to do so, having another rate quote available to serve proof that you were given a lower rate will give you more negotiating power.

However, in addition to negotiating your interest rate, you can also ask about the various fees that are being charged. While not all mortgage costs are negotiable, some have more flexibility. For example, while appraisal costs and title insurance fees are usually set in stone, you’ll likely be able to negotiate lender-specific fees like the application fee or origination fee.

3. Use discount points

If your goal is to secure the best possible interest rate, another option may be to use discount points. Also known as mortgage points, these are fees that you can pay directly to the lender in exchange for a lower interest rate. Essentially, with this method, you’re paying upfront to secure a lower payment over the life of the loan. Usually, you can expect to pay 1% of the loan amount per point.

With that said, where points are concerned, it’s absolutely crucial to understand how long it will take to break even on your purchase. You’ll also want to consider how long you plan to be in the home. In general, if you’re only planning on staying put a few years, points may not be worth the upfront cost.

4. Build up your credit card history and score

Another thing you can do to ensure you secure the best interest rate is to work on your credit score before you apply for a loan. Truthfully, no matter what the current rate forecast looks like, the best interest rates are always given to the borrowers with the highest scores.

5. Make a bigger down payment

Lastly, making a bigger down payment could also help ensure that you have access to the best interest rates. Put simply, the size of your down payment affects your loan-to-value ratio. If your loan-to-value ratio is less than 80%, which means you’ve made a down payment of over 20%, you’ll likely get access to the best available rates.

If you don’t have enough savings to make a big down payment, you could always ask your lender about available home buyer programs. Often, these programs try to ease the upfront cost burden of buying a home by offering grants or silent loans that can be put towards your down payment or closing costs.

Why You Should Not Refinance Your Mortgage?

Let’s us look at four of the most common reasons why you shouldn’t refinance your mortgage.

1. A Longer Break-Even Period

One of the first reasons to avoid refinancing is that it takes too much time for you to recoup the new loan’s closing costs. This time is known as the break-even period or the number of months to reach the point when you start saving. At the end of the break-even period, you fully offset the costs of refinancing.

There’s no magic number that represents an acceptable break-even period. There are a couple of different factors you have to consider to come up with a viable estimate. It depends on how long you plan to stay in the property and how certain you are about that prediction.

To calculate your break-even period, you’ll need to know a couple of facts. The closing costs on the new loan and your interest rate are the most crucial. Once you know the interest rate, you can figure out how much you’ll save in interest each month. You should be able to get an estimate of these figures from a lender. So let’s suppose the closing costs to refinance amount to $3,000 and your potential monthly savings are $50. Here’s how to calculate your break-even period:

- Break-even period = closing costs ÷ monthly savings

- $3,000 ÷ $50 = 60

In this instance, it will take you 60 months or five years to reach your break-even period.

2. Higher Long-Term Costs

Once you’ve spoken to your bank or mortgage lender, consider what refinancing will do to your bottom line in the long run. Refinancing to lower your monthly payment is great unless it puts a big dent in your pocketbook as time goes on. If it costs more to refinance, it probably doesn’t make sense.

For instance, if you’re several years into a 30-year mortgage, you’ve paid a lot of interest without reducing your principal balance very much. Refinancing into a 15-year mortgage will probably increase your monthly payment, possibly to a level that you won’t be able to afford.

If you start over again with a new 30-year mortgage, you’re starting with almost as much principal as last time. While your new interest rate will be lower, you’ll be paying it for 30 years. So your long-term savings could be insignificant, or the loan may eventually cost you more. If lowering your monthly payment saves you from defaulting on a current, higher payment, you might find this long-term reality acceptable.

You might also want to consider the opportunity cost of the refinancing process. It takes time and effort to refinance a mortgage. You might have more fun and make more money doing home improvement projects, getting a certification, or looking for clients.

3. Adjustable-Rate vs. Fixed-Rate Mortgages

Refinancing to a lower interest rate doesn’t always result in substantial savings. Suppose the interest rate on your 30-year fixed-rate mortgage is already fairly low, say 5%. In that case, you wouldn’t be saving that much if you refinanced into another 30-year mortgage fixed at 4.5%. Once you factor in the closing costs, your monthly savings wouldn’t be significant unless you have a mortgage several times larger than the national average.

So is there an alternative? Getting an adjustable-rate mortgage (ARM) may seem like a great idea because they typically have the lowest interest rates. It may seem crazy not to take advantage of them, especially if you plan to move by the time the ARM resets.

When rates are so low—by historical and absolute standards—they aren’t likely to be significantly lower in the future. That means you’ll probably face substantially higher interest payments when the ARM resets.

Suppose you already have a low fixed interest rate and you’re able to manage your payments. In that case, it’s probably a better idea to stick with the sure thing. After all, an adjustable-rate mortgage is usually much riskier than a fixed-rate mortgage. Sticking with a low fixed rate may save you thousands of dollars in the end.

4. Unaffordable Closing Costs

There’s no such thing as a free refinance. You either pay the closing costs out of pocket or pay a higher interest rate. In some cases, you’re allowed to roll the closing costs into your loan. However, you are then left paying interest on closing costs for as long as you have that loan.

Think about the closing costs and figure out how each one of these cases fits into your situation. Can you afford to spend several thousand dollars right now on closing costs? Or do you need that money for something else? Is the refinance still worthwhile at the higher interest rate? If you’re looking at rolling the closing costs into your loan, consider that $6,000 at a 4.5% interest rate will cost thousands of dollars over 30 years.

The only person who can decide whether this is a good time to refinance is you. If you want a professional opinion, you are most likely to get an unbiased answer from a fee-based financial advisor. Refinancing is always a good idea for someone who wants to sell you a mortgage. Your situation, not the market, should be the largest factor in when to refinance.

Should I Pay off Credit Cards Before Refinancing?

Over half of U.S. adults (55 percent) owning credit cards say they also have debt, according to a 2019 CNBC Make It and Morning Consult survey. For people applying for a mortgage loan, credit card debt can pose a problem.

If you don’t qualify for the lowest possible rate, you’ll owe thousands of extra dollars in interest over the life of the loan. You can also be denied a mortgage loan if your credit card balances are too high or your payment history lowers your credit score beneath the required threshold.

Should you pay off all credit card debt before getting a mortgage? In some cases, especially if your current credit score makes you ineligible for a mortgage loan, it’s a good idea to pay down credit card debt. But credit card debt isn’t the only factor in getting mortgage approval. There are several variables you need to consider if you carry debt and are looking to be approved.

You don’t need excellent credit, but it helps

A home is one of the single biggest purchases the average American will make. With the median price of a home in the United States now $243,225, the interest rate you receive really matters.

For instance, the difference between a 3.5 percent and 4.0 percent rate means $56 dollars a month on a $200,000 mortgage. That $56 isn’t just money you get to keep in your wallet, either. The lower the interest rate is, the bigger the principal payments you’ll make each month. You are actually building equity faster when you have a lower interest rate.

When you look online, the low rates you see are “teaser rates,” typically only available to people with excellent credit (a score of 780 or above). It’s important to have a realistic sense of what your rate will be based on your current credit score.

Paying off your debt can raise your credit score, but it’s not always necessary to have an excellent score in order to end up with a competitive interest rate. If you have a good to very good score (at least 620) and qualify for a private mortgage loan (580 for an FHA loan), you can usually buy a “point” for an additional 1 percent of the loan value in order to reduce the interest rate from, say, 5 percent to 4 percent. Over the long haul, that could be a good investment.

Another option is to hold your mortgage for a few years, allow equity to build and then refinance to a lower rate. This can be a riskier strategy since mortgage rates could climb, the price of real estate could drop or both.

Having credit card debt isn’t going to stop you from qualifying for a mortgage unless your monthly credit card payments are so high that your debt-to-income ratio is above what lenders allow. Banks and other mortgage lenders obtain your debt-to-Income (DTI) ratio by dividing your monthly debt by your gross (pre-tax) income.

There are actually two different DTI ratios that a mortgage lender may consider:

- The front-end ratio divides your monthly household expenses, including the mortgage payment, by your gross income. You typically need to stay below 28 percent to be approved.

- The back-end ratio takes your total debt payment into consideration, including your credit card payment. The figure you need to stay below is 36 percent.

Lenders generally consider the back-end DTI ratio more significant, and if it’s above 36 percent, you’ll have a hard time qualifying for a loan. Neither DTI ratio takes into consideration things like food and gas each month, and some don’t consider installment debt that is almost paid off.

Read Also: The Ultimate Beginners Guide to Budgeting and Saving

There are several ways to pay down credit card debt before you apply for a home mortgage loan, but some of them can affect your credit score in the short-term. For instance, if you get a new credit card with an introductory zero percent APR, you’ll see a slight hit to your credit just for having a hard inquiry on your account. This is something to keep in mind if you plan on applying for a mortgage loan within a few months.

Another way to pay off debt is to get a personal loan from friends or family members. Just remember that lenders calculate DTI based on your monthly payment amounts, not your credit card balance. Paying off some of a credit card loan won’t affect your DTI that much — though it could be just enough to put you below 36 percent.

Credit card debt is costly to own and should be the first thing you target in a debt-reduction strategy. But if you’d like to buy a house right away, it won’t necessarily be an impediment to loan approval 9provided that your DTI percentage is low enough and you have good to excellent credit).