Working in the financial industry is one of the most rewarding career choices that you can make. Financial planners work with different types of clients, helping them to make the right investment decisions.

These clients may be businesses as well as individuals. In order to become a financial adviser, there are certain training that you have to go through. You will also need to obtain some accreditation.

- What Does a Financial Advisor do?

- Financial Advisor Career

- Financial Advisor Course

- Certified Financial Planner

- Financial Advisor Cost

- Financial Advisor Certification

- Becoming a Financial Advisor at 40

- How to Become a Financial Advisor Without a Degree

- How Long Does it Take to Become a Financial Advisor

- Financial Advisor Jobs

- Financial Advisor Salary

- How do Financial Advisors make Money?

- Can a Financial Advisor Make You Rich?

- How Much do Financial Advisors Make Starting Out?

- Is Being a Financial Advisor Worth it?

- How Many Hours a Week do Financial Advisors Work?

- How Much Money Does a CFP Make?

- How Much do Self Employed Financial Advisors Make?

What Does a Financial Advisor do?

These professionals meet with their clients to analyze their financial, circumstances and to set short-term and long-term goals. They will come up with plans that are tailored to their client’s needs and make necessary adjustments as time progresses to keep the plans on track.

Read Also: Ways you can Improve Your Relationship With Money

They also act as intermediaries between their clients and the various companies they plan to invest in. They will make sure that diligent research is done to confirm the viability of those investments.

As a financial advisor, you will provide your clients with advice on the types of stocks to buy or the commodities to invest in. You may also choose to specialize on particular areas of this profession.

Some of these specializations include rating analysis, stock market investments, small business financial management, insurance and estate planning. Most of your work will be done in an office but you will have to visit your clients and attend meetings from time to time.

This makes it necessary to have excellent people skills. This job can sometimes be tasking but it has a lot of monetary rewards. You can make over $100,000 per year.

You will have job satisfaction when you work as a financial adviser because you can easily see the result of your efforts when you help your clients to achieve their investment goals. It is a challenging profession but it definitely has a lot of rewards.

It will give you the opportunity to become a professional in a very vital area of life. There are numerous job opportunities in this field and you have a chance to earn a good income.

Becoming a financial adviser

The basic qualification for becoming a financial adviser is a university degree. This could be in finance, accounting or business. You should also understand numbers easily and have the ability to solve problems.

You may choose to work on your own or work for a big corporation. An understanding of the laws that relate to taxes, money markets, and other areas of the economy is also required.

You may have more advantages if you have a master’s degree in an appropriate discipline. If you choose to specialize in particular areas, you could register for the required program so that you can receive the license. Certain areas such as insurance selling or insurance planning require state licenses.

Voluntary certifications are also available. It will be better to start your career in a financial institution so that you can acquire the experience that you need to succeed in this profession. You will also have access to free training.

Financial Advisor Career

Taking on the role of a financial advisor provides a range of opportunities not widely available in many career fields. In addition to offering valuable advice to clients, successful financial advisors have virtually unlimited earning potential, flexibility in work schedules, and control over their practice.

271,900

The number of financial advisors in the U.S., according to the Bureau of Labor Statistics.

The career also has a slew of drawbacks that range in severity and duration. Among the most prominent cons are the high-stress environment of the industry, the length of time it takes to build a client base, and the continuous need to meet regulatory requirements.

Financial Advisor Course

Certification and licensure options for financial advisors also exist. Those buying or selling financial products or insurance have to get licensed. Although it is not required, financial advisors may pursue certification as a Certified Financial Planner (CFP). This credential requires work experience and a bachelor’s degree as prerequisites.

Introductory Financial Advising

In an introductory financial advising course, students learn about the duties of a financial advisor, which include helping clients make saving and investment decisions, as well as valuation and asset management.

Course topics include trading, pricing of securities in financial markets, sources of capital and risk management. Some courses may include insurance basics. Students use these skills to help individuals and businesses plan their financial strategies.

Accounting

Accounting is an important class for prospective financial advisors because it teaches students to record business transactions, understand accounting cycles and evaluate inventory, payroll, shareholder equity and liabilities.

Accounting courses provide a foundation in financial statement analysis, cost behavior and profit analysis. This course provides students with accounting basics but does not prepare them for careers as accountants.

Risk Management

Financial advisors use risk management principles in order to give sound financial advice to clients. Risk management courses generally cover disability, life and medical insurance and introduce students to the importance of risk management in the global financial market. Topics like investment risk, market risk and probability theory are examined. Students learn how to read insurance policies and advise clients on insurance issues.

Investment Planning

Students learn basic investment concepts, types of investment vehicles, investment risks and returns, bond and stock valuation and asset allocation. Other special topics of instruction include efficient market theory, portfolio management, investment taxation, securities market, security analysis and growth stocks.

Retirement and Employee Benefit Planning

Students learn about social security plans and other types of retirement plans. Additional subjects of instruction include qualified and non-qualified retirement plans, IRAs, disability insurance, employee benefit plans, stock options and group life insurance. Students may need to complete accounting or math prerequisites before enrolling in this course.

Estate Planning

Estate planning issues, methods of property transfers, estate planning documents, gift taxation and gifting strategies are covered in this class. Students learn about liquidity needs, estate tax calculations, valuation, powers of appointment and marital deductions. Coursework may include analysis of case studies.

Certified Financial Planner

Certified Financial Planner (CFP) is a formal recognition of expertise in the areas of financial planning, taxes, insurance, estate planning, and retirement (such as with 401(k)s).

Owned and awarded by the Certified Financial Planner Board of Standards, Inc., the designation is awarded to individuals who successfully complete the CFP Board’s initial exams, then continue ongoing annual education programs to sustain their skills and certification.

Earning the CFP designation involves meeting requirements in four areas: formal education, performance on the CFP exam, relevant work experience, and demonstrated professional ethics.

The education requirements comprise two major components. The candidate must verify that they hold a bachelor’s or higher degree from an accredited university or college recognized by the U.S. Department of Education. Second, they must complete a list of specific courses in financial planning, as specified by the CFP Board.

Much of this second requirement is typically waived if the candidate holds certain accepted financial designations, such as a chartered financial analyst (CFA) or certified public accountant (CPA) designation, or has a higher degree in business, such as a master of business administration (MBA).

As for professional experience, candidates must prove they have at least three years (or 6,000 hours) of full-time professional experience in the industry, or two years (4,000 hours) in an apprenticeship role, which is then subject to further individualized requirements.

Lastly, candidates and CFP holders must adhere to the CFP Board’s standards of professional conduct. They must also regularly disclose information about their involvement in a variety of areas, such as criminal activity, inquiries by government agencies, bankruptcies, customer complaints, or terminations by employers. The CFP Board also conducts an extensive background check on all candidates before granting the certification.

Even successful completion of the above steps doesn’t guarantee receipt of the CFP designation. The CFP Board has final discretion on whether or not to award the designation to an individual.

Financial Advisor Cost

What a financial advisor cost depends on the fee structure they use with their clients. Advisors who charge flat fees can cost between $2,000 and $7,500 a year, while the cost of advisors who charge a percentage of a client’s account balance — typically 0.25% to 1% per year — will vary based on the size of that balance.

For example, a client who invests $10,000 with an advisor who charges a 0.50% management fee will pay $50 a year, while a client who has $100,000 invested will pay $500.

Many advisors charge based on how much money they manage for you, a fee structure called “assets under management,” or AUM. Some advisors charge a flat fee — either per financial plan, per year or per hour — instead of a management fee.

| Fee type | Typical cost |

|---|---|

| Assets under management (AUM) | 0.25% to 0.50% annually for a robo-advisor; 1% for a traditional in-person financial advisor. |

| Flat annual fee (retainer) | $2,000 to $7,500 |

| Hourly fee | $200 to $400 |

| Per-plan fee | $1,000 to $3,000 |

Financial Advisor Certification

Professional certifications showcase your knowledge and abilities and can enhance your resume. However, earning certification remains voluntary. Popular certifications include certified financial planner (CFP), chartered financial analyst (CFA), and personal financial specialist (PFS).

Each certification requires candidates to pass at least one exam and meet educational standards. CFP certification requires three years of work experience, while the CFA looks for four years. The PFS designates a personal finance specialization for individuals holding valid CPA licensure.

These credentials also consider professional ethics, for which reason credentialing organizations require professional references before granting certification.

Once you earn initial certification, most certification boards require ongoing education and training. Continuing education ensures professionals stay current on the laws and regulations pertaining to their areas of expertise. Certifications typically require 15 contact hours of professional development each year. Some may require a portion of those hours to include instruction in professional ethics.

Becoming a Financial Advisor at 40

Becoming a financial advisor as a second career, especially becoming a financial advisor at 40, can be a great career decision.

“Career changers over 40 already have business and life experience; a few gray hairs can help with perceived credibility, as well,” says Ryan Sullivan, managing director of Applied Insights at Hartford Funds. In fact, “some firms actively seek out career changers who have proven successful in other industries.”

Here are the steps to become a financial advisor at 40:

- Decide if it’s the right career for you.

- Interview people in the industry.

- Choose which firms to apply to.

- Get ready to apply.

A role as a financial advisor can be a great second career. “You get to help others with their financial goals, there could be unlimited income potential. And, once you’re established, there’s ever-increasing flexibility in where and how you work,” Sullivan says.

When asked what advice he gives people interested in becoming a financial advisor as a second career, Giljum said only: “Don’t wait!”

While it’s another challenging market today, “now is the time to act,” he says. “New financial advisors have an opportunity to build relationships now when people are most willing to listen to advice, and they can create a meaningful impact for both their clients and their communities right out of the gate.”

How to Become a Financial Advisor Without a Degree

If you see yourself with a future in finance but don’t see a four-year degree in that path, here are some steps to follow to become a financial adviser without a degree:

1. Determine what type of financial advice you want to provide

Decide what financial advice you want to provide your clients. The type of advice you want to give affects the licenses you must earn to become a financial adviser. For example, the license to advise clients on stocks differs from the license to advise clients on mutual funds.

2. Explore online course options

Explore online course options to learn more about becoming a financial adviser. Look into textbooks or similar resources to teach yourself about the financial industry. Also, consider signing up for coursework to help prepare you for your license exams.

3. Pass the exams and earn your licenses

Becoming a financial planner requires you to earn specific licenses. The licenses vary based on the type of financial adviser you want to be, and requirements may also vary by state. Here are the licenses you may need to earn or exams you may need to take:

Securities Industries Essentials exam

The Securities Industry Essentials (SIE) exam is an introductory-level exam administered by the FINRA. The exam covers basic securities industry information, concepts, products, agencies and practices. Many licenses require you to pass the SIE exam as a corequisite to other license exams.

The SIE exam includes 75 multiple-choice questions. You have one hour and 45 minutes to complete the exam. The FINRA requires a score of at least 70 to pass.

Series 6 exam

The Investment Company and Variable Contracts Products Representative Qualification Examination (IR), or Series 6 exam, is a FINRA entry-level exam. The Series 6 exam relates to the functions of investment companies and their contracts. The SIE exam is a corequisite of the Series 6 exam. Passing both exams qualifies you to sell, solicit and purchase security products like:

- Mutual funds

- Municipal fund securities

- Unit investment trusts

- Variable annuities

- Variable life insurance

The Series 6 exam includes 50 multiple-choice questions. You have one hour and 30 minutes to complete the exam. The FINRA requires a score of at least 70 to pass.

Series 7 exam

The General Securities Representative Qualification Examination (GS), or the Series 7 exam, is a FINRA entry-level exam. The Series 7 exam assesses your ability to work as a general securities representative. The SIE is a corequisite of the Series 7 exam, Passing both exams qualifies you to sell, purchase or solicit all securities products, such as:

- Options

- Direct participation programs

- Corporate securities

- Investment company products

- Variable contracts

- Municipal fund securities

The Series 7 exam includes 125 multiple-choice questions. You have three hours and 45 minutes to complete the exam. The FINRA requires a score of at least 72 to pass.

Series 65 exam

The NASAA Investment Advisers Law Examination, or the Series 65 exam, is a NASAA exam administered by the FINRA. Most states require you to pass the Series 65 for you to work as an investment adviser representative, such as providing investment advice or financial planning services. Having a Series 65 license means you may only work on a non-commission basis and charge hourly fees.

The Series 65 exam includes 130 multiple-choice questions. You have three hours to complete the exam. The NASAA requires you to answer 94 out of 130 questions correctly to pass.

Series 66 exam

The NASAA Uniform Combined State Law Examination, or the Series 66 exam, is a NASAA exam administered by the FINRA. The Series 66 exam qualifies candidates as investment adviser representatives and securities agents. The Series 7 exam is a corequisite for this exam.

The Series 66 exam includes 100 multiple-choice questions. You have two hours and 30 minutes to complete the exam. The NASAA requires you to answer at least 73 out of 100 questions correctly to pass.

4. Earn state certifications

In addition to your licenses, some states require additional certifications. These certifications may also vary based on your focus as a financial adviser. Earning a certification may require you to complete a training course or pass an exam.

5. Find an internship

An internship can be helpful to gain real-world experience. Explore internship opportunities relevant to your desired focus as a financial adviser. Consider pursuing an internship in a different focus to build your skills or learn more about other areas.

6. Look for a mentor

Having a mentor provides you with a powerful connection for career advice and personal guidance. A mentor can also provide you with honest feedback to help you further your skills. Your mentor may also provide you with guidance through the application and hiring processes, helping you prepare to stand out from other candidates.

7. Find an entry-level job

Once you earn your certifications, look for an entry-level job. Your job will allow you to apply your skills to help others understand their financial options. Ensure you have a strong resume that highlights your strengths and credentials.

8. Consider pursuing a degree

After you begin your career as a financial planner, consider pursuing further education. Having at least a bachelor’s degree may expand your opportunities and your expertise. For example, you must have at least a bachelor’s degree to become a Certified Financial Planner.

How Long Does it Take to Become a Financial Advisor

Financial advisors help people make decisions about their finances, including investment, tax, debt, and insurance decisions. Advisors meet with their clients to determine their financial goals and help them create a plan that they can follow to reach them.

Clients may seek out financial advisors to plan for life changes like marriage, starting a family, sending children to college, or preparing for retirement. They may also hire financial advisors to help them identify good investment opportunities and to monitor their investments and accounts.

It can take seven or more years to become a Certified Financial Planner, including time spent earning a bachelor’s degree and gaining the experience necessary to meet certification requirements. Financial Advisors who are not pursuing certification can start seeking work after earning their bachelor’s degree.

Financial Advisor Jobs

The Bureau of Labor Statistics projects that the employment of financial advisors will grow by 27 percent between 2012 and 2020, much faster than the average for all occupations. The BLS attributes this growth to an increased need for retirement planning as the baby boom generation ages and fewer workers receive pension benefits through their jobs.

There are many large financial planning firms across the country, and many smaller, local firms as well. You can apply for openings at these firms, and you can try applying for work at other organizations like banks and insurance companies.

If you want to be self-employed, like 20 percent of financial advisors are, you will need to find your own clients by marketing your services in your community. Establishing a presence in both traditional and social media can help you attract clients.

Financial Advisor Salary

In Canada for example, compensation ranges are very wide for financial advisors, with base salaries starting at low at $30,000 and going up to over $100,000.

Most financial advisors are also compensated with bonuses paid out if certain performance objectives are reached. Some advisors are also compensated on a commission basis if they invest their client’s money in certain managed funds.

As with many other finance-related professions, relevant experience is rewarded. This means that managers who have been practicing for many years are typically the ones who end up at the higher end of the income spectrum.

Obtaining designations such as the CFA charter or an MBA can help expedite an individual’s progress up the career ladder. Many financial firms also require a certain minimum GPA cut-off for new graduates, meaning that excellent grades are a must.

How do Financial Advisors make Money?

- Commission only: Some advisors receive only commissions for selling financial services products, such as investments, real estate, insurance products, or loans. Examples include advisors affiliated with companies like State Farm, American Family, and Edward Jones.

- Commission and fees: A commonly misunderstood term used to describe this compensation method is fee-based. Examples include registered representatives of companies like Ameriprise, AIG Financial Advisors, Wachovia, and UBS. Commission and fee advisors may receive a fee for developing a financial plan for you and then receive commissions when they sell you insurance and investment products recommended in your financial plan.

- Salary plus bonuses: Many discount brokerage firms and banks compensate their employees with a base salary plus incentive pay for bringing new client accounts into the institution. They may receive substantially higher bonuses by recommending or selling certain products and services over other options.

- Fee-only: Fee-only financial advisors provide advice or ongoing management and aren’t registered representatives of any financial services company. They’re typically self-employed Registered Investment Advisors (RIA) or employees of this type of firm. One benefit of hiring fee-only financial advisors is that they have no financial stake in the recommendations they give you. They recommend only what they believe is in your best interest.

The most popular form of compensation for personal financial advisors and planners is currently a combination of commissions and fees. These financial advisors may be affiliated with a large brokerage firm or insurance company, or they may be registered representatives with an independent broker-dealer.

Often, the majority of their compensation comes from the sale of the products they recommend. However, they may also provide financial planning services and advice for a separate hourly fee, flat fee, or retainer fee.

Fee-only financial advisors charge in three ways:

- Hourly fee: You pay for all the time that the financial advisor works on your case or spends with you. Multiply the time spent by the advisor’s hourly charge, and that’s how much your fee is. Always find out the expected cost and the maximum cost before you begin working with an advisor who charges by the hour. Hourly-based pricing is best for:

- People who need specific advice about one or a few financial topics.

- Do-it-yourselfers who just want a professional’s opinion.

- People who want to do as much as possible to save money but want expert analysis and direction.

- Flat fee: Some financial advisors offer flat fees for a package of services. Flat-fee pricing is best for people who need specific advice or services and are willing to take the gamble that the flat-fee arrangement will cost no more than it would have if they paid by the hour.

- Retainer fee: A retainer fee is often calculated based on a percentage of some sort, such as 1 percent of the assets the advisor manages for you, or some percentage of your net worth or income, or mixture of the two. Retainer fees are also computed by estimating the amount of time required to provide the services promised based on the complexity of the case and the skills required of the advisor, for the time covered under agreement to retain the advisor. A retainer fee is best for people who need, want, or can afford to transfer the responsibility of managing their personal financial affairs to a financial advisor.

Can a Financial Advisor Make You Rich?

Financial advisors can be great when you are confused, emotional, or simply ignorant of various wealth-management topics. Add in the fact that a majority of people can’t see far enough into the future to imagine their retirement, much less plan for it, professional advice can be very handy. A qualified advisor will ask you a lot of questions—some of them uncomfortable—in order to get the full picture of where you want to take your life.

Once all of the details are in hand, they can put together a plan and offer you advice on investments, retirement planning, estate planning, tax liability, and your kids’ college education. The breadth of the advisor’s knowledge can make a lot of your difficult decisions easier.

Some financial planners go further, actively helping you to buy insurance products and to invest in financial products, like mutual funds or certificate of deposits (CDs). While not all financial advisors can actually trade actual securities, such as stocks or bonds, they can act as your liaison with a broker or money manager who does. They can also work with a trust and estate planning lawyer or an accountant on your behalf.

Just as there are many good reasons to seek out the services of a financial advisor for a one-time or short-term need, it can also make sense to engage the services of an advisor on a full-time basis.

Various advisors and firms all work in different ways, but it is common for an advisor in one of these arrangements to provide ongoing investment management services, as well as ongoing advice on financial planning issues that an investor might encounter. These topics can include estate and tax planning, preparations for retirement, saving for your children’s college, and a host of other considerations.

Payment for these services is sometimes a percentage of the investment assets under management (AUM). Other times the fee structure is a flat retainer. Typically, under this type of arrangement, the investor and advisor would formally meet (in-person or virtually) twice per year or quarterly, with the client having access to the advisor as often as needed for any questions or issues that might arise in the interim.

The benefit to this sort of arrangement is that the investor not only has a professional watching their assets, but they also receive advice on their overall situation throughout the various stages.

How Much do Financial Advisors Make Starting Out?

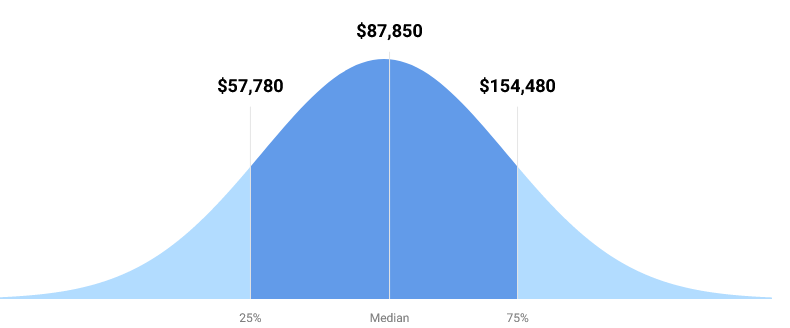

Financial Advisors made a median salary of $87,850 in 2019. The best-paid 25 percent made $154,480 that year, while the lowest-paid 25 percent made $57,780.

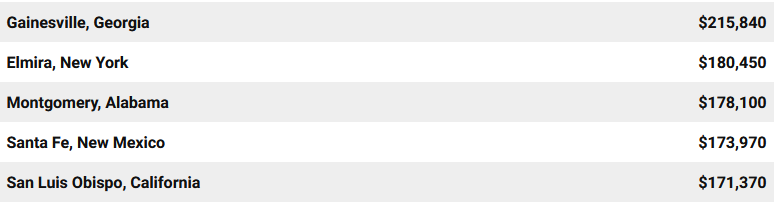

Best-Paying Cities for Financial Advisors

The metropolitan areas that pay the highest salary in the financial advisor profession are Gainesville, Elmira, Montgomery, Santa Fe, and San Luis Obispo.

Is Being a Financial Advisor Worth it?

The benefits of a career as a financial advisor go well beyond compensation. The financial advisor field has a projected growth rate of 15% from 2016-2024, which is significantly higher than the average job outlook (7%), according to the Bureau of Labor Statistics Here are some of the primary benefits of becoming a financial advisor:

Offering Meaningful Advice

While offering meaningful advice is not often the reason financial advisors begin a career in the industry, it is common that this aspect of the job is the most rewarding. Consumers are all too often overwhelmed and confused regarding which investments or insurance vehicles are appropriate for them.

The greatest role a financial advisor plays is providing education to clients so suitable decisions can be made. A success in the financial life of a client often equates to success for the client’s financial advisor.

Unlimited Income Potential

For most financial advisors, there is no limit on earning potential. Financial advisors are either fee-based, commission-based, or a combination of both. This means income is based on the amount of new business or recurring revenue created each year. While pay structures differ, advisors have the ability to earn as much, or as little, as they are able.

Work Schedule Flexibility

Finding a balance between work and personal life can be a challenge when starting a new career and financial advisors are no different. However, once an advisor establishes a client base, the career lends itself to flexibility in work hours. Seasoned advisors have the advantage of scheduling client meetings around their personal calendars and, over time, have the opportunity to work less than a full 40-hour week.

Creativity in Practice Structure

Financial advisors have the opportunity to be creative in building their client bases. While some focus on serving the Baby Boomer generation, others cater exclusively to Millennials. Gen X is another group to serve. Advisors can also decide to specialize in a particular type of type of client, such as doctors, lawyers, or entrepreneurs.

They can also provide a wide range of products and services to clients, including financial planning, investment management, life or disability insurance, or retirement plans, giving them full control over their practices.

How Many Hours a Week do Financial Advisors Work?

The responsibilities of a financial advisor can be overwhelming, as they are under pressure to provide accurate, timely information to clients. Financial advisors must constantly process information, make quick and accurate decisions, and sell services daily. There is not much room for error, as poor decisions can be costly to clients and ruin the advisor’s and the firm’s reputations.

Financial advisors primarily work in offices at small or large firms. Some travel may be required to attend conferences, seminars, or networking events to bring in new clients. They may also need to travel to clients’ offices or homes.

Most financial advisors work at least 40 hours per week. They often go to meetings on evenings and weekends to meet with clients.

How Much Money Does a CFP Make?

The average annual pay for a CFP in the United States is $83,123 a year. Just in case you need a simple salary calculator, that works out to be approximately $39.96 an hour. This is the equivalent of $1,599/week or $6,927/month.

While ZipRecruiter is seeing annual salaries as high as $150,000 and as low as $23,500, the majority of CFP salaries currently range between $62,500 (25th percentile) to $94,500 (75th percentile) with top earners (90th percentile) making $125,000 annually across the United States.

The average pay range for a CFP varies greatly (by as much as $32,000), which suggests there may be many opportunities for advancement and increased pay based on skill level, location and years of experience.

We’ve identified 10 cities where the typical salary for a CFP job is above the national average. Topping the list is Lakes, AK, with San Francisco, CA and Santa Clara, CA close behind in the second and third positions. Santa Clara, CA beats the national average by $14,122 (17.0%), and Lakes, AK furthers that trend with another $15,798 (19.0%) above the $83,123 average.

Importantly, Lakes, AK has a moderately active CFP job market with only a few companies currently hiring for this type of role.

With these 10 cities having average salaries higher than the national average, the opportunities for economic advancement by changing locations as a CFP appears to be exceedingly fruitful.

Finally, another factor to consider is the average salary for these top ten cities varies very little at 6% between Lakes, AK and Bridgeport, CT, reinforcing the limited potential for much wage advancement. The possibility of a lower cost of living may be the best factor to use when considering location and salary for a CFP role.

| City | Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage |

|---|---|---|---|---|

| Lakes, AK | $98,921 | $8,243 | $1,902 | $47.56 |

| San Francisco, CA | $97,923 | $8,160 | $1,883 | $47.08 |

| Santa Clara, CA | $97,245 | $8,104 | $1,870 | $46.75 |

| Washington, DC | $96,158 | $8,013 | $1,849 | $46.23 |

| Los Angeles, CA | $95,135 | $7,928 | $1,830 | $45.74 |

| Fremont, CA | $94,167 | $7,847 | $1,811 | $45.27 |

| Jersey City, NJ | $93,992 | $7,833 | $1,808 | $45.19 |

| Green River, WY | $93,399 | $7,783 | $1,796 | $44.90 |

| San Buenaventura, CA | $93,277 | $7,773 | $1,794 | $44.84 |

| Bridgeport, CT | $92,705 | $7,725 | $1,783 | $44.57 |

How Much do Self Employed Financial Advisors Make?

The average annual pay for a Self Employed Financial Advisor in the United States is $133,750 a year. Just in case you need a simple salary calculator, that works out to be approximately $64.30 an hour. This is the equivalent of $2,572/week or $11,146/month.

Read Also: The Ultimate List of Personal Finance Tips

While ZipRecruiter is seeing annual salaries as high as $370,000 and as low as $40,000, the majority of Self Employed Financial Advisor salaries currently range between $56,500 (25th percentile) to $250,000 (75th percentile) with top earners (90th percentile) making $340,000 annually across the United States.

The average pay range for a Self Employed Financial Advisor varies greatly (by as much as $193,500), which suggests there may be many opportunities for advancement and increased pay based on skill level, location and years of experience.

Finally

Whether a client is financially stable or not, an advisor is still often helping him or her through major decisions that impact the present and future, and will also need to help keep them calm and help them make the best choice for them and their family.

A couple with a baby on the way may look to a financial advisor for advice on how to save money for future expenses or safe investments that are more likely to bring a return. Perhaps an investor is looking to add to and diversify their portfolio, but isn’t quite sure how to start and wants a qualified professional to help.

Or maybe someone has come into more money and wants to make sure it’s not wasted. No matter the client, financial advisors need to provide quality advice and be a trustworthy presence in their life.