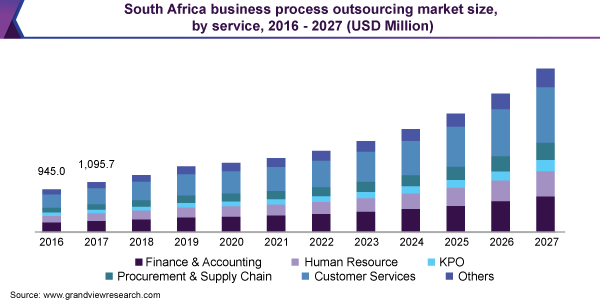

It is estimated that the South Africa business process outsourcing market was worth USD 1.4 billion back in the year 2019 and is expected to grow by a compound annual growth percentage (CAGR) of 13.2 percent between 2020 and 2027. The market’s growth is led by advances in technology, continual innovation and an increase in competition, a trend which will continue to grow over the next few years. The need for control of operational costs, align processes, focus on core competencies and recruit qualified workers is expected to propel forward the market over the next years. South Africa has been home to numerous call center operations over the last several years and , as a result, has earned global recognition as a favorite and reliable offshore outsourcing location.

It is also one of the leading locations that offer Global Business Services – or offshoring business processes. An adequate expertise, a substantial talent pool, lower expenses and easy-to-understand English accents are just a few of the main reasons leading companies to think about South Africa among their preferred outsourcing destinations. In the context of analysis and Artificial Intelligence (AI)-driven solutions, South Africa has a larger quantity of actuarial professionals as when compared to India and offers support for a wide range of languages including French and Spanish. The utilization for AI and robotics in conjunction with a strategy for human resource management could also help the incumbents of this South Africa BPO industry in the race against competitors in Europe and in the Middle East & Africa.

This, in turn, is anticipated to accelerate industry’s growth in the near future. In addition, Business Process Enabling South Africa is one of the African Business Process Outsourcing industry body has played a major role in helping to boost the industry’s expansion by assisting in the development of skills by sharing best practices and giving its members the ability to connect with other businesses and associations that influence the transition of the industry into an economy that is digital. Additionally to that, there is a need for the South African government has introduced various tax incentive and schemes to establish infrastructure and support for skills. One of the most prominent programs can be described as The Monyetla Work Readiness Program.

The main objective of this program is to expand employment opportunities for entry-level personnel. The program is based on The Monyetla Work Readiness Programme, BPO employers lead a consortium approach to recruit and train entry-level workers. These initiatives have helped create young jobs and contributing to the region’s export revenue from offshoring services. It is evident that the afribpo industry in SA has grown continuously with new opportunities for job creation which in turn play a major part in the region’s growth. Outsourcing service providers believe that South Africa enjoys better opportunities as compared to other countries in Africa in providing the business services that outsourcing companies require. Cape Town has particularly emerged as a BPO location preferred by BPO providers.

Service Insights

The segment of customer service dominated the market with a market share of over 31% in 2019 , and will grow at the fastest CAGR from 220-2027. This rise is due to the rapid growth of service centers that necessitate the availability of technical support online and offline. Customer service BPOs are dedicated to managing questions from customers via email, chat, phones and social media platforms as well as other channels. The customer service BPO industry is flourishing and growing in Cape Town and has risen rapidly over the last few years and is expected to witness significant growth in the future. Additionally, South Africa holds an advantage when it comes to client service BPO services. The capability to help companies cut costs overall, coupled with a speedy shift towards remote operations due the Covid-19 pandemic earned south africa’s centers for customer service an edge over other hubs.

The finance & accounting segment is projected to grow with a robust rate of 13.6% over the forecast period. The value of finance & accounting BPO services in reduced cost for financial tasks has also prompted their use throughout a number of financial institutions in the country. South Africa is steadily advancing in the area of international service delivery to the financial service industry. Several financial organizations are also gradually preferring South Africa for establishing their African back-office shared services hubs to be components of their worldwide delivery network.

End-of-use Insights

The IT & telecommunication segment took the lead in the regional market, by capturing more than 35% in 2019. The IT and telecommunication sector is among the top adopters of BPO services. In the IT space, South Africa has performed an essential function in the realm of service desk and technical helpdesk because of its excellent capabilities in the field of voice. Furthermore, the country is made up of a significant number of IT graduates who have the required technical capabilities, which, in turn, reduces the burden as well as the cost of training on the part of businesses. South Africa continues to remain one of the top destinations to outsource IT services due to the rapidly expanding group of companies. These companies offer IT-focused solutions to various verticals including web design and development, and the development of platforms and applications. The rising ICT spending in the country for the regular maintenance of established IT and communication infrastructures and the replacement of outdated systems will likely drive segment growth.

The BFSI segment is expected to record the highest CAGR throughout the forecast period. The ease of access to a trained workforce, that includes Chartered Financial Analysts (CFAs), Chartered Accountants (CAs) and actuaries have been the driving force behind success for the country in this area. Additionally, international banks are turning to South Africa for the delivery of intricate work in banking areas, such as life finance and insurance processes. The country delivers vast volumes of voice communications in the insurance industry and banking, including commission handling claims processing and policy administration.

Key Companies & Market Share Insights

The marketplace is extremely competitive as most of the large companies are focusing on increasing their market presence by adopting various business strategies such as partnerships, mergers & acquisitions and product development. These strategies help organizations expand their geographic footprint and increase their offerings to world and the national. For instance, in August 2020 WNS (Holdings) Ltd announced EXPIRIUS the first-ever customers’ experience (CX) solution that integrates human-assisted designs with AI-driven conversational insights to help improve customer experiences. Some of the biggest players operating in South Africa’s South Africa business process outsourcing market are:

Accenture Plc

Amdocs

Capgemini

HCL Technologies Ltd.

IBM Corp.

Infosys Ltd. (Infosys BPM)

NCR Corp.

Sodexo

TTEC Holdings, Inc.

Wipro Ltd.

Mango5 BPO

Indox (PTY) Ltd.

Outworx Contact Centre

SA Commercial

Talksure Group

Boomerang Marketing

IContactbpo

121 BPO Services

Altron

The IT Guys

Merchants SA (Pty) Ltd.

CCI South Africa

Capita plc

Digicall Group

DSG Group

Startek

WNS (Holdings) Ltd.

Webhelp

O’Keeffe & Swartz

Ignition Group

Rewardsco

Teleperformance SE

Encore Capital Group

Pra Group, Inc.

Paschoalotto Logo

Pioneer Credit

Credit Corp Group

Collection House Ltd.

Segments included in the Report

This report forecasts growth in revenue at the country levels and offers an analysis of the most recent industry trends from 2016 to 2027 across every sub-segment. In order to conduct this report, Grand View Research has divided the South Africa business process outsourcing market report on the basis of final-use and service:

Service Outlook (Revenue USD Million between 2016 and 2027)

Finance & Accounting

Human Resources

Knowledge Process Outsourcing (KPO)

Supply Chain & Procurement

Customer Service

Others

“End-user” Outlook (Revenue, USD Million Between 2016 and 2027)

Banking, Financial Services, and Insurance (BFSI)

Healthcare

Manufacturing

IT & Telecommunication

Retail

Others

For more details read Dehradun news. Because Dehradun Live is an independent, Uttarakhand news portal. It gives you a first-hand account of the latest Dehradun News, analysis, and opinions on business, entertainment, politics, sports, health, lifestyle, interesting facts, and whatnot.