The term credit spread is used in the fixed income corporate bond investment market and the bank debt market. It reflects the risk premium charged by bond investors and banks, for corporate debt investment risk over government debt risk. It’s a term used in the everyday language of a bond trader, and the jargon used in good Wall Street movies!

A credit spread is the risk premium add-on to the base interest rate used when pricing corporate debt issues. It reflects the credit rating or risk rating of the company, the maturity of the issue, current market spread rates, as well as other components such as security and liquidity.

- What is Credit Spread?

- How does a Credit Spread Work?

- What Means Credit Spread?

- How does Credit Spreads Work for Bonds and Options?

- Is a Higher Credit Spread Better?

- How do you Profit From Credit Spreads?

- How far out Should you Sell a Credit Spread?

- What are Credit Spread Risks?

- Are Credit Spreads Profitable?

- Best Practices for Credit Spreads

What is Credit Spread?

A credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Credit spreads are measured in basis points, with a 1% difference in yield equal to a spread of 100 basis points.

Read Also: What are the Global Investment Performance Standards?

As an example, a 10-year Treasury note with a yield of 5% and a 10-year corporate bond with a yield of 7% are said to have a credit spread of 200 basis points. Credit spreads are also referred to as “bond spreads” or “default spreads.” Credit spreads allow for a comparison between a corporate bond and a risk-free alternative.

A credit spread can also refer to an options strategy where a high premium option is written and a low premium option is bought on the same underlying security. This provides a credit to the account of the person making the two trades.

The spread is used to reflect the additional yield required by an investor for taking on additional credit risk. Credit spreads commonly use the difference in yield between a same-maturity Treasury bond and a corporate bond. As Treasury bonds are considered risk-free due to their being backed by the U.S. government, the spread can be used to determine the riskiness of a corporate bond.

For example, if the credit spread between a Treasury note or bond and a corporate bond were 0%, it would imply that the corporate bond offers the same yield as the Treasury bond and is risk-free. The higher the spread, the riskier the corporate bond.

How does a Credit Spread Work?

Would you like to determine your profit potential and exactly how much money you’re risking before placing an options trade? If so, credit spreads may be for you.

Credit spreads are an options strategy where you simultaneously buy and sell options that are of the:

- Same class (puts or calls)

- Same expiration date

- But with different strike prices

Credit spreads have several useful characteristics. As mentioned, they can be a helpful risk-management tool for you. Credit spreads allow you to reduce risk substantially by forgoing a limited amount of profit potential. In most cases, you can calculate the exact amount of money that you’re risking when you enter the position.

Credit spreads are also versatile. You can find a combination of contracts to take a bullish or bearish position on a stock by establishing either a:

- Credit put spread: A bullish position with more premium on the short put

- Credit call spread: A bearish position with more premium on the short call

To better understand the profit and loss characteristics of credit put spreads, let’s examine five different price scenarios, based on the chart above. We’ll assume that once this spread is established, it’s held until expiration. (Reminder: trade fees, taxes, and transaction costs are not included in these scenarios.)

Scenario 1: The stock drops significantly and closes at $62 on option expiration

- If this happens, you will exercise your 65 puts, and sell short 1,000 shares of XYZ stock for $65,000.

- At the same time, your short 70 puts will be assigned, and you will be required to buy back your short position for $70,000 to close.

The difference between your buy and sell price is -$5,000. However, because you brought in $1,500 when the spread was established, your net loss is only $3,500. This will be the case at any price below $65. Therefore, this spread is only advantageous over uncovered puts if XYZ drops below $64.50.

Scenario 2: The stock drops only slightly and closes at $67 on option expiration

- If this happens, you won’t exercise your 65 puts, because they’re out of the money.

- However, your short 70 puts will be assigned, and you’ll be required to buy 1,000 shares of XYZ at a cost of $70,000.

- You can then sell your shares at the market price of $67, for $67,000.

The difference between your buy and sell price results in a loss of $3,000. However, because you brought in $1,500 when the spread was established, your net loss is only $1,500. Your loss will vary from zero to $3,500, at prices from $68.50 down to $65.

Scenario 3: The stock closes at exactly $68.50 on option expiration

- If this happens, you will not exercise your 65 puts, because they’re out of the money.

- However, your short 70 puts will be assigned, and you’ll be required to buy 1,000 shares of XYZ at a cost of $70,000.

- You can then sell your shares at the market price of $68.50, for $68,500.

The difference between your buy and sell price results in a loss of $1,500. However, since you brought in $1,500 when the spread was established, your net loss is zero.

Scenario 4: The stock rises only slightly and closes at $69 on option expiration

- If this happens, you won’t exercise your 65 puts, because they’re out of the money.

- However, your short 70 puts will be assigned, and you’ll be required to buy 1,000 shares of XYZ at a cost of $70,000.

- You can then sell your shares at the market price of $69 for $69,000.

The difference between your buy and sell price results in a loss of $1,000. However, because you brought in $1,500 when the spread was established, your net gain is $500. This gain will vary from zero to $1,500, at prices from $68.50 up to $70.

Scenario 5: The stock rises substantially and closes at $72 on option expiration

- If this happens, you won’t exercise your 65 puts, because they are out of the money.

- Your short 70 puts won’t be assigned, because they’re out of the money as well.

- In this case, all the options expire worthless, and no stock is bought or sold.

However, because you brought in $1,500 when the spread was established, your net gain is the entire $1,500. This maximum profit of $1,500 will occur at all prices above $70. As you can see from these scenarios, using credit put spreads works to your advantage when you expect the price of XYZ to rise, which will result in a narrowing of the spread price or, ideally, both options expiring worthless.

What Means Credit Spread?

The credit spread is the difference in yield between bonds of a similar maturity but with different credit quality. Spread is measured in basis points.

Typically, it is calculated as the difference between the yield on a corporate bond and the benchmark rate. The yield on a government bond generally is considered to be a benchmark rate. The credit spread thus gives an indication of the additional risk that lenders take when they buy corporate debt versus government debt of the same maturity.

Changes in the spread indicate that perceptions of the risk of a specific issuer has changed or that perceptions of general market conditions have changed. For example, if the market becomes more skeptical about the creditworthiness of an issuing company, the spread of that company’s bonds widens (its yield relative to the benchmark widens).

Or, if markets become more negative and risk-averse, spreads in general tend to widen. Similarly, if sentiment towards an issuer or a market improves, the relevant spreads would decrease.

How does Credit Spreads Work for Bonds and Options?

A bond credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. Debt issued by the United States Treasury is used as the benchmark in the financial industry due to its risk-free status being backed by the full faith and credit of the U.S. government. US Treasury (government-issued) bonds are considered to be the closest thing to a risk-free investment, as the probability of default is almost non-existent. Investors have the utmost confidence in getting repaid.

Corporate bonds, even for the most stable and highly-rated companies, are considered to be riskier investments for which the investor demands compensation. This compensation is the credit spread. To illustrate, if a 10-year Treasury note has a yield of 2.54% while a 10-year corporate bond has a yield of 4.60%, then the corporate bond offers a spread of 206 basis points over the Treasury note.

Credit Spread (bond) = (1 – Recovery Rate) * (Default Probability)

Credit spreads vary from one security to another based on the credit rating of the issuer of the bond. Higher quality bonds, which have less chance of the issuer defaulting, can offer lower interest rates. Lower quality bonds, with a higher chance of the issuer defaulting, need to offer higher rates to attract investors to the riskier investment. Credit spreads fluctuations are commonly due to changes in economic conditions (inflation), changes in liquidity, and demand for investment within particular markets.

For example, when faced with uncertain to worsening economic conditions investors tend to flee to the safety of U.S. Treasuries (buying) often at the expense of corporate bonds (selling). This dynamic causes US treasury prices to rise and yields to fall while corporate bond prices fall and yields rise. The widening is reflective of investor concern. This is why credit spreads are often a good barometer of economic health – widening (bad) and narrowing (good).

There are a number of bond market indexes that investors and financial experts use to track the yields and credit spreads of different types of debt, with maturities ranging from three months to 30 years. Some of the most important indexes include High Yield and Investment Grade U.S. Corporate Debt, mortgage-backed securities, tax-exempt municipal bonds, and government bonds.

Credit spreads are larger for debt issued by emerging markets and lower-rated corporations than by government agencies and wealthier and/or stable nations. Spreads are larger for bonds with longer maturities.

A credit spread can also refer to a type of options strategy where the trader buys and sells options of same type and expiration but with different strike prices. The premiums received should be greater than the premiums paid resulting in a net credit for the trader.

The net credit is the maximum profit that trader can make. Two such strategies are the bull put spread, where the trader expects the underlying security to go up, and the bear call spread, where the trader expects the underlying security to go down.

An example of a bear call spread would be buying a January 50 call on ABC for $2, and writing a January 45 call on ABC for $5. The trader’s account nets $3 per share (with each contract representing 100 shares) as they receive the $5 premium for writing the January 45 call while paying $2 for buying the January 50 call. If the price of the underlying security is at or below $45 when the options expire then the trader has made a profit. This can also be called a “credit spread option” or a “credit risk option.”

Is a Higher Credit Spread Better?

Historically, 2% is the average credit spread between 2-year BBB-rated corporate bonds (see below for more about bond credit ratings) and 2-year U.S. Treasuries. However, economic conditions now change so quickly that an average credit spread may be a thing of the past.

Credit spreads indicate the credit risk perceived by market participants/investors and are dynamic reflecting real-time market conditions, unlike credit ratings which are revised (upgraded or downgraded) with some lag. When the financial conditions of an issuer deteriorate, the probability of default increases leading to participants (lenders) demanding higher compensation in the form of extra yield. In effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting) spreads are indicative of a decline in credit risk.

Credit spreads often widen during times of financial stress wherein the flight-to-safety occurs towards safe-haven assets such as U.S. treasuries and other sovereign instruments. This causes credit spreads to increase for corporate bonds as investors perceive corporate bonds to be riskier in such times.

How do you Profit From Credit Spreads?

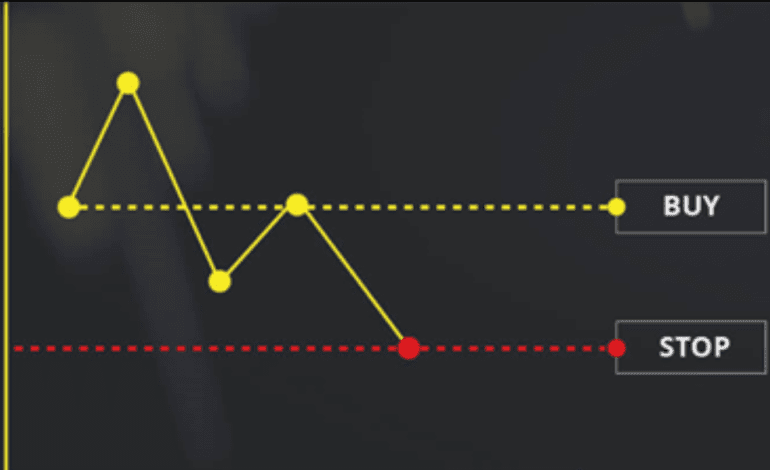

A credit spread involves selling or writing a high-premium option and simultaneously buying a lower premium option. The premium received from the written option is greater than the premium paid for the long option, resulting in a premium credited into the trader’s or investor’s account when the position is opened.

When traders or investors use a credit spread strategy, the maximum profit they receive is the net premium. The credit spread results in a profit when the spreads narrow.

For example, a trader implements a credit spread strategy by:

- Writing one March call option with a strike price of $30 for $3

- Buying one March call option at a strike price of $40 for $1

These two actions are done simultaneously. Since the usual multiplier on an equity option is 100, the net premium received is $200 for the trade. Furthermore, the trader profits if the strategy narrows.

A bearish trader expects stock prices to decrease. They buy call options (long call) at a certain strike price and sell (short call) the same number of call options within the same class and with the same expiration at a lower strike price. In contrast, bullish traders expect stock prices to rise, and therefore, buy call options at a certain strike price and sell the same number of call options within the same class and with the same expiration at a higher strike price.

But why would a trader use this strategy? It allows them to mitigate their risk if the market moves in the opposite direction and the requirements for margin accounts when using credit spreads tend to be lower than other options. Keep in mind, though, that the long option of the spread minimizes any potential for profits. And commissions tend to be higher since the spread requires two options.

How far out Should you Sell a Credit Spread?

Time decay is the basic principle of credit spreads. We know that out-of-the-money options expire worthless. Credit spreads simply capitalize on this process while hedging to limit risk.

Still, there are some nuances. The pace of time decay accelerates closer to expiration, so it often makes sense to sell put spreads with no more than 2-3 weeks until expiration. This lets you capture the quickest premium destruction. (Which is good because you’re short!)

Second, events like earnings can distort time decay. Instead of premium disappearing at a smooth and predictable rate, it may occur all at once after the news passes. That’s why traders should know companies well before writing credit spreads. It’s important to understand the types of catalysts that can impact share prices.

Recent years have featured some dramatic volatility events. These caused painful losses for some traders who sold options to generate income.

While credit spreads include a built-in hedge, it’s also important to realize that they often work better at times of calm. When volatility slams the entire market, certain patterns stop working. Support levels don’t hold and ranges widen. This can throw a giant monkey wrench in a probability-based trading system.

That’s not an argument against credit spreads. It’s just something to bear in mind.

Remember that the goal is to capture time decay — not necessarily to short volatility. That requires predictability, which is easier when swings are less extreme.

What are Credit Spread Risks?

Spread risks are not associated with contractual guarantees but rather originate from the intersection of interest rates, credit ratings and opportunity cost. There are really two types of spread risk, although they are not mutually exclusive.

The first kind, true spread risk, represents the likelihood the market value of a contract or a specific instrument is reduced based on the actions of the counterparty. If the issuer of a bond does not default on its bond obligations, but makes other financial mistakes that lower the issuer’s credit rating, the value of the bonds likely drops. This risk is assumed by the investor.

The second type of spread risk comes from credit spreads. Credit spreads are the difference between yields of various debt instruments. The lower the default risk, the lower the required interest rate; higher default risks come with higher interest rates. The opportunity cost of accepting lower default risk, therefore, is higher interest income. Credit spread risk is an important but often ignored component of income investing.

Are Credit Spreads Profitable?

Credit Spreads are a powerful income generating strategy for options traders. This strategy tends to have a high probability of profit as it is quite forgiving in that the strategy can remain profitable, even if the underlying stock remains neutral.

While Credit Spreads do limit the maximum profit to the credit received when selling the spread, the high probability of profit can provide the consistent returns needed to grow a small trading account and also gives the investor confidence by being profitable in the majority of the trades when used correctly.

Read Also: What is Capital Budgeting?

Credit Spreads are a limited risk and limited reward strategy. Should the underlying make a significant adverse directional move, the investor is protected and will not lose as much as selling a naked call or put option.

A Credit Spread is a 2-legged option strategy that involves selling a near or at the money option and buying an out of the money option. This results in a net credit received which represents the maximum reward of the trade. The aim is to buy back the Credit Spread at a lower price than what it was originally sold for. There are 2 types of Credit Spreads:

Put Credit Vertical Spread – Bullish/Neutral

- Sell an at the money Put option

- Buy an out of the money Put option

- Moderately bullish/neutral directional view

Call Credit Vertical Spread – Bearish/Neutral

- Sell an at the money Call option

- Buy an out of the money Call option

- Moderately bearish/neutral directional view

Example: Stock Canadian Pacific (CP) is trading at $90. The investor has a bullish outlook on the stock and will therefore sell a Put Credit Spread:

- Sell to Open 1 $CP $90 Put @ $3.90

- Buy to Open 1 $CP $84 Put @ $1.65

- Net credit received = $2.25 (max gain)

- Max loss = $3.75 (vertical width – net premium received) ($6 – $2.25)

- Breakeven stock price = $87.75 (short strike – net premium received) ($90 – $2.25)

Source: OptionsPlay

If the $CP rallies higher, the value of the spread will decline and the investor can buy to close the Credit Spread at less than $2.25, resulting in a net profit. The long strike ($84) represents the cut off point for the maximum loss If the stock were to decline, losses are capped at the spread width minus premium received.

In the example above, even if $CP declined significantly below $84, the spread will still have a maximum loss of $3.75 at expiration. The maximum profit is achieved as long as $CP stays above $90 by expiration. If it expires between $90 and $87.75, a partial profit is made from the trade. In the event that $CP expired between the long strike, $84 and the breakeven stock price, $87.75, a partial loss is incurred.

Best Practices for Credit Spreads

Using the following best practices is key for investors to achieve sustainable and consistent growth in their trading accounts:

- Optimal Expirations of 45 days to expiration – this timeframe provides a balance between higher premiums and acceleration in time decay that occurs for shorter dated options compared to longer dated options.

- Optimal strike prices are to sell the At-the-money Call/Put and buy the 25 Delta Call/Put. Our research shows that using this combination of strike prices collects the highest premium while providing a balance to reduce the overall risk of the trade.

- The 1/3 Rule – investors should always look to collect a minimum of 33% of the vertical width in premium. A $10 credit spread should receive at least $3.33 in premium for it to be considered optimal. This has to do with the relationship between risk/reward on a credit spread. When you collect 33%, that translates to risking 67% of the vertical width. The goal is to collect as much income as possible, which also reduces risk. However if you’re collecting less than 33%, you are typically risking too much for every $1 in potential reward.

- Stop Loss and Take Profits – The general rule of thumb is to take profits at 50% of Max Gain and cut losses at 100% of the Max Gain. If a Credit Spread is sold for $3, the rule to take profit is at $1.50 Debit and the stop loss is at $6.00 Debit.

- The 21 Day rule – this refers to always closing a Credit Spread at 21 days to expiration (if the take profit or stop loss level has yet to be reached). This reduces assignment risk and gamma risk of the strategy as expiration approaches.