A property tax bill is an integral element of the homeownership experience. Local governments collect these taxes to pay for community-wide projects and services including roads, schools, police, and other emergency services. There are two main methods for paying your property tax bill: as part of your monthly mortgage payment or straight to your local tax office.

Property taxes are ad valorem taxes, which means they are calculated based on the assessed worth of an object. A property assessor calculates the value of your property by calculating its fair market value (FMV), which is the amount that a willing buyer and seller would agree to in an open market.

To accomplish this, the assessor examines the sales records of comparable properties in the region (known as “comps”) that are similar in condition, features, and size. The assessor may also take into account the property’s rental income history (or potential), replacement costs, maintenance costs, and any recent modifications you made to it.

How Is Property Tax Calculated?

To determine your tax bill, the tax office multiples your property’s assessed value by the local tax rate. For example, if your home is assessed at $200,000, and the local tax rate is 1%, your tax bill would be $2,000. Of course, the higher the assessed value, the higher the tax bill.

Some local governments apply the tax rate to just a portion of the assessed value. This is known as the assessment ratio. If your home is assessed at $200,000, and your county has an assessment ratio of 80% and a tax rate of 1%, your tax bill would be $1,600 ($200,000 × .80 × .01).

How to Pay Your Property Tax

In general, there are two ways to pay your property tax bill: as part of your monthly mortgage payment or directly to your local tax office.

PITI

If you have a mortgage, your property taxes may be rolled into your monthly mortgage payment. If so, your lender divides your estimated tax bill by 12 and includes that amount in your monthly payment, along with the principal, interest, and private mortgage insurance—four costs collectively known as “PITI” (principal, interest, taxes, and insurance). For a $2,000 annual property tax bill, for example, you would pay about $167 a month. Your lender estimates your tax bill, so you’ll get a refund if you paid too much, or you might have to make an extra payment if the amount you paid comes up short.

You can find out the total amount of property tax you paid by looking at box 10 (“Other”) of IRS Form 1098. Your lender will send this to you by January 31st if you paid $600 or more in mortgage interest the previous tax year. If you didn’t receive a 1098—and you should have—call your lender or find the information on your lender’s website. You may be able to lower your tax bill by appealing your assessment (if you think it’s too high) or finding out if you’re eligible for any exemptions.

Pay Your Local Tax Office

If you don’t pay your property tax as part of a monthly mortgage payment, you’ll pay the tax office directly. You should receive a bill in the mail that includes payment directions. Depending on where you live, you may have several payment options:

- By check or money order sent through the mail

- Online using a credit or debit card

- Online using an electronic check payment (eCheck)

- By telephone using a credit or debit card

In addition to the different payment options, you may get to choose if you want to pay the bill all at once or split it into monthly, quarterly, or biannual payments. Pay attention to any prepayment discounts offered—some municipalities provide a discount if you pay early.

Real estate—your land and any property attached directly to it—is called “real property.” When people talk about property taxes, they’re usually referring to this type of property. Of course, real property tax may not be the only property tax you owe.

Depending on where you live, you may also owe taxes on personal property. Personal property is classified as tangible, which includes cars, boats, RVs, and aircraft, or intangible, consisting of things like stocks, bonds, insurance policies, and intellectual property. Like real property taxes (those on your home), personal property taxes are an ad valorem tax, meaning they’re based on the value of the property.

Tangible personal property taxes typically fall from year to year as the property’s value decreases. The value of intangible personal property taxes is made using a method known as calculated intangible value (CIV).

Implications of Not Paying Property Taxes

Property tax due dates vary by location but are commonly set on an annual or semi-annual basis. The due date is predetermined by local tax authorities. Typically, tax bills are sent well in advance of the due date, providing property owners with sufficient time to make necessary arrangements for payment.

Read Also: How do I File Taxes as an Influencer?

Property taxes are typically calculated by multiplying the assessed value of a property by the local tax rate. The assessed value is determined through evaluations by tax assessors, taking into account factors like the property’s size, location, and features. The tax rate, set by local authorities, is a percentage applied to this assessed value. Additionally, specific local projects or services may result in additional assessments, contributing to the overall property tax bill.

Not paying your property tax bill can result in a cascade of financial and legal consequences. Initially, you may face penalties and interest on the overdue amount. This will steadily increase the amount you owe.

Failure to address the issue promptly can lead to a tax lien on your property. A tax lien gives the government a legal claim on your property. This can also hinder your ability to sell or refinance the property, as you have to disclose whether or not there are liens/legal claims against your property during the sale process. There is also an industry that will buy this debt; the National Tax Lien Association estimates that $21 billion of real estate property taxes go delinquent each year, with up to $6 billion of these taxes being auctioned off to private investors.

One of the more severe repercussions is the potential for foreclosure. If property taxes remain unpaid for an extended period, the government may initiate foreclosure proceedings. This means they take control of your property, auction it off, and use the sale proceeds to recover the outstanding tax debt. This impact extends beyond the immediate financial burden, as a foreclosure can have long-term effects on credit scores and the ability to secure loans or housing in the future.

Everyone who owns real property is on the hook for property taxes, whether it’s for a house, farm, or vacant land. While you can’t get out of paying property taxes, you can deduct up to $10,000 in combined state and local taxes—including property taxes.

If your property taxes are rolled into your mortgage payment, note that your lender must pay the tax on your behalf before you can claim the deduction. Contact your lender if you have any questions about the payment schedule.

How Does the Property Tax Work?

Every year, you pay property taxes to both your state and municipality. The median yearly property tax cost in the United States is $2,578, however your actual bill will differ based on where you reside and the value of your home. Because property taxes are a necessary expense, understanding how they function is essential, especially if you are attempting to construct a family budget after purchasing a home.

Here, we will explain what property taxes are and how to calculate them.

Property taxes make up a certain percentage of each state’s revenue. State and local governments rely on property taxes to fund community services such as the police department you call in the event of an emergency, the public school your children attend, the public parks and libraries you enjoy, the well-maintained roadways you travel, and much more.

How do I calculate property taxes?

Your state and local governments determine how your property taxes are calculated. If you want to estimate your property taxes, you can use the formula below:

Assessed home value x tax rate = property tax

The tax rate can also be expressed as the “millage rate.” One mill equals one one-thousandth of a dollar, or $1 for every $1,000 of home value. The equation would be:

Assessed value x mills / 100 = property tax

Depending on where you live, the assessed value or fair market value is used in this calculation. The assessed value is determined by your local property appraiser, while the fair market value is how much the home would sell for, based on comparable sales of other properties in the area.

For example, if a home has an assessed value of $300,000 and the millage rate is 29 mills, you will pay $8,700 in property taxes.

$300,000 x 29 mills / 1000 = $8,700

Homeowners should note that not all states use 100 percent of the property’s value when calculating the taxable value. For example, homestead exemptions can lower a tax bill. Additionally, some states have property taxation limits that keep property taxes below a certain amount.

You can pay property taxes directly to your local tax authority, but you will want to confirm accepted forms of payment.

You can also add them to your monthly mortgage payments after you’ve bought a home. It’s easier for some people to pay their property taxes this way because it means they don’t owe a big lump sum once a year. Since it is separate from your mortgage payment, the property tax money is placed in an escrow account and sent to your local tax authority on your behalf when the bill is due. A mortgage lender also might require a borrower to pay their taxes this way.

The state and local tax (SALT) deduction allows taxpayers to deduct their property taxes on their federal tax returns, as well as their state income taxes or their sales taxes (but not both income and sales taxes). The Tax Cuts and Jobs Act passed in 2017 limited the SALT deduction to $10,000. Before the 2018 tax year, the SALT deduction had no cap and all state and local taxes were deductible.

You have to itemize your tax deductions to take the SALT. Just taking the standard deduction on your tax return may be quick and easy, but sometimes, itemizing deductions can get you a bigger tax refund, especially if you live in a state with high property taxes. You may need to have a tax professional run both calculations to see which offers the biggest benefit.

Property taxes can be a financial burden for some, but deductions, credits and exemptions can potentially lower property taxes. However, not every exemption is available to all homeowners.

Common exemptions available to homeowners include the homestead exemption and “circuit breaker” programs. The homestead exemption reduces the taxable value of a primary residence by a predetermined amount. The rules for this exemption vary by state.

Property tax circuit breaker programs reduce property tax liabilities for seniors, disabled people, low-income residents and others who qualify. Circuit-breaker tax programs also vary widely among the states that offer them.

Additionally, there are tax deferrals that allow seniors, disabled homeowners and others who qualify to defer property tax payments until the sale of the property or the death of the owner. You can get details on the programs mentioned above, and other deductions, credits and exemptions, from your local tax authority or by talking to a tax professional.

What is the Purpose of the Local Property Tax?

On 2 June 2021, the Minister for Finance, Paschal Donohoe T.D., announced changes to the Local Property Tax (LPT). The proposed changes included a reduction in the rate of the tax, widening of the bands and the removal of the exemption for properties built since 2013. The changes are projected to deliver a yield of €560 million.

As a result of the proposed changes, it is expected that: 3% of residential property owners will incur a higher LPT charge by over €100 (an increase of two bands); 33% of residential property owners will incur a higher LPT charge by up to €100 (an increase of one band); there will be no change to the LPT charge for 53% of residential property owners and 11% will see a decrease in their LPT charge.

The proposed changes to the LPT were legislated for in the Finance (Local Property Tax) (Amendment) Act 2021, which was signed by the President of Ireland, Michael D. Higgins on 22 July 2021.

The legislation provides for property valuations to be reviewed every four years, which will facilitate the regular addition of new properties into the LPT. All new properties built between valuation dates will be retrospectively valued as if they had existed on the preceding valuation date and become liable on the next liability date of 1 November.

Since the announcement of the proposed changes to LPT, Revenue has been making the essential technical and administrative preparations in advance of the valuation date of 1 November 2021. On 17 September 2021, Revenue launched its communication campaign in relation to LPT for 2022, contacting 1.4 million residential property owners over the following weeks to advise them of what they need to do to comply with their LPT obligations for 2022 and to draw attention to the resources available to assist taxpayers, including an online valuation tool.

The LPT was introduced in 2013 to provide a stable funding base for local authorities and to deliver significant structural reform by broadening the tax base in a manner that did not directly impact on employment.

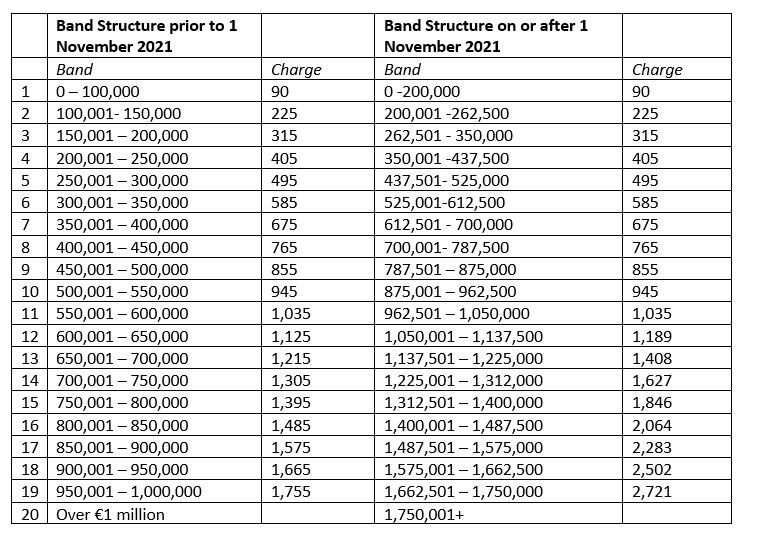

On its introduction, LPT was calculated based on the value of the property on 1 May 2013 with property values organised into valuation bands from €0 to €1 million and a LPT rate assigned to each band ranging from €90 to €1,755. No bands applied to property values over €1 million, instead, an actual valuation for the property was required. LPT was then calculated at 0.18% on the first €1 million in value and 0.25% on the portion of the value above €1 million.

From 2015 onwards, Local Authorities could vary the LPT base rate on residential properties. The base rate is the rate as applied in 2014. The Local Authority could increase or decrease the rate by up to 15% from the base rate (the ‘Local Adjustment Factor’ (LAF). Revenue provide an online calculator to assist property owners to calculate their LPT charge.

When LPT was introduced in 2013, the next valuation date was set for 1 November 2016. Following a review of the regime in 2015, it was decided to postpone the revaluation date to 1 November 2019. The Review of Local Property Tax: The report of the Interdepartmental Group – March 2019 (2019 LPT Review), was undertaken by the Minister for Finance in advance of the revaluation date on 1 November 2019. The 2019 LPT Review sought to reform the regime to achieve relative stability in payments for homeowners given the substantial increase in property prices since the introduction of the LPT in 2013.

It was decided to further defer the revaluation date to 1 November 2020 to allow the Oireachtas Committee on Budgetary Oversight to consider the 2019 LPT Review and issue its scrutiny report in September 2019.

The Programme for Government published in June 2020 committed to bring forward legislation for the LPT to ensure that most homeowners will face no increase, bring new homes into the LPT regime and allow all money collected locally to be retained within the county.

In 2020, the revaluation date was once again deferred to 1 November 2021 given the impact of the COVID-19 pandemic on the planned reform of the regime.

New Basis for Calculating LPT

The 2019 LPT Review analysed five scenarios broadly based on a €500 million target yield (excluding any LAF). The proposed new basis for calculating LPT liabilities builds on the existing band structure, maintaining the number of bands at 20. The bands structure applying to residential property prior to 1 November 2021 (which determined the LPT charge up to 2021) and the new band structure applying from 1 November 2021 which determine the LPT charge for 2022 to 2025 are detailed below.

Properties in Band 20 are charged on the individual property values as before. The actual value is assessed at 0.1029% on the first €1.05 million, 0.25% between €1.05 million and €1.75 million, and 0.3% on the balance.

New LPT Band Structure

The new self-assessed valuation on 1 November 2021 will determine the LPT charge to be paid each year for the next 4 years (from 2022 to 2025). Revenue has released an interactive valuation tool to help property owners to self-assess the value of their property, by providing an estimated average valuation band for residential properties in each area in a map format.

When accessing the online valuation tool, users are presented with a self-assessment message reminding them that the tool is a guide only and it may not reflect their property’s value. Property owners should consider the specifics of their property in comparison to other properties in their area – it may have unique features to be taken into account.

Revenue has the right to request further information on the self-assessed valuation, even if it is in line with the average valuation band for their area. Property owners are advised to keep a copy of information sources and supporting documentation used to determine the market value.