An F1 visa is a nonimmigrant visa for those wishing to study in the U.S. You must file an F1 visa application if you plan on entering the US to attend a university or college, high school, private elementary school, seminary, conservatory, language training program, or other academic institution.

There’s no way around it: college is expensive. If you’re a college student and you need to earn money for tuition and expenses—or you would just like to have a little more cash to spend on the weekends—there are a few alternative ways to earn an income and Youtube is one of them.

- Can You Make Money From Youtube With an F-1 Visa?

- What Are the F1 Student Visa Work Restrictions?

- Can You do Any Work on an F-1 Visa?

- Examples of forbidden work on an F1 visa

- What kind of additional work can I do on an F1 visa?

- How much can you earn with an F-1 Visa?

- How Can F1 Students Earn Passive Income?

- Can a student with F-1 visa status in the USA invest using Robinhood app?

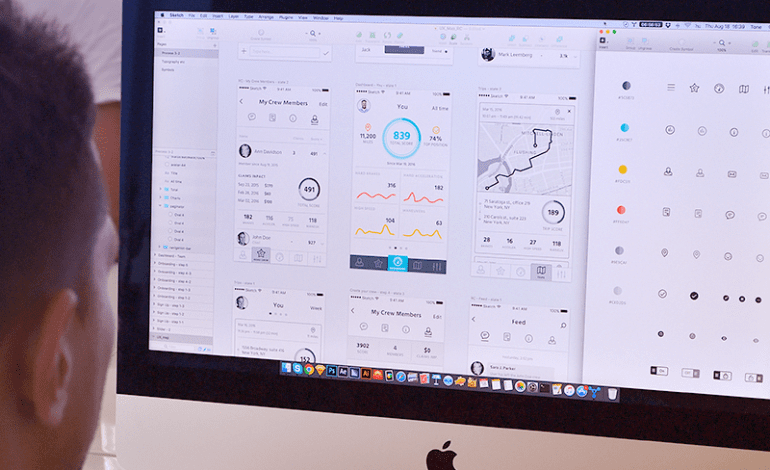

- Apps For Students to Make Money

- Can an International Students Make Money From YouTube in Canada?

- Can F1 Student Receive Passive Income?

- How to Make Money on F1 Visa

- How do F1 Visa Students Deal With Adsense Earnings in The US?

- F1 Visa Passive Income

- Can International Students Sell Online?

- Can F1 Student Have Adsense?

- Can I Earn Money From YouTube on F1 Visa?

- Can an International Student Start a YouTube Channel?

- How to Generate Passive Income as an F1 Visa/OPT International Student

- Can International Students Make Money From YouTube in Germany?

- F1 Visa Financial Aid

- Can I Freelance on a Student Visa?

- Can I Have YouTube Channel on OPT?

- Can I Start a YouTube Channel on H1B Visa?

- Can F1 Student Work in Home Country?

- Can International Students Make Money From YouTube in USA?

- Can I Earn Through Adsense While on an F1 Visa?

- Can F1 Students Receive Donations?

- Can I do Freelance Work on F1 Visa?

- Can I Earn From YouTube While on F1 Visa?

Can You Make Money From Youtube With an F-1 Visa?

Direct from the USCIS web site, with the critical line bolded

“Individuals must be work-authorized to perform any employment in the United States, even if it is not employment in an employer-employee relationship requiring completion of the Form I-9. Undocumented aliens, or others lacking work authorization, are NOT authorized to be self-employed or to work as independent contractors. Any person who obtains the labor of an independent contractor, knowing that the contractor is not work authorized, is subject to civil penalties under section 274A of the INA.”

Read Also: Tax Credit for College Students

This came from instructions to employers, but clarified the USCIS definition of “employment” as any activity to earn money, even if it is and internet-based direct sale of services, with an “employer” per se other than oneself.

F-1 visa holders are not “work-authorized” except for limited jobs arranged for or by the University. The only income allowed must come from investments.

This means that if you monetize your channel, you are making money in the United States so that violates your F-1 visa conditions. That can lead to problems later.

An American gamer was making money on YouTube and Twitch while in Korea, and that led to visa problems. He ended up returning to the United States.

You might be able to apply for a business visa on condition that you hire some Americans as assistants to your channel and register your channel as a business. Or if your channel becomes really really successful, you can apply for EB-1 first-priority exceptional talent visa.

What Are the F1 Student Visa Work Restrictions?

These restrictions protect the initial purpose of an F1 student visa. You’re in the United States to study, after all, not to seek income. While your semester is in progress, you’re only allowed to work up to 20 hours a week.

This is so you won’t fall behind on your studies and fail on the account that you didn’t spend enough of your time studying. This means you can only opt for part-time jobs during your semester. This still applies even if you have tons of free time at your disposal.

Don’t worry though, if you want to earn more passive income, you can do so during your semester break periods. You’re allowed to work up to 40 hours a week on your break. This means you can apply for a full-time job during this time.

Can You do Any Work on an F-1 Visa?

It’s essential to remember that F1 visas are intended for full-time students and are not designed as work visas. With this in mind, international students are typically able to work 20 hours a week on campus when school is in session and full-time while school is in recess, but you may need to seek approval from the Department of Homeland Security and the International Office at your school first. Working illegally while on an F1 visa is a serious violation of the regulations, and could result in deportation.

Additionally, F1 visa holders are eligible to apply for permission to work off-campus for up to 12 months. This permission is called Optional Practical Training (OPT) and allows F1 students to train, and thus work, in a field that is related to their field of study. For more information, be sure to contact an international student advisor at your school, but OPT is traditionally used in the following situations:

- part-time work during the F-1 student’s studies,

- full-time work during periods of recess, or

- after graduation in a field related to the program of study.

What kind of work can I do on campus with an F1 visa?

On an F1 visa, you are allowed to work on campus:

- Up to 20 hours per week during regular full-time quarters or semesters

- More than 20 hours per week between quarters or semester

- More than 20 hours per week during school breaks (like winter or summer break)

On-campus work is typically at on-campus locations such as the cafeteria, library, research labs, or admissions office. In these instances, you are usually an employee of the university. You can work in more than one job but you must comply with the hour restrictions above across all of the jobs.

The work may also be for a vendor on campus that directly serves students (for example, you can work in a Jamba Juice in the cafeteria or for a vendor that provides janitorial services in the dorms). However, it can’t be for a vendor that happens to work on campus but does not directly serve students.

Under emergent circumstances, the 20 hour rule may be waived. Speak to your Designated School Official (“DSO”) if you believe you may qualify for a waiver to work on campus for more than 20 hours a week.

What should I do if I want to pursue on-campus work while I am on an F1 visa?

If you want to pursue authorized on-campus work while on an F1 visa, you should speak to your DSO and request a certification letter to present to the Social Security Administration in order to receive a social security number. You need a social security number in order to be paid and to prepare your taxes.

Examples of forbidden work on an F1 visa:

Example 1: Working more than 20 hours per week in the library during the semester. Why? This violates the 20 hour a week on-campus work rule

Example 2: Working for a construction firm that is constructing a building on your school’s campus. Why? This firm is not providing services directly to students and it is probably not directly tied to your field of study, so it doesn’t qualify under CPT or OPT

What kind of additional work can I do on an F1 visa?

Important! The following applies only after your first academic year

After your first academic year in the US, you can continue to pursue up to 20 hours per week of work on campus during the academic year and more than 20 hours per week of work on campus during breaks.

In addition, you can participate in 3 and only 3 types of off-campus employment:

Type 1 Curricular Practical Training (CPT)

- CPT is temporary authorization for training directly related to your field of study. It can be paid or unpaid. It is typically used for things like summer internships, co-ops, or internships that you are earning academic credit for during the academic year or on your annual summer break. In order to use CPT, you must earn academic credit for any work performed.

- To use your CPT, request Form I-20 “Certificate of Eligibility for Nonimmigrant Student Status” from your DSO. Here’s an example of an I-20 form.

- CPT can be full-time or part-time.

- If necessary for your course of study, you can get CPT approved in your first semester. Speak to your DSO.

Type 2 Optional Practical Training (OPT)

- OPT is temporary employment in the US that is directly related to your field of study. You can receive up to 12 months of OPT authorization pre-completion (before you have finished your studies) or post-completion (after you have finished your studies). Pre-completion gets deducted from post-completion, so the cumulative amount is 12 months. So if you work a summer internship for 12 weeks between your junior and senior year of college and use your OPT instead of your CPT, that will get deducted from your allotted OPT and you will only have 9 months of work authorization left after graduation. You do not need to receive academic credit for OPT work.

- To use your OPT, request Form I-20 from your DSO. Also mail in Form I-765 “Application for Employment Authorization” to USCIS and pay the filing fee. USCIS will mail you back Form I-766 “Employment Authorization Document” (EAD).

- Don’t start working until you receive your EAD!

- If school is in session, you can work under your OPT for up-to 20 hours per week. If school is not in session, you can work more than 20 hours per week.

- You get 12 months of OPT at each education level. For example, you would get 12 months at the Bachelors level and 12 months at the Masters level.

Type 3 STEM Optional Practical Training Extension (STEM OPT Extension)

- Certain F1 students that receive science, technology, engineering, or math (STEM) degrees can get an additional 24 month extension of their OPT.

How much can you earn with an F-1 Visa?

Some entry level jobs will pay approximately $7.00 to $9.00 per hour, but more highly skilled positions may pay $10 or more per hour. Students are allowed to work up to 40 hours per week. Depending on the job, you may also have the option of overtime. The type of job you have will depend on the school curriculum, as well as your work experience, background, skills, English ability, and personal ambition.

How Can F1 Students Earn Passive Income?

The United States provides many scholastic opportunities for foreigners which is why in 2018, there were over 1.09 million international students in the US, setting a new record. Living and studying abroad is often a forgiving experience. However, few students find they can use their downtime to earn extra money.

This is often why students look for ways to earn passive income during their stay. Knowing how to find F1 student visa work is essential as there are certain legal restrictions that may pose a challenge.

Understanding what you can and can’t do is important if you want to be able to finish your studies abroad.

Student visas don’t forbid you to generate passive income outside of school-related opportunities. You only have to know where to look for proper F1 student visa work to generate legal passive income abroad. Here are some ways you can start earning money today.

Can a student with F-1 visa status in the USA invest using Robinhood app?

Yes, you can’t do daily trading on F1-visa but rest is fine. Robinhood will issue you a bunch of tax forms (usually 1099 forms) at the end of the year. You’ll need to put in the info from those forms into whatever tax filing software you and/or your college uses.

Some college uses Glacier Tax Prep but if you’re using TurboTax, there is an option to enter your Robinhood Account Info and all your tax info will get transferred! Once your Tax form is complete, you’ll know whether you need to pay more tax or you’ll receive a refund.

1. Renting Out a Room

This is the most common way for you to generate income abroad as a foreign student. It’s also the safest way to do so if you let property management companies do most of the work on your behalf.

This means you’ll have to pay them for maintenance and interacting with tenants but you should turn a profit from renting out a room.

You’re going to need a social security number in this case though. Without one, you may face different tax implications which can cost you more money.

2. Investing

If you have confidence in your ability to predict the stock market, then investing in stocks is another legal way for you to generate income. This is legal as long as you make no more than 4 trades in a week. Making more trades would have your actions recognized as day-trading, a known profession.

You can also invest in different businesses to turn a profit. This remains legal as long as you participate strictly passively in the business’s functions. You can’t work in the business you’ve invested in for any reason.

3. Writing Manuscripts and the Like

You can’t submit books, manuscripts, etc. for publication and profit to the United States. However, nothing is stopping you from submitting to other countries like the UK, though. Sending your work to get published in the UK can generate income for you through royalties.

While you’re living in the U.S., any royalties you acquire fall under the passive income category. This means it’s a legal way to generate income while you’re abroad.

4. Entering Competitions

Any competition you enter and win outside the campus won’t get you in trouble with US laws. Cash prizes you win also fall under the passive income category like royalties. No matter how much money you accumulate, you’re staying within legal restrictions.

This applies to competitions which have nothing to do with your studies. Additionally, winning any form of lottery prize also counts as passive income.

5. Volunteering

You can volunteer in different jobs during your stay abroad in the United States. Since it’s not official employment, there’s no reason for you to worry since you won’t breach F1 visa restrictions. This is legal as long as you’re not depriving an American citizen of a job by volunteering.

This can also be an opportunity for you to enhance different skills. In the long run, the skills you gain from volunteering will make you a better candidate for employment. While not a typical passive income strategy, it’s one that you’ll reap the benefits from for years to come.

6. Tutor

If you’re proficient in a specific subject and you enjoy (or at least don’t hate!) teaching, you can tutor other students at your school. But the real money might be in tutoring schoolchildren who live in your college town.

If they’re struggling in an area or just need a little supplemental help to keep them on track they have parents who are willing to pay and often willing to pay a lot more than your on-campus peers.

Approach local schools about tutoring possibilities or consider putting ads in your local paper, libraries, churches, pediatricians’ offices, and other places parents gather.

7. Blog

If you’re online a lot anyway and enjoy writing, consider blogging for bucks. It will take some real work to get it started, but if you can find a unique angle to draw readership you can make money through programs like Google Adsense, and AmazonAssociate’s affiliate program.

You can also identify potential advertisers through affiliate program aggregators like Affiliatescout.com. Get good enough and you may even draw the attention of advertisers who will pay to put ads on your site or give you free stuff for you to review.

8. Design School Stuff

Students, parents, alumni, staffers—there’s a whole universe of people who are fans of your school and you can make money off them by designing stuff they’ll buy, like t-shirts, bumper stickers, mugs, hats, and jewelry.

Many sites allow you to quickly and easily upload designs and order products that you can sell online through your own website, on-campus at events, or through local groups and organizations.

9. Get Paid for Your Opinion or Participation

Professors have to get published in order to get tenure and part of that process often involves running studies—for which they need subjects. Check to see if there are on-campus studies that pay students for participation.

Expand your scope and call local companies or organizations (businesses, associations, museums, and hospitals) to see if they are running studies or organizing focus groups and if you could qualify for participation.

10. Organize a Trip

Find out if there are groups on campus with a common interest and offer (for a fee) to make all the arrangements for a trip to the destination of their choice. It will take some work, including booking airfare, securing ground transportation, reserving lodging and spots at local destinations, and many other tasks—but it can be a fun way to earn some money and help out an on-campus group in the process.

And you could possibly work out the terms of your agreement that you get to come on the trip for free. Make sure you’ve included some trip insurance to cover you both financially and legally in the event that the trip doesn’t go exactly as planned.

11. Repair Cars or Sell Other Specialized Skills

It’s a sure bet that the majority of college students who have a car don’t know the first thing about how to maintain them or make minor repairs on their own. If you do, you’re in luck. Make a small investment in tools and supplies and then advertise for reasonably-priced onsite repairs and maintenance work like oil changes.

The same goes for other specialized skills—can you build bunk beds, organize closets, or groom animals? There’s probably a market for your skills nearby.

Apps For Students to Make Money

You already do everything from banking to handling your bills via smartphone. So why not use your phone to earn money, too?

The apps listed below generally won’t make you rich any time soon. But many can give you ways to earn just a bit of extra cash you need to survive as a student. Check them out if you want to earn a little money on the side, often for little to no actual work.

1. Robinhood Free Share of Stock (Up to $200)

Robinhood is an investing app that offers you the opportunity of buying stocks with a $0 trading cost. The beauty of the app is that you can invest in partial shares of stock; so if you only have $20 to invest, you can still own part of Google!

The bonus of Robinhood is that when you sign-up (which is free), you’ll be awarded a free share of stock. This share of stock can range in value anywhere between $2.50 and $200 (the value of the stock is likely on the low end but you’ve got a shot for a good one!)

2. Bookscouter

This book lets you find retail pricing for used books and textbooks. Just use your phone’s camera to snap a picture of the book’s ISBN, and you’ll see what it’s worth online. You can even use the app to create a shipping label for the books you send to Bookscouter. This is a great app if you want to declutter some books, cash in on your used college textbooks, or shop for potentially valuable used books at garage sales and thrift stores.

3. Swagbucks – $10 Bonus

Without a doubt one of the best money making apps out there, Swagbucks allows you make money using your phone in 6 different ways. Plus you can get a free $10 just for signing up.

Swagbucks allows users to earn SB Points by watching videos, taking paid surveys, playing games, searching the web, or shopping online. You can then redeem your SB points for cash deposited directly in your PayPal account or by claiming gift cards to one of over 1500 retailers (like Walmart or Amazon).

The best part is that there is no limit to how much you can earn. You’re not going to replace your full-time income from it, but if you use Yahoo! as your browser, play a few games and take a few surveys, there is no reason you can’t boost your income by at least $25-50 each month.

With an A+ rating with the BBB and over $166,000,000 paid to members to date, there is no reason not to try one of the highest paying apps out there.

4. InboxDollars – $5 Bonus

As the name suggests, InboxDollars will pay you for opening and skimming emails and answering simple surveys. There is also a $5 signup bonus.

InboxDollars works on a cash-only system, so you don’t have to worry about converting points to cash or only being compensated in gift cards. And according to their website, they have paid out over $57 million to users who have completed surveys over the years.

After my initial $5 bonus, I found that many of the surveys did not pay out a ton of money, which was a bit of a bummer.

Nonetheless, clicking around and answering questions can still net you a couple of bucks an hour, which is better than nothing.

5. MyPoints – $10 Bonus

Want $10 for a few minutes of your time? MyPoints is one of those money-making apps that bribes users to sign up by offering $10 Amazon gift card for new users. But that’s not where it ends.

By installing the app, and using on a regular basis, users accumulate points that they can exchange for cash, gift cards or physical gifts. It’s basically a rewards program for your phone…and that is exactly how you should look at it.

These money making apps are not get rich quick schemes. Their purpose is to add a few bucks to your bottom line each month by doing things you’re already doing. You can sign up here with your email address and then download the mobile app.

6. Rakuten – $10 Bonus

You’ve probably heard of Rakuten (formerly Ebates) before for desktop, but they also have a mobile app.

All you have to do is shop at the stores you love (either online or in-person), and you get cashback on your purchases. If you take advantage of special events, holidays, and promotions, you can earn up to 12% back in some cases.

Better yet, they’re offering new users $10 just for signing up.

All you have to do is log in to the app and search the retailer you’d like to shop with. You’ll go directly to their e-commerce store and start collecting rewards automatically when you buy. You have the option of redeeming those rewards as cash, gift cards or a PayPal deposit.

Cool thing is, this is on top of any discounts/coupon codes you already have.

7. Ibotta – $10 Bonus

Ibotta is yet another of the money-making apps you’ll see on this list that revolves around cashback shopping.

But unlike some of the others, Ibotta has become immensely popular worldwide because of it extends to grocery brands and it has an affiliate program that allows users to invite friends and make even more money.

You get $10 just for signing up, and similar to an app like Lucktastic, they pay you $5 more for each friend you refer. Your earnings potential is unlimited. Not bad considering you’re helping your friends save money and handing them an extra ten bucks at the same time.

8. Dosh – $5 Bonus

Dosh is a smartphone app that gives you cashback every time you make a purchase at participating outlets using your credit card.

Not having to jump through hoops to earn cashback is probably the biggest perk of Dosh. For instance, I’ve been getting cashback from Exxon each time I fill up my gas tank and I didn’t even realize it until recently. The money just gets added to my Dosh account.

Just download the app, link your credit card (this is secure), then you’re off to the races. You can start shopping at participating merchants using your credit card and points will be added to your “Dosh Wallet” straight away. Once your balance reaches a minimum of $25, you can cash out via Direct Deposit or PayPal.

9. Stash

Stash is another investing app designed to make investing simple. For most people that’s a good thing. If you’re a seasoned investor you may find the app too simple for your taste (but that’s kind of the point).

Stash does most of the work for you. You pick what you are interested in (like tech, or clean energy, or retail stores) and Stash can provide a user with diversified portfolio options. From there you can set up the app to pull a few bucks a week from your bank account and can start to grow your investing principle.

If you’re interested in investing, but have no clue to start, try starting with as little as $5 and let Stash do the rest. Better yet, Stash will spot you $5 just to get started.

10. Slidejoy

Slidejoy belongs on this list because it is without a doubt one of the easiest money-making apps out there. I am not saying this because it’s going to make you rich. It won’t. But it will make you a cool $5-15 per month according to the developers.

So how does this money-making app work? Per Slidejoy:

Upon turning on your phone, you will view an aesthetically pleasing ad on your lock screen. Then,

- You will have a choice to ignore the ad by sliding right and unlocking your phone

- You will also have a choice to engage with the ad by sliding left. Upon sliding left, the phone will unlock and you will be directed to a destination specified by the advertiser (YouTube, advertiser website, Google Play, coupon page, etc.)

- To prevent bias, you will make an equal amount regardless of whether or not you engage with an ad

- Over time, Slidejoy learns your ad preference based off of your behaviors during different times of the day and curates a more relevant user experience

- You can cash out your earnings via PayPal/several gift cards or choose to donate it to charity

As long as you can put up with your smartphone’s lock screen being trending news stories or ads (which disappear when you open your phone), you’re looking at $180 a year (or more).

Slidejoy says that as the ads get more catered to your interests, the payouts actually go up. They don’t say by how much but getting up to $200 a year shouldn’t be too hard. Not bad for selling your phone’s lock screen to the highest bidder (literally).

Can a International Students Make Money From YouTube in Canada?

Yes, you can. One of the best a greatest things about the internet is that it doesn’t matter where in the world you are, you can use it to your benefit and YouTube is no exception.

Can F1 Student Receive Passive Income?

The United States provides many scholastic opportunities for foreigners which is why in 2018, there were over 1.09 million international students in the US, setting a new record. Living and studying abroad is often a forgiving experience. However, few students find they can use their downtime to earn extra money.

This is often why students look for ways to earn passive income during their stay. Knowing how to find F1 student visa work is essential as there are certain legal restrictions that may pose a challenge.

Student visas don’t forbid you to generate passive income outside of school related opportunities. You only have to know where to look for proper F1 student visa work to generate legal passive income abroad. Here are some ways you can start earning money today.

1. Renting Out a Room

This is the most common way for you to generate income abroad as a foreign student. It’s also the safest way to do so if you let property management companies do most of the work on your behalf.

This means you’ll have to pay them for maintenance and interacting with tenants but you should turn a profit from renting out a room.

You’re going to need a social security number in this case though. Without one, you may face different tax implications which can cost you more money.

2. Investing

If you have confidence in your ability to predict the stock market, then investing in stocks is another legal way for you to generate income. This is legal as long as you make no more than 4 trades in a week. Making more trades would have your actions recognized as day-trading, a known profession.

You can also invest in different businesses to turn a profit. This remains legal as long as you participate strictly passively in the business’s functions. You can’t work in the business you’ve invested in for any reason.

3. Writing Manuscripts and the Like

You can’t submit books, manuscripts, etc. for publication and profit to the United States. However, nothing is stopping you from submitting to other countries like the UK, though. Sending your work to get published in the UK can generate income for you through royalties.

While you’re living in the U.S., any royalties you acquire fall under the passive income category. This means it’s a legal way to generate income while you’re abroad.

4. Entering Competitions

Any competition you enter and win outside the campus won’t get you in trouble with US laws. Cash prizes you win also fall under the passive income category like royalties. No matter how much money you accumulate, you’re staying within legal restrictions.

This applies to competitions which have nothing to do with your studies. Additionally, winning any form of lottery prize also counts as passive income.

5. Volunteering

You can volunteer in different jobs during your stay abroad in the United States. Since it’s not official employment, there’s no reason for you to worry since you won’t breach F1 visa restrictions. This is legal as long as you’re not depriving an American citizen of a job by volunteering.

This can also be an opportunity for you to enhance different skills. In the long run, the skills you gain from volunteering will make you a better candidate for employment. While not a typical passive income strategy, it’s one that you’ll reap the benefits from for years to come.

How to Make Money on F1 Visa

In the US, the F1 visa rules should give you clear guidance on the dos and don’ts. To work in the UK, you would likely have a Tier 4 visa, which comes with certain restrictions too. In Canada, research the Canadian Study Permit of the kinds of jobs and hours you are eligible for.

If you’re in Australia, you are allowed to work 20 hours per week when school is in session, and during school vacations, you can work however long you want.

Let us walk you through the legal ways that you, as an international student can make some money:

Renting out property

If you have properties or rooms, you are allowed to rent it out to make some side income. This is common, but usually done through paying a fee to a management company so you don’t have to deal with tenants yourself. God knows you don’t need the trouble while you’re chasing assignment deadlines!

Investment

A good way to generate income is to invest. If you are blessed with a financial sixth sense and an ability to predict the stock market, this is another legal opportunity to earn money. And who knows? You could be Wolfing your way onto Wall Street on the down-low.

As long as you have no say in companies you have shares in, and you don’t make too many trades, you don’t have to worry about getting into trouble. You’ll still generate profit, and your costly dream of owning bitcoin can finally come true!

Writing

Consider yourself somewhat of an Ernest Hemingway? Another popular and legal way to earn money is to become a freelance writer. If you’re good and establish a good relationship with editors, you could earn a pretty penny.

While the US won’t allow F1 visa holders to submit books, manuscripts, etc. for publication and profit, there’s nothing stopping you from submitting to other countries like the UK, though.

Competitions and paid surveys

Do you have the lucky charm? A fun way to get some side money is to enter as many competitions as you can — winning something small is still considered winning. Having the option to keep or sell whatever you win — now, wouldn’t that be great?

Paid surveys are a way to get some cash into your account — make sure you get a separate email to avoid a large number of spam mail coming your way soon. You’d be surprised by the amount of paid survey websites in every country, and when you are a regular surveyor, the number of coins will start to add up.

Online freelance work

One minute you’re avidly reading through the Tattletales From Tanqueray on “Humans of NY”, the next moment you’re on “Youtube” looking at videos of spicy chicken mukbangs — the internet can be a mean blackhole of distraction, procrastination and misinformation.

However, if you are good at online work — graphic design, social media, blogging, and the likes — freelance work could be for you. With an entrepreneurial-like way of thinking, companies will definitely have use for your skills on a freelance basis. It also gives you a chance to build your CV while working a flexible schedule.

Tutoring

Don’t worry if you don’t have a formal teaching qualification. If you have stellar grades, you could help parents who are usually looking for university students to tutor their kids. In the UK, you could be making 20 pounds an hour or more.

Plus, if you complete a Teaching English as a Foreign Language (TEFL) course, you could set yourself up for job opportunities around the world. It’s also a great way to expand your savings, and explore different cultures on your travels abroad.

Participate as a paid volunteer

Fancy being a guinea pig? When you participate in a focus group, clinical trial, or any other similar experiment, you are usually compensated in cash, food and drink. As this is paid volunteering, there are no legal issues to face here. Imagine if you were part of a group of trial testers for finding the cure to coronavirus!

Dog-walking or babysitting

Last but not least, another easy method to expand your bank account would be to babysit or dog-walk. You’d have to juggle your study schedule around, but it’s something that could rake in loads of extra cash for little effort.

How do F1 Visa Students Deal With Adsense Earnings in The US?

No – not without a valid EAD issued by USCIS. Otherwise that will constitute “unauthorized (self) employment” in violation of the terms of your F-1 visa status and is sure to sooner or later land you in removal proceedings in immigration court.

F1 Visa Passive Income

But still, the question remains whether you may earn a passive income whilst living in the U.S. on an F1 visa. May you be an Uber driver for extra income? What about renting out the spare room in your apartment on Airbnb?

Read Also: Should you Pay off Student Loans While in College?

Immigration lawyers help to give the best advice here. You can always contact one to help you in your unique situation. The general consensus is that it’s totally legal to earn passive income since you aren’t doing any work.

Renting out a room is legal especially if you use a property management company to do it on your behalf. They collect the money, they do any maintenance or upkeep work, and they deal with tenants. Just beware, using Airbnb to rent the room will be difficult since it requires you to have a Social Security Number (SSN), or else there are some intricate tax implications.

We would also advise you to contact a tax specialist to help you with the filing of your taxes if you are unsure about your situation. You earned this income whilst in the U.S. and you need to make sure you do it according to the rules set out by the IRS (Internal Revenue Service).

Unfortunately, you won’t be able to become an Uber driver since it’s most likely outside your field of studies.

Can International Students Sell Online?

Whether or not you can legally sell clothes online depends on whose clothes you are selling. If you are running on online business (eg. buying and reselling clothes) then you are ALMOST CERTAINLY in violation of your visa. If you are selling your own clothes, probably not.

Whether or not it was ok for you to sell them in the first place, now that you have, you have to pay the appropriate taxes (either personal or business.) Failure to do that will only result in making the situation worse.

Can F1 Student Have Adsense?

The simple answer is that you just can’t. Not to my knowledge at least. Being an international student on an F1 visa living in the US, you have certain work restrictions that do not allow you to work off-campus. You are only legally allowed to work in jobs on campus, or jobs affiliated in some way with the school that you are attending.

A violation of this rule may end up in serious immigration issues if you are a student carrying an F1 visa. Some of you might be wondering if there are any possible ways you can work around these rules and use Google Adsense. There are ways to try and work around these rules, but they may be breaking some of the terms and agreements that you agree upon when joining Google Adsense.

The first way to work around this is to just start up a Google Adsense account from your home country. By doing this, you do not have to deal with any of the tax issues that you would have to if you set up an account with the United States as your county.

You would, however, have to give in an address in your home country which your check can be sent to you. This shouldn’t really be a problem for those of you that have family or friends in your home country. The problem with doing this, though, is that it might be going against the contract that you have agreed upon with Google when you first joined Adsense.

If you are setting up the account from a country outside of the United States, you’re not supposed to have anyone within the United States contributing to your blog or website, including you. If you aren’t updating your site in any way while you are in the United States, then you should be fine. If you plan on doing so, I would strongly suggest against this.

The second way to work around this is to have someone create the account for you, but I strongly suggest that you do not do this. I’m sure that there are tons of people out there that are doing this, but I personally wouldn’t risk it. Again, this will not be legal if you become an active member of maintaining the website.

If you really have a good idea for a blog or a website, just give it to someone else that could make something out of it. He could pay you, or eventually split the money with you. Although still sitting on dangerous territory, I think it should be more acceptable.

Even with these two ways to sort of getting around the limitations that you international students get from living in the United States on an F1 visa, I highly suggest finding other means of income rather than looking to Adsense. Although it seems like a nice option, not being sure about the risks could seriously affect your status as an international student. If you’re willing to risk it, go ahead. I’d just look for a job on campus.

Can I Earn Money From YouTube on F1 Visa?

You cannot work in the US, except for authorized work in accordance with your visa, such as work-study or practical experience, without violating your visa requirements. Further, any US source income must be reported on a US income tax return, unless it is less than the amount of your standard deduction.

As you describe, you are using the internet to conduct your business from the US. Your question indicates you know very little about compliance with US tax laws. Failure to comply with US tax law could be considered for any visa or immigration renewal or change. You should get professional advice before you make bad decisions that may affect your entire life.

Can an International Student Start a YouTube Channel?

Youtube is an international platform hence you can start a channel from anyway. It does not matter who you are, where you come from and where you live at any point in time. So long as you have access to internet connection and can open a google account, then you are good to go.

In terms of revenue, you need an Adsense account in order to monetize your channel. To do this you need a website with which you can submit an application to monetize. This website must meet the Adsense guidelines for your application to be successful.

How to Generate Passive Income as an F1 Visa/OPT International Student

Working on campus is common knowledge that all F-1 students know as a secure way to earn income (outside of CPT and OPT), but in all sincerity it is not enough. If you live in a big city or expensive state, such as myself, your on campus employment job will barely cover your rent in Los Angeles.

1. Renting Out a Room

The safest way to start earning passively while studying abroad as an international student is turning a profit from renting out your room. It is especially legal, if you let a property management company do the work while you pay them for maintenance. If this is the case, you will need a social security number. Not having one may cost you more money with different tax implications.

2. Investing

If you have some understanding of the stock market, investing in stocks is a legal way to generate passive income. It’s important that you make no more than 4 trades per week, since making more trades than that will be counted as day-trading, a known profession.

3. Publishing your Work to Non-U.S. Countries

Although you can’t submit your writing, such as books and manuscripts, for publication and profit to the United States, you can do so to non-U.S. countries. For example, you can submit your work and get published in the UK while generating income through royalties. Any royalties you acquire fall under the passive income category in the U.S.,which allows you to legally generate income as a F1 student.

4. Entering Competitions

Any form of prizes you win from competitions, including lottery contests and cash prize competitions, fall under the passive income category. This also applies to competitions that have nothing to do with your studies. No matter how much money you accumulate, you’re staying within legal restrictions.

Can International Students Make Money From YouTube in Germany?

The short answer is, you probably might make money.

First of all, there are certain requirements you need to fulfil before you can join the YouTube Partnership Program. The most important are:

- at least 1,000 subscribers;

- at least 4,000 hours watch time in the last 12 months.

The second one means that in a year, people must have spent a total of at least 4,000 hours watching your videos. It’s not enough just to get a load of fake subscribers: they have to actually watch your videos, which means you have to publish enough videos for people to actually watch.

If you can do that, and you don’t have copyright strikes and community guidelines strikes on your channel, you need to get a Google AdSense account and then you can start monetizing your videos.

Since you’re resident in Germany, you have to supply Google with your German tax ID number. If you don’t, Google will have to take up to 30% off your earnings before paying it out to you, exposing you to the risk of double taxation.

And of course this counts as freelance work. Your clients are Google and your viewers; more importantly, though, Google is not your employer.

F1 Visa Financial Aid

Prospective F-1 or M-1 students must have the financial resources to live and study in the United States. This includes being able to cover the cost of tuition, books, living expenses and travel. Designated school officials (DSOs) must collect evidence of the student’s financial ability before issuing a Form I-20, “Certificate of Eligibility for Nonimmigrant Student Status.”

Additionally, prospective students must bring their evidence of financial ability when applying for their student visa with the U.S. Department of State. It is also advised to have the evidence on-hand when entering the country at a U.S. port of entry, in the event a U.S. Customs and Border Protection officer asks to review it.

While international students are not eligible for U.S. government-funded financial aid, sometimes SEVP-certified schools offer financial aid and scholarships for their F and M students. Here are some resources for finding scholarship and financial aid opportunities:

- Check with your SEVP-certified school: The United States has many different types of colleges and universities, which means that financial aid options vary. Some schools offer assistance based on financial need, while others offer academic and athletic scholarships. Once you receive your acceptance, contact your school’s financial aid office and DSO to find out what type of aid you might qualify for and how to apply.

- Visit EducationUSA: EducationUSA is a U.S. Department of State network with advising centers in more than 170 countries, and represents the largest group of advisers committed to promoting accredited U.S. higher education institutions. You can visit an advising center near you or visit the EducationUSA website. The website offers a variety of information about the international student process in the United States, including how to finance your studies.

Can I Freelance on a Student Visa?

A student visa does not allow self-employment. This means in order to undertake work you should be given a formal document by the employer such as a ‘contract of employment’ or a ‘worker’s agreement’ or some other written statement confirming your employment status.

This includes where you will be undertaking work for one or more of the Colleges, or for the University. Please note you may find that other students (who are not on a student visa) may not need to have the same documentation in place.

Self-employment normally includes activities such as freelance writing or publishing, private tutoring or selling goods or services directly to an end customer, for example as a consultant. If you are not on the employer or agency’s employee payroll, it is likely the work being offered is on a self-employed basis. If you are unsure, it is important you check your employment status prior to starting work.

Students on a student visa can do most kinds of work, but you must not:

- be self-employed;

- engage in business activity;

- work in a position that would fill a full-time permanent vacancy;

- work as a professional sportsperson including as a sports coach, paid or unpaid, as defined by the Home Office on pages 94-95 of the Student route guidance;

- work as an entertainer, paid or unpaid;

- work as a doctor or dentist in training, unless you are on the foundation programme.

These restrictions apply throughout your time on a student visa.

Can I Have YouTube Channel on OPT?

No, you cannot earn money from your Youtube Channel, Tiktok or any other content platform while you ar present in the US on a F1 Visa or OPT. Always, be aware of the consequences if someone reports you or your activities to the USCIS – you might end up getting deported for violating the conditions of your visa status.

If you already have monetization enabled on your channel. You must turn off monetization to the channel after you land in the US on a F1 student visa or if you are working on OPT.

Can I Start a YouTube Channel on H1B Visa?

Your H1B visa restricts your employment income to your sponsoring employer. While in theory you could own a business and earn passive income from the enterprise, the fact is that Google will treat you as an independent (worker) contractor, and report your earnings as income — and that puts you offside of your visa.

In other words, while theoretically you could “own” a YouTube channel (which of course you don’t because Google owns YouTube) just creating the content and earning money for it would effectively be work income under US immigration rules, and so offside.

Can F1 Student Work in Home Country?

After you are approved for your F1 visa, you are able to enter the United States as an international student. However, after you arrive, you will need to stay aware of your obligations as an F1 visa holder. If you do not maintain your valid F1 visa status, you will not be allowed to return to re-enter the US if you leave and you will not be eligible for practical training (OPT or CPT) or on-campus employment.

Here are some tips to assure you’re in good standing during your study abroad:

Upon Arrival

Make sure you arrive in the US no more than 30 days prior to the first day of classes. Check in with your international advisor as soon as possible before your program begins.

During Your Program

You must remain enrolled full time. Go to class and maintain passing grades. If you are having difficulty in your classes, notify your international advisor. If you are unable to complete your program by the date listed on your Form I-20, your international advisor can help you request a program extension.

Your passport should be valid for at least 6-months in the future. Your country’s consulate or embassy can help you extend your passport if needed. Carry a copy of your passport with you along with your I-94 card for identification purposes.

Working

F1 visa students are not allowed to work off-campus. However, you may have some on-campus work or curricular practical training options if you qualify. Check with your international advisor to see if this is a possibility for you. If you choose to work without proper authorization, your visa will be revoked and you will be forced to leave the United States.

Upon Program Completion

You have 60 days upon completion of your program to leave the United States under your F1 visa. To remain in the US, you will need to re-enroll in a higher program, transfer to another school to receive a new I-20 form, or apply to change your visa status. Your international advisor can give you more information regarding your options.

Can International Students Make Money From YouTube in USA?

First off, YouTube wouldn’t be considered an international company. Secondly, it doesn’t matter where the company is based. Unless you have authorization from the U.S. government to work while on an F-1 visa (typically OPT), then no, you cannot do any kind of work and get compensated for it.

It depends on where you are staying, what the conditions of your specific visa are, and where and how you get paid, etc. If you get paid and taxed in your home country (or a third country, where you have the right to work), then in general it should not affect your visa status.

But if you get paid and taxed in your host country, there will be limits. It may be that you can spend up to so many hours a week working online, it may be that you can’t do it at all – check your visa. Needless to say: if in doubt, engage a lawyer.

Can International Students Make Money From YouTube in UK?

Someone with a Student visa cannot undertake self-employment or business activity. It seems that earning money from clicks on your YouTube videos would be both.

Legally? Almost certainly not.

You’ll be limited to 20 hours per week of working, and might earn £160 per week like that. That’s if you can find a job anyway; unemployment has risen sharply since the start of the lockdown, so there will be more competition for every job, and lots of the fast food places that normally employ students have closed or reduced their opening hours.

You are presumably planning to come to the UK to be a student, not cheap labour. If you can’t afford it unless you work, then you should not come — your visa is based on the idea that you can afford to, without depending on earnings. £18,000 a year is a full-time employee’s salary, not casual earnings, and you are not remotely likely to manage that and be a full-time student. If you start missing classes or falling behind with your work, your visa will be revoked.

Can I Earn Through Adsense While on an F1 Visa?

Yes, most likely.

Even though as per F1 visa, your purpose of stay in the US is purely educational and you cannot indulge in employment other than what is allowed on campus as an F1 ( and OPT/CPT after you graduate); there is no harm in earning through Adsense as it does not constitute as employment per se.

However, do take approval from the authorities before hand, and you must report any earnings from this (during your stay in US ) for taxation purposes.

Can F1 Students Receive Donations?

You are allowed to be given money on an F1 visa, you just aren’t allowed to work (with some exceptions). People are free to financially help you out if they want to. Your friends and relatives could send you thousands of dollars if they wanted to. You are also allowed to apply for some scholarships (the ones that do not require citizenship or permanent residency).

If you suddenly started giving rides to people for 5$, and driving people all over town all day making a living, then yes, that would be violating your F1 visa and would also be breaking taxi registration laws.

Can I do Freelance Work on F1 Visa?

F1 visas are intended for full-time students and are not designed as work visas. With this in mind, international students are typically able to work 20 hours a week on campus when school is in session and full-time while school is in recess, but you may need to seek approval from the Department of Homeland Security and the International Office at your school first. Working illegally while on an F1 visa is a serious violation of the regulations, and could result in deportation.

F1 visa holders are however eligible to apply for permission to work off campus for up to 12 months. This permission is called Optional Practical Training (OPT) and allows F1 students to train, and thus work, in a field that is related to their field of study. Thus OPT is traditionally used in the following situations:

- part-time work during the F-1 student’s studies,

- full-time work during periods of recess, or

- after graduation in a field related to the program of study.

You can thus exploit this option to your advantage if you want to do a freelance, provided it is related to your program of study.

Can I Earn From YouTube While on F1 Visa?

Yes, you will be able to work in the US on a F-1 student visa. However, you will have to follow certain F-1 visa rules and restrictions:

- You can only work part time on campus while your academic term is in session

- You can only work a maximum of 20 hours per week

- You may be able to work off campus with the approval of your university

During academic breaks, you will be permitted to work full time, if your university allows it. You can learn more about working as a F-1 international student by referring to USCIS.gov.

When searching for work while you study, make sure to seek approval from your DSO first.

Keep in mind, once you finish your program, you will have a grace period of 60 days to leave the US.

Finally

As an F-1 student, it might be difficult for you to survive financially. That is why this article has explained what you need to do to earn money as an international student. Apply them as much as possible and earn something for yourself.